Property Taxes Documents

Property Taxes

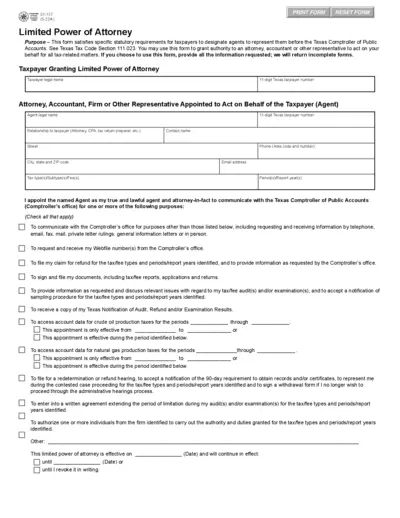

Texas Comptroller Limited Power of Attorney Form

This form grants limited power of attorney for taxpayers to designate agents. It allows representatives to act on taxpayers' behalf. Ensure all required information is provided.

Property Taxes

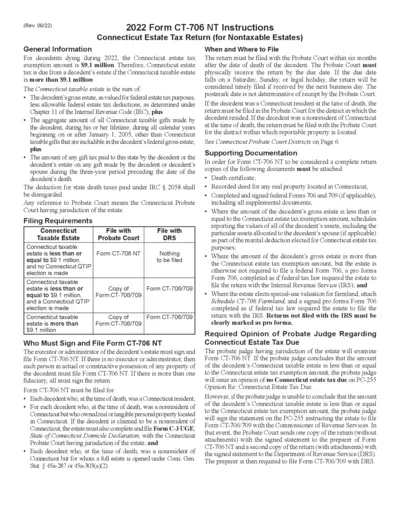

CT-706 NT Nontaxable Estates Form Instructions

This document provides detailed instructions for filling out the Connecticut Estate Tax Return (CT-706 NT) for non-taxable estates. It includes filing requirements, necessary documentation, and steps for proper submission.

Property Taxes

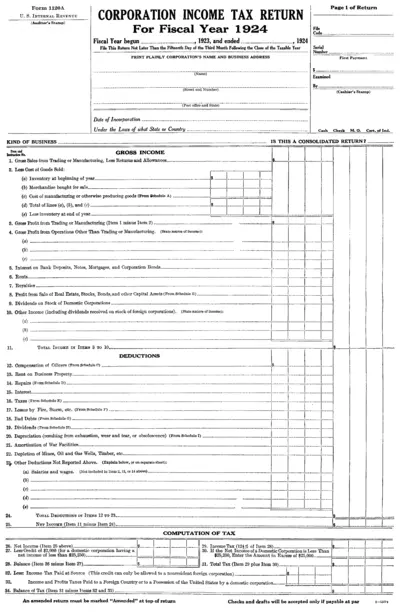

Form 1120A Corporation Income Tax Return for 1924

Form 1120A is a U.S. Corporation Income Tax Return for the fiscal year 1924. It includes instructions for calculating gross income, deductions, and tax. Corporations must file this return no later than the fifteenth day of the third month following the close of the taxable year.

Property Taxes

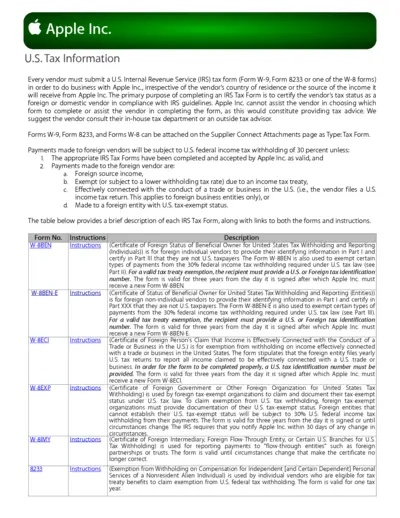

Apple Inc. U.S. Tax Information Forms for Vendors

This file provides information on U.S. tax forms required by Apple Inc. for vendors. It outlines the types of forms available and their specific use cases. The instructions for filling out and submitting the forms are included.

Property Taxes

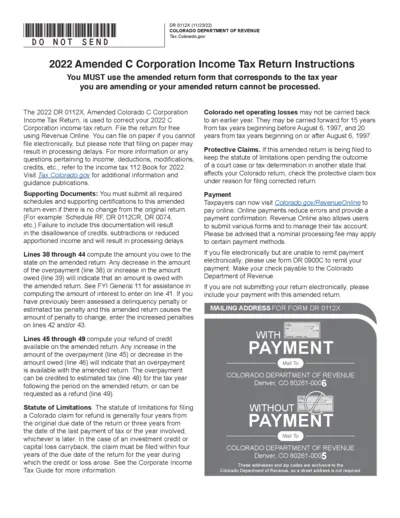

2022 Amended C Corporation Income Tax Return Instructions

The 2022 Amended Colorado C Corporation Income Tax Return Instructions provide guidelines for correcting your 2022 return. It includes details about necessary documents, interest calculations, and statute of limitations. Visit Tax.Colorado.gov for more information.

