International Tax Documents

Cross-Border Taxation

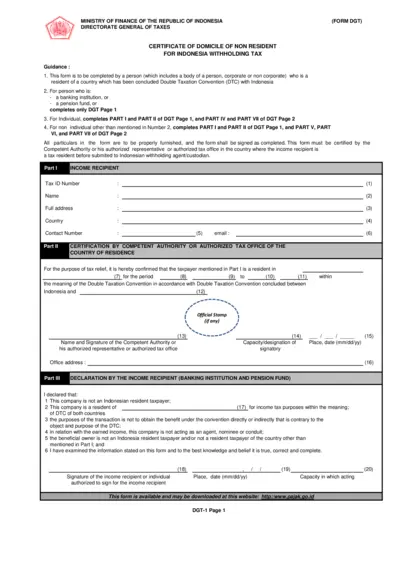

Certificate of Domicile for Non-Resident Tax Relief

This file provides a comprehensive guide for non-residents seeking withholding tax relief in Indonesia. It includes detailed instructions and sections to be filled out by individuals and entities. Use this form to ensure compliance with the Double Taxation Convention and facilitate tax relief efficiently.

Cross-Border Taxation

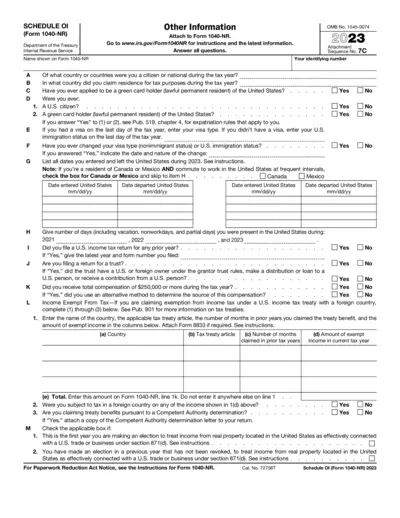

Schedule OI Form 1040-NR Instructions and Details

This file contains the Schedule OI for Form 1040-NR, detailing important information on residency, citizenship, and income tax treaty benefits. It serves as a guide for users needing help with their tax filing in the U.S. and outlines the necessary steps to complete the form accurately.

Cross-Border Taxation

Arizona Property Tax Exemptions Assessment Procedures

This document outlines the property tax exemptions and assessment procedures in Arizona. It provides comprehensive guidance for taxpayers and assessors. Updated regularly, it ensures compliance with state laws and best practices.

Cross-Border Taxation

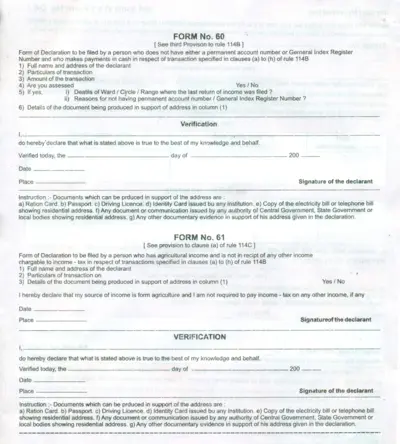

Declaration Forms for Tax Compliance Guidelines

This file contains essential declaration forms required for individuals without a permanent account number. It outlines instructions for filling out Form No. 60 and Form No. 61. Ideal for those making cash transactions and agricultural income declarations.

Cross-Border Taxation

URA Simplifies TIN Registration Process

The Uganda Revenue Authority has launched a simplified web-based TIN registration process. This new system enhances user experience and expedites application procedures. Individuals can now apply for their Tax Identification Number conveniently online.

Cross-Border Taxation

Colorado Department of Revenue Form 104X Instructions

This document provides detailed instructions for filing the Amended Colorado Income Tax Return using Form 104X. It includes guidelines on completing the return, essential attachments, and filing methods. Users can access a secure online service for efficient submission.

