Tax Forms Documents

Tax Forms

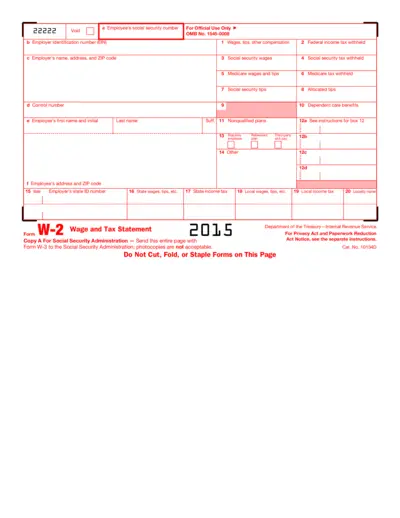

W-2 Wage and Tax Statement Explanation

This file provides essential details about the W-2 Wage and Tax Statement needed for tax filing. Users can find instructions and examples to help fill out this form efficiently. It is crucial for both employees and employers to understand the contents and requirements of this document.

Tax Forms

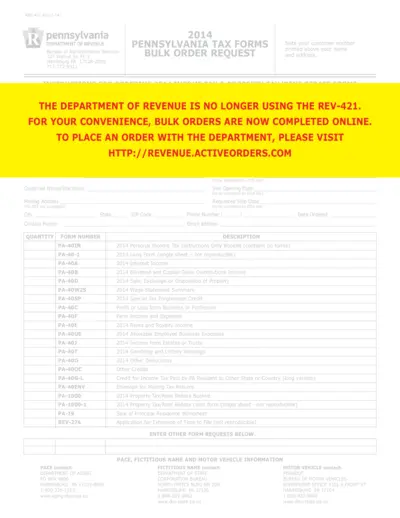

Pennsylvania Tax Forms Bulk Order Request

This document contains instructions for ordering Pennsylvania tax forms in bulk. It includes a comprehensive list of available forms and contact information for assistance. Ideal for VITA sites and organizations needing multiple tax forms.

Tax Forms

IRS Schedule A 2011 Instructions for Itemized Deductions

This document provides detailed instructions for completing Schedule A of Form 1040 for 2011. It outlines itemized deductions such as medical expenses and taxes paid. Users can determine the best deductions to maximize their tax returns.

Tax Forms

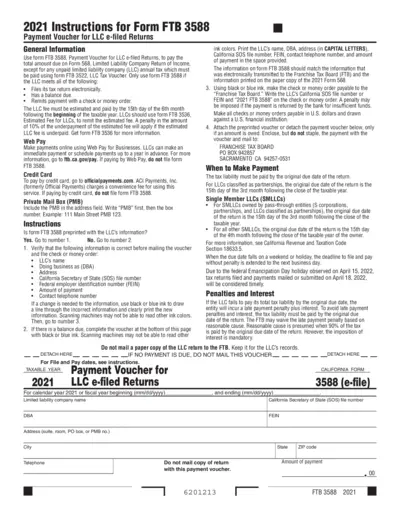

Instructions for Form FTB 3588 Payment Voucher LLC

The FTB 3588 form is used by LLCs to pay their tax liabilities electronically. It is crucial for LLCs with a balance due on Form 568. This guide will help you understand the payment process and requirements.

Tax Forms

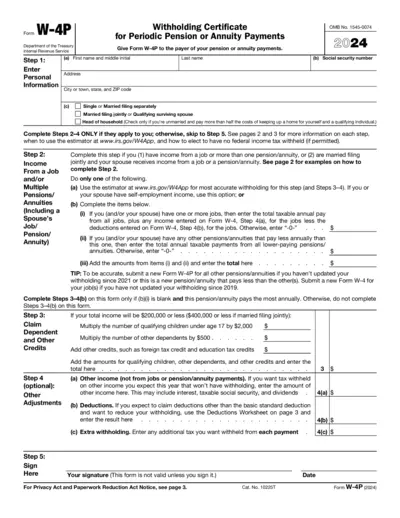

Withholding Certificate for Pension and Annuity Payments

The Form W-4P is crucial for individuals receiving periodic pension or annuity payments. It allows recipients to ensure correct federal income tax withholding from their payments. Completing this form correctly helps avoid underpayment or overpayment of taxes.

