Tax Documents

Income Tax

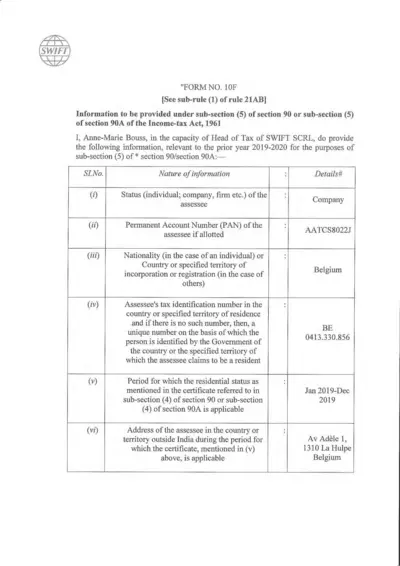

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

Income Tax

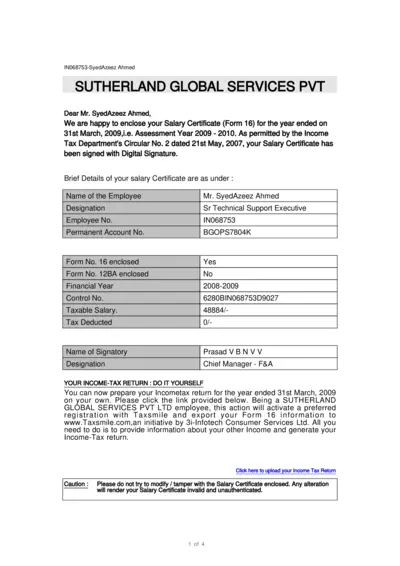

Salary Certificate and Income Tax Return Filing Guide

This file provides the salary certificate for Mr. SyedAzeez Ahmed for the financial year 2008-2009 and guidance for income tax return filing. It includes critical details for filing taxes, such as income and deductions. Follow the instructions provided to ensure accurate preparation and submission of your income tax returns.

Income Tax

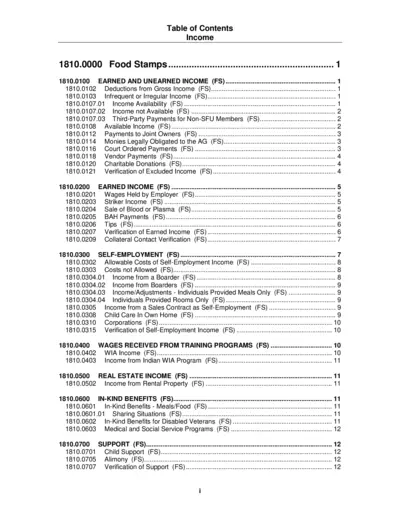

Comprehensive Income Guide and Instructions

This file provides a detailed overview of various income sources including earned and unearned income. It also includes instructions for filling out and submitting related forms. Users can refer to this document for guidance on income verification for assistance programs.

Income Tax

Procedure to Download TDS Certificate in form 16B

This guide provides a step-by-step procedure to download the TDS Certificate in form 16B. It is essential for property buyers to fulfill their tax obligations. Follow the instructions carefully to ensure successful completion.

Income Tax

Procedure to Download TDS Certificate in Form 16B

This file provides a step-by-step guide to download the TDS certificate in Form 16B. It includes instructions for logging in and retrieving tax-related documents. Perfect for buyers of immovable properties who need to access their tax certificates.

Income Tax

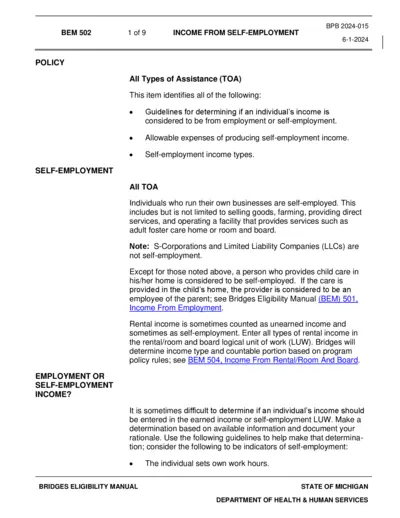

Income from Self-Employment Guidelines 2024

This file provides comprehensive guidelines on determining income from self-employment. It includes allowable expenses, types of self-employment income, and essential examples for clarity. Ideal for individuals navigating self-employment income reporting for assistance programs.

Tax Returns

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

Payroll Tax

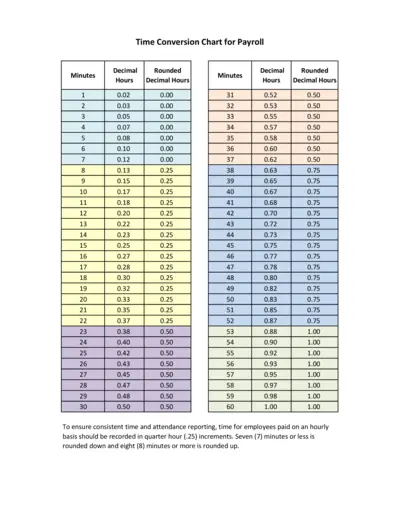

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

Federal Tax Forms

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.

Sales Tax

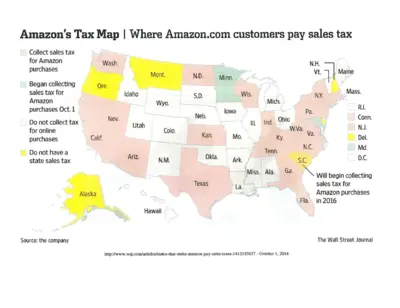

Amazon Sales Tax Map and Collection Details

This document provides a map of U.S. states where Amazon collects sales taxes and details the reasons for tax collection. It includes information on states with physical Amazon facilities, affiliate nexus laws, and states that will begin collecting taxes in the future. This is useful for understanding Amazon's tax obligations across states.

Cross-Border Taxation

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

Payroll Tax

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.