Tax Forms Documents

Tax Forms

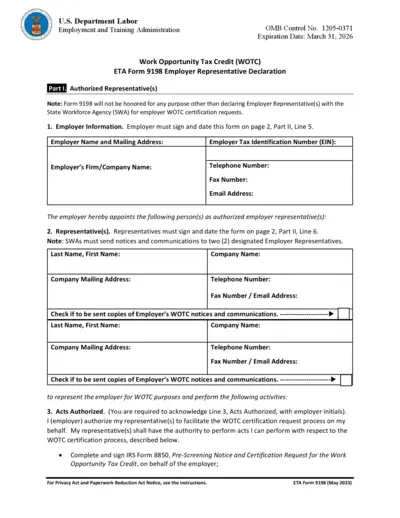

Employer Representative Declaration - WOTC Form 9198

The Employer Representative Declaration Form 9198 allows employers to authorize representatives for Work Opportunity Tax Credit (WOTC) certification requests. This form is essential for employers seeking to navigate the WOTC certification process effectively. By filling out this form, employers can ensure crucial communications regarding WOTC are handled by designated representatives.

Tax Forms

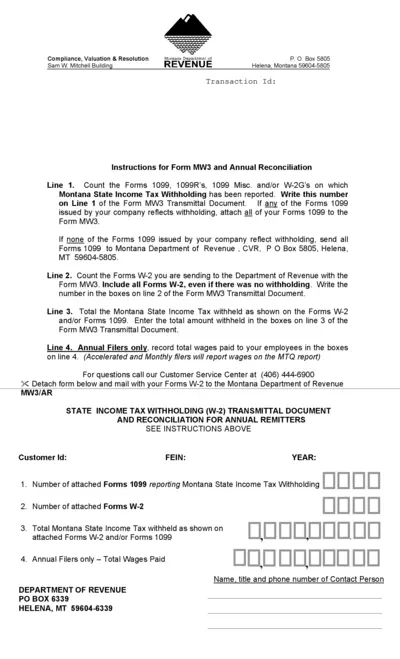

Montana MW3 Withholding Tax Form Instructions

This file provides detailed instructions for completing the Montana MW3 withholding tax form, essential for annual reconciliation. Users will find guidance on reporting taxes withheld from W-2s and 1099 forms. Ensure compliance with state tax requirements by following these steps.

Tax Forms

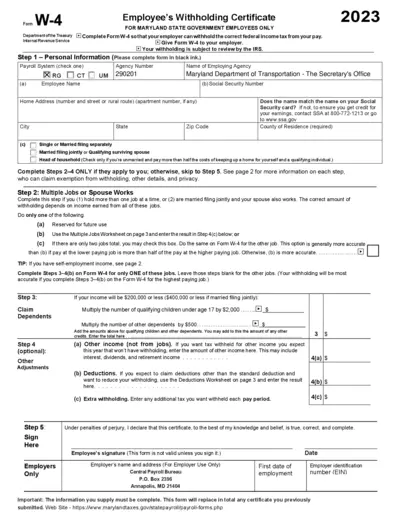

W-4 Employee's Withholding Certificate for Maryland

The W-4 form, Employee's Withholding Certificate, is essential for Maryland state government employees. It guides how much federal income tax should be withheld from paychecks. Completing this form accurately ensures proper tax withholding and compliance with IRS regulations.

Tax Forms

IRS Form 8288-A Instructions for Users

This file provides essential instructions for IRS Form 8288-A, used for withholding on certain dispositions by foreign persons. It includes details about the form's components and filing requirements. Ideal for tax professionals and individuals involved in U.S. property transactions.

