Tax Forms Documents

Tax Forms

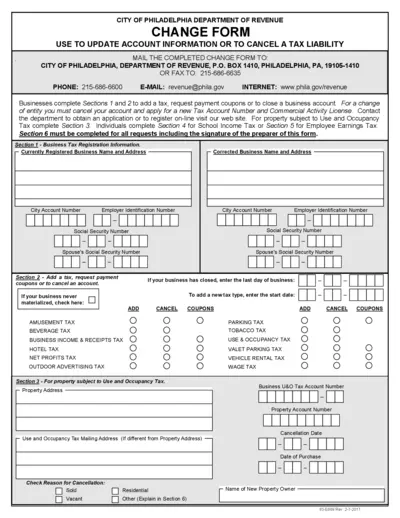

Philadelphia Department of Revenue Change Form

This form allows Philadelphia businesses to update their tax account information or cancel a tax liability. It is essential for compliance with local tax regulations. Fill it out carefully to ensure your information is accurate and up to date.

Tax Forms

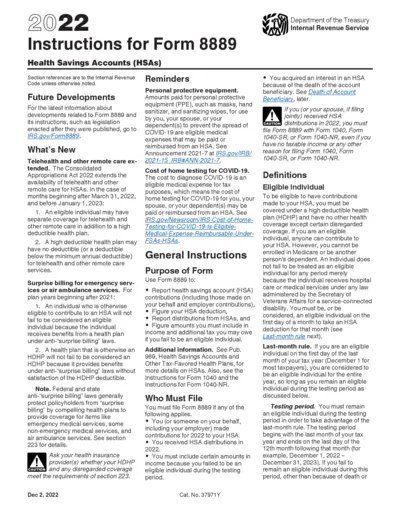

Instructions for Form 8889 Health Savings Accounts

This file provides detailed instructions for Form 8889 related to Health Savings Accounts. It outlines contributions, distributions, and eligibility criteria. Essential for anyone managing HSAs for tax purposes.

Tax Forms

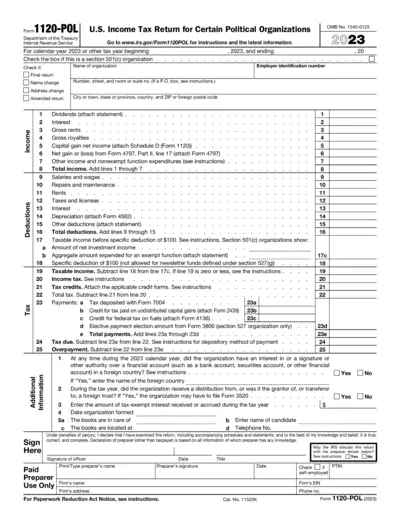

Form 1120-POL - U.S. Income Tax Return for Political Organizations

This file is the 1120-POL U.S. Income Tax Return for Certain Political Organizations. It provides guidance on completing the return accurately. Users can refer to the IRS website for detailed instructions and support.

Tax Forms

IRS Form 1096 Instructions for Filers and Users

This document provides detailed instructions on how to properly fill out IRS Form 1096. Essential for anyone transmitting information returns, it ensures compliance with IRS requirements. Follow these guidelines closely to avoid penalties.

Tax Forms

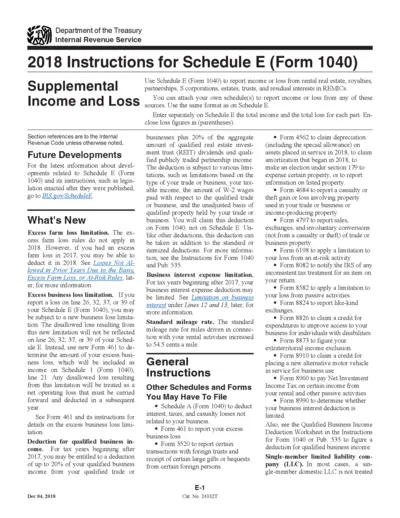

2018 IRS Schedule E Instructions for Income and Loss

This file contains the detailed instructions for completing Schedule E (Form 1040), used to report income or loss from various sources. It covers essential information including requirements, limitations, and relevant forms. Perfect for taxpayers with rental real estate, royalties, partnerships, or other related income.

Tax Forms

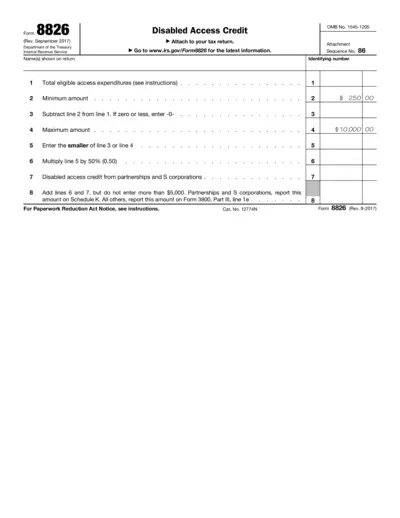

Form 8826 Instructions for Disabled Access Credit

Form 8826 is used by eligible small businesses to claim the disabled access credit. This form is essential for compliance with the Americans with Disabilities Act. Complete it accurately to benefit from available tax credits.

