Property Taxes Documents

Property Taxes

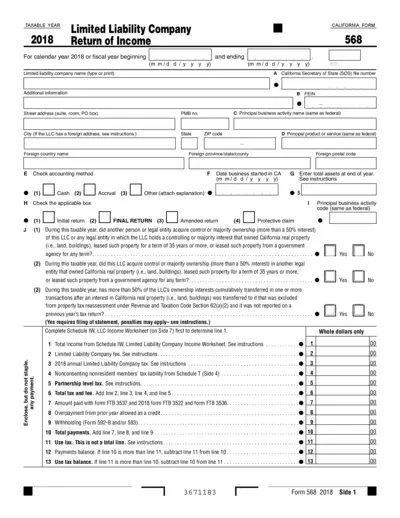

California LLC Tax Return Form 568 Instructions

The California Form 568 is the official return of income for Limited Liability Companies (LLCs). It provides essential information for tax filing for the taxable year 2018. The form includes details on income, assets, and tax liabilities.

Property Taxes

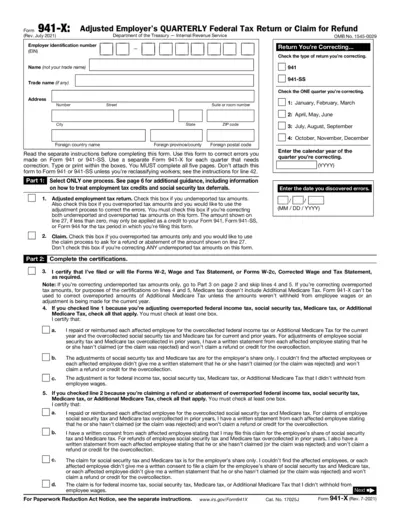

941-X Adjusted Employer's Quarterly Tax Return

Form 941-X is used to correct errors made on Form 941 or 941-SS. This form allows employers to adjust their reported tax amounts and claim refunds. Stay compliant with IRS regulations by accurately completing this form.

Property Taxes

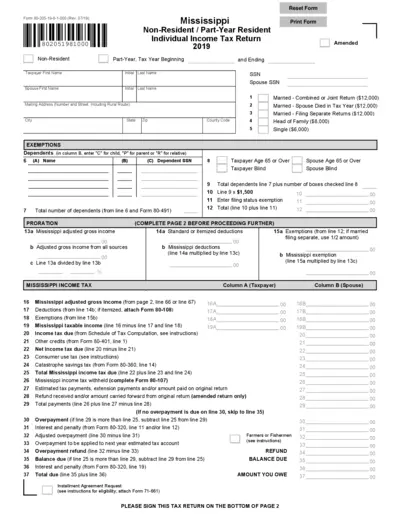

Mississippi Non-Resident Individual Income Tax Return

This file contains the form 80-205 for filing the Mississippi non-resident or part-year resident individual income tax return for 2019. It provides sections for reporting income, deductions, exemptions, and determining tax liabilities. Use this file to ensure compliance with state tax obligations.

Property Taxes

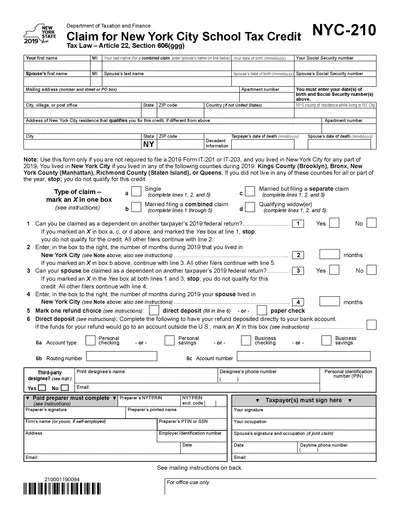

Claim for New York City School Tax Credit (2019)

This form is essential for residents of New York City who want to claim their School Tax Credit. It outlines the necessary information regarding eligibility and the submission process. Users can complete the form efficiently to ensure they receive their due credits.

Property Taxes

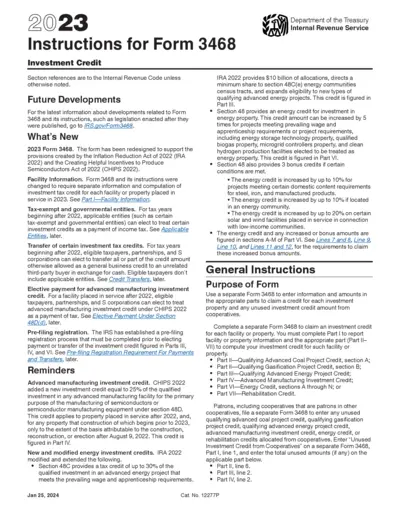

Instructions for Form 3468 Investment Credit

This document provides essential instructions and guidelines for taxpayers regarding Form 3468, which pertains to the Investment Credit. Users will find insights into eligibility, changes, and the claiming process for investment credits introduced by the Inflation Reduction Act and CHIPS Act. It's an invaluable resource for individuals and businesses looking to navigate the complexities of tax credits associated with investments.

Property Taxes

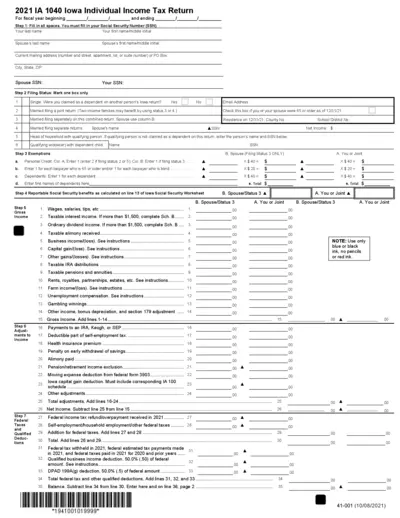

2021 Iowa Individual Income Tax Return Form IA 1040

The 2021 IA 1040 is the Iowa Individual Income Tax Return required for filing your state tax. This form is essential for residents of Iowa to report their income and calculate their tax liability. Follow the instructions to ensure accurate completion and submission.

