International Tax Documents

Cross-Border Taxation

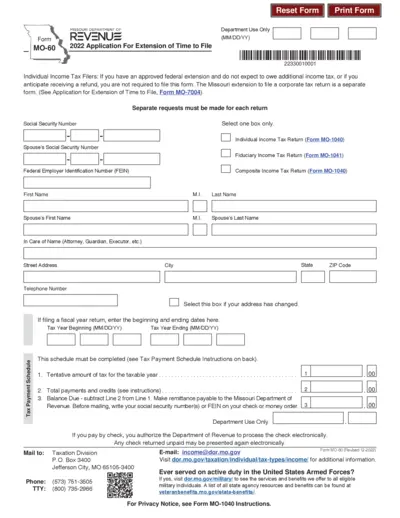

Missouri Department of Revenue Application for Extension

The Missouri Department of Revenue Form MO-60 allows for an extension of time to file individual and composite income tax returns. This form is essential for anyone who owes tax liabilities and needs more time to submit their returns. Be sure to check the specific conditions under which this form must be filed.

Cross-Border Taxation

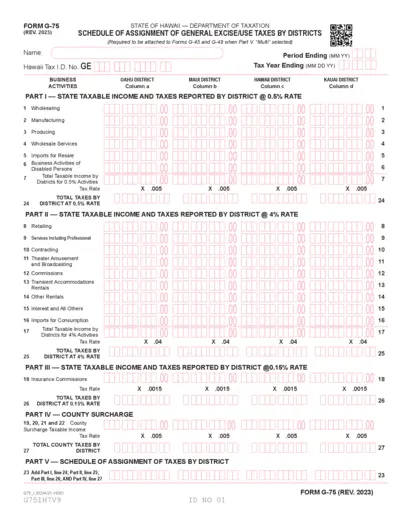

Hawaii Department of Taxation Form G-75 Instructions

Form G-75 is used by taxpayers with income from multiple Hawaii taxation districts. It helps determine taxes attributable to each district. Ensure correct submission to avoid penalties.

Cross-Border Taxation

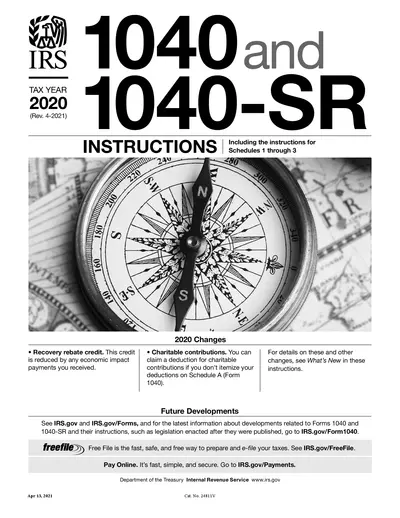

IRS 2020 Form 1040 and 1040-SR Instructions

This document provides comprehensive instructions for completing IRS Form 1040 and 1040-SR for the 2020 tax year. It includes details on filing requirements, line instructions, and relevant changes. Navigate through the contents to better understand your filing process.

Cross-Border Taxation

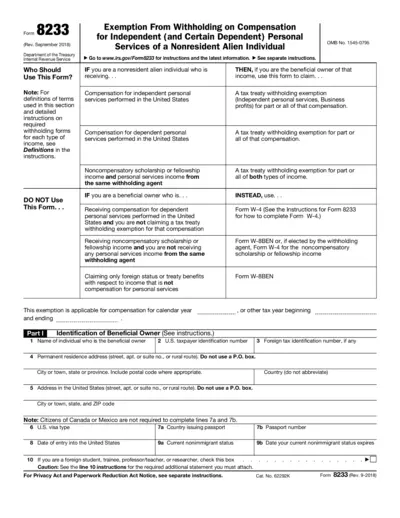

Form 8233 Tax Exemption for Nonresident Aliens

Form 8233 is used by nonresident alien individuals to claim exemption from withholding on compensation for independent and certain dependent personal services. This form is essential for ensuring that tax treaties are appropriately applied. Accurate completion of this form helps prevent unnecessary withholding of taxes by U.S. entities.

Cross-Border Taxation

2015 Oregon Income Tax Filing Instructions

This document provides complete instructions for filing the 2015 Oregon income tax as a full-year resident. It includes essential forms, deadlines, and filing options. Ensure you understand each step to maximize your filing effectiveness.

