Understanding W-2 and 1099 for Independent Contractors

This file provides essential information on the differences between W-2 and 1099 forms, detailing tax responsibilities and contractor classifications. It outlines the IRS criteria for determining employment status and offers guidance on completing these forms. Navigate through concise instructions and important considerations for independent contractors and employers.

Edit, Download, and Sign the Understanding W-2 and 1099 for Independent Contractors

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, begin by gathering all necessary financial records. Ensure you understand the distinctions between W-2 and 1099 forms to select the appropriate one. Follow the included instructions meticulously to complete the form accurately.

How to fill out the Understanding W-2 and 1099 for Independent Contractors?

1

Gather your financial records and required information.

2

Determine if the individual is an employee (W-2) or independent contractor (1099).

3

Choose the appropriate form based on the classification.

4

Fill out personal and financial details as required.

5

Review the completed form for accuracy before submission.

Who needs the Understanding W-2 and 1099 for Independent Contractors?

1

Freelancers needing proper tax documentation.

2

Employers wanting to classify workers correctly for tax purposes.

3

Accountants assisting clients with tax filings.

4

Businesses seeking clarity on contractor payment processes.

5

Individuals managing multiple income sources requiring accurate reporting.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Understanding W-2 and 1099 for Independent Contractors along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Understanding W-2 and 1099 for Independent Contractors online.

Edit your PDF seamlessly on PrintFriendly. Our intuitive editor allows you to modify text and details as needed. Save your edited version swiftly and easily for your records.

Add your legally-binding signature.

Signing your PDF is straightforward with PrintFriendly. Access our signing feature to add your signature digitally. Ensure your document is legally recognized with our user-friendly signing process.

Share your form instantly.

Share your edited PDF directly from PrintFriendly. Quickly generate a shareable link to your document. Collaborate effortlessly with others by providing access to your revised file.

How do I edit the Understanding W-2 and 1099 for Independent Contractors online?

Edit your PDF seamlessly on PrintFriendly. Our intuitive editor allows you to modify text and details as needed. Save your edited version swiftly and easily for your records.

1

Upload your PDF file to the PrintFriendly editor.

2

Select the text you wish to edit and make your changes.

3

Review all modifications to ensure accuracy.

4

Download the edited document to your device.

5

Share or print your finalized PDF as needed.

What are the instructions for submitting this form?

To submit this form, ensure you have filled it out completely and accurately. Email the completed form to the appropriate department or upload it via the designated online submission portal. Alternatively, you may send a physical copy to the IRS address specified for your filing category.

What are the important dates for this form in 2024 and 2025?

For 2024 and 2025, it is crucial to submit W-2 forms by January 31 and 1099 forms by February 28. Ensure that all filing and distribution deadlines align with IRS regulations to avoid penalties. Being aware of these dates aids in maintaining compliance and timely reporting.

What is the purpose of this form?

The purpose of this form is to clarify the distinction between W-2 and 1099 forms, providing vital information for employers and independent contractors. It serves to guide users in properly classifying workers and fulfilling their tax obligations accurately. This understanding protects both parties and ensures compliance with IRS guidelines.

Tell me about this form and its components and fields line-by-line.

- 1. Employee Information: Includes details of the employee or contractor being compensated.

- 2. Income Details: Specifies the amount earned by the individual.

- 3. Tax Withholdings: Details any taxes withheld from payments made.

What happens if I fail to submit this form?

Failing to submit this form can lead to significant penalties from the IRS. Inaccurate tax reporting may result in audits and additional fines. It is essential to adhere to submission deadlines to avoid complications.

- Penalties: Failure to submit timely can incur monetary penalties.

- Audits: Inaccuracies may trigger IRS audits.

- Delayed refunds: Incorrect forms can delay tax refunds.

How do I know when to use this form?

- 1. Hiring freelancers: Use this form to accurately report payments made to freelancers.

- 2. Tax reporting: Essential for reporting income to the IRS for both employees and contractors.

- 3. Contractor payments: Necessary when issuing payments to independent contractors.

