Tax Forms Documents

Tax Forms

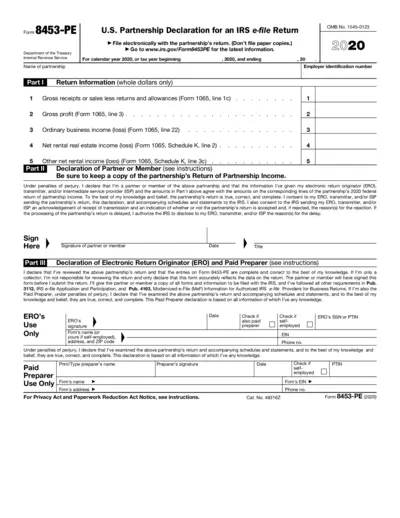

U.S. Partnership Declaration IRS e-File Return 2020

Form 8453-PE is essential for partnerships filing IRS e-File returns. It authenticates Form 1065 and authorizes designated transmitters. Use this form to ensure compliance with federal partnership income tax filing requirements.

Tax Forms

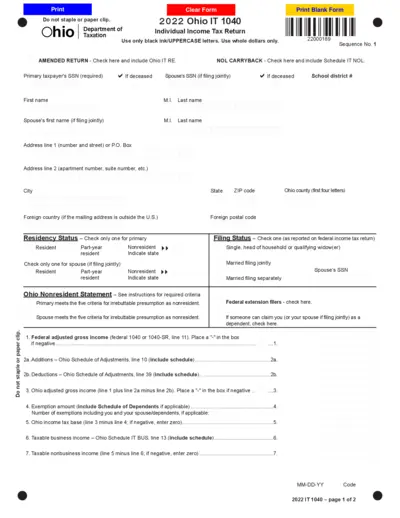

2022 Ohio IT 1040 Individual Income Tax Return

The 2022 Ohio IT 1040 Individual Income Tax Return is essential for residents and nonresidents filing their state income taxes in Ohio. It provides crucial information regarding income, deductions, and credits. Properly filling out this form ensures compliance with state tax regulations.

Tax Forms

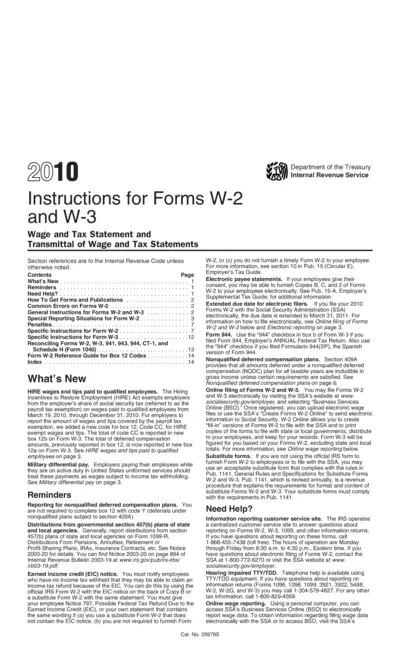

IRS Instructions for Forms W-2 and W-3 2010

This document provides comprehensive instructions for completing Forms W-2 and W-3. It includes essential updates, filing guidelines, and special reporting situations. Ideal for employers managing employee tax documents.

Tax Forms

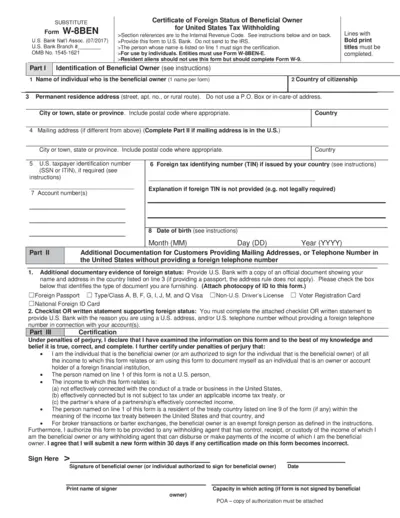

W-8BEN Foreign Status Certification for U.S. Tax

The W-8BEN form helps foreign individuals certify their foreign status for U.S. tax purposes. It is essential for individuals receiving income from U.S. sources. This form is necessary to claim tax treaty benefits and avoid unnecessary withholding taxes.

