Tax Forms Documents

Tax Forms

California 540NR Nonresident Tax Filing Instructions 2023

The California 540NR booklet provides essential instructions for nonresidents or part-year residents to file their state income tax. It includes important dates, forms, credits, and common errors to avoid. This guide is crucial for understanding the filing process and ensuring compliance with California tax regulations.

Tax Forms

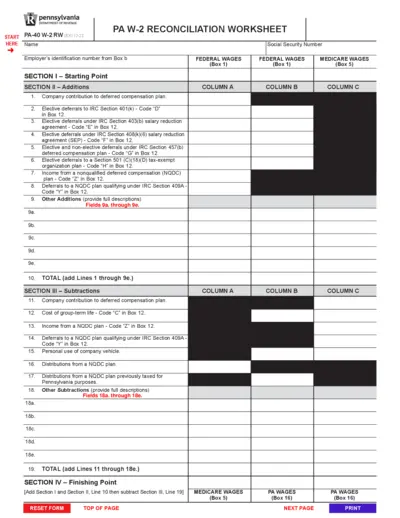

PA W-2 Reconciliation Worksheet Instructions

The PA W-2 Reconciliation Worksheet is essential for reconciling Pennsylvania income tax purposes. It assists taxpayers in detailing information from federal Form W-2. Use this form for reporting income accurately and ensuring compliance with tax regulations.

Tax Forms

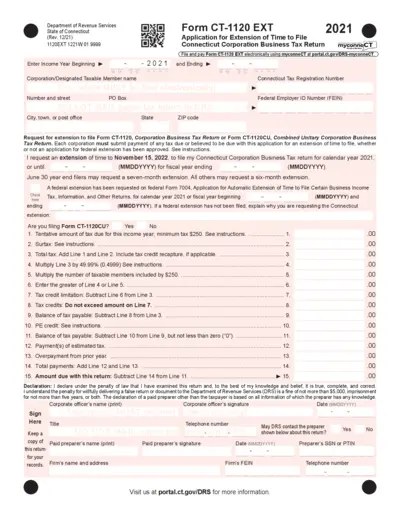

Connecticut Corporation Business Tax Extension Form

Form CT-1120 EXT is a vital document for Connecticut corporations seeking an extension to file their business tax return. It allows business owners to request extra time and provides clear instructions on electronic filing, deadlines, and payment obligations. Ensure timely submission to avoid penalties.

Tax Forms

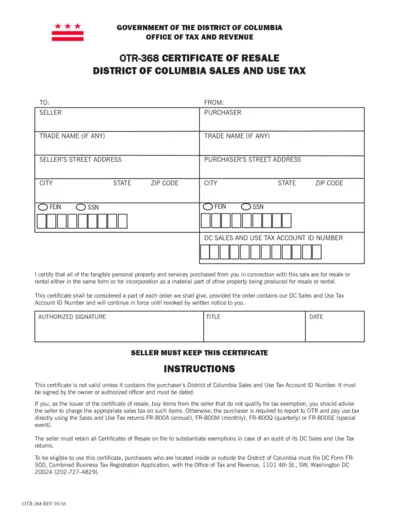

OTR-368 Certificate of Resale for DC Sales Tax

The OTR-368 Certificate of Resale is a crucial document used in the District of Columbia for tax exemption on resale or rental. This form is necessary for purchasers to certify that their bought items are intended for resale. Proper completion and retention of this certificate are vital for compliance with DC sales and use tax regulations.

Tax Forms

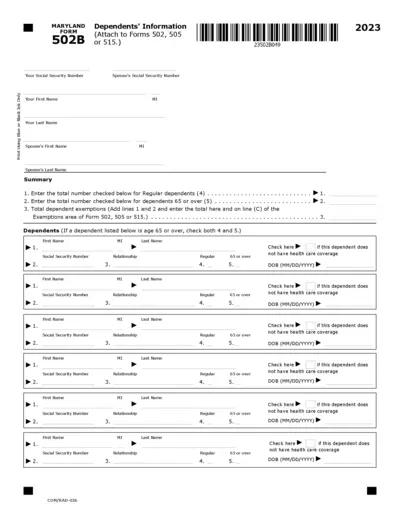

Maryland Form 502B Dependents Information 2023

The Maryland Form 502B is used for reporting dependents' information. This form should be attached to Forms 502, 505, or 515 when filing taxes. Ensure to provide accurate details to maximize your exemptions.

Tax Forms

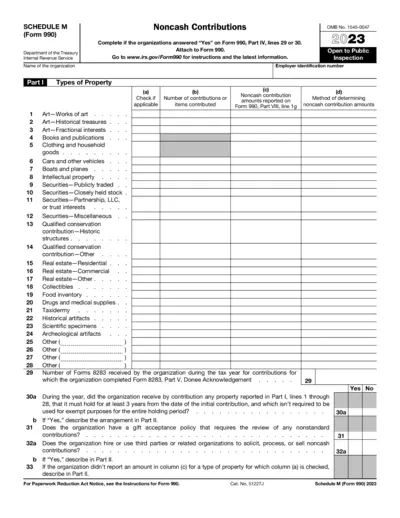

Schedule M Form 990 Noncash Contributions 2023

Schedule M (Form 990) is required for organizations reporting noncash contributions. It details the types of noncash contributions received during the tax year. Filling out this schedule accurately is crucial for compliance with IRS regulations.

