Tax Forms Documents

Tax Forms

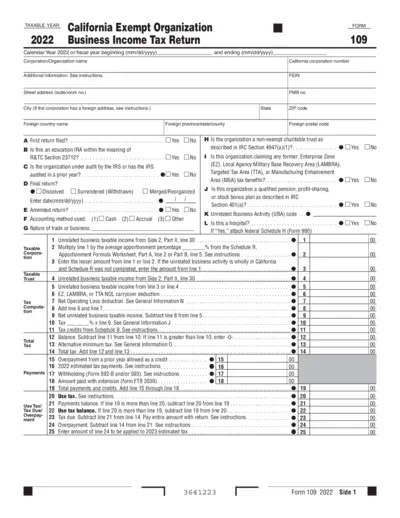

California Business Income Tax Return Form 109 - 2022

The California Business Income Tax Return Form 109 is used by exempt organizations to report their taxable income for the tax year 2022. This form is essential for organizations to accurately report their financial activities and determine their tax obligations. Completing this form ensures compliance with state tax regulations.

Tax Forms

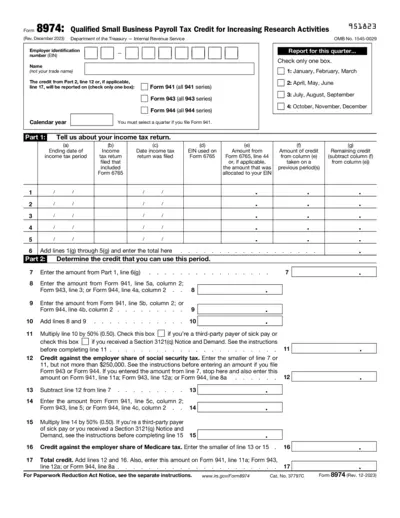

Qualified Small Business Payroll Tax Credit Form

The Qualified Small Business Payroll Tax Credit form helps taxpayers claim credits for increasing research activities. This form must be completed accurately to ensure all eligible credits are claimed. Familiarize yourself with the requirements to effectively utilize the form.

Tax Forms

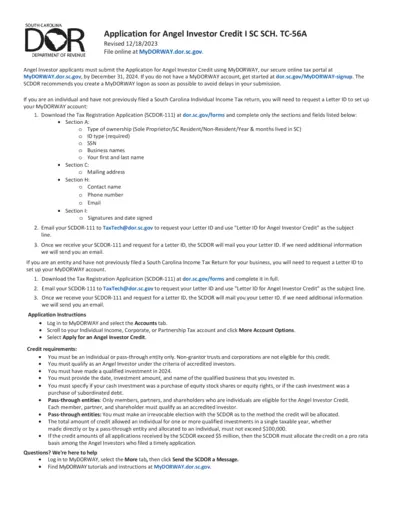

Angel Investor Credit Application - South Carolina

This document provides details on how to apply for the Angel Investor Credit in South Carolina. It includes essential instructions, requirements, and submission deadlines pertinent for applicants. Gain insight into the necessary steps to secure your Angel Investor Credit effectively.

Tax Forms

T1135 Guide Foreign Income Verification Statement

The T1135 file provides essential information for Canadian taxpayers regarding the Foreign Income Verification Statement. It outlines the necessary steps to report specified foreign property accurately. This guide ensures compliance with Canadian tax regulations.

Tax Forms

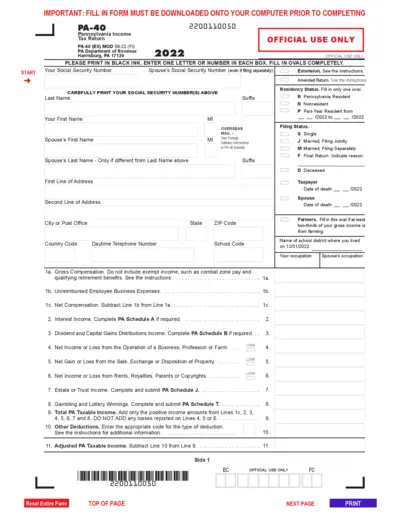

PA-40 Pennsylvania Income Tax Return Instructions

This file contains the PA-40 Pennsylvania Income Tax Return form and its detailed instructions. It is essential for individuals filing their state tax returns in Pennsylvania. Users can fill out this form to comply with state tax requirements.

Tax Forms

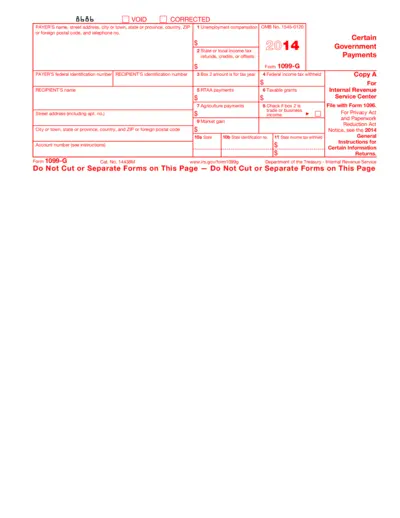

Form 1099-G: Reporting Government Payments

This file contains IRS Form 1099-G, which is used to report certain types of government payments. It outlines necessary fields for unemployment compensation and state income tax. Proper completion is vital to comply with tax regulations.

