Property Taxes Documents

Property Taxes

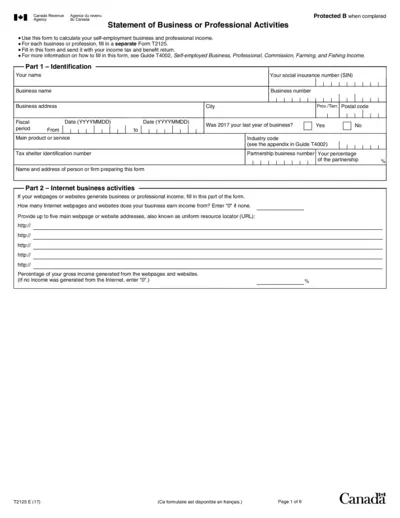

Statement of Business or Professional Activities Form T2125

This file is used to calculate self-employment business and professional income. It includes sections for business and professional income, internet activities, cost of goods sold, and net income before adjustments. Instructions, identification details, and various fields for entering financial data are provided.

Property Taxes

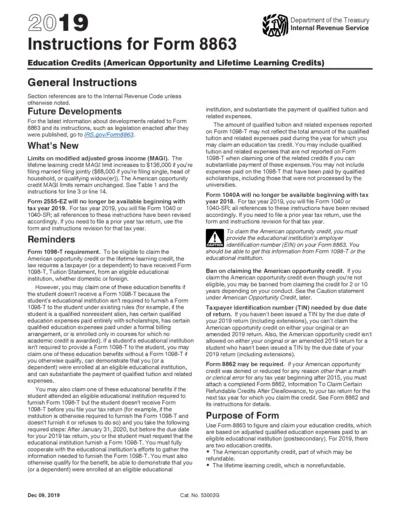

IRS Form 8863 Instructions 2019 for Education Credits

Instructions for Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits). Includes updates for tax year 2019 and detailed guidance for taxpayers.

Property Taxes

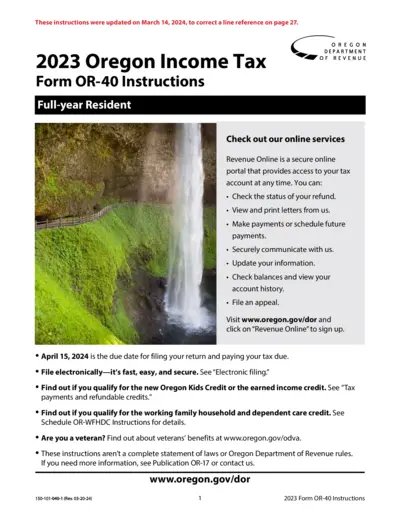

2023 Oregon Income Tax Form OR-40 Instructions

This file provides detailed instructions for filing the 2023 Oregon Income Tax Form OR-40 for full-year residents. It includes information on e-filing, tax credits, and various tax-related topics. Check out the content to ensure accurate and timely tax filing.

Property Taxes

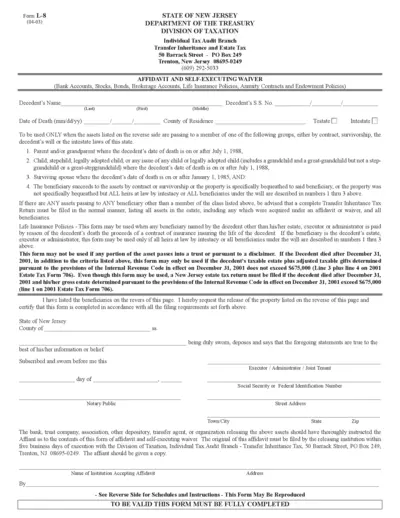

NJ Form L-8 Affidavit and Self-Executing Waiver

Form L-8 is for the release of certain assets without the need for a formal New Jersey inheritance tax waiver. It covers bank accounts, stocks, bonds, brokerage accounts, and life insurance policies. The form is used for beneficiaries including spouse, parents, grandparents, and children.

Property Taxes

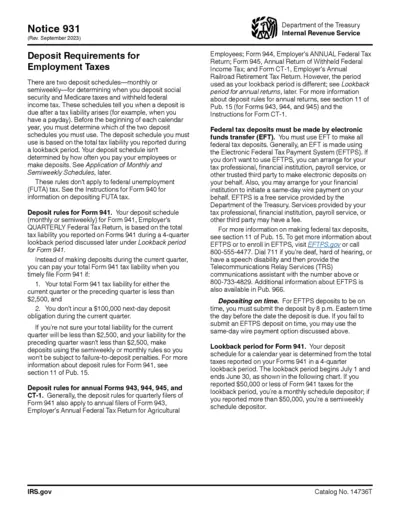

Deposit Requirements for Employment Taxes

This document provides detailed deposit requirements for employment taxes, including schedules, rules for quarterly and annual filers, and electronic funds transfer requirements. It also explains the $100,000 next-day deposit rule and provides examples for better understanding. Additionally, it outlines the lookback period calculations and adjustments.

