Property Taxes Documents

Property Taxes

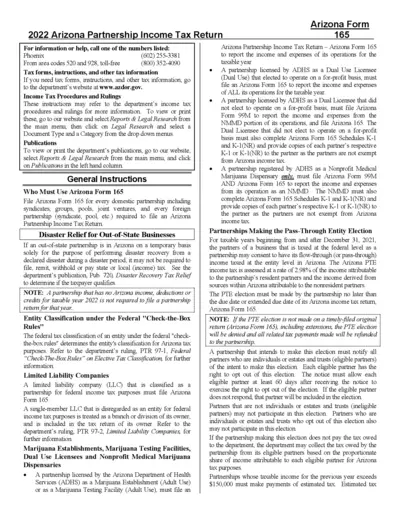

2022 Arizona Partnership Income Tax Return Form 165

The 2022 Arizona Partnership Income Tax Return Form 165 is essential for domestic partnerships to report their income. Properly filling this form ensures compliance with Arizona tax laws. Follow the guidelines closely to complete your submission.

Property Taxes

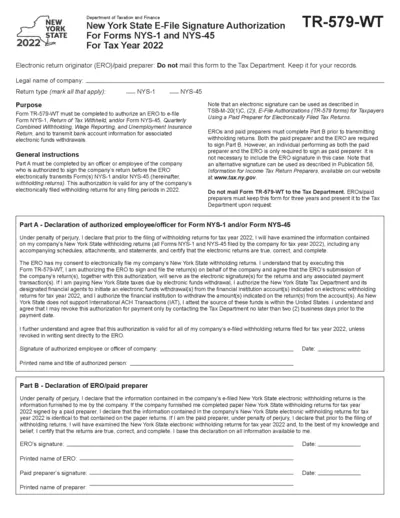

New York State E-File Signature Authorization 2022

This file provides essential information for completing the New York State E-File Signature Authorization for tax year 2022. It outlines the requirements for electronic return originators and paid preparers to e-file NYS-1 and NYS-45 forms. Familiarize yourself with the general instructions and the declaration process to ensure compliance.

Property Taxes

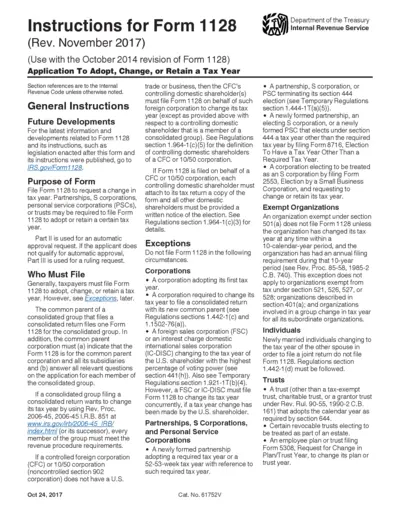

Form 1128 Instructions for Tax Year Changes

This PDF provides detailed instructions for completing Form 1128, which is used to adopt, change, or retain a tax year. It outlines the eligibility criteria, necessary forms, and submission details. Understanding these instructions is essential for ensuring compliance with IRS requirements.

Property Taxes

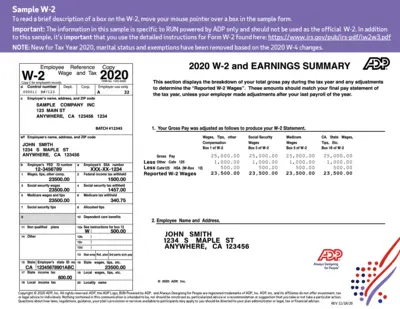

Sample W-2 Form Instructions and Guidelines

This document provides details and instructions for filling out the W-2 form, including its purpose and how to use it. Users can learn about the contents, fields, and necessary steps to complete the form accurately. It serves as a comprehensive guide for both employees and employers.