Tax Forms

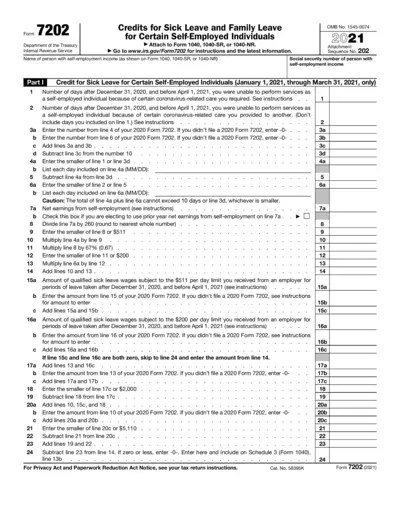

Credits for Sick Leave and Family Leave for Self-Employed

Form 7202 assists self-employed individuals in claiming credits for sick leave and family leave related to COVID-19. This form applies to specific dates in 2021 for those unable to work due to caring for themselves or others. It helps determine eligible days and corresponding tax credits.

Tax Forms

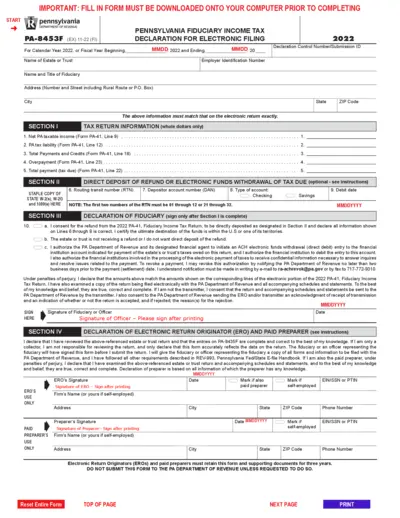

Pennsylvania PA-8453F Electronic Filing Declaration

The PA-8453F form is essential for estate or trust fiduciaries to declare the electronic filing of the Pennsylvania Fiduciary Income Tax for the year 2022. It ensures all relevant information is accurately represented and submitted to the PA Department of Revenue. This form is vital for compliance and to facilitate direct deposit of refund or electronic payment of taxes owed.

Tax Forms

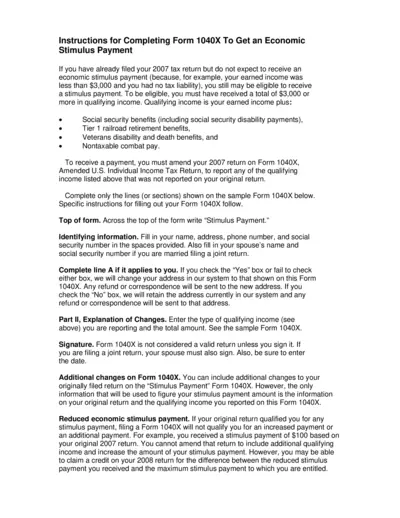

Completing Form 1040X for Economic Stimulus Payment

This file provides important instructions for completing Form 1040X to claim your economic stimulus payment. It outlines eligibility criteria, filing instructions, and essential details for tax amendment. Perfect for taxpayers seeking to maximize their benefits from the IRS.

Tax Forms

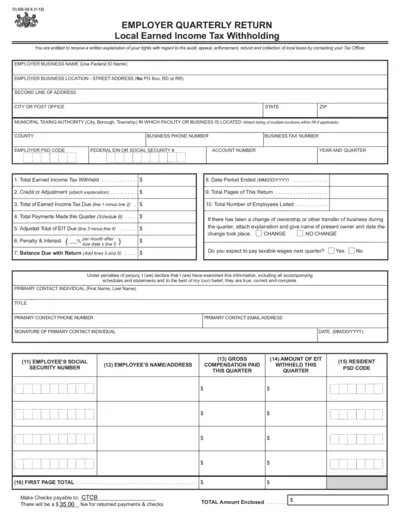

Employer Quarterly Return for Local Earned Income Tax

This file is essential for employers to report local earned income tax withholding for their employees. It ensures compliance with local tax regulations and provides necessary details to tax authorities. Utilize this form to accurately calculate your earned income tax liabilities each quarter.

Tax Forms

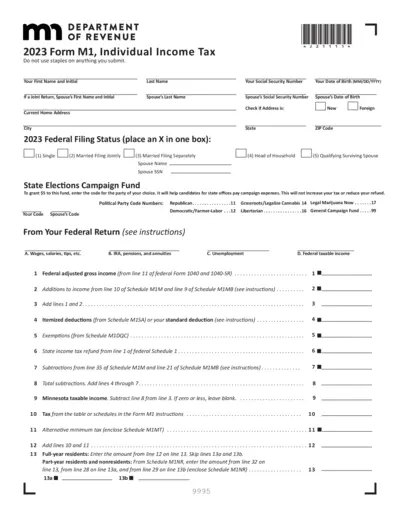

2023 Individual Income Tax Form M1

The 2023 Form M1 is the Individual Income Tax return for Minnesota residents. This form is essential for filing your state income tax accurately. Complete it with your personal and financial details to ensure proper tax assessment.

Tax Forms

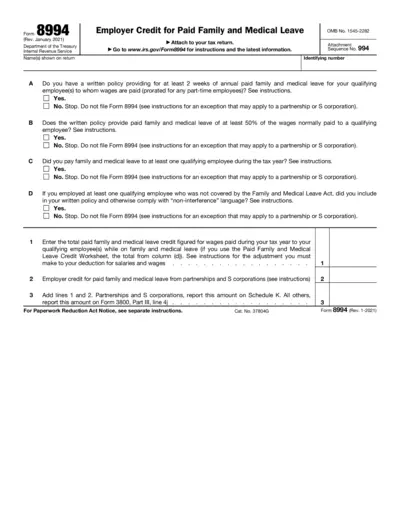

Employer Credit for Paid Family and Medical Leave

Form 8994 allows eligible employers to claim a tax credit for providing paid family and medical leave to employees. This form includes a series of questions to determine eligibility and the amount of credit that may be claimed. It is essential for businesses looking to benefit from the Employer Credit for Paid Family and Medical Leave.