Tax Forms

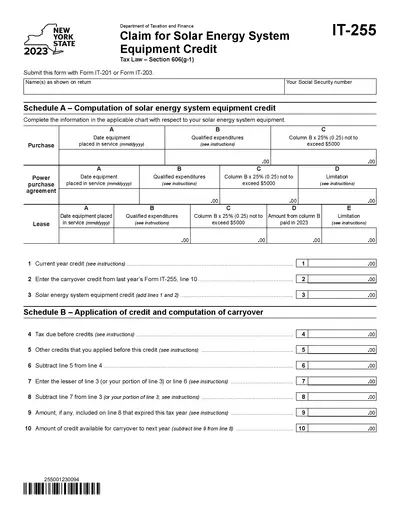

NY State 2023 Solar Energy System Equipment Credit

This document is the Claim for Solar Energy System Equipment Credit Form IT-255 for 2023. It provides essential information and instructions for taxpayers applying for the solar credit. Ensure you follow the guidelines to maximize your benefits.

Tax Forms

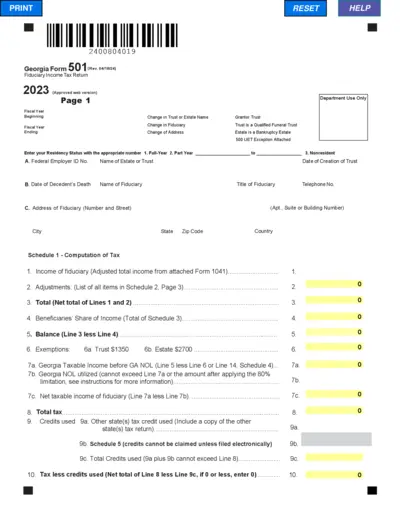

Georgia Form 50 1 Fiduciary Income Tax Return 2023

The Georgia Form 50 1 is a fiduciary income tax return required for estates and trusts. It provides essential tax information and calculations for the 2023 fiscal year. Complete this form accurately to ensure compliance with state regulations.

Tax Forms

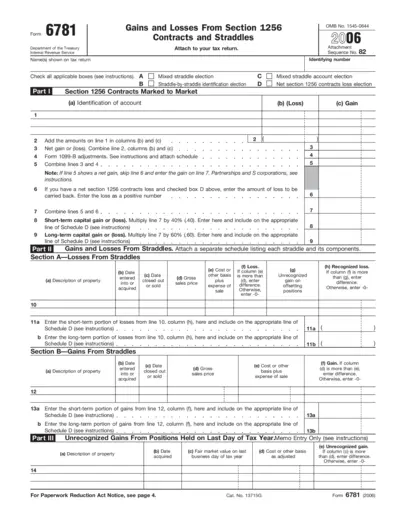

Form 6781 for Reporting Gains and Losses

Form 6781 is used to report gains and losses from Section 1256 contracts and straddles. This form helps taxpayers accurately calculate capital gains or losses for tax return purposes. Ensure you follow the detailed instructions to complete it correctly.

Tax Forms

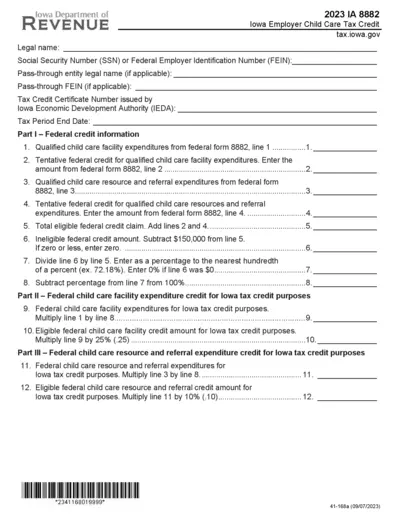

Iowa Employer Child Care Tax Credit Instructions

This file provides detailed instructions for completing the Iowa Employer Child Care Tax Credit (form 8882). It covers eligible expenditures, required information, and calculation procedures. Use this guide to successfully claim your tax credit.

Tax Forms

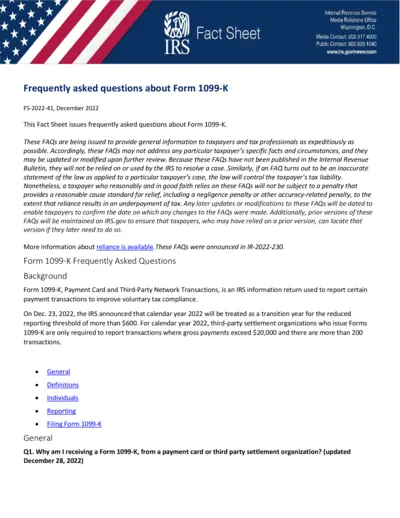

IRS Form 1099-K Frequently Asked Questions

This file provides essential FAQ information about IRS Form 1099-K. It helps taxpayers and tax professionals understand reporting requirements. Users can find detailed instructions and guidance for accurate filing.

Tax Forms

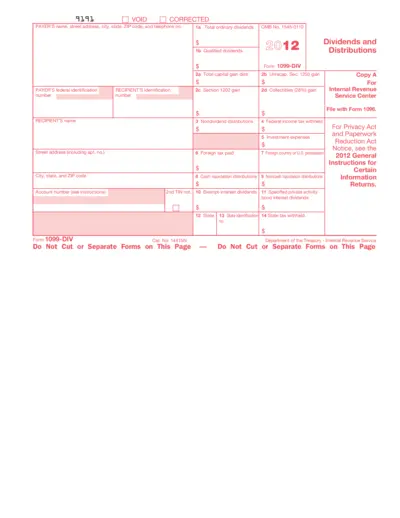

Understanding Form 1099-DIV for Dividends and Gains

This file provides detailed information regarding Form 1099-DIV, which reports dividends and distributions. It is essential for taxpayers to accurately declare their investment income. Use this document to understand how to fill out the form and what to include.