Property Taxes

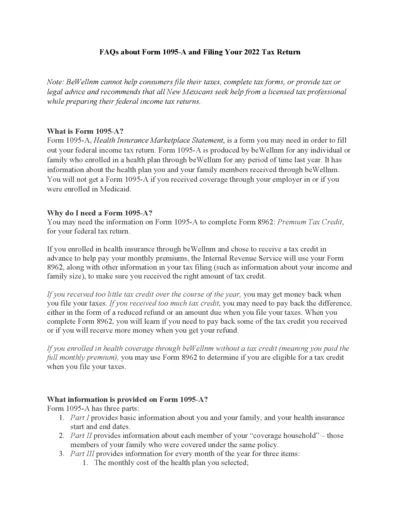

Form 1095-A FAQs for Filing 2022 Tax Return

This document contains frequently asked questions about Form 1095-A and the steps to complete Form 8962 for your 2022 tax return. BeWellnm provides this information for individuals and families who enrolled in a health plan through the marketplace.

Property Taxes

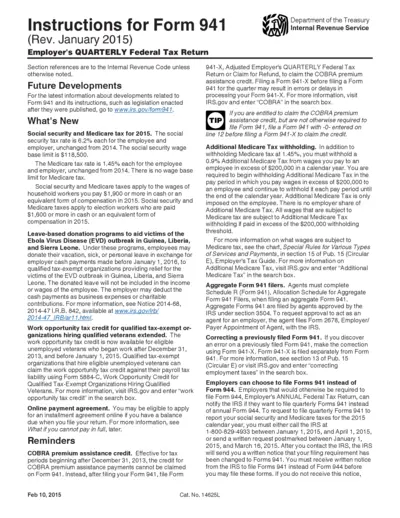

Instructions for Form 941, Employer's QUARTERLY Federal Tax Return

This document provides detailed instructions for employers on how to file Form 941, the Employer's Quarterly Federal Tax Return. It includes information on tax rates, new tax legislation, and special programs for employers.

Property Taxes

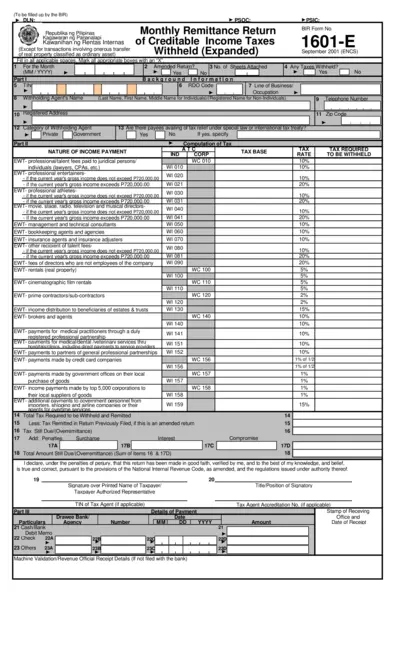

Monthly Remittance Return of Creditable Income Taxes Withheld

This document is used for the monthly remittance of creditable income taxes withheld by withholding agents. It should be filed in triplicate and submitted by every withholding agent, both individual and non-individual. Detailed instructions for filling out and submitting the form are provided.

Property Taxes

Notifying Employees About the Earned Income Credit (EIC)

This file provides guidelines for employers on how to notify their employees about the Earned Income Credit (EIC). It details which employees should be notified, how and when to notify them, and how employees can claim the EIC. It includes information about required forms and notices that must be given to employees.

Property Taxes

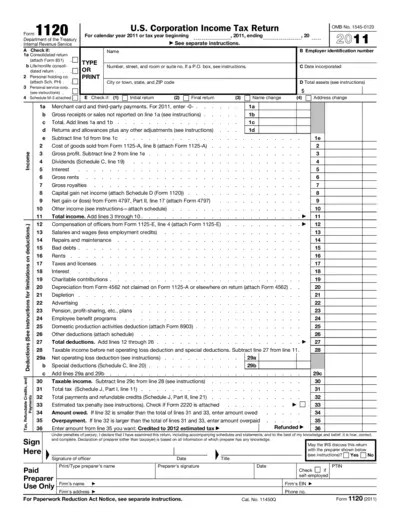

Form 1120: U.S. Corporation Income Tax Return

Form 1120 is used by corporations to file their income tax returns. It includes details on income, deductions, and tax computation. Corporations should refer to instructions for accurate completion.

Property Taxes

TransCore IFTA Fuel and Mileage Tax Reporting Services

This file provides details about TransCore's IFTA fuel and mileage tax services which help businesses manage fuel tax reporting. It includes service options, features, and instructions for compliance. Learn how you can streamline your fuel tax reporting process with TransCore.

Property Taxes

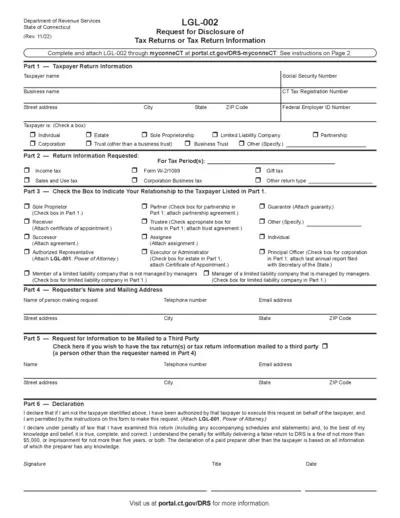

Connecticut Form LGL-002: Request for Disclosure of Tax Returns

This form, LGL-002, from the Department of Revenue Services in Connecticut is used to request tax returns or tax return information. It is applicable for various types of taxpayers including individuals, corporations, estates, and trusts. Follow the instructions provided on the second page to correctly fill out and submit the form.