Tax Forms

Contractor Certification Form ST-220-TD

The ST-220-TD form certifies that contractors are registered to collect New York sales tax. This document is essential for contractors involved in contracts that exceed $100,000. Ensure you provide accurate and complete information for compliance.

Tax Forms

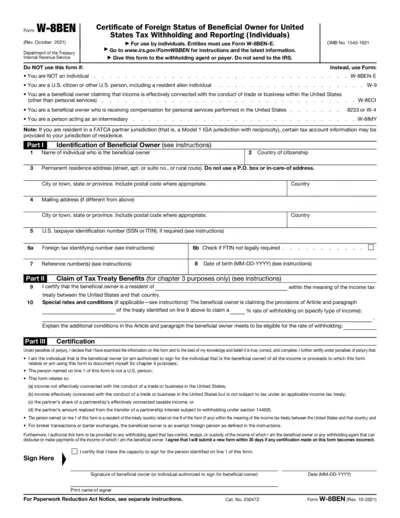

Certificate of Foreign Status for Tax Withholding

This document serves as a Certificate of Foreign Status of Beneficial Owner used for tax withholding and reporting for individuals. It helps foreign individuals claim tax treaty benefits and validates their non-U.S. person status. Understand the importance of submitting this form accurately to ensure compliance with IRS regulations.

Tax Forms

Employer's Quarterly Federal Tax Return Instructions

This document provides comprehensive instructions for completing Form 941, the Employer's Quarterly Federal Tax Return. It outlines tax rates and filing requirements for employers. Ensure compliance with federal tax regulations and file timely to avoid penalties.

Tax Forms

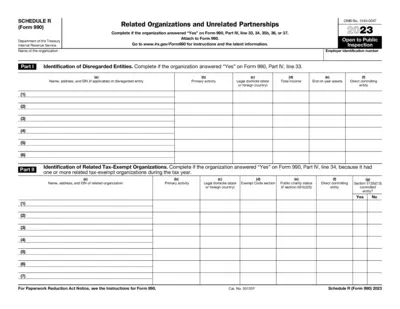

Schedule R Form 990 Related Organizations 2023

The Schedule R Form 990 is a crucial document for organizations to report their related organizations and partnerships. It provides detailed information necessary for compliance with IRS regulations. Proper completion of this form ensures transparency and accountability in financial dealings.

Tax Forms

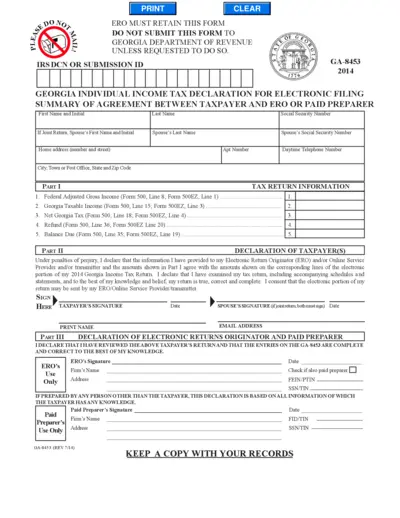

Georgia Individual Income Tax Declaration Form

The GA-8453 form is essential for electronic filing of Georgia individual income tax returns. It ensures the authenticity of the electronic return data provided by the taxpayer. This summary form must be retained by the taxpayer and not submitted unless requested by the Georgia Department of Revenue.

Tax Forms

Tax Exemption Form for Foreign Earned Income

Form 673 allows U.S. citizens to claim exemption from income tax withholding on foreign earned income. This early release draft provides essential information and instructions for filing. Ensure you're informed about the requirements to benefit from this tax exemption.

Tax Forms

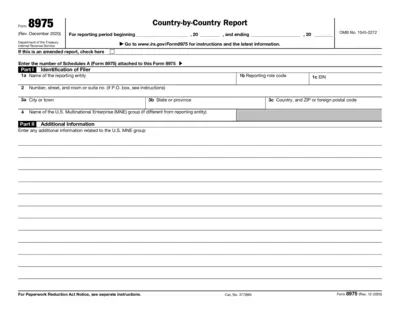

Country-by-Country Report Form 8975 Instructions

Form 8975 is a Country-by-Country Report designed for U.S. Multinational Enterprises. It facilitates essential reporting for IRS compliance. This file contains relevant forms and instructions necessary for submission.