Tax Forms Documents

Tax Forms

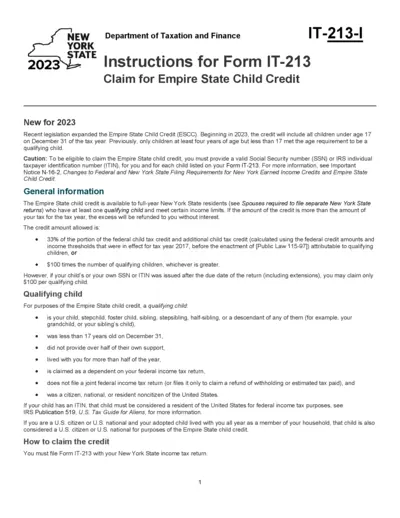

Instructions for Form IT-213 Claim for Empire State Child Credit

This file contains important instructions for completing Form IT-213 to claim the Empire State Child Credit. It outlines eligibility requirements, how to calculate the credit, and specific line-by-line instructions. This information is crucial for New York residents seeking to benefit from this tax credit in 2023.

Tax Forms

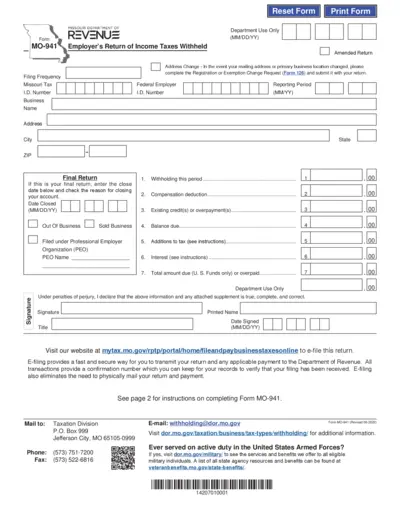

Employer's Return of Income Taxes Withheld MO-941

This file is essential for reporting income taxes withheld by employers in Missouri. It provides detailed instructions for filing an amended return. Completing this form accurately ensures compliance with state tax regulations.

Tax Forms

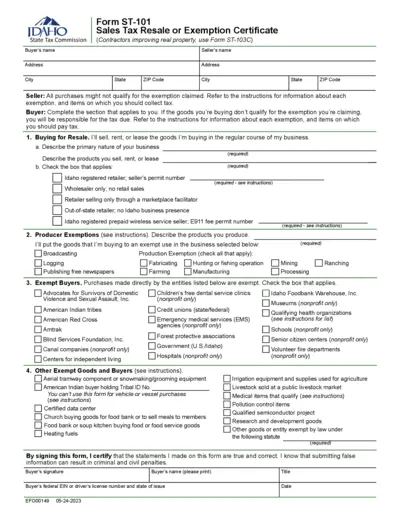

Idaho Sales Tax Resale or Exemption Certificate

This document serves as the Sales Tax Resale or Exemption Certificate for the State of Idaho. Businesses and organizations can use this certificate to claim tax exemptions on eligible purchases. Properly completed, this form helps buyers avoid unnecessary tax payments.

Tax Forms

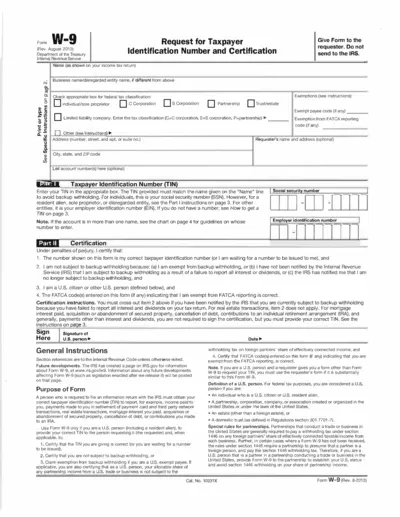

W-9 Taxpayer Identification Number Certification

The W-9 form is used by the IRS to collect taxpayer information. It's essential for individuals and businesses to ensure proper tax reporting. Complete this form to provide your correct Taxpayer Identification Number (TIN).

