Tax Forms Documents

Tax Forms

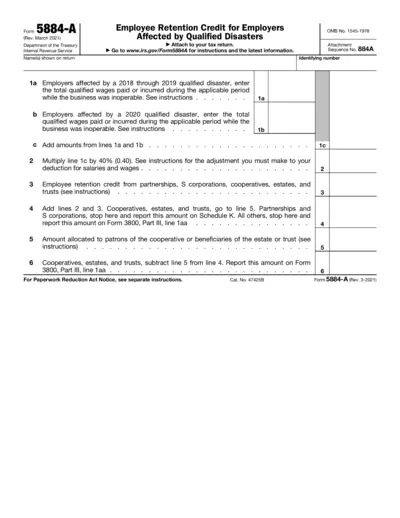

Employee Retention Credit for Employers The IRS Form

This form allows employers to claim the Employee Retention Credit for qualified disasters. It provides details on eligible wages and the calculation of credit. Proper completion can help businesses maximize their tax benefits.

Tax Forms

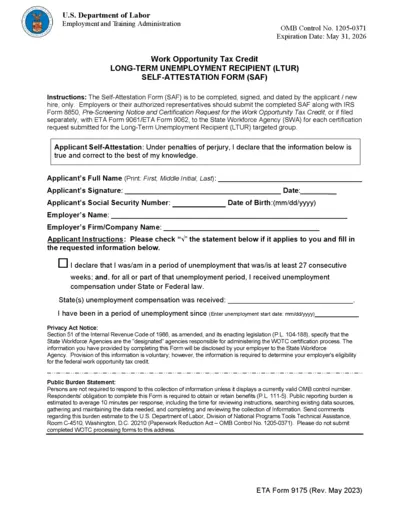

Work Opportunity Tax Credit Self-Attestation Form

The Self-Attestation Form (SAF) is required for applicants applying for the Work Opportunity Tax Credit. It collects essential information from long-term unemployment recipients to determine eligibility for the credit. Employers must submit this form along with IRS Form 8850.

Tax Forms

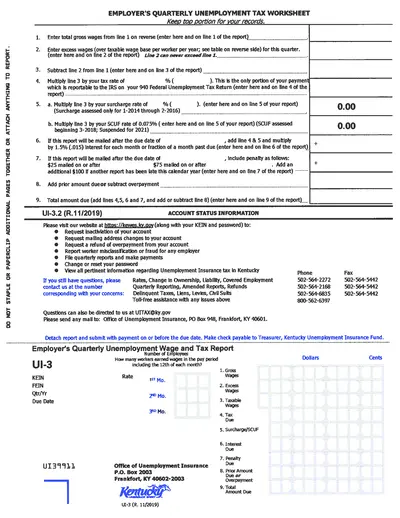

Employer Quarterly Unemployment Tax Worksheet

This form is essential for employers to report wages and calculate taxes for unemployment insurance. It provides clear instructions for completing each section accurately. Use this worksheet to ensure compliance with unemployment tax regulations in Kentucky.

Tax Forms

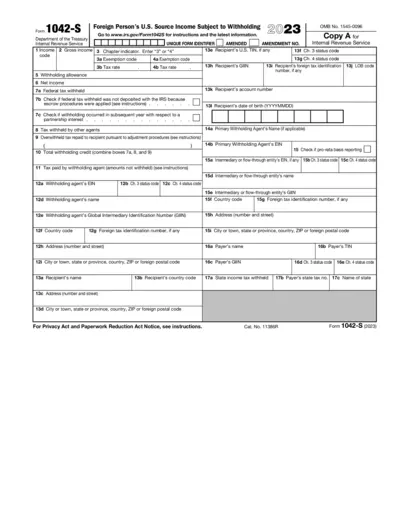

Foreign Person's U.S. Source Income Form 1042-S

This file provides a detailed overview of Form 1042-S used for reporting U.S. source income of foreign persons. It includes instructions for compliance and various income types. Ideal for nonresident aliens and foreign corporations managing U.S. income.

Tax Forms

2021 Oregon Income Tax Form OR-40 Instructions

This document provides detailed instructions for filling out the 2021 Oregon Income Tax Form OR-40. It includes important deadlines, e-filing information, and resources for obtaining assistance. Essential for full-year residents of Oregon filing their income taxes.

Tax Forms

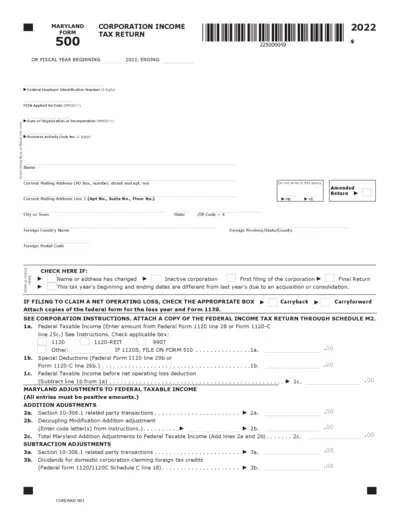

Maryland Corporation Income Tax Return 2022

This file contains the Maryland Form 500 for Corporation Income Tax Return for the fiscal year 2022. It is essential for corporations operating in Maryland to accurately report their income and calculate their tax obligations. This form includes necessary instructions and fields for completion.

