Property Taxes Documents

Property Taxes

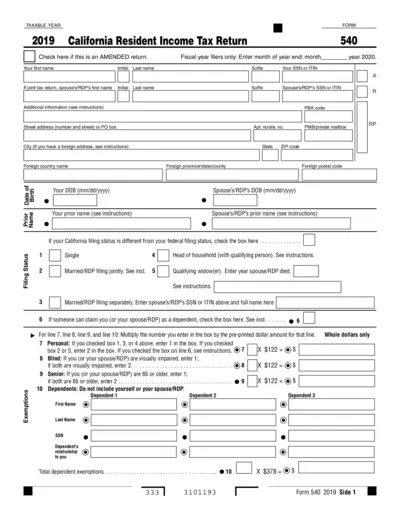

2019 California Resident Income Tax Return Form 540

This document is the California Resident Income Tax Return Form 540 for the taxable year 2019. It is used for filing state income taxes for residents of California. The form includes sections for personal information, exemptions, income, deductions, and tax calculations.

Property Taxes

2021 IRS Form 8995 Instructions: Qualified Business Income Deduction

Form 8995 instructions help taxpayers calculate the Qualified Business Income Deduction for eligible businesses. It includes details on eligibility, calculating QBI, and aggregating trades or businesses.

Property Taxes

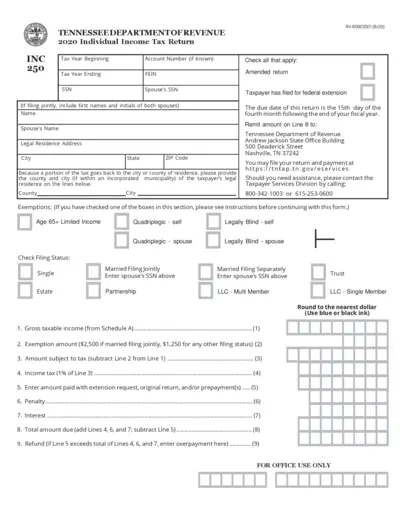

Tennessee 2020 Individual Income Tax Return

This document is the Tennessee 2020 Individual Income Tax Return form. It is used for reporting taxable interest and dividend income. The form includes sections for listing taxable and non-taxable income, calculating tax amounts, and claiming exemptions.

Property Taxes

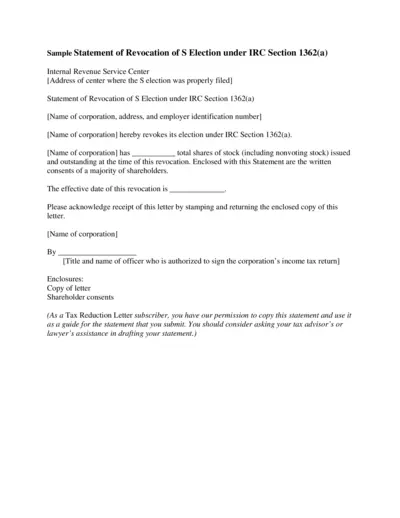

Revocation of S Election under IRC Section 1362(a)

This file contains a statement for revoking an S election under IRC Section 1362(a). It includes details such as the name of the corporation, address, and employer identification number. It also outlines the steps necessary to complete the revocation process and obtain shareholder consents.

Property Taxes

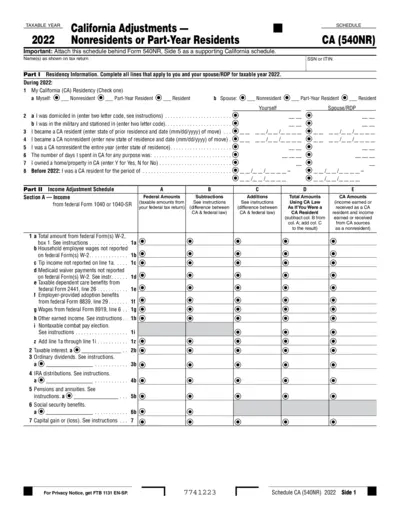

California Adjustments Nonresidents Part-Year Residents 2022

This document provides California adjustments for nonresidents or part-year residents for the taxable year 2022. It includes detailed sections on income adjustments, additional income, and adjustments to income, along with residency information. Essential for taxpayers completing Form 540NR.

Property Taxes

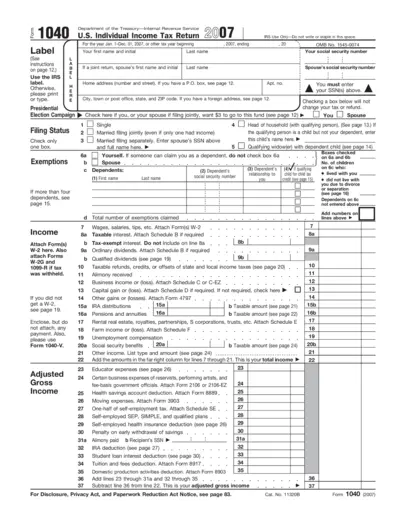

2007 IRS Form 1040 - U.S. Individual Income Tax Return

The 2007 IRS Form 1040 is used by U.S. taxpayers to file an annual income tax return. The form includes sections for personal information, income, deductions, and credits. Make sure you have all relevant documents, such as W-2s and 1099s, before you begin.

