Property Taxes Documents

Property Taxes

Review Process Motor Carrier Seminars 2017

This file outlines the review process for taxpayers regarding assessments. It includes information on appeal rights, documentation, and final determination procedures. Essential for understanding taxpayer rights and options.

Property Taxes

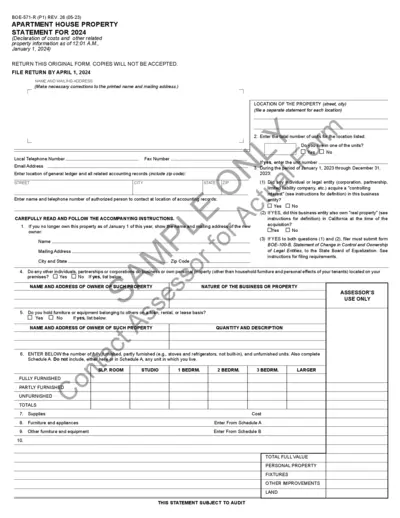

Apartment House Property Statement for 2024

This file serves as a property statement outlining costs and related information required for apartment houses. It is essential for tax assessment purposes in California. Filers must complete and submit this document by April 1, 2024.

Property Taxes

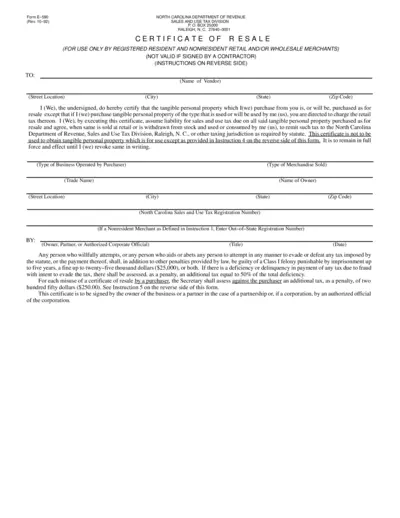

North Carolina Resale Certificate Form E-590 Instructions

The North Carolina E-590 form is a resale certificate for registered merchants, allowing them to purchase tangible personal property for resale. It outlines the requirements and responsibilities of merchants while providing a legal framework for tax exemptions on resale items. Completing this form accurately is essential for compliance with state tax regulations.

Property Taxes

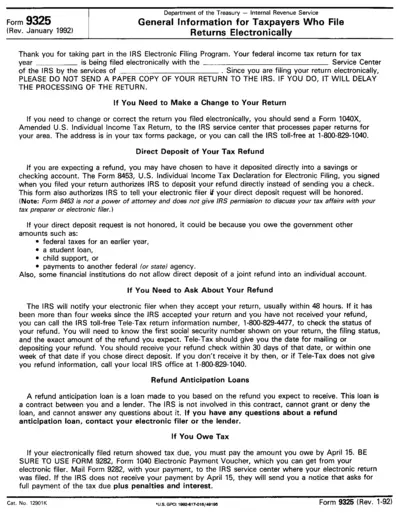

Form 9325 Instructions for Electronic Filing

Form 9325 is essential for taxpayers who file their returns electronically with the IRS. This form confirms the electronic submission and outlines necessary steps after filing. Understanding this form ensures you manage your tax return efficiently.

Property Taxes

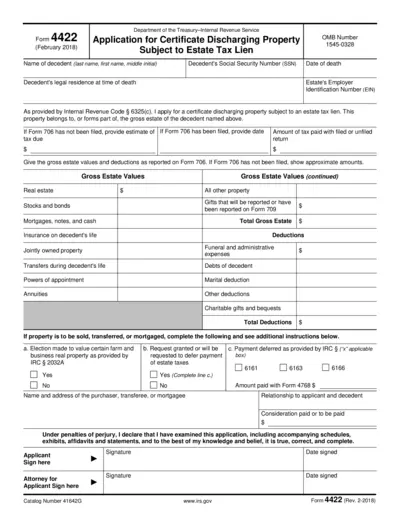

Form 4422 Application for Estate Tax Lien Certificate

Form 4422 is an application used to discharge property from estate tax liens. It provides essential information on the decedent's estate and tax obligations. Users may need this certificate when selling or transferring property included in an estate.

Property Taxes

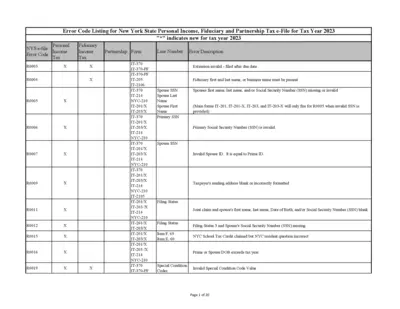

New York State Personal Income Tax e-File Error Codes

This document lists error codes for New York State Personal Income, Fiduciary and Partnership Tax e-File for the 2023 tax year. It provides essential error codes and descriptions to assist taxpayers in identifying and correcting filing issues. Understanding these codes will help ensure accurate and timely submission of tax returns.

Property Taxes

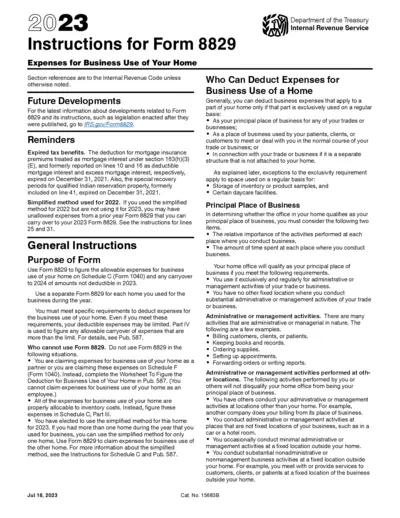

IRS Form 8829 Instructions for Business Home Use

This file provides detailed guidance on completing Form 8829 for deducting business expenses related to the use of your home. It outlines eligibility criteria, necessary calculations, and specific instructions for various scenarios. Ideal for taxpayers who need clarity on home office deductions.