Tax Forms Documents

Tax Forms

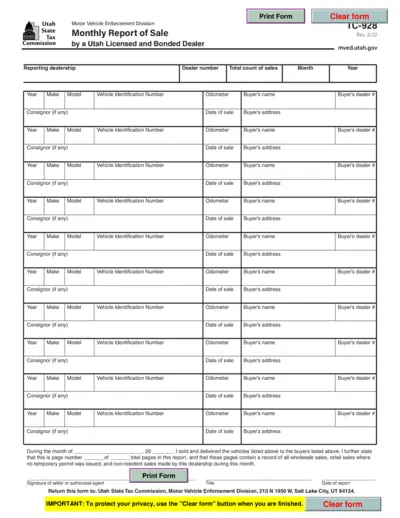

Utah Monthly Vehicle Sales Report Form TC-928

This document is a monthly vehicle sales report form (TC-928) required by the Utah State Tax Commission for licensed and bonded motor vehicle dealers. It is used to report sales made to other dealers, retail customers without temporary permits, and nonresidents. Dealers must file this form every month, even if no sales were made.

Tax Forms

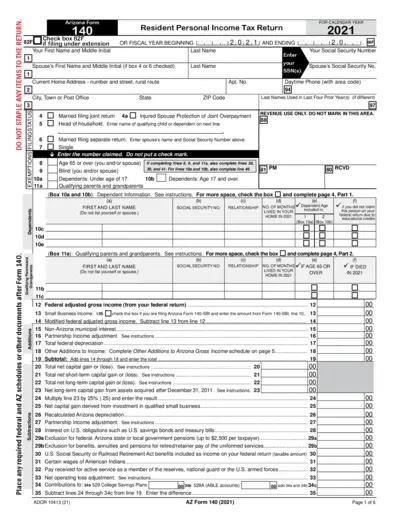

Arizona Form 140 - Resident Personal Income Tax Return 2021

Arizona Form 140 is used for filing Resident Personal Income Tax Return for the calendar year 2021. This form includes sections for personal information, exemptions, deductions, and tax computations. Ensure all required fields are filled accurately to avoid any delays in processing.

Tax Forms

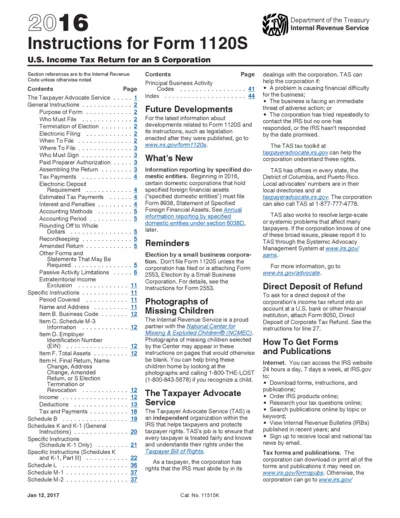

2016 Form 1120S Instructions: U.S. Income Tax Return for S Corporation

This document provides instructions for completing Form 1120S for filing U.S. Income Tax Return for an S Corporation. It details the requirements, specific instructions, and accounting guidelines necessary to properly complete and submit the form. Additionally, it outlines the electronic filing options and important reminders for taxpayers.

Tax Forms

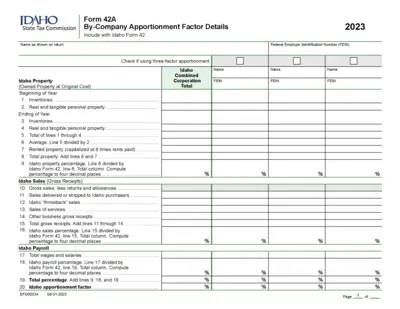

Idaho State Tax Commission Form 42A 2023

This file contains the Idaho State Tax Commission Form 42A for 2023. It details a by-company apportionment factor and must be included with Idaho Form 42. Includes sections on Idaho property, sales, payroll, and instructions.

Tax Forms

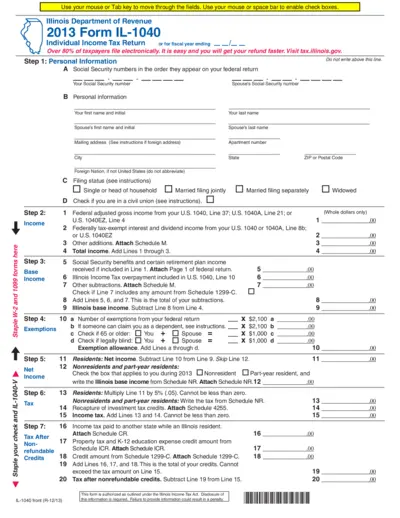

Illinois Department of Revenue 2013 Form IL-1040

The Illinois Department of Revenue 2013 Form IL-1040 is the Individual Income Tax Return form for Illinois residents and part-year residents. This form is used to report income and calculate tax obligations. It includes sections on personal information, income, exemptions, and credits.

Tax Forms

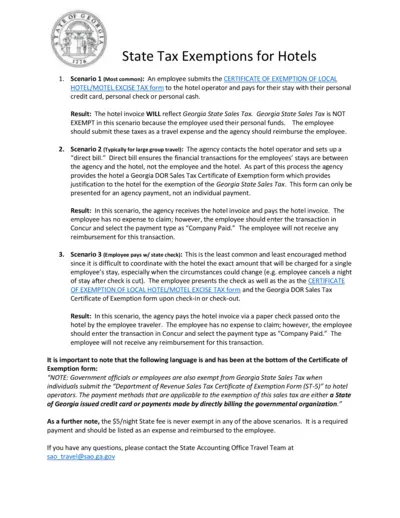

Georgia State Tax Exemptions for Hotel Accommodations

This document outlines scenarios in which state tax exemptions apply for hotel stays in Georgia. It provides detailed steps and scenarios for government employees and agencies. Key information includes differences in exemptions based on payment methods.