Property Taxes

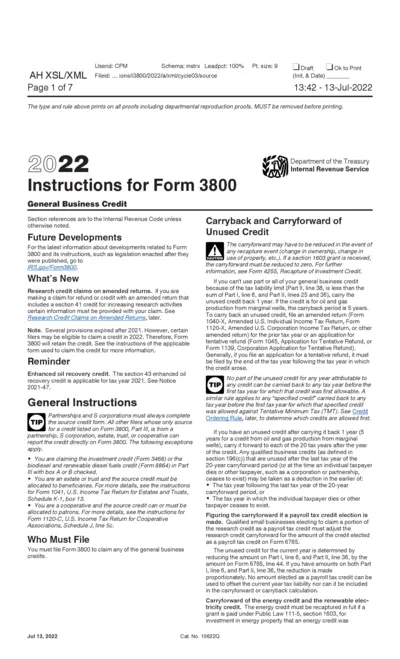

Instructions for Form 3800: General Business Credit

This file contains essential instructions for Form 3800, which details the general business credit. It offers guidelines and relevant updates for tax filers. Understanding these instructions is crucial for accurate tax reporting and credit claims.

Property Taxes

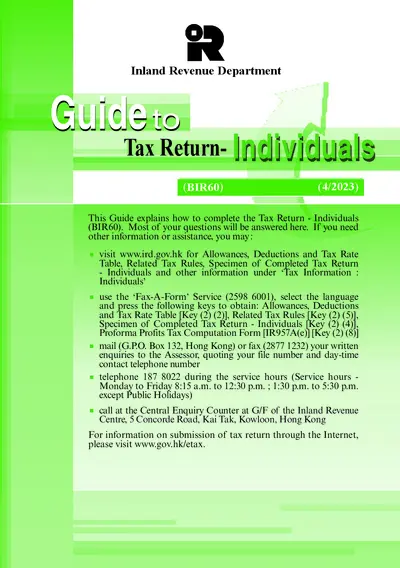

Inland Revenue Tax Return for Individuals Guide

This guide provides essential instructions for completing the Tax Return - Individuals (BIR60). It answers common questions regarding personal data and submission processes. Use this comprehensive resource for successful tax filing.

Property Taxes

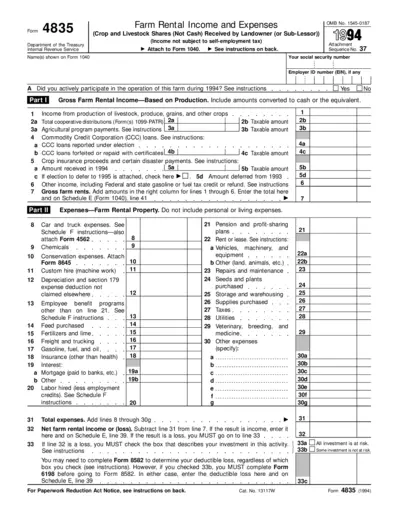

Farm Rental Income and Expenses Form 4835 1994

Form 4835 is used to report farm rental income based on production of crops and livestock. It is essential for landowners who did not materially participate in the operation of the farm. Ensure accuracy to comply with IRS regulations and optimize your tax reporting.

Property Taxes

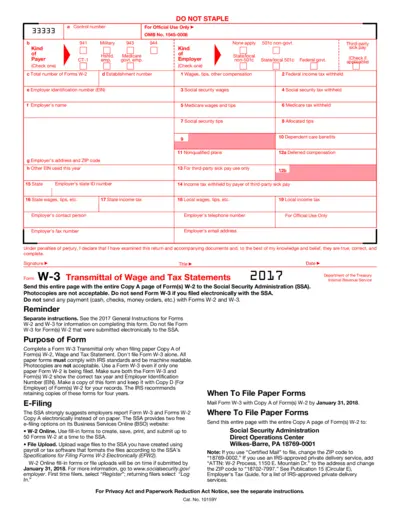

Form W-3 Transmittal of Wage and Tax Statements 2017

Form W-3 is a transmittal document for reporting wage and tax statements. It's essential for employers to file with the IRS when submitting Forms W-2. This file includes instructions and information on employer tax submission.