Tax Forms

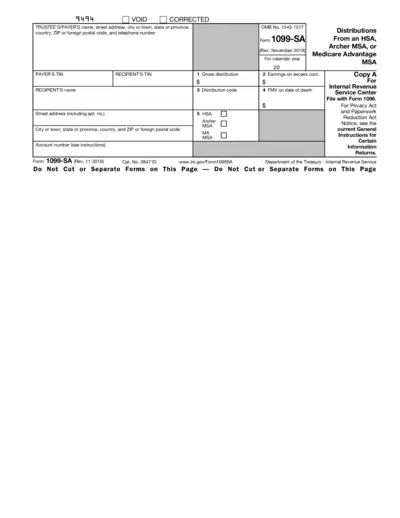

Form 1099-SA Instructions for Distributions

This document provides essential details about Form 1099-SA. It outlines how to report distributions from health savings accounts (HSAs) or medical savings accounts (MSAs). Understanding these instructions is crucial for accurate tax reporting.

Tax Forms

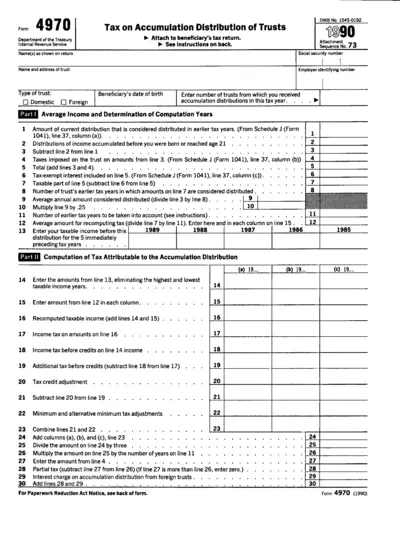

Form 4970 Instructions for Trust Tax Distribution

Form 4970 is used to report the tax on accumulation distributions from trusts. Beneficiaries must complete this form to compute any additional tax liabilities. Properly filling out this form ensures compliance with IRS tax laws.

Tax Forms

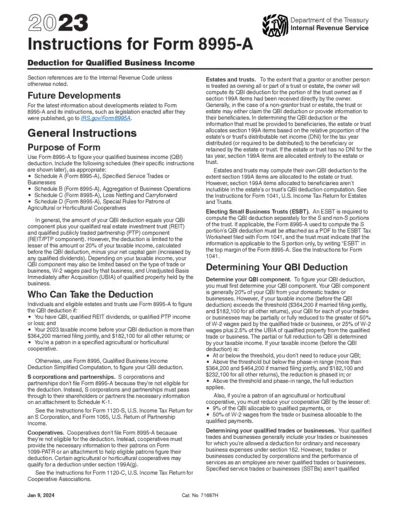

Form 8995-A Instructions for Business Income Deduction

Form 8995-A helps individuals and eligible entities figure their Qualified Business Income deduction. It includes necessary schedules and detailed guidelines to assist users in their calculations. This form is essential for those looking to optimize their tax deductions through qualified business income.

Tax Forms

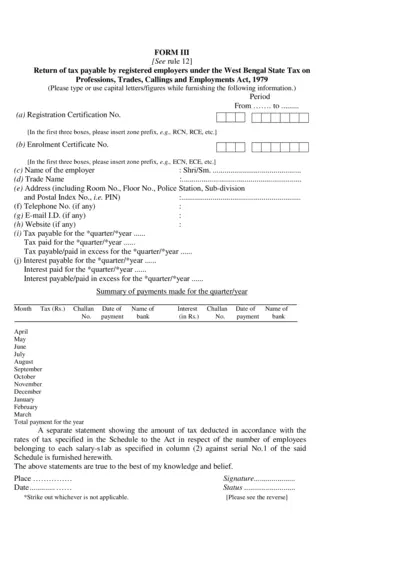

West Bengal Tax Return Form for Employers

This document is a tax return form required by registered employers in West Bengal under the Professions, Trades, Callings, and Employments Act, 1979. It outlines the necessary details that need to be submitted on a quarterly or yearly basis. Use this form to report your tax payments accurately.

