Tax Forms Documents

Tax Forms

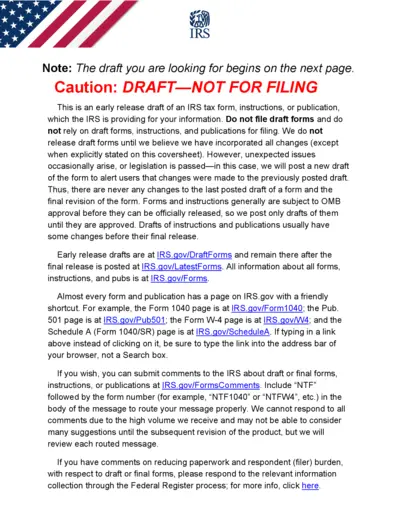

IRS Instructions for Form 8936 Qualified Vehicle Credit

This file contains instructions for completing Form 8936, which is used to claim the Qualified Plug-in Electric Drive Motor Vehicle Credit. It provides detailed information on eligibility, how to fill out the form, and important updates regarding the credit for new clean vehicles. This essential guide is particularly useful for taxpayers looking to maximize their credits for electric and clean vehicles.

Tax Forms

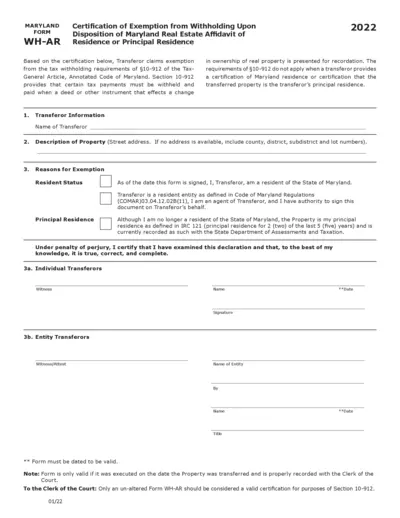

Maryland WH-AR 2022 Real Estate Withholding Exemption

The Maryland WH-AR form certifies exemption from withholding on the transfer of real estate. It is essential for Maryland residents and property owners. Ensure accurate completion to meet tax obligations.

Tax Forms

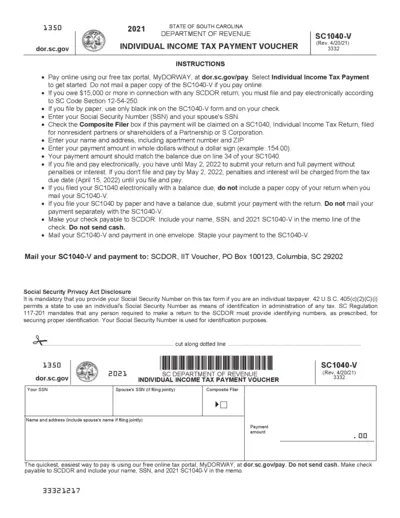

South Carolina Individual Income Tax Payment Voucher

This file provides the SC1040-V voucher for individual income tax payments. Users must fill out the form accurately to ensure proper processing. It includes essential instructions and deadlines for submission.

Tax Forms

FTB 5870A Instructions: Tax on Trust Distributions

The FTB 5870A instructions provide guidance on calculating tax on accumulation distributions from trusts. This document is essential for taxpayers dealing with foreign or domestic trusts. It ensures compliance with California tax laws and aligns with federal regulations.

Tax Forms

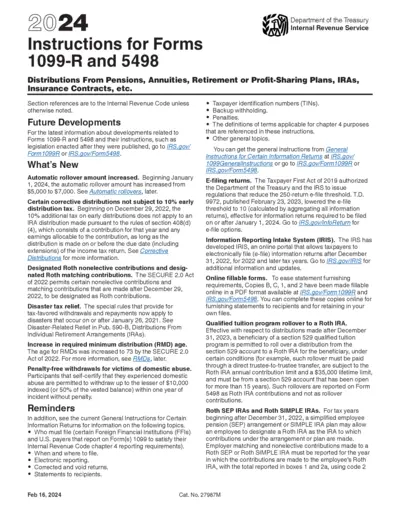

Instructions for Forms 1099-R and 5498 Distributions

This document provides essential guidance for completing Forms 1099-R and 5498, required for reporting distributions from retirement plans and IRAs. It includes updates for the current tax year, as well as detailed instructions for various scenarios related to pension, annuity, and retirement account distributions. Understanding these instructions is crucial for taxpayers and professionals handling retirement distributions.

Tax Forms

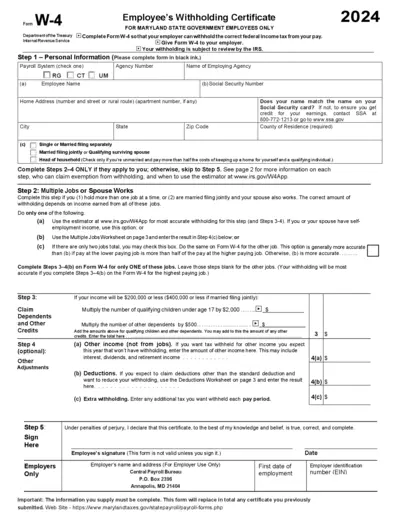

W-4 Employee Withholding Certificate Maryland 2024

This file is the W-4 Employee's Withholding Certificate specifically designed for Maryland state government employees. It is essential for ensuring correct federal income tax withholding from your pay. Complete this form accurately to help your employer with the proper tax withholding.

