Tax Forms Documents

Tax Forms

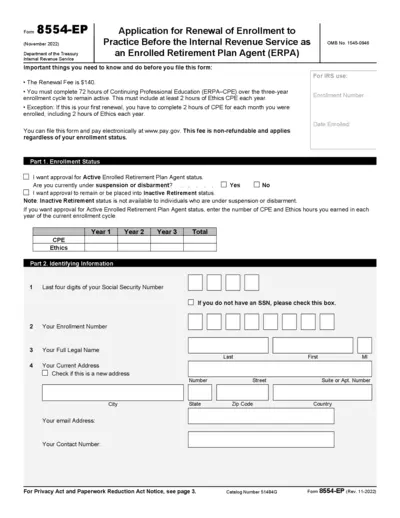

Application for Renewal of Enrollment ERPA

Form 8554-EP is used for the renewal of enrollment as an Enrolled Retirement Plan Agent with the IRS. It provides essential information and instructions required to maintain active status. Completing this form is critical for tax compliance and practice before the IRS.

Tax Forms

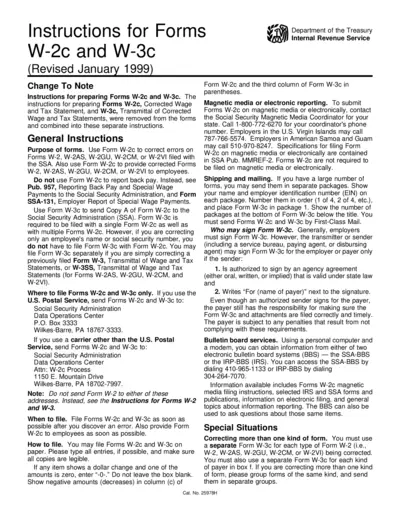

IRS Instructions for Forms W-2c and W-3c

This document provides comprehensive guidelines for correcting wage and tax statements using Forms W-2c and W-3c. It serves as an essential resource for employers aiming to rectify errors in submitted tax information accurately. Understanding these instructions ensures compliance with IRS regulations.

Tax Forms

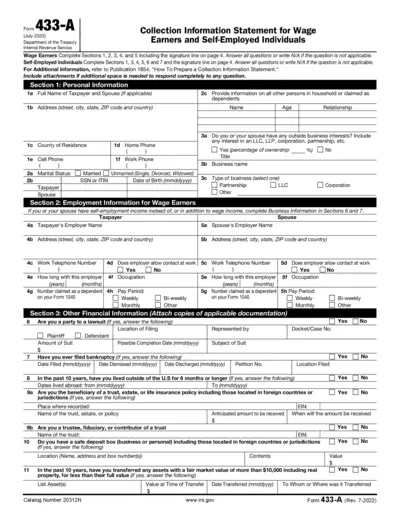

Form 433-A Collection Information Statement Guidelines

The Form 433-A is used by wage earners and self-employed individuals to provide financial information to the IRS. It assists in determining the taxpayer's ability to pay. Proper completion of this form is essential for accurate assessment of payment options.

Tax Forms

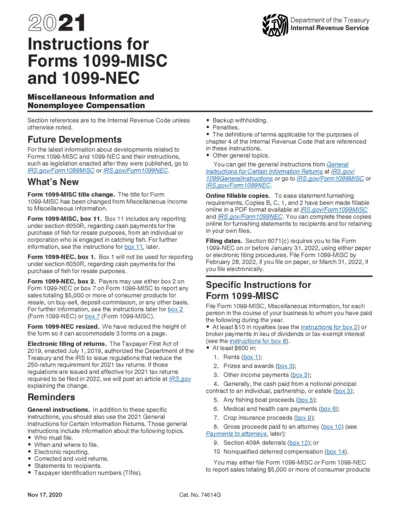

2021 Instructions for Forms 1099-MISC and 1099-NEC

This file contains vital instructions for filling out Forms 1099-MISC and 1099-NEC for tax reporting. It provides important updates regarding changes in form usage and filing requirements. Perfect for businesses that need clear guidance on nonemployee compensation and miscellaneous information reporting.

Tax Forms

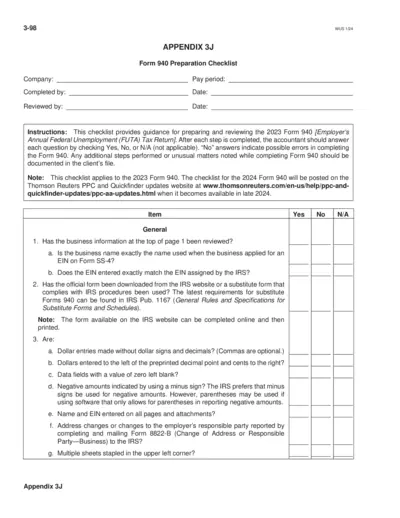

Form 940 Preparation Checklist for Employers

This file provides a comprehensive checklist for employers to accurately prepare and review the 2023 Form 940. It helps in identifying potential errors and ensuring compliance with IRS guidelines. Utilize this checklist to streamline the submission process of your Federal Unemployment Tax Return.

Tax Forms

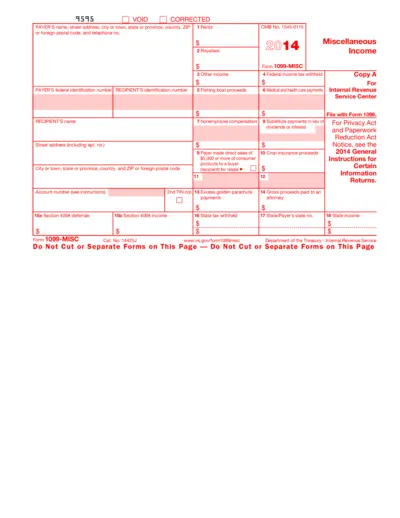

Form 1099-MISC Instructions and Details

This file contains essential instructions for completing the IRS Form 1099-MISC. It provides details regarding fields and requirements to report miscellaneous income. Users will find guidance on what information to include to ensure accurate submissions.