Tax Forms

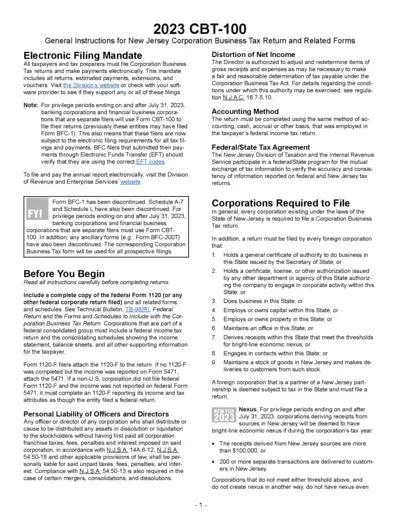

New Jersey Corporation Business Tax Return Guidelines

This document provides comprehensive instructions for filing the New Jersey Corporation Business Tax Return (CBT-100). It outlines electronic filing mandates, eligibility criteria, and details on submissions. Tax preparers and corporations will benefit from following these guidelines.

Tax Forms

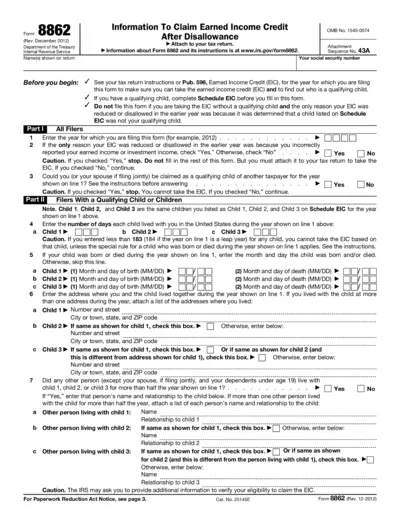

Form 8862 Instructions for Earned Income Credit

Form 8862 is used by taxpayers to claim the Earned Income Credit after it has been disallowed in a previous year. It helps ensure that taxpayers understand their eligibility requirements for the credit. This form must be attached to your tax return if you're claiming the Earned Income Credit.

Tax Forms

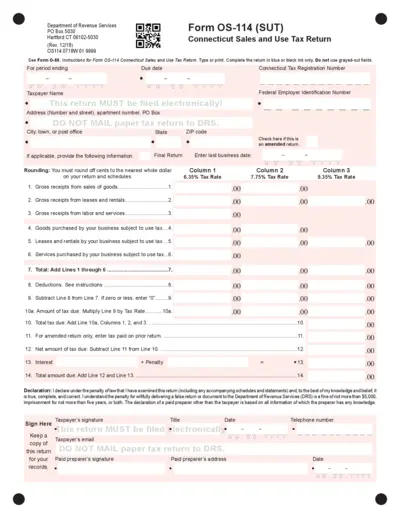

Connecticut Sales and Use Tax Return Form OS-114

Form OS-114 is necessary for reporting sales and use tax in Connecticut. This form must be filed electronically and includes various fields for tax calculations. Proper completion of this return is crucial for compliance with state regulations.

Tax Forms

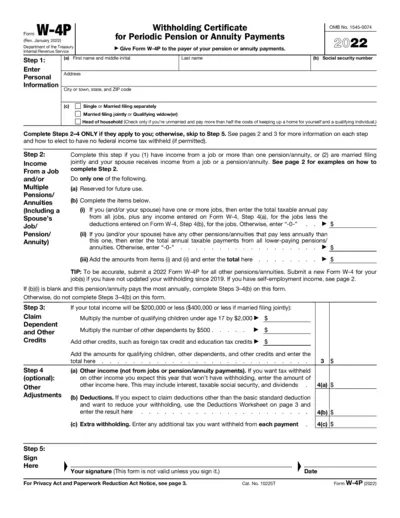

W-4P Withholding Certificate for Pension Payments

The W-4P form is essential for taxpayers receiving pension or annuity payments. It allows individuals to specify how much federal income tax should be withheld from these payments. By accurately filling out this form, taxpayers can ensure they meet their tax obligations and avoid unexpected liabilities.

