Property Taxes Documents

Property Taxes

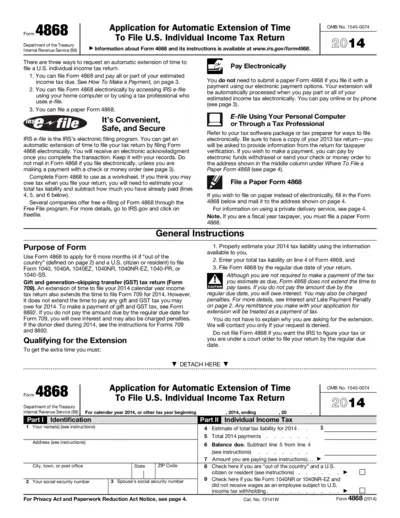

Form 4868: Application for Automatic Extension of Time

Form 4868 allows U.S. taxpayers to apply for an automatic extension of time to file their individual income tax returns. This form provides various methods for submission and outlines important instructions and deadlines. It is crucial for avoiding late filing penalties.

Property Taxes

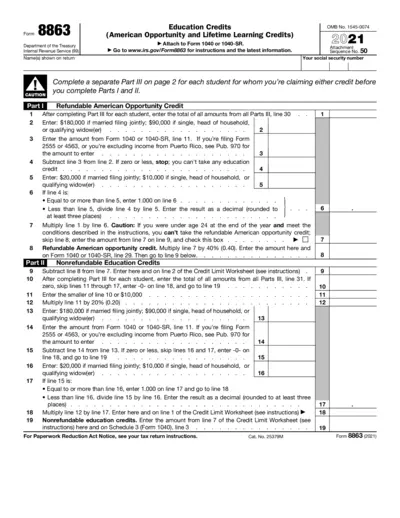

Form 8863 - Education Credits: American Opportunity and Lifetime Learning

Form 8863 is used to claim education credits such as the American Opportunity Credit and Lifetime Learning Credit. It should be attached to Form 1040 or 1040-SR. Visit www.irs.gov/Form8863 for the latest information and instructions.

Property Taxes

H&R Block 2023 Tax Forms and Instructions Overview

This file contains a comprehensive list of H&R Block tax forms and instructions for the tax year 2023. It includes forms for individual income tax returns, health coverage, credits, and various other tax-related documents. Users can find detailed instructions on how to fill out these forms.

Property Taxes

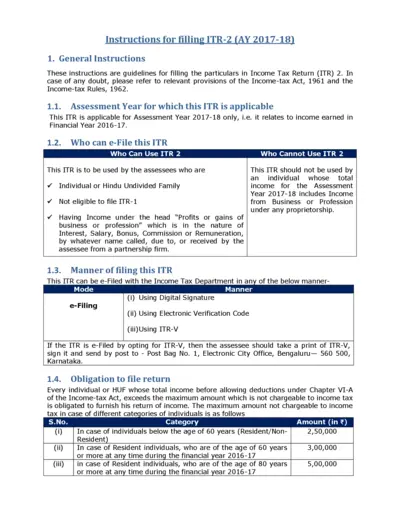

Instructions for Filling ITR-2 for Assessment Year 2017-18

The document provides detailed instructions for filling the ITR-2 form for the assessment year 2017-18. It covers general instructions, eligibility criteria, manner of filing, and personal information requirements. Follow these guidelines to correctly fill and submit your ITR-2.

Property Taxes

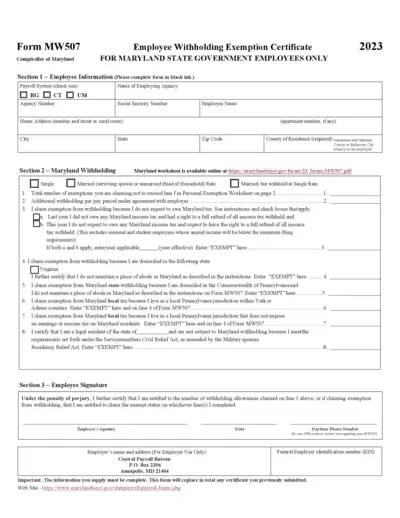

2023 Maryland State Employee Withholding Exemption Certificate

This file is the 2023 Maryland State Employee Withholding Exemption Certificate (Form MW507). It provides necessary information for Maryland state government employees to claim withholding exemptions. The form must be filled in black ink and includes sections for employee information, withholding details, exemptions, and signature.

Property Taxes

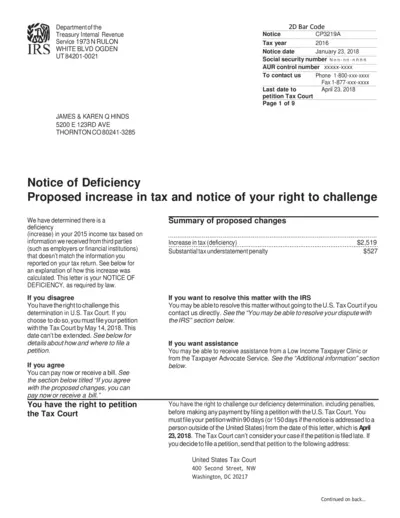

IRS Notice of Deficiency CP3219A Tax Year 2016

This document is an official IRS Notice of Deficiency for the 2016 tax year. It includes details about the proposed increase in tax, options to challenge, and instructions. It also provides support contacts and additional resources.

