International Tax Documents

Cross-Border Taxation

Alabama Corporation Income Tax Return Instructions

This file provides detailed instructions for preparing the Alabama Corporation Income Tax Return for 2021. It includes essential updates and requirements for compliance with the current laws. Users can find guidance on filing procedures and important tax information here.

Cross-Border Taxation

Wisconsin Revenue Extensions of Time to File

This publication provides detailed information on obtaining extensions to file various Wisconsin tax forms. It covers individual income tax returns, corporate franchise tax returns, and more. Essential for taxpayers seeking guidance on filing deadlines and extension procedures.

Cross-Border Taxation

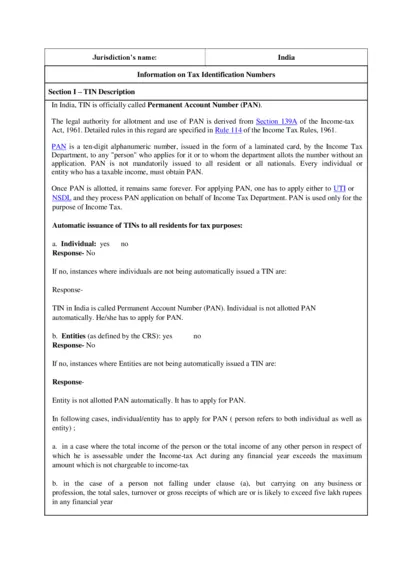

India Tax Information on Permanent Account Number

This document provides essential information about the Permanent Account Number (PAN) in India, a key Tax Identification Number (TIN). It details the legal authority, application process, and structures associated with PAN. A valuable resource for individuals and entities needing to navigate India's tax identification requirements.

Cross-Border Taxation

Form SS-4 Instructions for EIN Application

This PDF provides essential instructions for completing Form SS-4 to apply for an Employer Identification Number (EIN). It outlines eligibility, requirements, and recent updates relevant to the application process. Aimed at business owners and organizations, this document ensures proper filling for tax identification.

Cross-Border Taxation

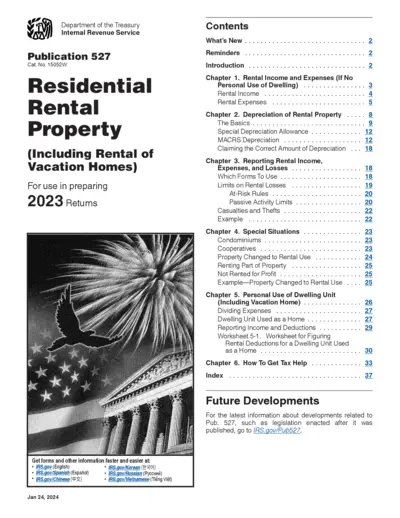

IRS Publication 527 Residential Rental Property 2023

This file contains essential information related to IRS Publication 527 for Residential Rental Property, including guidance on reporting income and expenses. Learn about deductions, depreciation, and special rental situations. It's a must-read for anyone involved in residential rental activities.

Cross-Border Taxation

Employer Annual Declarations EMP501 Submission Guide

This file provides essential information about the EMP501 annual reconciliation declaration for employers. It outlines important deadlines, compliance requirements, and submission guidelines for 2023. Ensure your submissions are accurate to support your employees' tax compliance.

Cross-Border Taxation

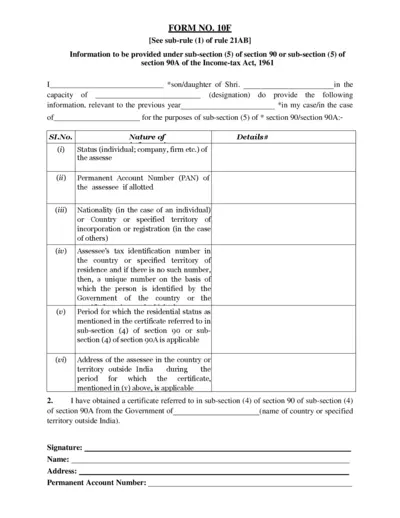

Form No. 10F: Income Tax Information Submission

Form No. 10F is required for providing tax information under sections 90 and 90A. Use this form to ensure compliance with tax regulations. Accurately filled forms help facilitate seamless processing of your tax-related matters.

Cross-Border Taxation

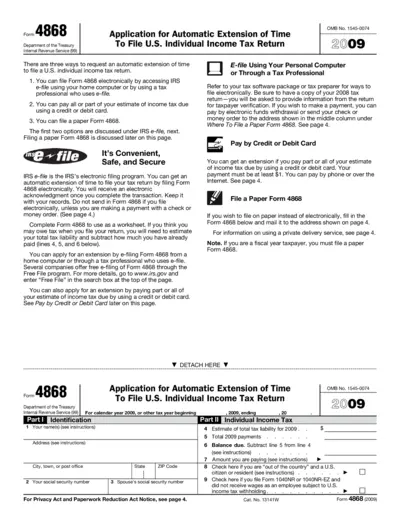

Form 4868 Automatic Extension Application 2009

Form 4868 allows U.S. individuals to request an automatic extension to file their tax returns. Users can apply for an additional six months to submit their returns. This document includes instructions for filling out and submitting the form.

Cross-Border Taxation

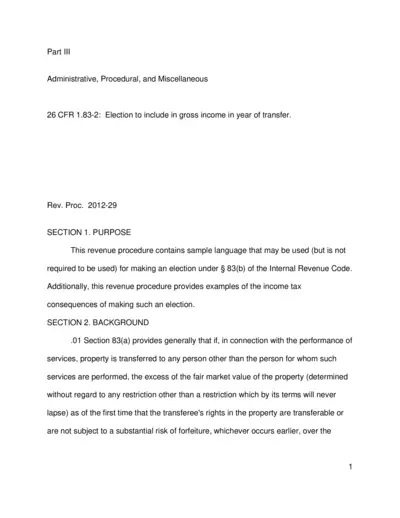

Election to Include in Gross Income under 83(b)

This document outlines the process of making an election under Section 83(b) of the Internal Revenue Code. It provides guidelines on the tax consequences and filing procedures necessary for individuals transferring property. Understanding these details is crucial for compliant tax reporting.

Cross-Border Taxation

Employer Tax Responsibilities for Disability Benefits

This document outlines essential tax information regarding employee disability benefits. It guides employers on taxation rules and reporting requirements. The file also details the taxability of benefits based on premium payments.

Cross-Border Taxation

E-TDS Filing Process Explained Concisely

This file provides essential guidelines on E-TDS filing. It outlines the objective and importance of filing a tax return electronically. Perfect for taxpayers looking to understand their obligations.

Cross-Border Taxation

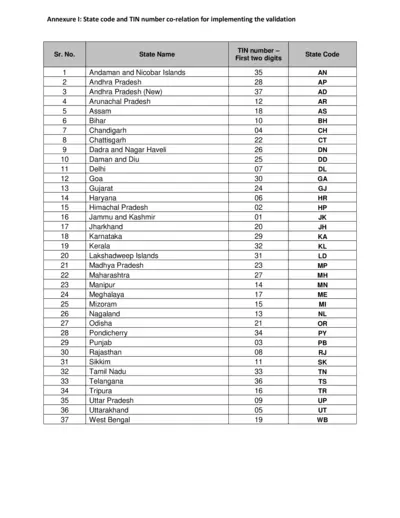

State Code and TIN Number Validation Guide

This file provides essential information on the correlation between state codes and TIN numbers in India. It serves as a reference for individuals and businesses to ensure proper validation. Use this guide to comply with regulatory requirements related to taxation.