Tax Forms

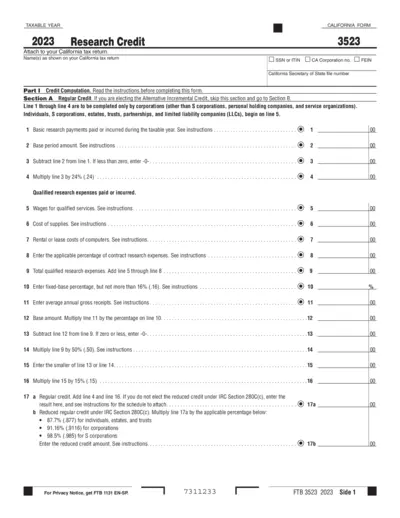

California 2023 Research Credit Form FTB 3523

The California Form 3523 is essential for claims related to research credits. This form assists businesses and individuals in calculating their qualifying research expenses. Complete and attach it to your California tax return for eligibility.

Tax Forms

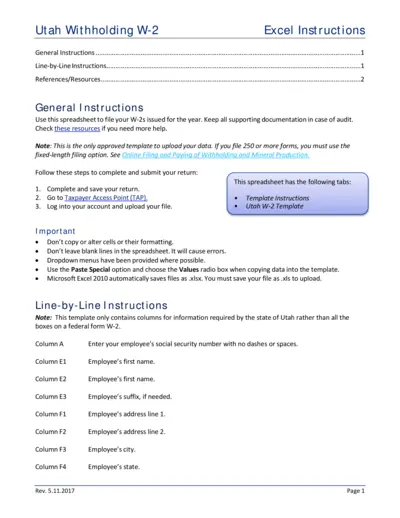

Utah Withholding W-2 Instructions and Template

This file provides essential instructions to complete and submit W-2 forms for Utah state. It includes a detailed spreadsheet template necessary for accurate reporting. Follow the guidelines carefully to ensure compliance with state regulations.

Tax Forms

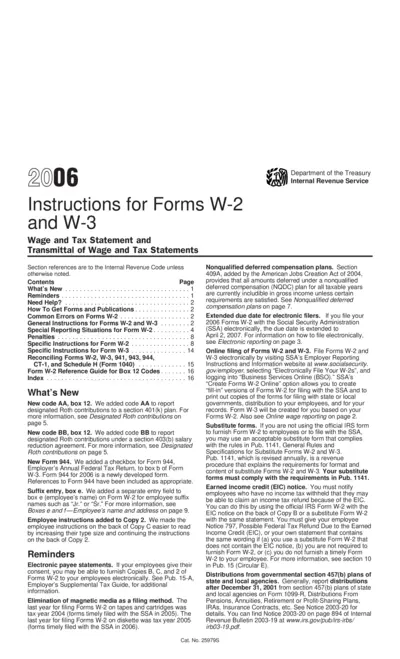

Instructions for Forms W-2 and W-3 Tax Reporting

This file provides comprehensive instructions for filling out Forms W-2 and W-3, which are essential for correctly reporting employee wages and taxes. It outlines common errors, special situations, and reporting requirements to help employers ensure compliance with IRS regulations. Use this file to guide your preparation and submission of these important tax forms.

Tax Forms

IRS Instructions for Form 2106 Employee Business Expenses

This file provides essential instructions for completing IRS Form 2106, which is related to employee business expenses. It is intended for individuals needing guidance on allowable deductions for business-related costs. Follow the instructions carefully to ensure proper filing.

Tax Forms

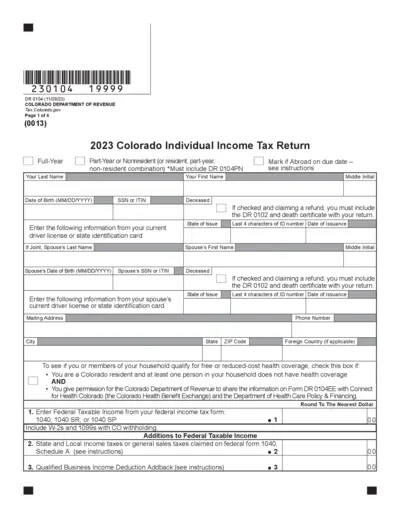

2023 Colorado Individual Income Tax Return Instructions

This document provides comprehensive instructions for filling out the 2023 Colorado Individual Income Tax Return. It includes essential information for both residents and non-residents. Users can navigate through various sections to ensure accurate and compliant submissions.

Tax Forms

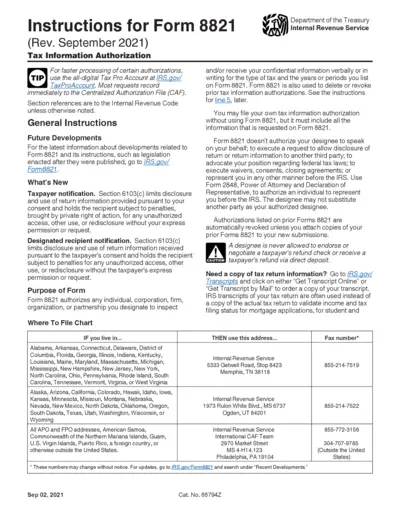

Instructions for Form 8821 Tax Information Authorization

Form 8821 allows individuals or entities to authorize others to access their tax information. It is crucial for those seeking assistance with tax matters or verification purposes. Follow the instructions carefully to ensure proper filing and authorization.