Tax Forms

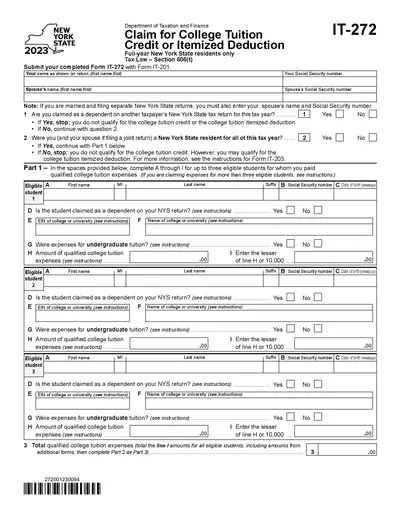

New York State College Tuition Credit Form IT-272 2023

The New York State College Tuition Credit Form IT-272 allows full-year residents to claim educational credits for their qualified tuition expenses. This form is designed for individuals who paid college tuition expenses for eligible students. It's essential for taxpayers looking to maximize their tax benefits while supporting higher education.

Tax Forms

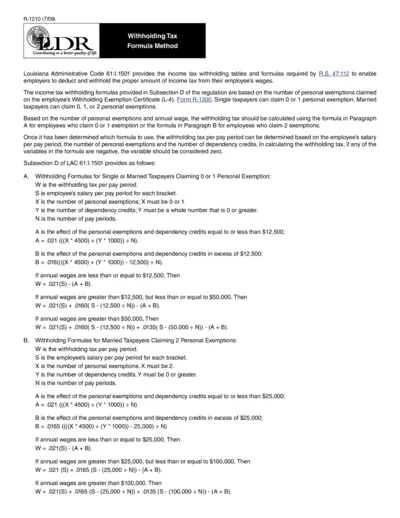

Income Tax Withholding Tax Forms and Instructions

This document provides essential information regarding income tax withholding in Louisiana. It includes formulas and instructions for employers to properly calculate withholding amounts based on employee exemptions and salary. Understanding this file is crucial for accurate payroll processing.

Tax Forms

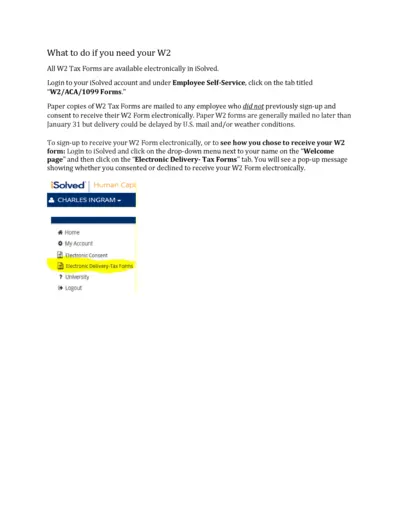

How to Access and Complete Your W2 Form

This document provides instructions for accessing and completing your W2 tax form electronically. It includes guidance on how to consent to receive the form digitally and the implications of choosing paper delivery. Follow these instructions to ensure you have your tax information ready for filing.

Tax Forms

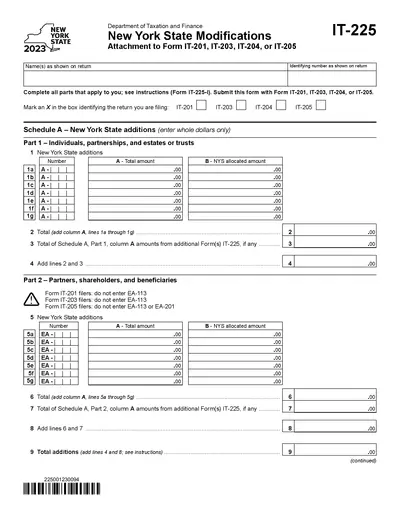

New York State Tax Modifications Form IT-225 2023

The New York State Modifications form IT-225 is essential for filing your tax return accurately. It includes necessary adjustments to ensure proper calculations. Use this form to report additions and subtractions relevant to your tax filings.

