Tax Forms Documents

Tax Forms

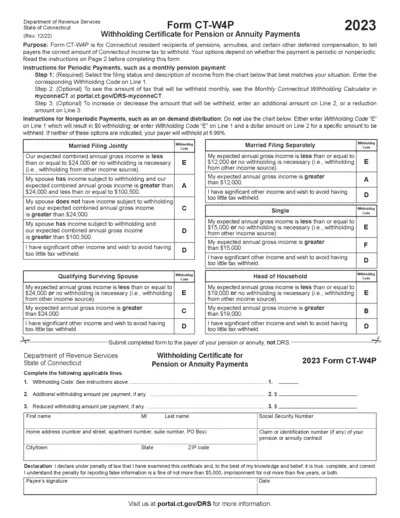

Connecticut Form CT-W4P: Withholding Certificate for Pension or Annuity Payments

This document is used by Connecticut residents receiving pensions, annuities, and other deferred compensation to inform payers about the correct withholding amount for state income tax. It helps prevent underpayment or overpayment of taxes by specifying the withholding code based on expected annual gross income. The form also provides instructions for periodic and nonperiodic payments.

Tax Forms

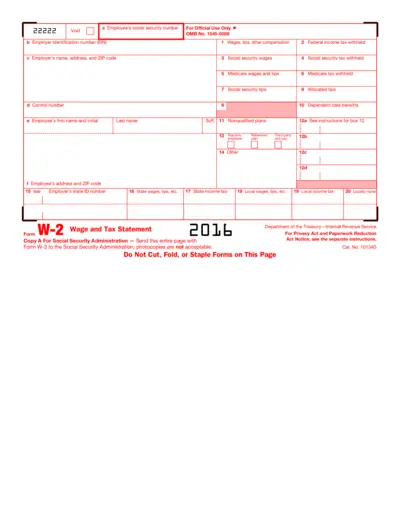

Complete Guide to IRS Form W-2: Wage and Tax Statement

This file is an IRS Form W-2, used to report wages paid to employees and the taxes withheld from them. Employers must complete this form for each employee. It's essential for both employers and employees during tax season.

Tax Forms

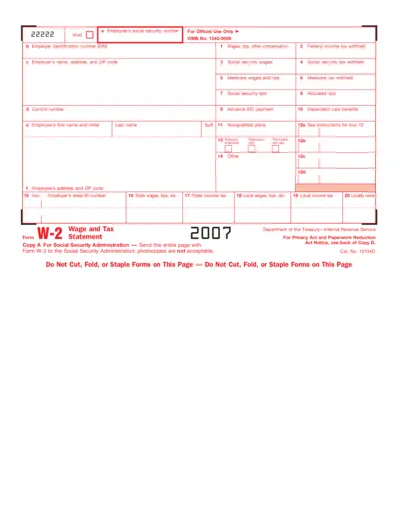

2007 W-2 Wage and Tax Statement Information

This file contains a W-2 form which provides information about wages, tips, and other compensation for employees. Employers use it to report wages paid to employees and the taxes withheld from them. The file also includes instructions and fields to be filled by both employees and employers.

Tax Forms

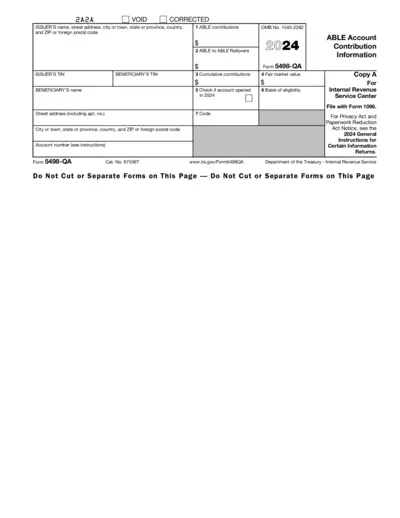

Form 5498-QA Instructions and Details

Form 5498-QA provides information on contributions to ABLE accounts, including rollovers and transfers. It is essential for accurate tax reporting. Learn how to fill it out correctly.

Tax Forms

Tax Information and IRS Form 1098-T - Bethune-Cookman University

This document provides important tax information for students, including how to access IRS Form 1098-T electronically, the benefits of electronic delivery, and answers to common questions.

