Tax Forms Documents

Tax Forms

IRS Form W-2 and W-3 Filing Instructions

This file contains detailed instructions for filing IRS Forms W-2 and W-3. It is essential for employers to accurately report wages and taxes for their employees. Following these guidelines ensures compliance with IRS regulations.

Tax Forms

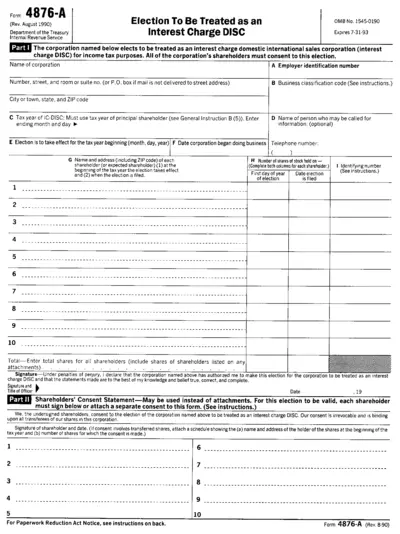

Form 4876-A Election for Interest Charge DISC

Form 4876-A is used by corporations to elect treatment as an interest charge domestic international sales corporation (IC-DISC). This form is necessary for tax purposes and requires unanimous consent from all shareholders. Proper completion ensures compliance with IRS regulations.

Tax Forms

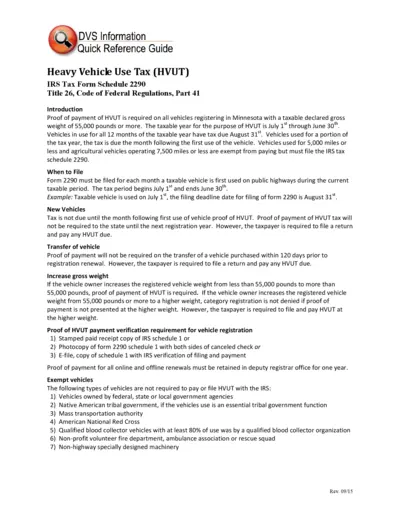

DVS Heavy Vehicle Use Tax Quick Reference Guide

This guide provides detailed information about Heavy Vehicle Use Tax (HVUT) requirements and filing procedures. Learn when and how to file IRS Tax Form Schedule 2290. Find out exemptions, payment proof requirements, and important tax deadlines.

Tax Forms

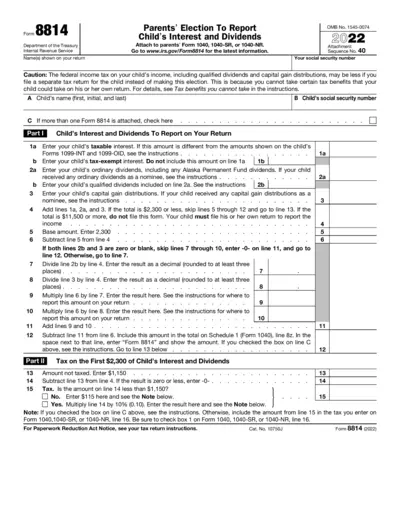

Form 8814 Child's Interest and Dividends Tax Reporting

Form 8814 allows parents to report their child's interest and dividends on their tax return. This form is essential for parents seeking to include their child's investment income in their own tax filings. Remember to follow the instructions carefully to ensure accurate reporting.

Tax Forms

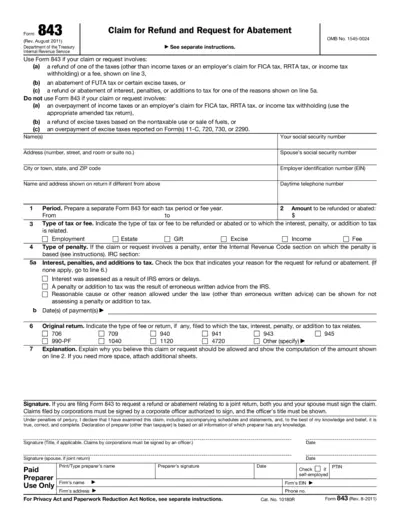

Claim for Refund and Request for Abatement Form

Form 843 is used to claim a refund or request an abatement of certain taxes. Users can file this form for various tax-related issues. It provides clear instructions for ensuring accurate submissions.

Tax Forms

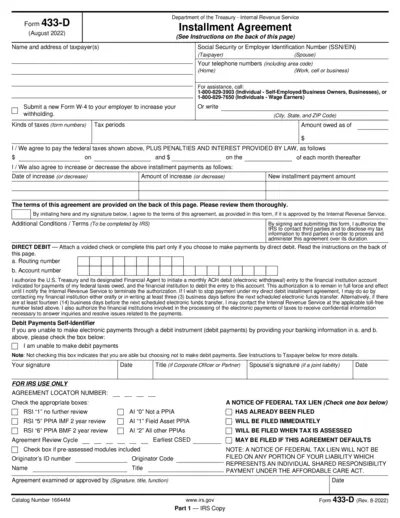

IRS Form 433-D Installment Agreement August 2022

Use Form 433-D to apply for an Installment Agreement with the IRS. This form assists taxpayers in paying their owed federal taxes over time. It includes agreements on payment terms and conditions.