Frequently Asked Questions

How can I edit this PDF?

You can edit this PDF by uploading it to PrintFriendly and using our editing tools to modify text.

Can I share the edited PDF?

Yes, you can share the edited PDF by generating a shareable link.

Is signing available for this document?

Absolutely! You can digitally sign the document within the PrintFriendly platform.

What formats can I download the edited PDF in?

You can download the edited PDF in standard formats like PDF for printing and sharing.

Do I need to create an account to edit PDFs?

No account is required to edit and download PDFs on PrintFriendly.

Can I add pages to my PDF?

Yes, you can add pages during the editing process.

Is customer support available for assistance?

Yes, our support team is available to help you with any questions regarding PDF editing.

Can I undo my changes in the editor?

Yes, you can undo changes as you edit your document to ensure accuracy.

Is there a limit on the number of PDFs I can edit?

There is no specific limit on editing PDFs on PrintFriendly.

Does PrintFriendly convert the PDF accurately?

Yes, PrintFriendly maintains the original formatting while allowing for edits.

Related Documents - W2_vs_1099_Guide

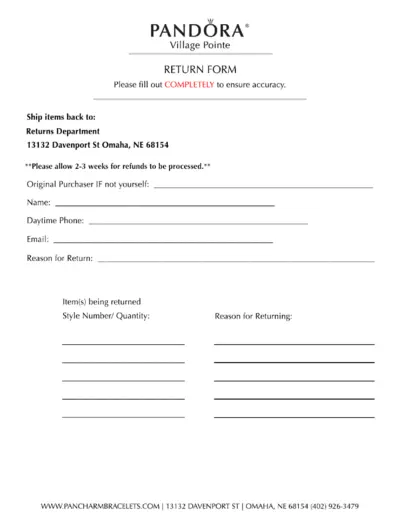

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

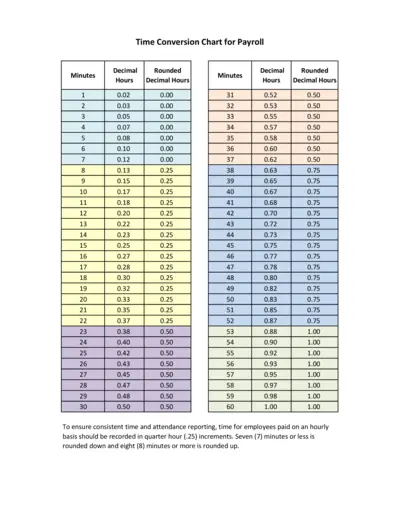

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.

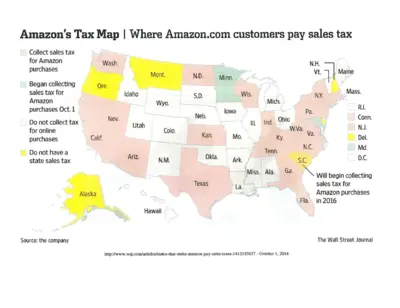

Amazon Sales Tax Map and Collection Details

This document provides a map of U.S. states where Amazon collects sales taxes and details the reasons for tax collection. It includes information on states with physical Amazon facilities, affiliate nexus laws, and states that will begin collecting taxes in the future. This is useful for understanding Amazon's tax obligations across states.

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

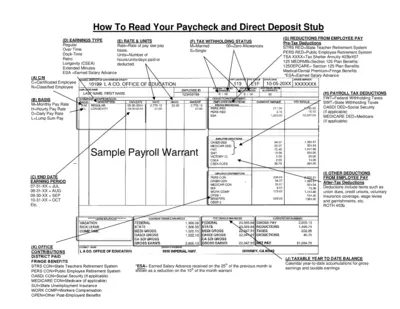

Understanding Your Paycheck and Direct Deposit Stub

This file helps employees understand their paycheck and direct deposit stub. It includes various sections explaining earnings types, tax withholding status, and deductions. Perfect for those who need clarity on their payroll system.