Tax Forms

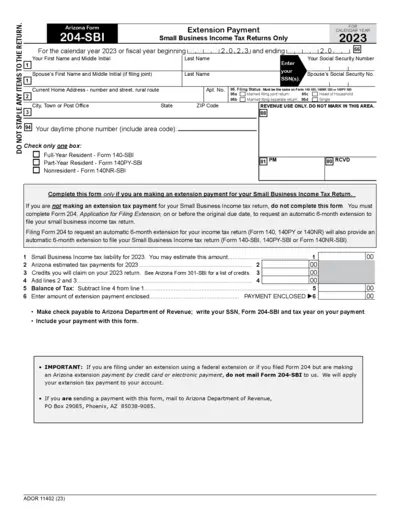

Arizona Form 204-SBI Extension for Small Business Tax Returns

This form is for Arizona small businesses to file an extension payment for their income tax. It is specifically designed for calendar year 2023 or fiscal year reporting. Ensure all required information is correctly filled for processing.

Tax Forms

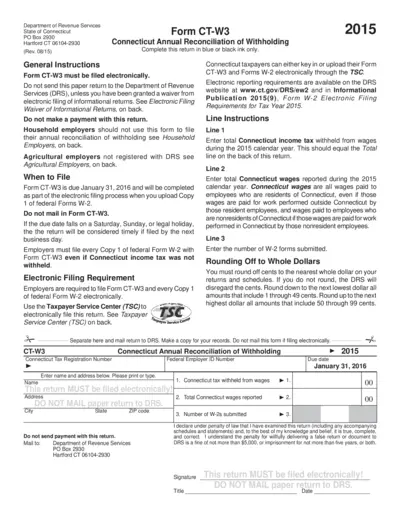

Connecticut Annual Reconciliation of Withholding 2015

Form CT-W3 is essential for Connecticut employers to report annual withholding. It aids in the reconciliation of income tax withheld from employee wages. This electronic submission is crucial for compliance and accurate reporting.

Tax Forms

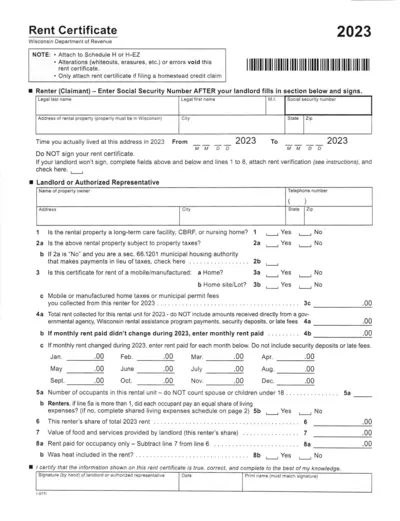

Wisconsin Rent Certificate Instructions 2023

This file is a Wisconsin Rent Certificate for 2023, which enables renters to file for homestead credit. It provides essential details needed for completing state-required forms accurately. Follow the instructions included to ensure compliance with state regulations.

Tax Forms

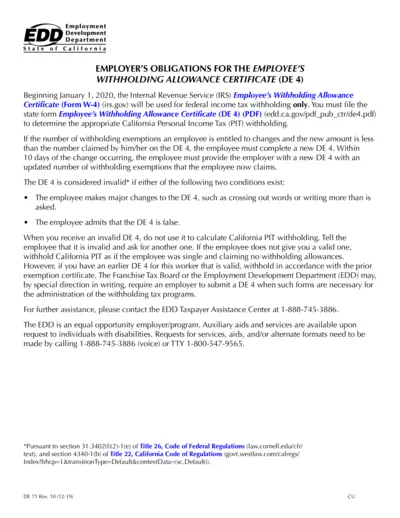

Employer's Obligations for Employee Withholding

This document outlines the responsibilities of employers regarding employee tax withholding in California. It provides detailed instruction on filling out the DE 4 form. Understanding this guide ensures compliance with state tax regulations.

Tax Forms

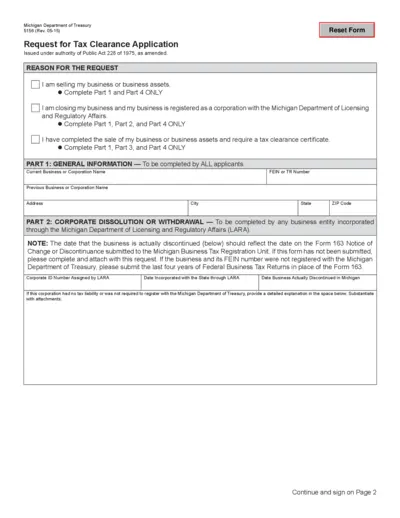

Request for Tax Clearance Application by Michigan Treasury

This document is the Request for Tax Clearance application issued by the Michigan Department of Treasury. It is designed for businesses either selling, closing, or requesting tax clearance after asset transactions. Proper completion is essential for compliance and to ensure a smooth process.

Tax Forms

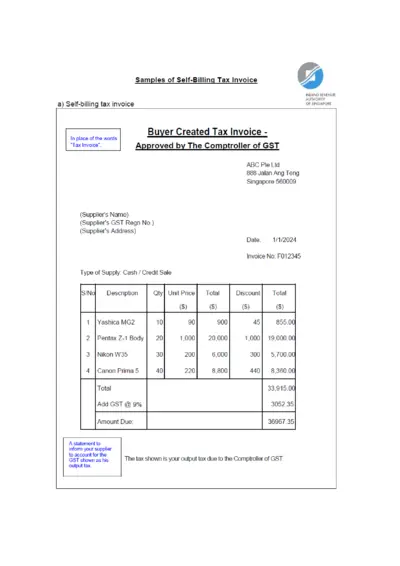

Sample Self-Billing Tax Invoice Templates

This file contains samples of self-billing tax invoices for businesses. It outlines various formats approved by the Comptroller of GST. Users can utilize these templates for proper GST reporting.