Tax Forms

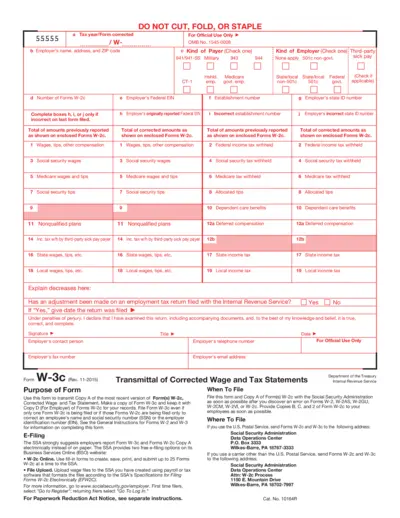

Form W-3c Transmittal of Corrected Wage Statements

This file is the W-3c form used for correcting wage and tax statements. It's essential for employers to rectify errors on previously filed forms. Correctly filling out this form ensures compliance with IRS regulations.

Tax Forms

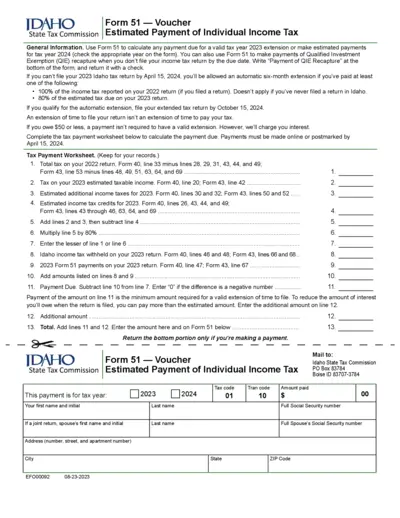

IDAHO Form 51 Voucher Estimated Payment Individual Income Tax

This file provides instructions for filling out Form 51 for estimated payments and extensions for Idaho state taxes. It is essential for individuals needing to make tax payments for the years 2023 and 2024. Users can efficiently calculate their payments and submit the form as required.

Tax Forms

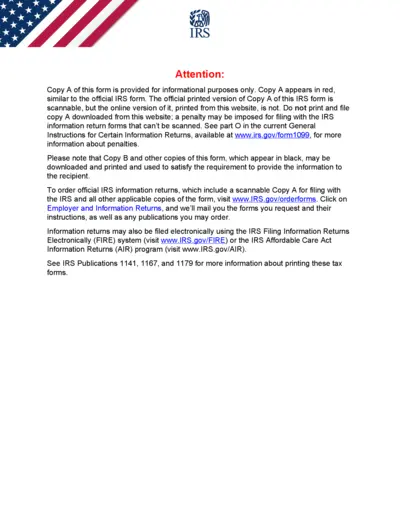

IRS Form 1099-A Instructions and Information

The IRS Form 1099-A reports the acquisition or abandonment of secured property. This form is essential for tax purposes and must be accurately completed. Users can edit and download the form easily using PrintFriendly.

Tax Forms

SARS Employer Annual Reconciliation Submission

This document contains essential information about the Employer Annual Reconciliation Submission for the year 2022. It outlines the submission deadlines, requirements, and responsibilities of employers. Ensure timely and accurate submissions to avoid penalties.

Tax Forms

Cincinnati Income Tax New Account Application

This file provides instructions for creating a new account with the City of Cincinnati's Income Tax Division. It includes details on types of accounts, necessary information, and submission methods. Perfect for businesses and individuals needing to register for taxes in Cincinnati.

Tax Forms

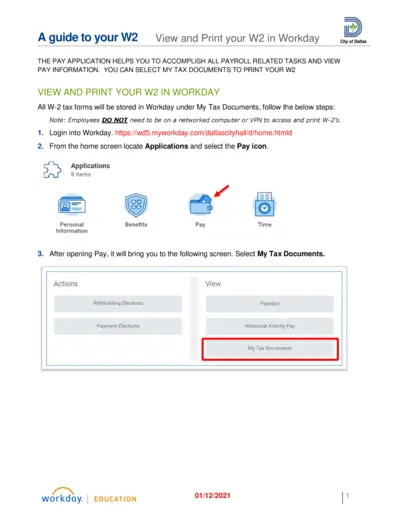

Guide to View and Print W2 in Workday

This guide helps employees view and print their W-2 forms through Workday. It contains step-by-step instructions for accessing tax documents. Perfect for City of Dallas employees looking to complete their payroll tasks efficiently.