Edit, Download, and Sign the Haven Attic Donation Receipt Form

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, begin by entering your personal information in the designated fields. Next, list the items you are donating along with their approximate values. Finally, sign the form to complete your donation receipt.

How to fill out the Haven Attic Donation Receipt Form?

1

Enter your personal details, including name and contact information.

2

List the items you are donating and their approximate values.

3

Check the boxes regarding mailing list preferences.

4

Sign the form to validate your donation.

5

Keep a copy for your records.

Who needs the Haven Attic Donation Receipt Form?

1

Individuals donating items to Haven Attic for tax deductions.

2

Families decluttering their homes and wanting to give back.

3

Organizers of charity events needing donation receipts.

4

Non-profits requiring acknowledgment of received donations.

5

Taxpayers needing to document their charitable contributions.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Haven Attic Donation Receipt Form along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Haven Attic Donation Receipt Form online.

With PrintFriendly, editing this PDF is effortless. Simply upload the document and click on the edit option. Adjust text and details as needed before saving your changes.

Add your legally-binding signature.

Signing the PDF is made easy with PrintFriendly. After editing, navigate to the sign option to add your signature. This ensures your donation receipt is complete and valid.

Share your form instantly.

Sharing your edited PDF is simple with PrintFriendly. Once finished, utilize the share feature to send the document to friends or family. Spread the word about your generous donation effortlessly.

How do I edit the Haven Attic Donation Receipt Form online?

With PrintFriendly, editing this PDF is effortless. Simply upload the document and click on the edit option. Adjust text and details as needed before saving your changes.

1

Upload the PDF document to PrintFriendly.

2

Select the area you wish to edit and make your changes.

3

Use the formatting tools to enhance your document as needed.

4

Click on the save button to secure your edits.

5

Download the updated document to your device.

What are the instructions for submitting this form?

To submit this form, please send it via email to donations@havenattic.org or fax it to (352) 378-7485. You may also deliver it in person to your nearest Haven Attic location. Ensure a copy is kept for your records and refer to this for any tax-related inquiries.

What are the important dates for this form in 2024 and 2025?

Important dates for using this form include the end of the calendar year for tax reporting. Ensure your donations are submitted by December 31st for tax benefits. Keep an eye out for any changes in tax laws that may affect your deductions in 2024 and 2025.

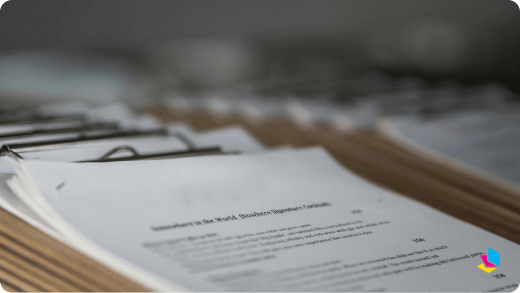

What is the purpose of this form?

The purpose of this donation receipt form is to ensure that donors can accurately document their contributions to Haven Attic. It provides crucial information for both the donor and the organization to maintain transparent records. This not only facilitates tax deductions but also supports the operational integrity of Haven Attic.

Tell me about this form and its components and fields line-by-line.

- 1. Donor's Name: The full name of the individual making the donation.

- 2. Contact Information: Includes email address and phone number for the donor.

- 3. Item Details: List of items being donated along with their estimated values.

- 4. Signature: Required signature confirming the donation has been made.

- 5. Date: The date when the donation is submitted.

What happens if I fail to submit this form?

If the form is not submitted correctly, your donation may not be recorded or recognized. Ensure all fields are filled out to avoid complications. Missing information can lead to delays in processing your donation.

- Incomplete Information: Missing fields may result in an invalid receipt.

- Failure to Sign: Not signing the form can invalidate your donation.

- Missing Documentation: Without proper details, your donation may not be tax-deductible.

How do I know when to use this form?

- 1. Charitable Donations: Use this form for any donations made to the Haven Attic.

- 2. Tax Record Keeping: Essential for tracking donations for tax deduction purposes.

- 3. Inventory Documentation: Helps in maintaining a record of donated items.

Frequently Asked Questions

How do I fill out the donation receipt?

Fill in your personal details, list the items, and sign the form.

Can I edit this PDF after downloading?

Yes, you can make edits using PrintFriendly before downloading.

Is the donation receipt tax-deductible?

Yes, donations to Haven are tax-deductible.

What if I forget to sign the form?

Your donation receipt must be signed to be valid.