Tax Forms

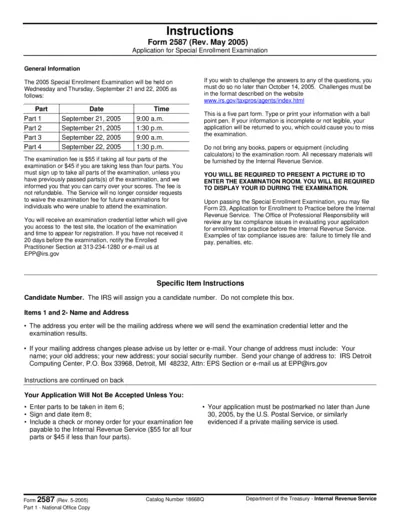

Application for Special Enrollment Examination

This file contains essential information and instructions regarding the Special Enrollment Examination. It provides guidelines on the examination process, including important dates, fees, and submission details. Ideal for candidates seeking to become enrolled agents.

Tax Forms

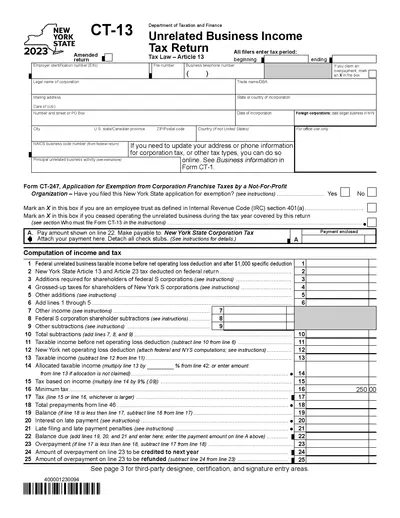

CT-13 Unrelated Business Income Tax Return 2023

The CT-13 form is used for filing Unrelated Business Income tax returns in New York State. It captures pertinent financial data from organizations operating unrelated businesses. Filing this form ensures compliance with state tax laws.

Tax Forms

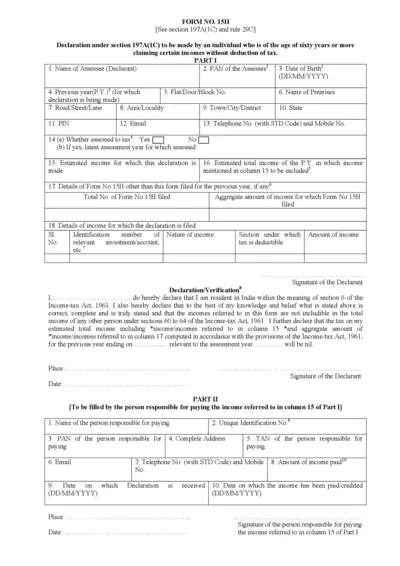

FORM NO. 15H Declaration for Individuals Over 60

FORM NO. 15H is a declaration form for individuals aged sixty years or older. This form allows residents to claim certain incomes without tax deductions. Proper completion and submission are essential for tax relief.

Tax Forms

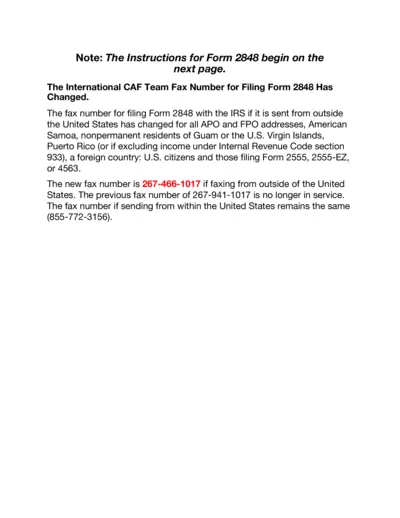

Instructions for IRS Form 2848 Power of Attorney

This document provides essential information on how to fill out IRS Form 2848 for Power of Attorney. It outlines the necessary steps and requirements for authorizing a representative for tax matters. Ideal for individuals needing to grant authority for tax-related issues.