Tax Forms

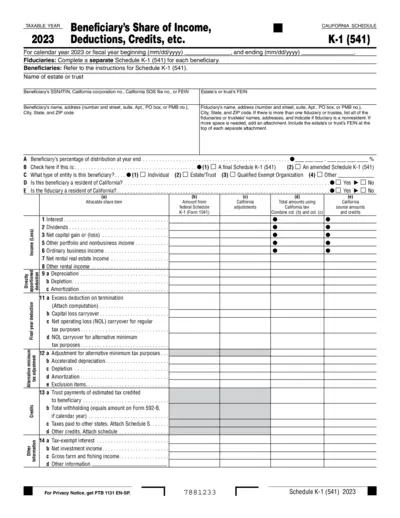

California Schedule K-1 2023 Beneficiary Income Details

The California Schedule K-1 for 2023 outlines the beneficiary's share of income, deductions, and credits. It is essential for fiduciaries to complete a Schedule K-1 for each beneficiary. Use this form to report income and distribute shares accurately.

Tax Forms

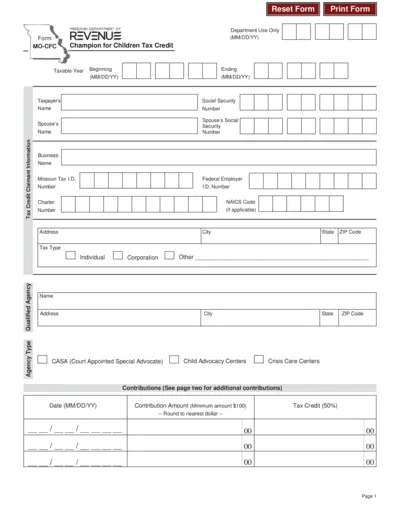

Missouri Champion for Children Tax Credit Form MO-CFC

The Missouri Champion for Children Tax Credit Form MO-CFC allows taxpayers to claim credits for contributions to qualified agencies. This form is essential for individuals and corporations looking to receive tax credits for charitable contributions. Make sure to follow the provided instructions carefully to maximize your eligibility.

Tax Forms

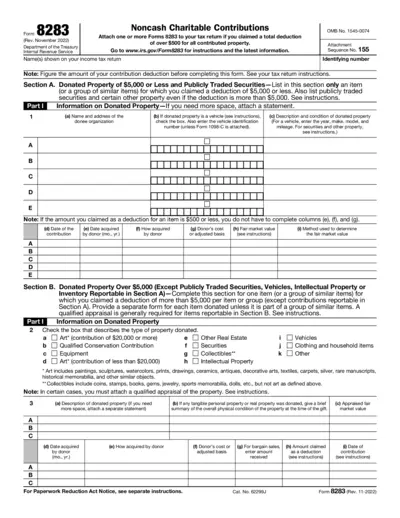

Form 8283 Instructions for Noncash Charitable Contributions

Form 8283 is essential for individuals claiming deductions for noncash charitable contributions exceeding $500. This form details the information required for reporting different types of donated property. Follow the instructions closely to ensure accurate tax filing.

Tax Forms

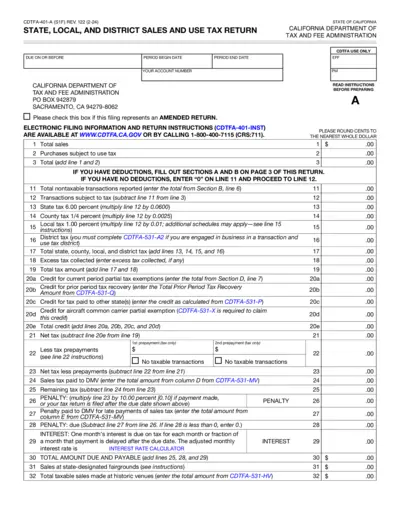

California Sales and Use Tax Return - CDTFA-401-A

The CDTFA-401-A form is essential for businesses in California to report their statewide and local sales and use taxes. It provides guidance on calculating total sales, deductions, and tax owed. Accurate submission ensures compliance with tax regulations set by the California Department of Tax and Fee Administration.

Tax Forms

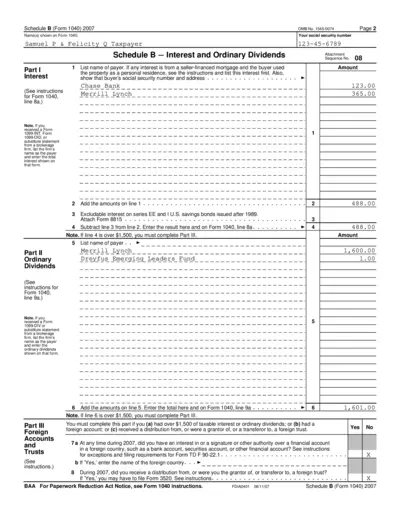

Schedule B Form 1040 for Interest and Dividends

This file provides information on Schedule B of Form 1040, used for reporting interest and ordinary dividends. It includes essential instructions and details for taxpayers. Understanding this form is crucial for accurate tax reporting.

Tax Forms

Investment Interest Expense Deduction Form 4952

Form 4952 allows taxpayers to deduct their investment interest expenses. This form is essential for accurately reporting investment income. Use it to ensure compliance with IRS regulations.