Tax Documents

Cross-Border Taxation

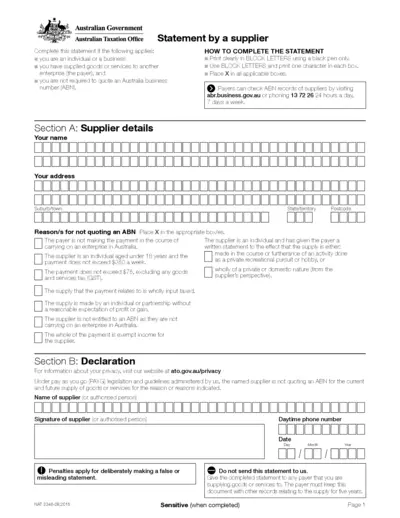

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

Income Verification

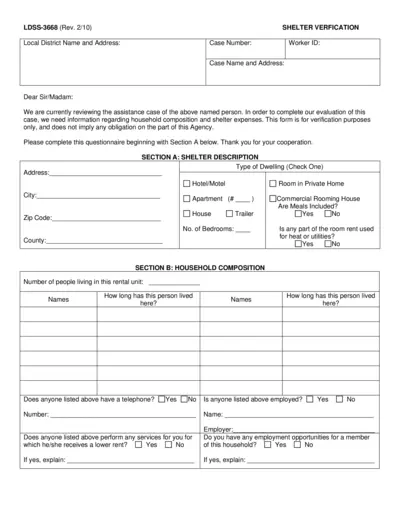

Shelter Verification Form for Assistance Evaluation

This form is used to verify household composition and shelter expenses for assistance evaluation purposes. It includes sections for shelter description, household composition, and shelter expenses. Complete the questionnaire for accurate verification.

Payroll Tax

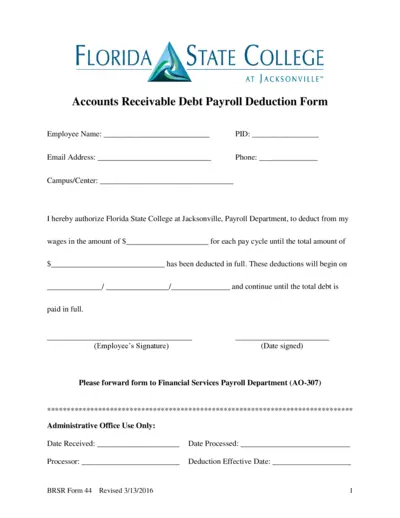

Florida State College at Jacksonville Payroll Deduction Form

This form is used by employees of Florida State College at Jacksonville to authorize payroll deductions to pay off accounts receivable debt. It includes fields for personal information, deduction amount, starting date, and employee signature. Upon completion, the form should be submitted to the Financial Services Payroll Department.

Cross-Border Taxation

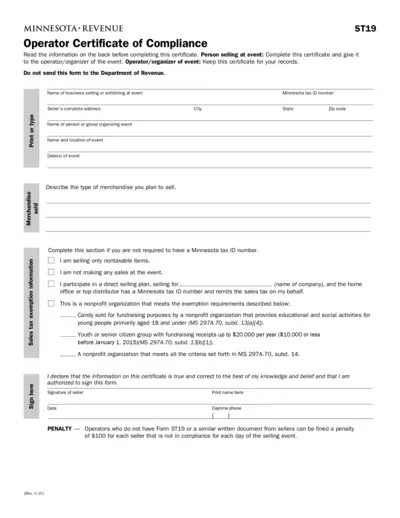

Minnesota ST19 Operator Certificate of Compliance

The Minnesota ST19 Operator Certificate of Compliance is required by law for sellers and event operators to certify compliance with sales tax regulations. The form must be completed by the seller and provided to the operator of the event. Penalties apply for non-compliance.

Cross-Border Taxation

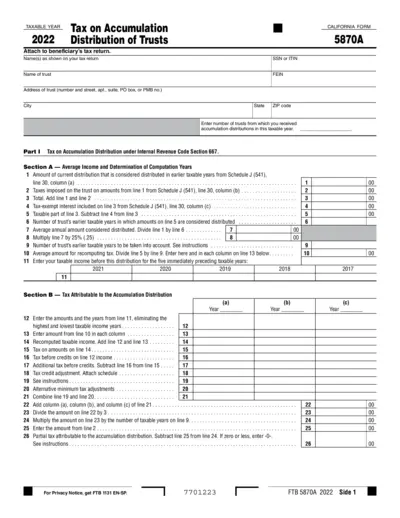

Tax on Accumulation and Distribution of Trusts 2022

This file provides instructions and fields for calculating tax on accumulation and distribution of trusts for the 2022 taxable year. It should be attached to the beneficiary's tax return. The form includes sections for tax computation, distribution of previously untaxed trust income, and mental health services tax.

Cross-Border Taxation

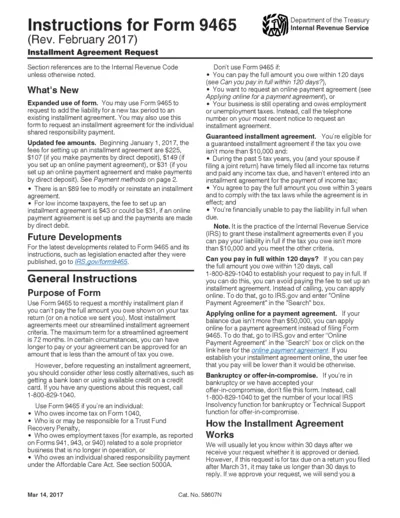

Instructions for Form 9465 Installment Agreement Request

Instructions for Form 9465 provide guidance on how to request a monthly installment plan for taxes owed. It includes information on installment agreement fees, payment methods, and eligibility criteria. Follow these instructions to successfully complete and submit Form 9465.