Cross-Border Taxation

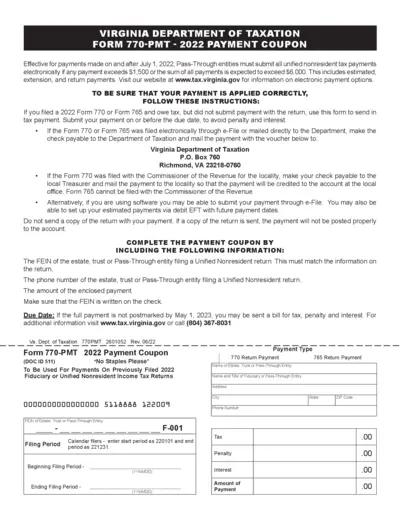

Virginia Department of Taxation Form 770-PMT Payment

The Virginia Department of Taxation Form 770-PMT is a payment coupon for unified nonresident tax payments. This form is essential for estates, trusts, and pass-through entities to submit their tax payments correctly. Complete the form accurately to avoid penalties and ensure timely processing.

Cross-Border Taxation

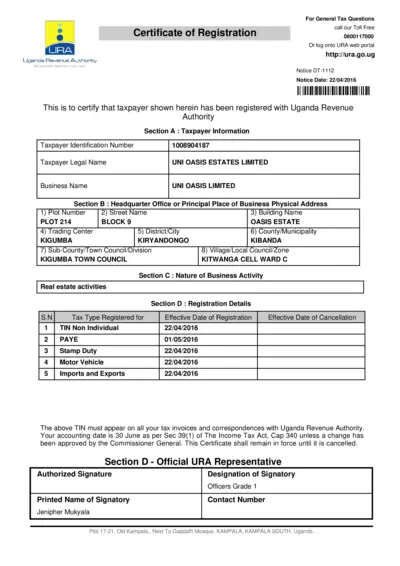

Certificate of Registration for Ugandan Taxpayers

This file serves as a Certificate of Registration issued by the Uganda Revenue Authority. It includes essential taxpayer information and registration details. Taxpayers are advised to maintain this document for reference in all tax-related correspondences.

Cross-Border Taxation

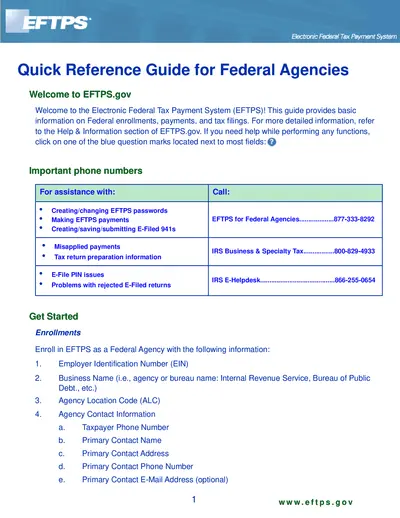

EFTPS Electronic Federal Tax Payment System Guide

This guide provides essential information about the EFTPS, including enrollment, payment methods, and tax filing instructions. Designed for federal agencies, it simplifies the tax payment process. For more thorough guidance, refer to the detailed sections within this document.

Cross-Border Taxation

FAQs for Income Tax Return Filing Guidance

This document provides key FAQs for taxpayers about filing their Income Tax Returns. It offers essential clarifications on common issues faced by taxpayers when completing their tax forms. Refer to this guide for effective resolution and compliance.

Cross-Border Taxation

UP Commercial Tax FAQs Guidance

This document provides comprehensive FAQs regarding UP Commercial Tax. Users can find crucial information about dealer search, contact details, and forms. Ideal for businesses and individuals seeking clarity on tax procedures.

Cross-Border Taxation

Instructions for Tax Clearance Certificate Pennsylvania

This document provides essential instructions for obtaining a Tax Clearance Certificate in Pennsylvania. It explains the process and requirements for entities ceasing business operations. Ideal for corporations and partnerships needing compliance with state regulations.

Cross-Border Taxation

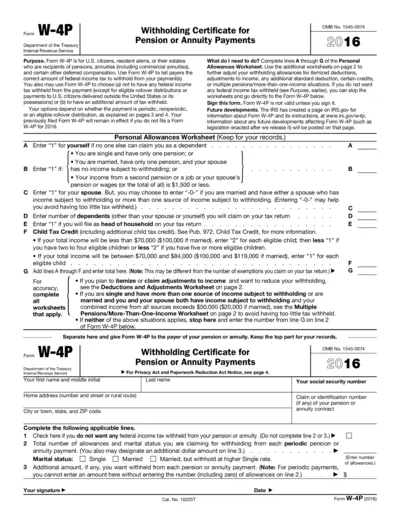

Form W-4P Withholding Certificate for Pension Payments

Form W-4P is the official tax document that allows U.S. citizens and resident aliens to indicate the amount of federal income tax to withhold from their pension or annuity payments. Completing this form accurately ensures proper withholding to meet tax obligations. It's essential for managing your tax liability effectively.