How can I share the receipt with someone?

Use the share option on PrintFriendly to send the PDF.

What items can I donate?

You can donate clothing, household items, and furniture.

Is there a limit to the value of donations?

There is no limit, but please ensure items are in good condition.

Do I receive a copy of the form?

Yes, keep a copy for your tax records.

Where will my donations go?

Donations are used to support the mission of Haven Attic.

Can I donate large appliances?

No, large appliances and electronics are not accepted.

Related Documents - Haven Donation Form

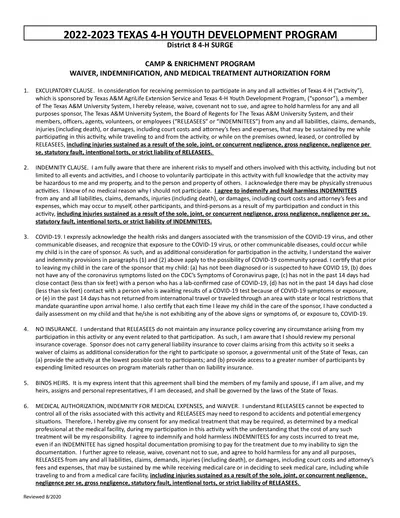

Texas 4-H Youth Development Program Form 2022-2023

This form is used for the Texas 4-H Youth Development Program's activities and includes waivers, indemnifications, medical treatment authorizations, and health and safety statements.

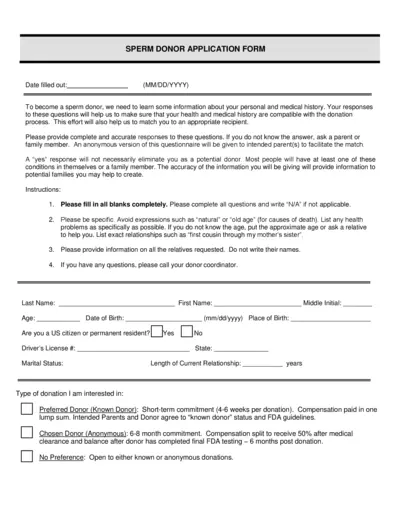

Sperm Donor Application Form for Personal and Medical History

This form gathers personal and medical history information to assess compatibility for sperm donation. Includes questions about health, family history, and donation preferences. Accurate information is crucial for matching with potential recipients.

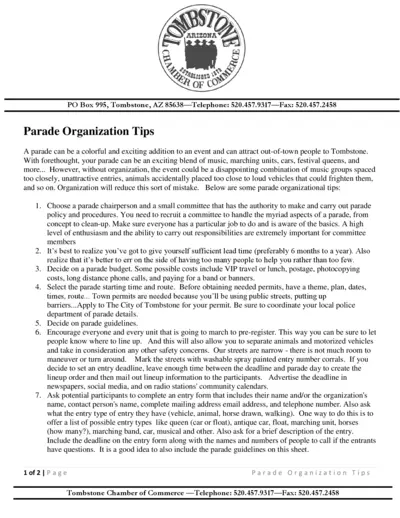

Parade Organization Tips and Guidelines for Tombstone Events

This comprehensive guide provides step-by-step instructions for organizing a successful parade in Tombstone. It includes tips on forming a committee, budgeting, obtaining permits, setting up the lineup, and much more. Utilize this file to ensure a smooth and enjoyable parade experience.

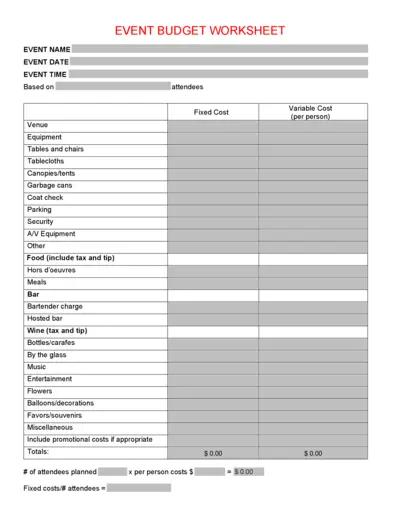

Event Budget Worksheet for Planning Success

This Event Budget Worksheet is designed to help planners organize financial details for events efficiently. It covers all essential expenses, from venue to food and entertainment. Perfect for event coordinators looking to stay on budget.