Tax Forms

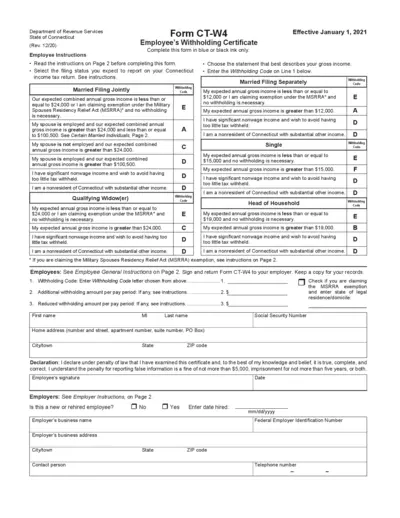

Connecticut Employee Withholding Certificate Form CT-W4

The Form CT-W4 is an Employee's Withholding Certificate for Connecticut residents. It helps employees specify their withholding amounts for state income tax. This form should be completed accurately to ensure proper tax withholding throughout the year.

Tax Forms

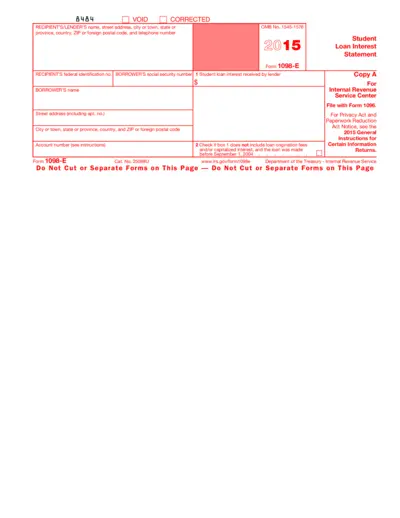

Form 1098-E Student Loan Interest Statement

Form 1098-E is an important tax document for reporting student loan interest paid in 2015. It is essential for borrowers seeking to deduct student loan interest on their tax return. Understanding and filling out this form correctly can maximize tax benefits related to educational expenses.

Tax Forms

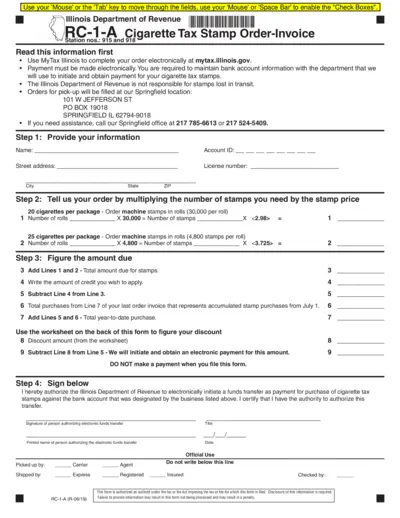

Illinois Cigarette Tax Stamp Order Form

This document is the RC-1-A Cigarette Tax Stamp Order-Invoice provided by the Illinois Department of Revenue. It includes detailed instructions for ordering cigarette tax stamps electronically. Business owners must complete this form to ensure timely payment and receipt of their stamp orders.

Tax Forms

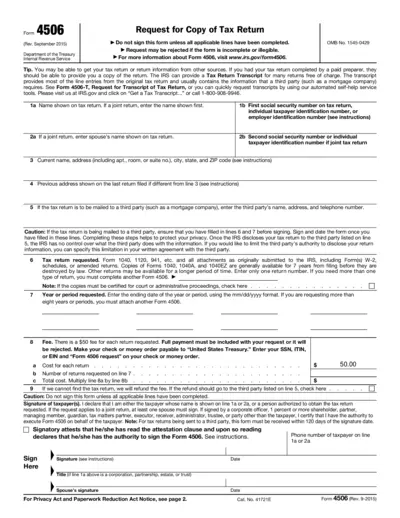

Request for Copy of Tax Return - Form 4506

Form 4506 allows you to request a copy of your tax return from the IRS. This form can be filled out by individuals or representatives for businesses to obtain tax documents. Learn how to complete this form and what information is needed to ensure your request is processed smoothly.

Tax Forms

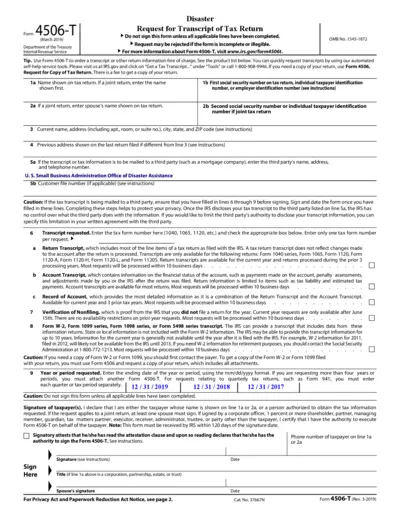

Request for Transcript of Tax Return Form 4506-T

Form 4506-T allows you to request a transcript or other return information from the IRS. It's essential for individuals and businesses needing access to tax documents. Make sure to fill out the form completely to avoid delays.

Tax Forms

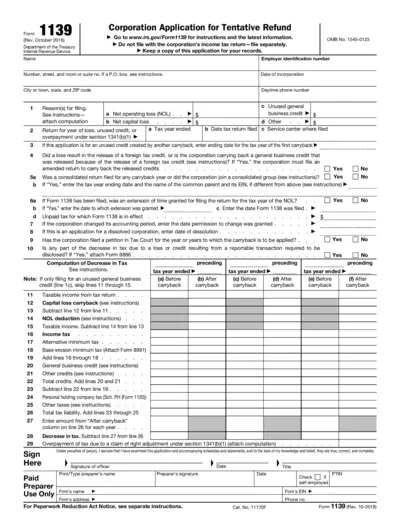

Corporation Application for Tentative Refund

This file is Form 1139 for corporations to apply for a tentative refund. It includes detailed sections for tax year carrybacks, losses, and credits. Proper completion can result in significant tax refunds.