Property Taxes

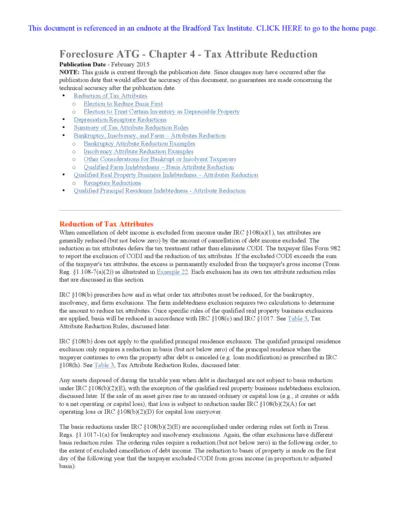

Tax Attribute Reduction Rules Guide - Foreclosure ATG

This document provides comprehensive guidelines on tax attribute reduction, focusing on aspects such as reduction of tax attributes, bankruptcy, insolvency, and farming-related rules. It includes key details on IRC §108 regulations, specific elections, and examples of application.

Property Taxes

IRS Form W-2 and W-3 Electronic Filing Instructions 2022

This document provides the necessary instructions for employers to file Forms W-2 and W-3 electronically with the SSA. Employers can create fill-in versions of the forms, print, file with state or local governments, distribute to employees, and keep for their records. The document also contains information about penalties for filing forms that can't be scanned and how to order official IRS forms.

Property Taxes

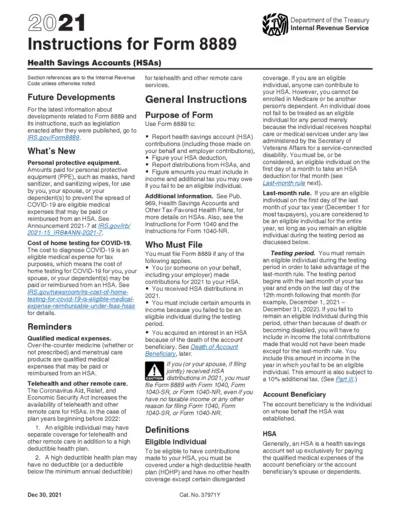

2021 Instructions for Form 8889, Health Savings Accounts

This file contains detailed information and instructions on filling out Form 8889 for Health Savings Accounts (HSAs), including new updates, general instructions, who must file, definitions, and specific instructions.

Property Taxes

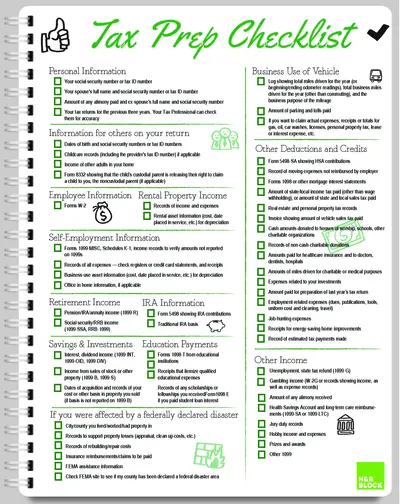

Tax Preparation Checklist Guide

This file provides a detailed checklist for gathering all necessary personal, income, and deduction information required for tax preparation. Use this guide to ensure you have all the required documents and information before filing your taxes. It includes sections on personal information, income records, rental income, self-employment details, retirement income, savings, investments, and more.

Property Taxes

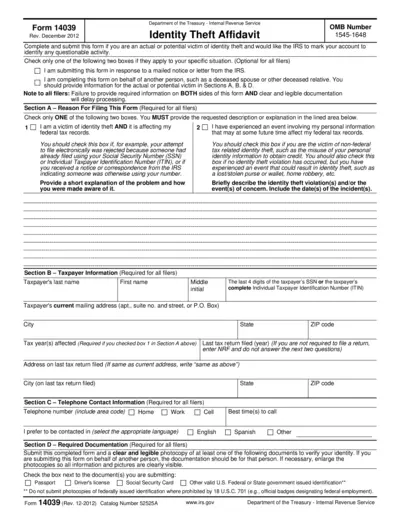

IRS Identity Theft Affidavit Form 14039 - Instructions & Details

Form 14039, Identity Theft Affidavit, is used to report identity theft issues to the IRS. This form helps individuals mark their account to identify any questionable activities. Complete and submit this form with the required documentation.

Property Taxes

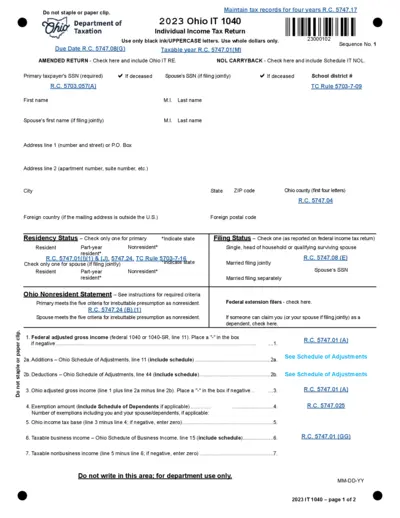

Ohio IT 1040 Individual Income Tax Return 2023

This file is for the 2023 Ohio IT 1040 Individual Income Tax Return. It includes detailed instructions for residents, nonresidents, and part-year residents. It also provides information on credits, deductions, and income reporting.