Sales Tax

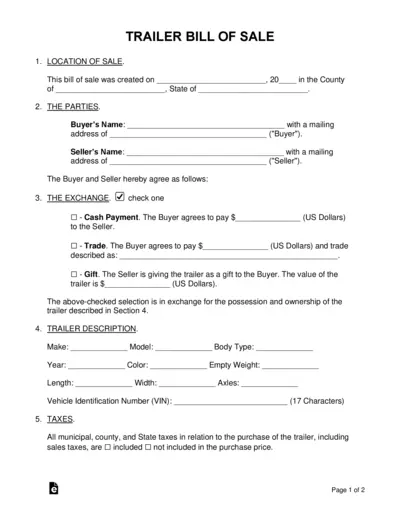

Trailer Bill of Sale Form for Buyers and Sellers

This file is a Trailer Bill of Sale form used to document the sale of a trailer between a buyer and a seller. It includes sections for the location of sale, parties involved, payment details, trailer description, taxes, conditions, and authorization. Both buyer and seller must sign the form to make the sale official.

Cross-Border Taxation

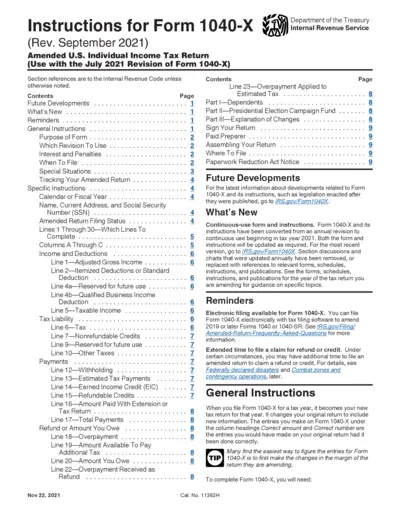

Instructions for Form 1040-X, Amended U.S. Individual Income Tax Return

This file provides detailed instructions for filling out Form 1040-X, which is used to amend U.S. individual income tax returns. It includes information on when to file, special situations, and interest and penalties. The instructions also cover specific lines and fields in the form, as well as how to assemble your return and where to file it.

Tax Returns

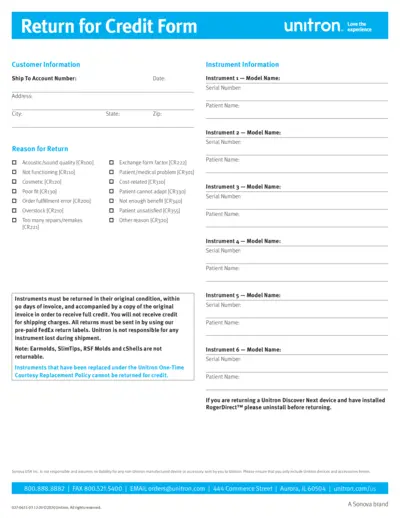

Return for Credit Form - Unitron Product Returns

The Return for Credit Form is used for customers to return Unitron products. It captures customer information, reason for return, and details about the instruments being returned. Follow the instructions to ensure your return is processed smoothly.

Tax Returns

American Airlines Lands' End Returns Procedure

This file provides instructions on how to make returns and exchanges for American Airlines uniforms via Lands' End. It includes detailed steps for completing the return form, packaging the items, and shipping them back. Additionally, it covers return policies and contact information for customer support.

Federal Tax Forms

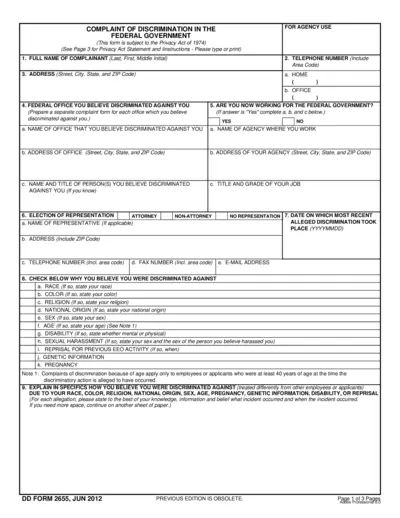

COMPLAINT OF DISCRIMINATION IN THE FEDERAL GOVERNMENT

This file is used for filing complaints of discrimination within the federal government. It includes sections for contact information, details of the complaint, and additional information. It is essential for those who believe they have faced discrimination.

Income Verification

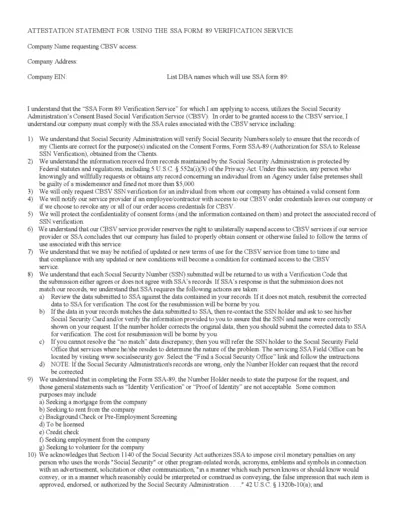

Attestation Statement for SSA Form 89 Verification

This file contains the attestation statement for using the SSA Form 89 Verification Service. It includes the rules and requirements for accessing the CBSV service. Additionally, it outlines the responsibilities for safeguarding Personal Identifiable Information (PII).