Tax Forms

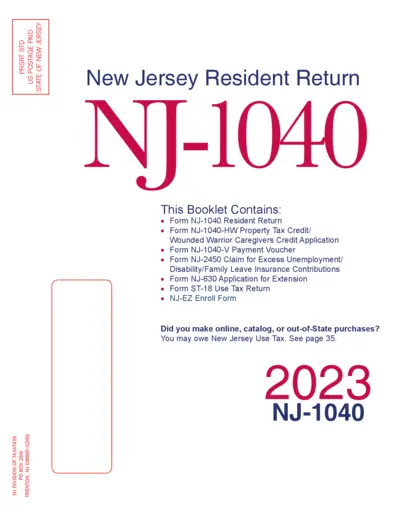

New Jersey 2023 NJ-1040 Tax Return & Instructions Guide

This file contains the 2023 NJ-1040 tax return form and instructions for New Jersey residents. It includes important tax credits, health insurance enrollment, and online filing information. Follow the included guidelines for a smooth filing process.

Tax Forms

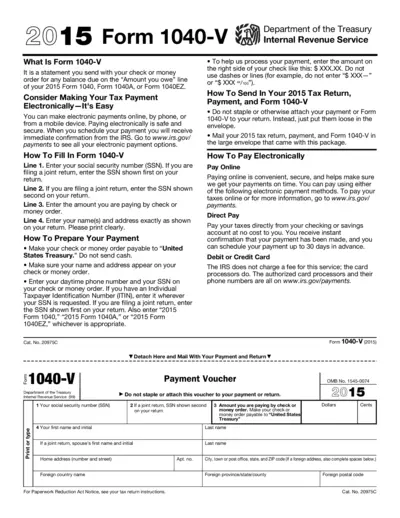

Form 1040-V: Payment Voucher Instructions 2015

Form 1040-V is a statement you send with your check or money order for any balance due on your 2015 tax return. It explains how to make electronic tax payments and provides payment mailing addresses. Learn how to fill out and submit this form correctly.

Tax Forms

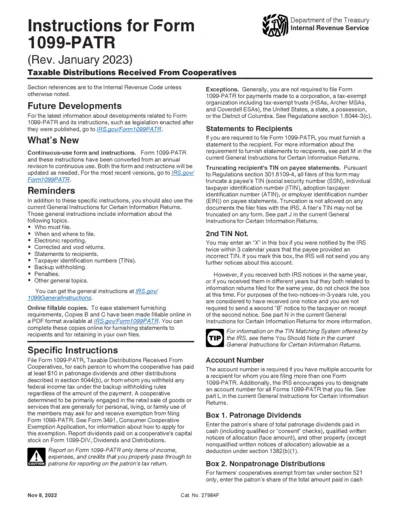

Instructions for Form 1099-PATR Rev. January 2023

Form 1099-PATR is used to report taxable distributions received from cooperatives. It provides specific instructions on how to properly report and file these distributions. Continuous-use form and instructions ensure the most recent versions are available.

Tax Forms

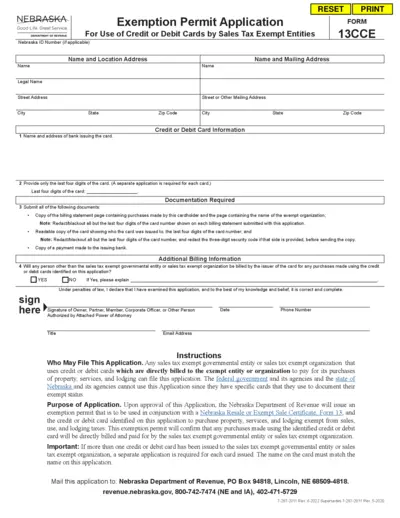

Nebraska Sales Tax Exempt Card Application

This document is the application for sales tax-exempt entities in Nebraska to use credit or debit cards. It includes instructions, requirements, and the necessary documentation. Organizations must submit a separate application for each card.

Tax Forms

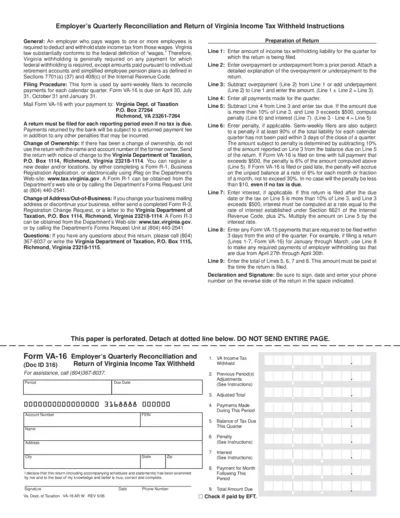

Employer's Quarterly Reconciliation and Return of Virginia Income Tax Withheld Instructions

This document provides instructions for employers on how to reconcile and return Virginia income tax withheld on a quarterly basis. It outlines the filing procedure, change of ownership, and other important guidelines. Additionally, it provides detailed instructions on how to prepare the return and the relevant forms required.

Tax Forms

1098-T Tax Form: Essential Information and FAQs

This document covers frequently asked questions regarding the 1098-T tax form. It includes details on eligibility, reasons for receiving the form, and how to access or request it.