Tax Forms

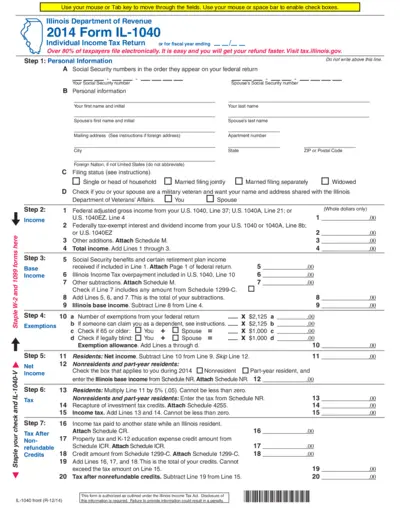

Illinois Department of Revenue Individual Income Tax

The 2014 Form IL-1040 is the Individual Income Tax Return form for residents of Illinois. It ensures that taxpayers accurately report their income and calculate their tax liability. Use this form to file your state taxes electronically or via mail.

Tax Forms

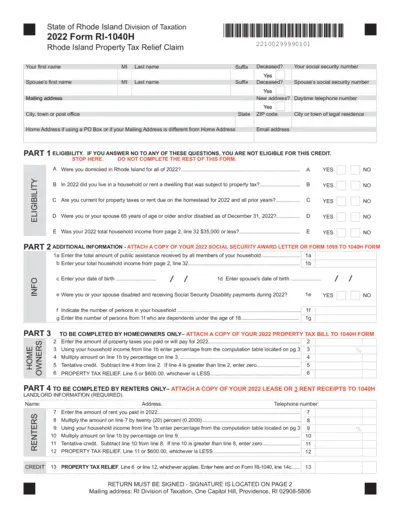

Rhode Island Property Tax Relief Form RI-1040H 2022

The 2022 Form RI-1040H allows Rhode Island residents to claim property tax relief. This form is specifically for those aged 65 or older and disabled individuals. Proper completion is essential for timely benefits.

Tax Forms

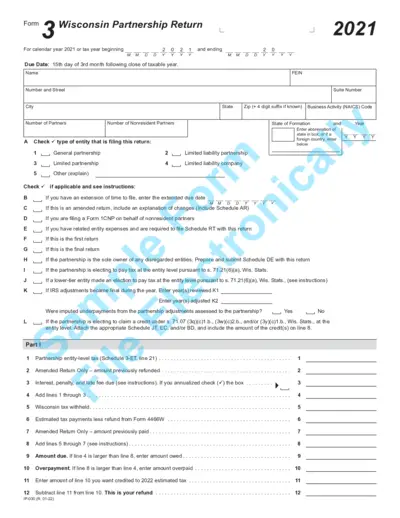

Wisconsin Partnership Return Form 3 2021

The Wisconsin Partnership Return (Form 3) is used by partnerships to report income, deductions, and tax credits. This form is essential for fulfilling tax obligations in Wisconsin. It must be completed accurately and submitted by the due date to avoid penalties.

Tax Forms

Form 5498-SA Instructions and Guidelines

This file provides essential information on Form 5498-SA, including how to fill it out and important guidelines for participants. It's crucial for reporting health savings accounts, providing details on contributions and other important account information. This document is intended for participants and trustees managing HSAs and related accounts.

Tax Forms

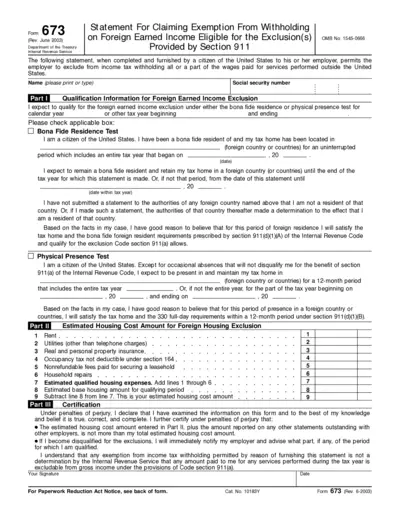

Claim Exemption From Withholding on Foreign Earned Income

This file provides a statement for U.S. citizens to claim an exemption from withholding taxes on foreign earned income. It is essential for individuals working abroad under the foreign earned income exclusion. Complete this form to allow your employer to correctly withhold taxes from your pay.

Tax Forms

IRS Form 1098-C Contributions of Vehicles and Boats

This file contains the IRS Form 1098-C for reporting contributions of motor vehicles, boats, and airplanes. It provides essential fields and instructions for donors and donees. Ensure compliance with IRS guidelines to avoid penalties.

Tax Forms

IRS Form 1024 Application for Exemption

This file contains the IRS Form 1024, which is used to apply for recognition of exemption under Section 501(a). It includes necessary instructions, updates, and information regarding filing. By following this guidance, organizations can ensure proper submission for tax-exempt status.