Property Taxes

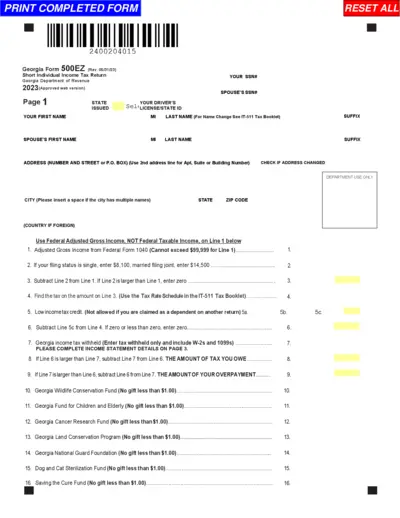

Georgia Form 500EZ - Short Individual Income Tax Return 2023

The Georgia Form 500EZ is a short individual income tax return form for state residents. It's meant for those who meet specific requirements such as having an income below $99,999 and not itemizing deductions. This form is used to calculate and report your state tax obligations for the year 2023.

Property Taxes

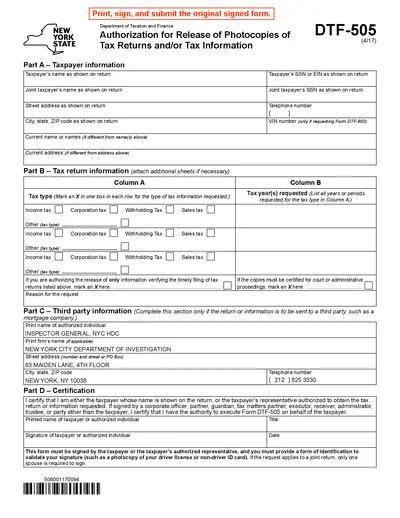

Authorization for Release of Tax Information - NY State

Authorization for Release of Photocopies of Tax Returns and/or Tax Information (DTF-505) from New York State. This form is used to request copies of e-filed or paper tax returns. Ensure to provide identification and processing fee.

Property Taxes

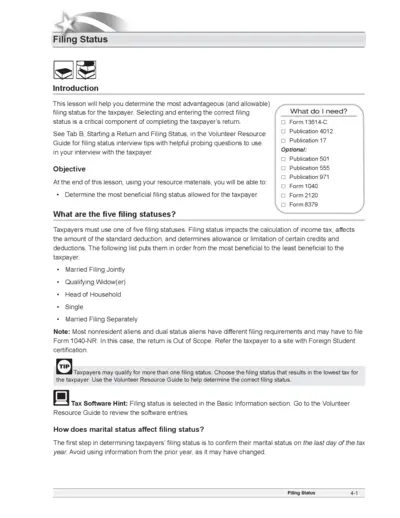

Filing Status Guide for Taxpayers

This file helps determine the most advantageous filing status for taxpayers and provides instructions for completing necessary forms. It includes information about different filing statuses and their requirements.

Property Taxes

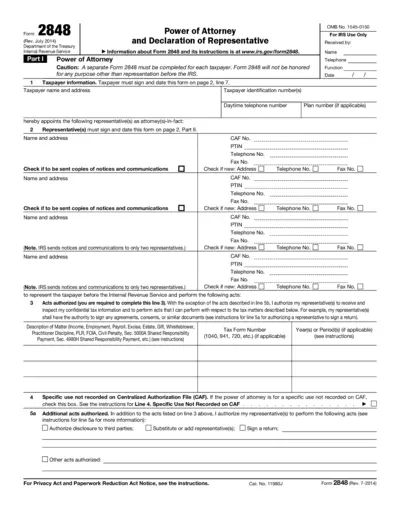

Form 2848 Power of Attorney and Declaration of Representative

Form 2848 allows taxpayers to appoint a representative before the IRS. This form is necessary for authorizing individuals to represent you and receive confidential tax information. Completing and submitting Form 2848 ensures your tax matters are handled as per your decisions.

Property Taxes

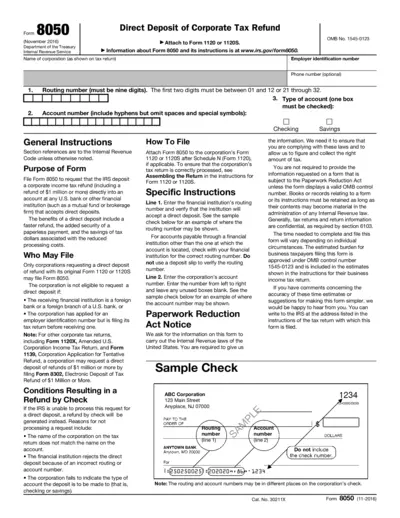

Direct Deposit of Corporate Tax Refund (Form 8050)

Form 8050 allows corporations to request a direct deposit of their corporate tax refund into any U.S. bank or financial institution. It provides instructions on how to complete the form and attach it to the corporate tax return. This form ensures a faster, more secure refund process.

Property Taxes

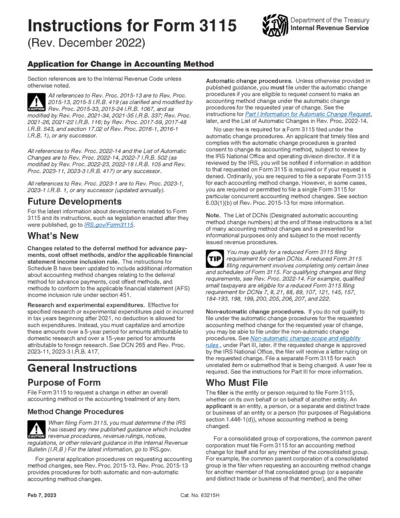

Instructions for Form 3115: Change in Accounting Method

This file provides detailed instructions for IRS Form 3115, which is used to request a change in accounting method. It includes guidance on the latest IRS regulations and procedures. Additionally, it offers specific steps for both automatic and non-automatic change requests.