Property Taxes

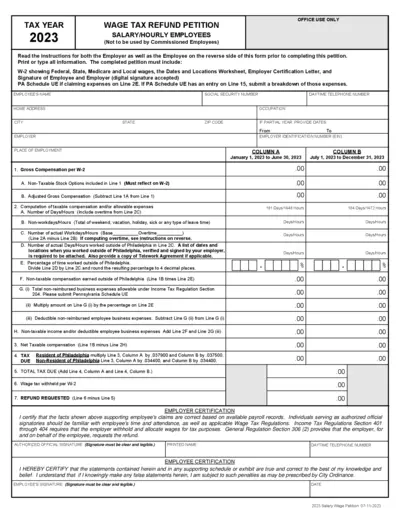

2023 Wage Tax Refund Petition Form for Employees

This file contains the Wage Tax Refund Petition for salary and hourly employees. It includes essential filing instructions and necessary documents for tax-related claims. Use this form to claim a refund for withheld wage tax.

Property Taxes

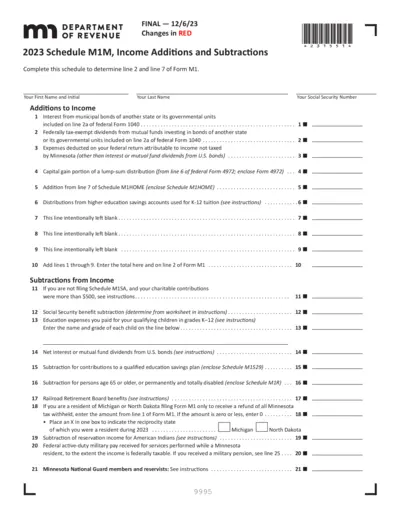

2023 Schedule M1M Income Additions and Subtractions

This file contains detailed instructions for the 2023 Schedule M1M, which is used to report income additions and subtractions. It provides guidance on how to complete the form to determine your taxable income effectively. Essential for individuals looking to comply with Minnesota tax regulations.

Property Taxes

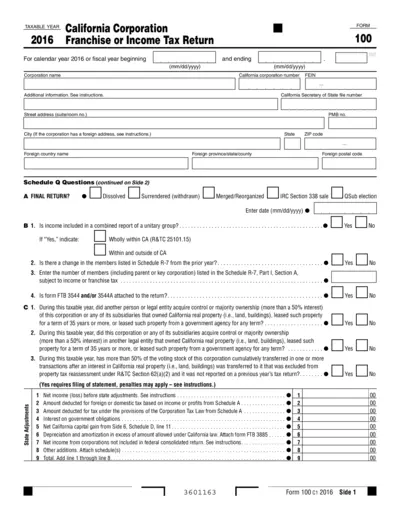

California Corporation Franchise Tax Return 2016

This document is the California Corporation Franchise or Income Tax Return for the year 2016. It provides essential instructions and necessary fields for corporations in California to fulfill their tax obligations. Proper completion of this form is crucial for accurate reporting and compliance with California tax laws.

Property Taxes

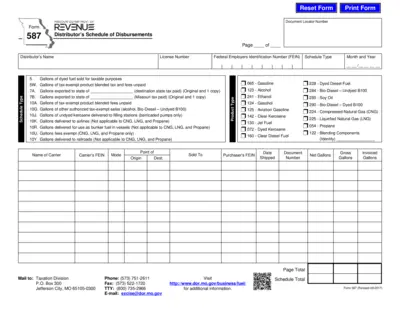

Distributor's Schedule of Disbursements Form 587 - Missouri

The Distributor's Schedule of Disbursements Form 587 is a crucial document for reporting disbursements related to fuel sales in Missouri. It provides detailed accounting of various fuel types sold, including tax-exempt products and exports. Users can accurately report their fuel transactions and comply with state regulations using this form.