Tax Forms

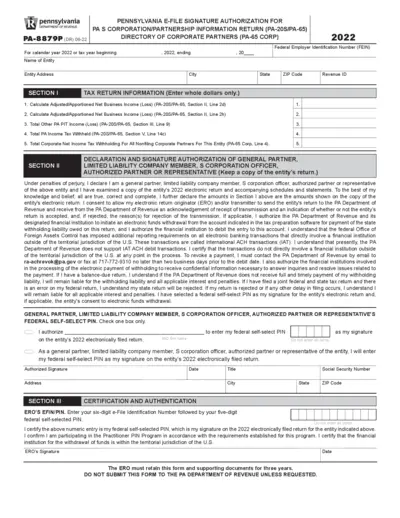

Pennsylvania E-File Signature Authorization Form

The PA-8879P allows general partners, LLC members, and S corporation officers to electronically sign tax returns. Proper completion is essential for a smooth filing process. Utilize this form to ensure compliance with Pennsylvania tax regulations.

Tax Forms

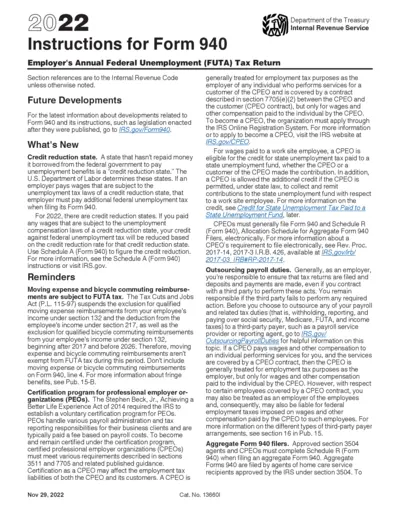

Instructions for Form 940 - Employer's Annual Federal Unemployment Tax

This document provides detailed instructions for completing Form 940, which is essential for reporting annual Federal Unemployment Tax. It outlines eligibility, filing requirements, and includes crucial information for employers. Stay compliant with federal guidelines and ensure accurate tax reporting with this comprehensive guide.

Tax Forms

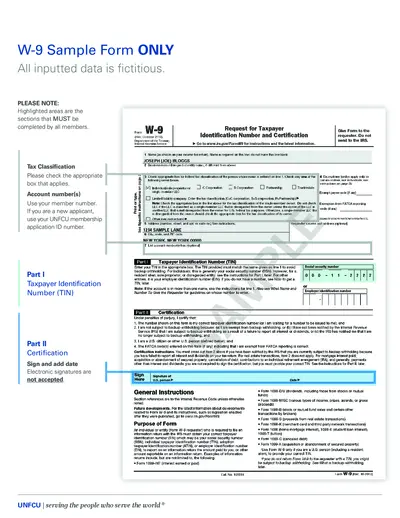

W-9 Request for Taxpayer Identification Number

The W-9 form is essential for providing your taxpayer identification number to entities that will report payments to you. It helps organizations accurately file their income information with the IRS. This sample form illustrates how to complete the W-9 accurately based on current IRS requirements.

Tax Forms

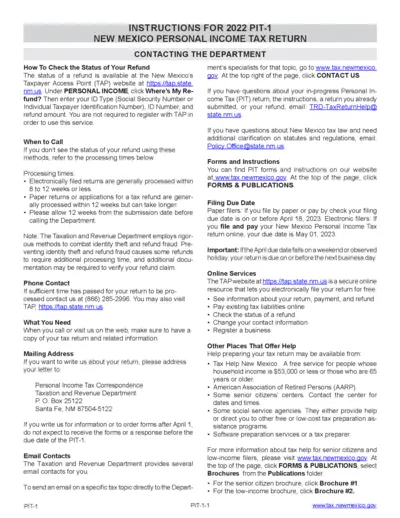

New Mexico Personal Income Tax Return Instructions

This file provides essential instructions for completing the 2022 PIT-1 form for New Mexico personal income tax. It includes contact information, filing deadlines, and guidance for residents and non-residents. Taxpayers can also find resources for assistance and details on military service members' tax obligations.