Property Taxes

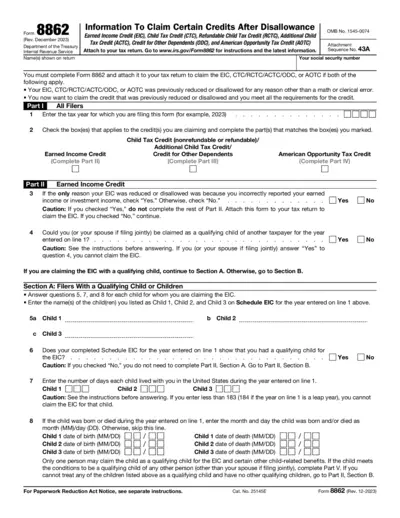

Form 8862 Instructions for Claiming Tax Credits

Form 8862 is used to reclaim certain tax credits after disallowance. It is essential for taxpayers who have had their Earned Income Credit or other credits reduced. This form must be completed accurately to ensure eligibility for these credits.

Property Taxes

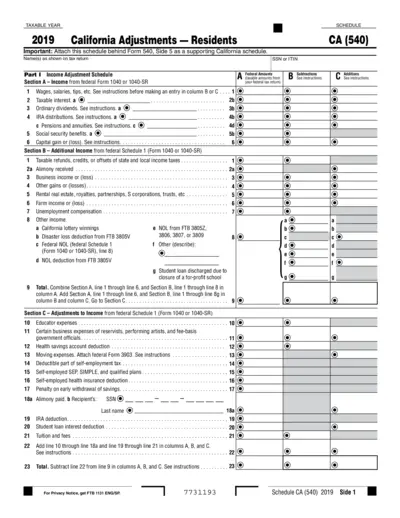

California Adjustments 2019 File for Tax Residents

This file contains the necessary California tax adjustments for residents filing in 2019. It offers detailed instructions on income adjustments, credits, and deductions. Taxpayers can use this document to accurately report their California income tax liability.

Property Taxes

Form 7004 Automatic Extension Request 2022

Form 7004 allows taxpayers to request an automatic extension of time to file certain business income tax returns. This form is essential for businesses needing additional time for paperwork. Ensure to file by the granted due date to avoid penalties.

Property Taxes

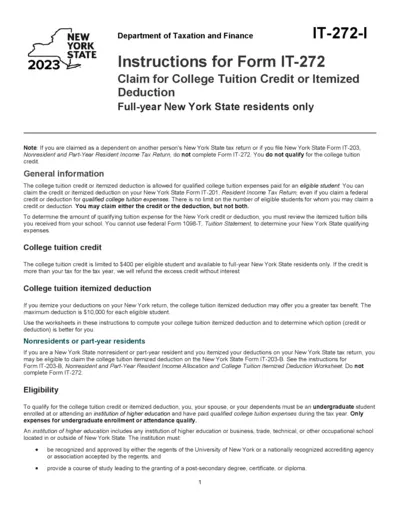

Instructions for New York College Tuition Credit

This document provides detailed instructions for New York State residents on claiming the College Tuition Credit or Itemized Deduction. It outlines eligibility criteria, required forms, and guidance for calculating the credit or deduction. Ensure you follow these guidelines precisely to maximize your tax benefits.

Property Taxes

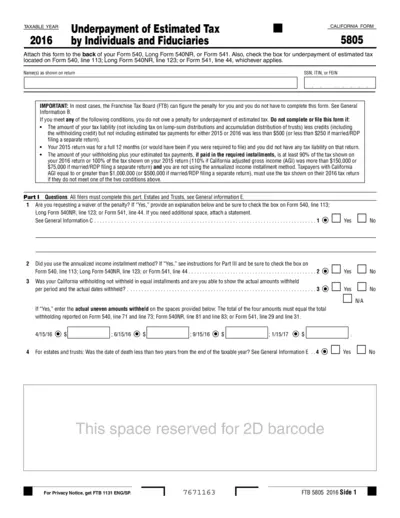

California Form FTB 5805 for Tax Year 2016

The California Form FTB 5805 is for reporting underpayment of estimated tax by individuals and fiduciaries. It is essential for those who may be subject to penalties for underpayment of tax. This form helps individuals determine if they owe a penalty based on their estimated tax payments.

Property Taxes

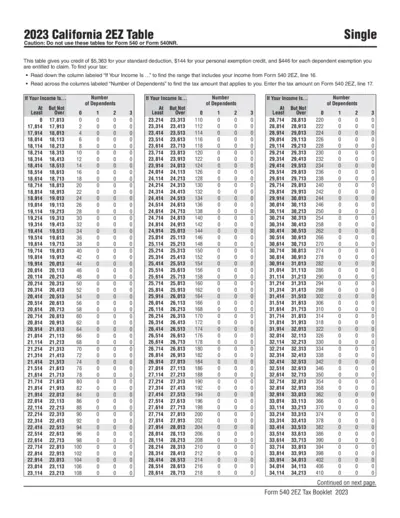

2023 California 2EZ Tax Form Instructions and Guidelines

This file provides comprehensive instructions for filling out the 2023 California 2EZ tax form. It outlines the required information and details regarding personal credits and dependent exemptions. Users can easily navigate the tax table to determine their applicable tax amount based on their income and number of dependents.