Tax Forms Documents

Tax Forms

Kansas Individual Income Tax Instructions 2015

This file contains the detailed instructions for filing the Kansas Individual Income Tax for the year 2015. It includes information on required documents, deadlines, and eligibility criteria. Users can find helpful guidance to ensure accurate completion of their tax returns.

Tax Forms

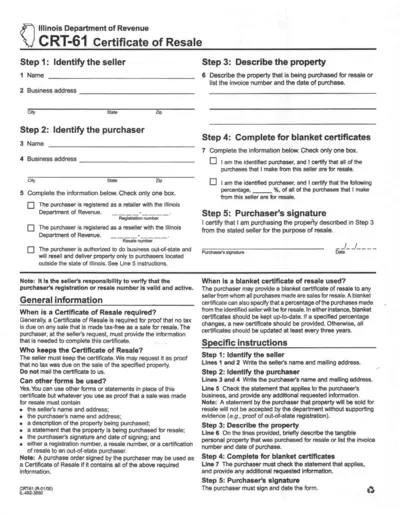

Illinois CRT-61 Certificate of Resale Guide

The CRT-61 Certificate of Resale is essential for businesses to make tax-exempt purchases intended for resale. This guide provides comprehensive information for both sellers and purchasers on completing the certificate. Ensure compliance with the Illinois Department of Revenue regulations by following the outlined steps.

Tax Forms

Form 4563 Instructions for American Samoa Residents

Form 4563 is essential for bona fide residents of American Samoa to exclude certain income from their gross income. This form helps ensure proper tax filing and compliance. Use this form to accurately report your eligible income from American Samoa.

Tax Forms

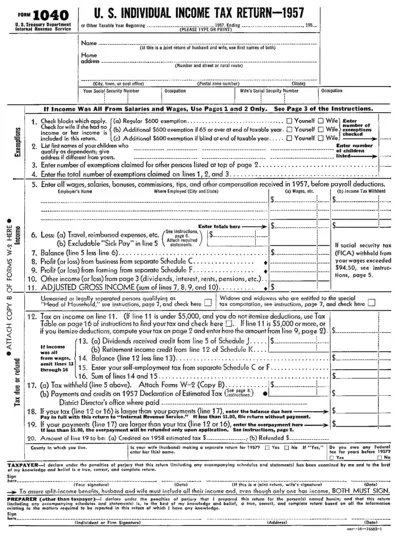

U.S. Individual Income Tax Return 1957 Form

This file contains the U.S. Individual Income Tax Return for the year 1957, detailing necessary information for filing taxes. It includes instructions on exemptions, deductions, and income reporting. Essential for individuals and couples to accurately file their taxes for 1957.

Tax Forms

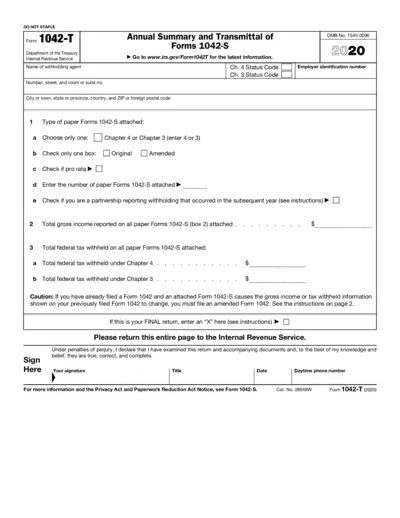

IRS Form 1042-T Transmittal of Forms 1042-S

This document is used for transmitting paper Forms 1042-S to the IRS. It is essential for foreign persons dealing with U.S. source income. Proper completion of this form ensures compliance with withholding tax obligations.

Tax Forms

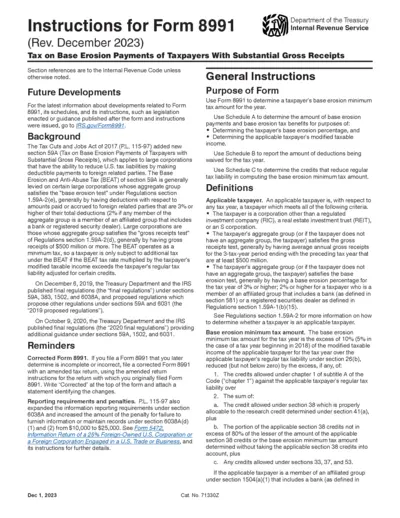

Form 8991 Instructions: Base Erosion Tax 2023

This document provides instructions for Form 8991, which is used to determine base erosion minimum tax amounts for taxpayers with substantial gross receipts. It outlines reporting requirements and penalties for large corporations involved in base erosion payments. Designed to assist taxpayers in complying with the Base Erosion and Anti-Abuse Tax (BEAT) provisions under section 59A.

Tax Forms

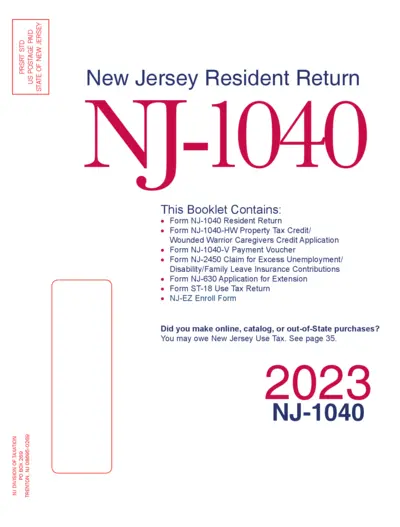

2023 NJ-1040 Resident Tax Return & Instructions

The 2023 NJ-1040 form is essential for New Jersey residents filing their state income taxes. This booklet includes instructions for filling out the form and important changes for the tax year. Utilize the NJ Online Filing service for fast and secure submission.