Tax Forms

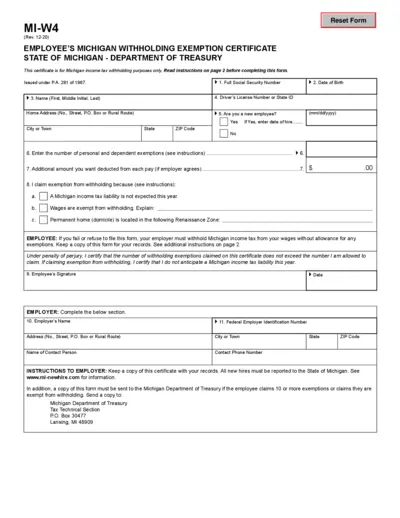

Michigan Withholding Exemption Certificate Form MI-W4

This form is essential for Michigan employees to declare their withholding exemptions. It ensures the correct amount of state income tax is withheld from paychecks. Properly filling out the MI-W4 can prevent over-withholding and ensure compliance with state regulations.

Tax Forms

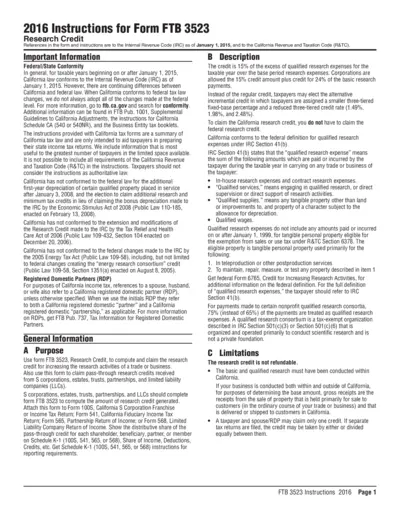

FTB 3523 Research Credit Instructions 2016

This file provides detailed instructions for completing Form FTB 3523 for claiming California research credits. It outlines eligibility, requirements, and step-by-step guidance for taxpayers. Use this essential resource to ensure accurate filing and maximize potential tax benefits.

Tax Forms

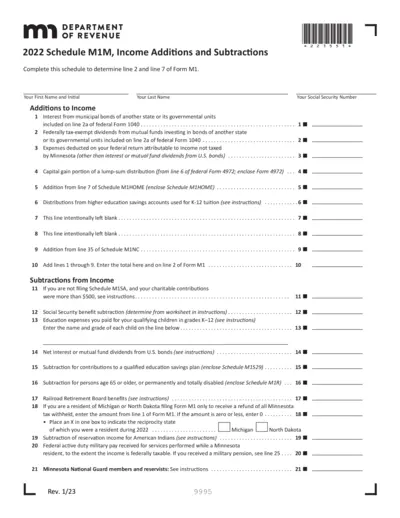

2022 Schedule M1M Income Additions and Subtractions

The 2022 Schedule M1M is a tax form used to report income additions and subtractions for Minnesota residents. This form is essential for accurately calculating your Minnesota taxable income. Follow the provided guidelines to ensure correct reporting.

Tax Forms

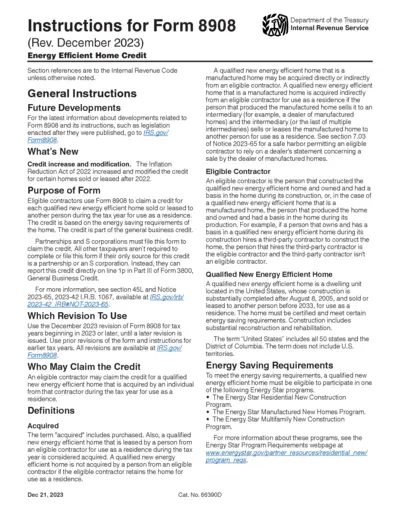

Instructions for Form 8908 Energy Efficient Credit

This document provides instructions for Form 8908, which allows eligible contractors to claim a credit for energy efficient homes. It outlines requirements, who may claim, and specific credits available. Stay informed about the latest updates and program participation details.