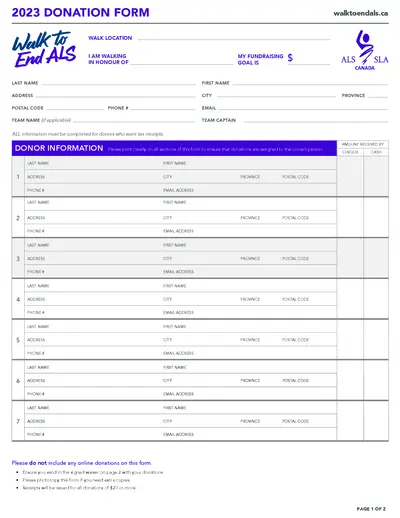

2023 Donation Form Walk to End ALS

This document is the official donation form for the Walk to End ALS event. It collects donor information for tax receipts and fundraising purposes. Please ensure all sections are filled out clearly to properly allocate donations.

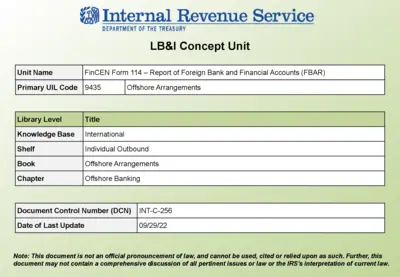

FinCEN Form 114 Reporting Guidelines and Overview

This file provides comprehensive details about FinCEN Form 114, required for reporting foreign bank accounts. It includes instructions, a summary of key points, and essential resources for United States persons. Understanding this form is crucial for compliance with the Bank Secrecy Act.

2023 SEC Quarterly Reports Form 10-Q Overview

This file provides comprehensive guidelines for completing the SEC Form 10-Q reports for quarterly financial disclosures. It includes essential details on compliance, deadlines, and key considerations. Users will find useful insights into effectively reporting their financial condition.

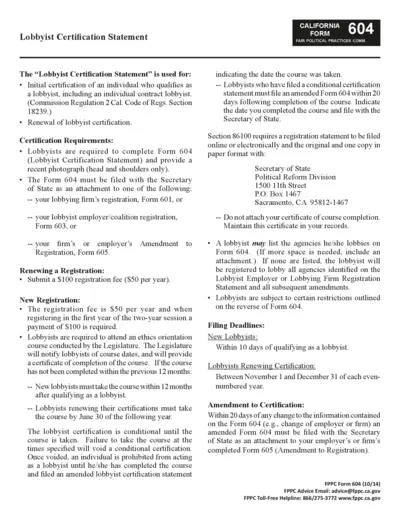

Lobbying Firm Activity Authorization Form

The Lobbying Firm Activity Authorization Form is essential for individuals and entities working with lobbying firms. It ensures proper authorization and compliance with California lobbying regulations. Use this form when engaging a lobbying firm for advocacy efforts.

Noodles & Company 8-K Report May 2023

This document is the Form 8-K report for Noodles & Company, detailing important financial results and operating updates. It includes key information on fiscal performance for the quarter ending April 4, 2023. Ideal for investors and analysts looking for timely corporate disclosures.

CPMT Meeting Minutes January 2024 Virginia

This document outlines the minutes from the Community Policy and Management Team meeting held on January 17, 2024. It details the budget review, action items, and participant information. Useful for members involved in children's services and family assessments.

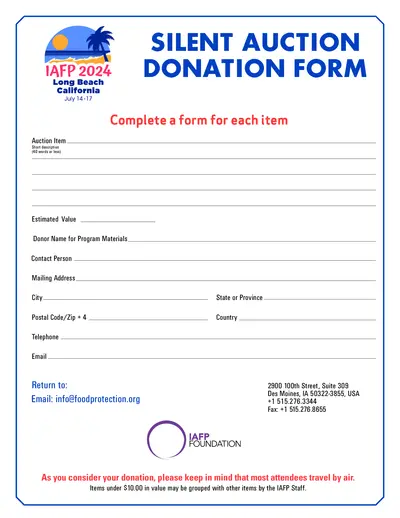

IAFP 2024 Silent Auction Donation Form

This document serves as the official donation form for the IAFP 2024 Silent Auction. It outlines the necessary details required for donating items and provides guidance on submission. Users can follow the instructions to fill out the form accurately and ensure their donations are processed.

Lobbyist Certification Statement Essential Guide

The Lobbyist Certification Statement is crucial for individuals seeking certification as lobbyists in California. It outlines the requirements and instructions for both initial and renewal certifications. Understanding this form helps ensure compliance with lobbying regulations.