Property Taxes

Aircraft Personal Property Tax Return Form Instructions

This document contains instructions and details for filing the Aircraft Personal Property Tax Return form. Users can find step-by-step guidelines on how to properly complete and submit the form. Additionally, it provides information on legal requirements and revisions.

Property Taxes

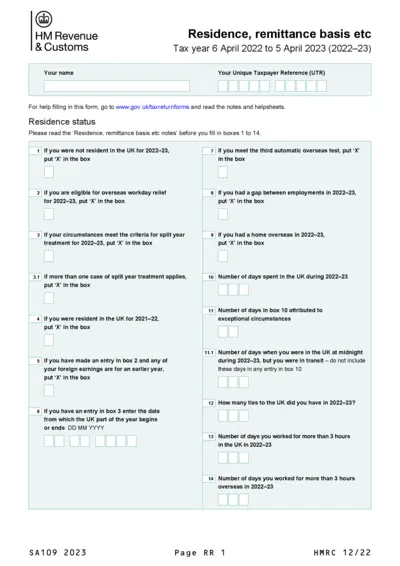

HMRC Residence, Remittance Basis Tax Form 2022-23

This document is a tax form provided by HMRC for the 2022-23 tax year. It includes sections on residence status, personal allowances, domicile, and more. Follow the detailed instructions to ensure accurate completion and submission.

Property Taxes

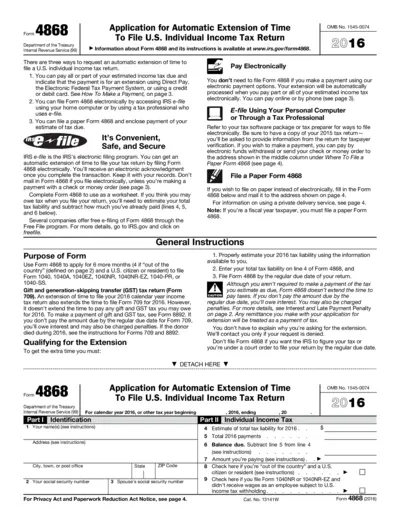

Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

This file provides comprehensive details and instructions for U.S. taxpayers on how to apply for an automatic extension of time to file their individual income tax return using Form 4868. It includes methods of submission, payment options, and important deadlines. The form is crucial for those needing extra time to prepare their tax documents accurately.

Property Taxes

Oregon Corporation Tax Payment Instructions and Form

This file contains instructions for making corporation tax payments to the Oregon Department of Revenue using Form OR-20-V. It provides details on payment options, how to mail payments, and required information. The form must be filled out accurately to ensure proper processing.

Property Taxes

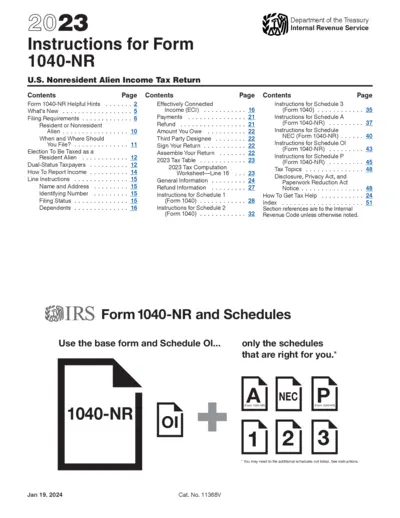

Instructions for Form 1040-NR 2023: Nonresident Alien Income Tax Return

This document provides detailed instructions for completing the 2023 Form 1040-NR, U.S. Nonresident Alien Income Tax Return. It includes helpful hints, filing requirements, and specific exceptions for nonresident aliens.

Property Taxes

Easy Guide to e-Verifying Your Income Tax Return

This file provides a step-by-step guide to e-Verifying your Income Tax Return (ITR) easily using various methods such as Aadhaar OTP, Net Banking, Bank Account, Demat Account, and Bank ATM. It aims to make the verification process quick, convenient, and eco-friendly.

Property Taxes

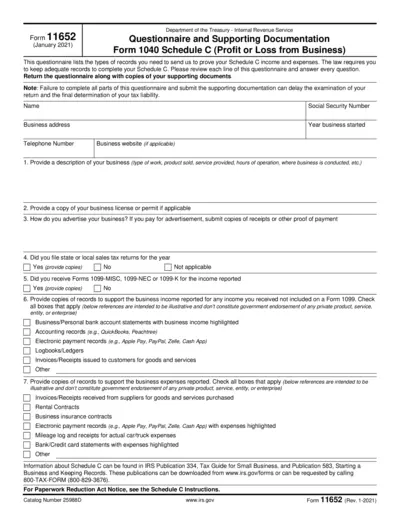

IRS Form 1040 Schedule C: Prove Business Income & Expenses

This IRS questionnaire helps you prove your Schedule C income and expenses. Fill out the details and submit supporting documents as instructed. Ensure accuracy to avoid delays in tax liability determination.