Tax Forms

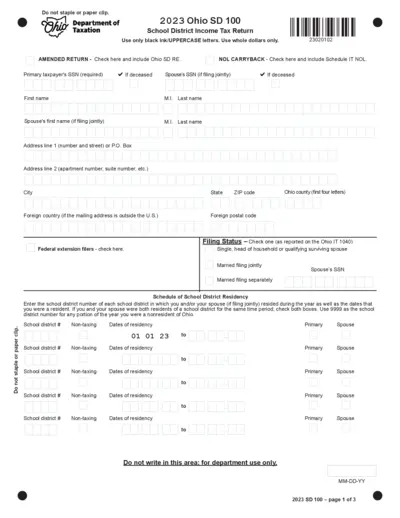

2023 Ohio SD 100 School District Income Tax Return

The 2023 Ohio SD 100 form allows individuals to file their School District Income Tax Return. It provides detailed information on income reporting, tax liabilities, and residency requirements. This form is essential for Ohio residents to ensure compliance with local tax regulations.

Tax Forms

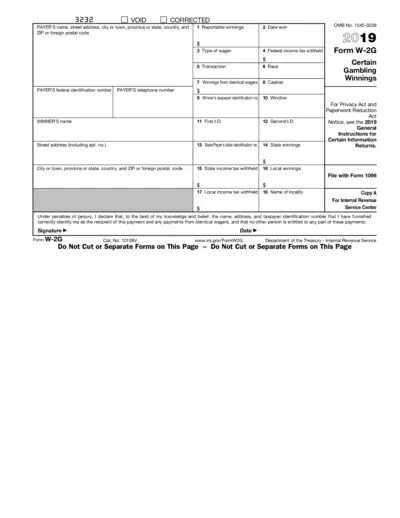

Form W-2G Instructions for Reporting Gambling Winnings

Form W-2G is essential for reporting certain gambling winnings to the IRS. This form includes details like payer information, winnings, and taxes withheld. It's important for individuals who win significant amounts to use this form correctly during tax filing.

Tax Forms

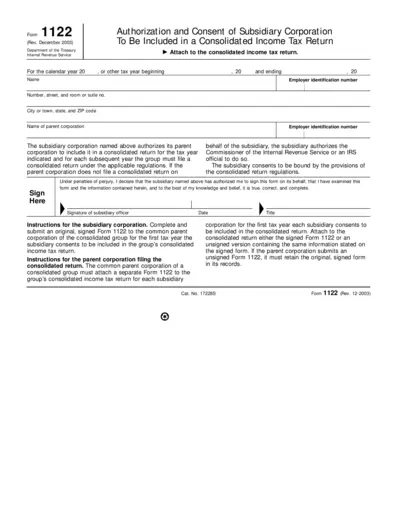

Form 1122 Authorization for Consolidated Tax Return

Form 1122 is a crucial IRS form allowing a subsidiary corporation to be included in a parent corporation's consolidated income tax return. This authorization simplifies the tax filing process for corporate entities. Proper submission ensures compliance with IRS regulations and avoids potential penalties.

Tax Forms

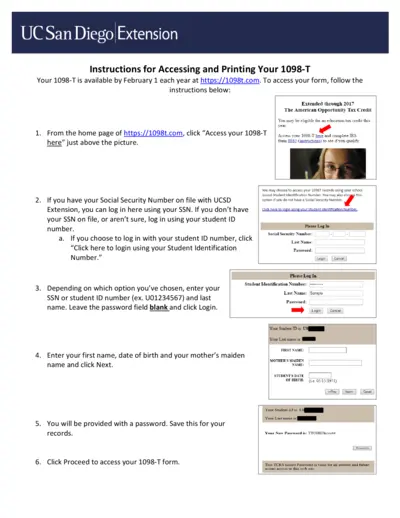

Instructions for Accessing and Printing Your 1098-T

This document provides detailed instructions for accessing and printing your 1098-T form. It is crucial for students to retrieve this form for tax purposes. Follow the steps outlined to ensure you have the correct information.

Tax Forms

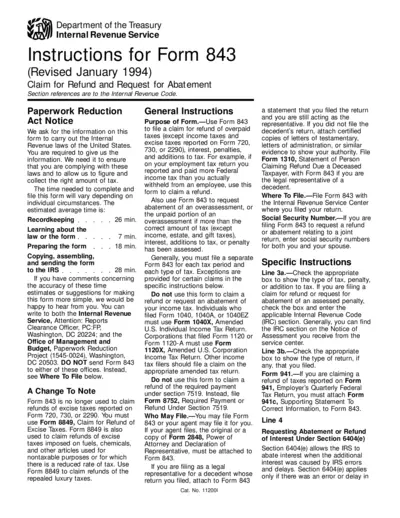

Instructions for Form 843 Claim for Refund

Form 843 provides instructions for claiming a refund or requesting an abatement for overpaid taxes and penalties. It is essential for those who need to correct their tax payments. Ensure to read the instructions thoroughly for accurate filing.