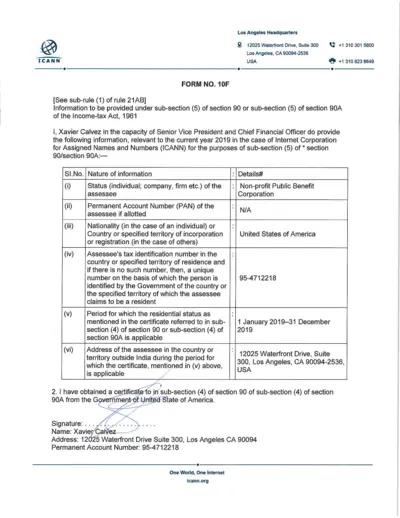

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

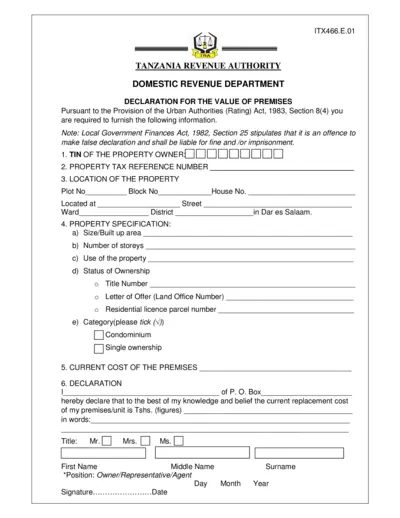

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

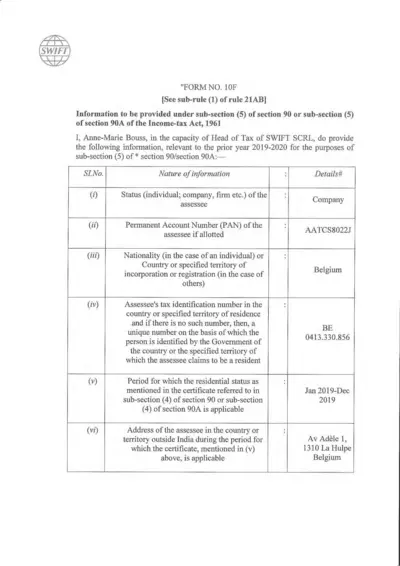

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

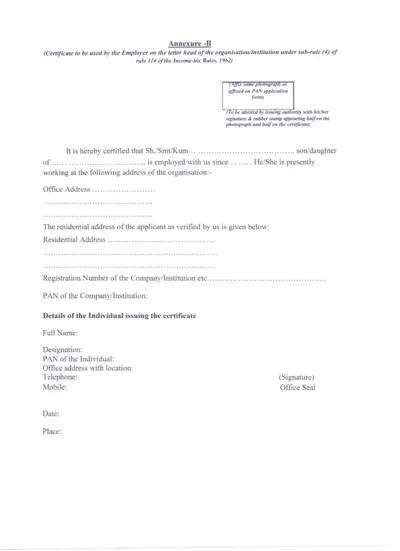

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

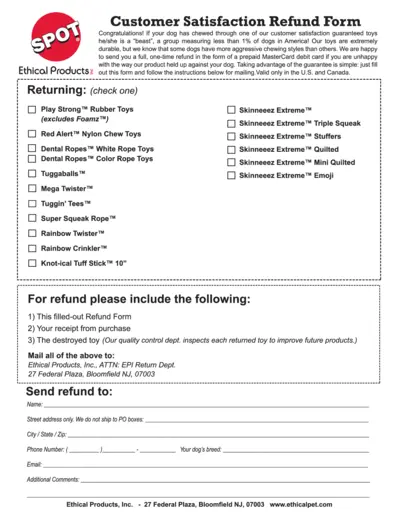

Customer Satisfaction Refund Form For Dog Toys

This file is a refund form for customer satisfaction guaranteed dog toys from Ethical Products Inc. If your dog has chewed through one of their durable toys, you can request a one-time refund using this form. Follow the instructions to obtain a refund via a prepaid MasterCard debit card.