Cross-Border Taxation

Wisconsin Pass-Through Entity Tax Guidance Document

This file provides essential guidance on Wisconsin's Pass-Through Entity withholding requirements. It outlines who needs to file, how to pay withholding taxes, and addresses common questions. Business owners and tax professionals will find this document invaluable for compliance and understanding tax obligations.

Cross-Border Taxation

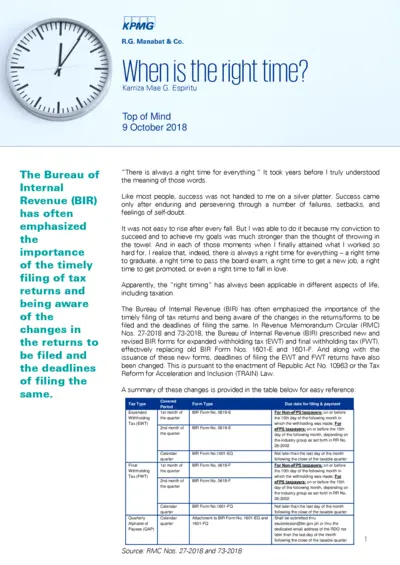

Guide on Timely Tax Filing and Compliance

This document provides essential information regarding timely tax filing with the BIR. It includes important changes in tax return forms and deadlines. Ideal for taxpayers wanting to stay compliant with tax regulations.

Taxation of Digital Services

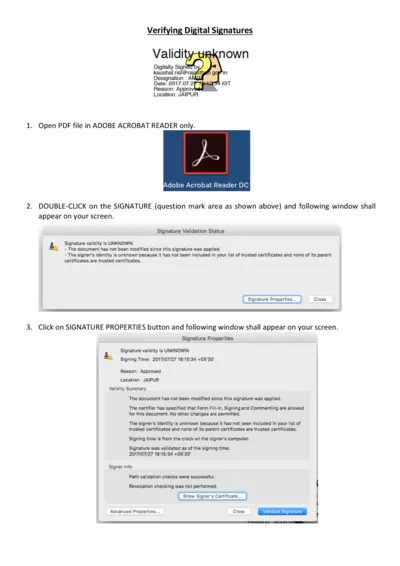

Guide for Verifying Digital Signatures and Certificates

This document provides detailed instructions for verifying digital signatures in PDF files. It outlines the necessary steps to ensure the authenticity of signatures and certificates. Users can follow the guidelines to enhance their understanding of digital signatures.

Cross-Border Taxation

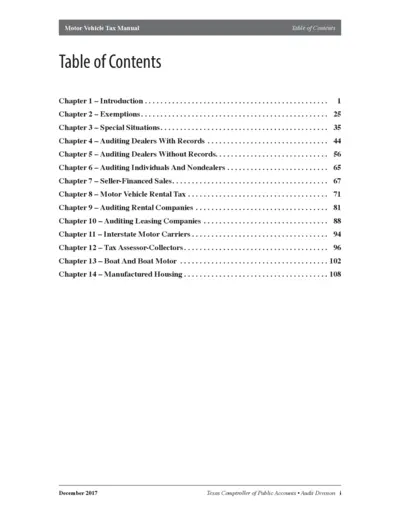

Motor Vehicle Tax Manual Comprehensive Guide

The Motor Vehicle Tax Manual provides essential information and guidelines for understanding motor vehicle tax regulations in Texas. It includes various chapters on exemptions, auditing, and specific situations related to motor vehicle taxes. This manual is a valuable resource for tax assessors, dealers, and individuals involved in motor vehicle transactions.

Cross-Border Taxation

Guidelines for Electronic Authority Release of Goods

This file provides guidelines on the eATRIG system for excise tax purposes. It outlines procedures for application processing and issuance. The document serves as an essential resource for compliance and operational efficiency.

Cross-Border Taxation

Massachusetts Withholding by Pass-Through Entities Guide

This file provides essential information regarding Massachusetts withholding tax obligations for pass-through entities. It outlines exemptions, necessary forms, and compliance requirements. Businesses and individuals involved with pass-through entities will benefit from understanding these regulations.