Property Taxes Documents

Property Taxes

IRS Notification Requirements for Tax-Exempt Organizations

This document outlines the IRS notification requirements under Section 501(c)(4). It highlights key compliance issues and provides recommendations for organizations. Essential for understanding tax compliance obligations.

Property Taxes

Instructions for Filing Form 1040X Amended Tax Return

This document provides comprehensive instructions for completing Form 1040X, the Amended U.S. Individual Income Tax Return. It covers the purpose of the form, important dates, and additional requirements for various situations. Perfect for individuals looking to amend their tax returns efficiently.

Property Taxes

IRS Form 8829: Business Use of Your Home Instructions

This form provides instructions for calculating expenses related to the business use of your home. It is essential for self-employed individuals who want to deduct home office expenses. Complete this form alongside Schedule C (Form 1040) for accurate reporting.

Property Taxes

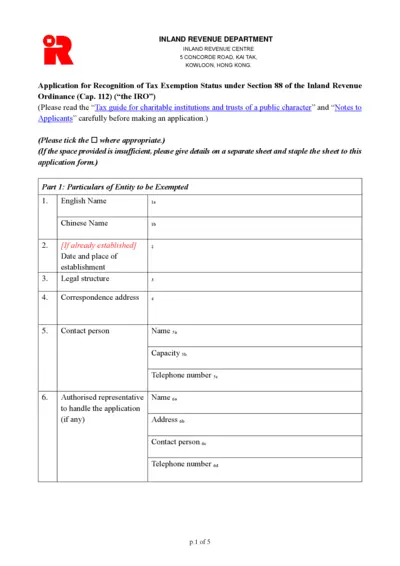

Application for Tax Exemption Status in Hong Kong

This file provides the application form for recognition of tax exemption status under Section 88 of the Inland Revenue Ordinance in Hong Kong. It is essential for charitable institutions and trusts of a public character seeking tax exemptions. Follow the instructions carefully to complete the application correctly.

Property Taxes

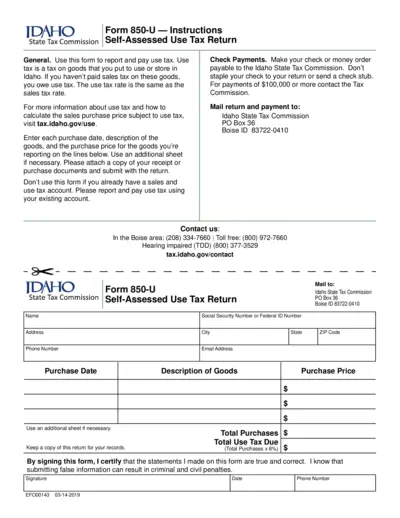

Idaho State Tax Commission Form 850-U Instructions

Form 850-U allows you to report and pay use tax in Idaho for goods that have not been taxed upon purchase. It provides clear instructions to ensure accurate reporting. Use this form to fulfill your tax obligations effortlessly.

Property Taxes

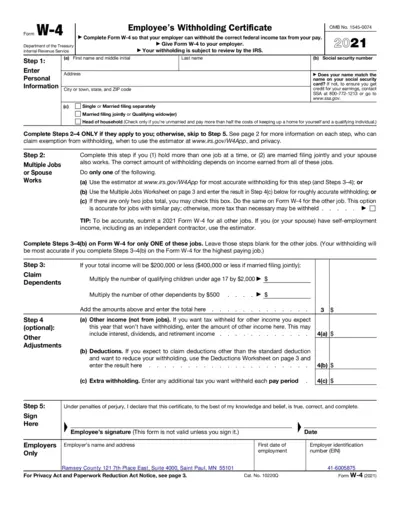

W-4 Employee's Withholding Certificate Form 2021

The W-4 form helps employees provide their withholding preferences to their employer for accurate federal income tax withdrawal. It is essential for adjusting your tax withholding based on personal circumstances. Completing this form correctly ensures you owe the right amount of tax or receive a refund when you file your return.

Property Taxes

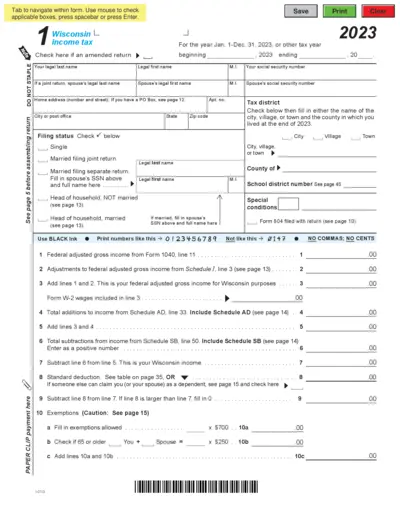

Wisconsin 2023 Income Tax Filing Form

This PDF file contains the necessary forms and instructions for filing Wisconsin income tax for the year 2023. It is essential for both residents and non-residents who earned income in Wisconsin. Ensure you fill it out accurately to avoid delays in processing.

Property Taxes

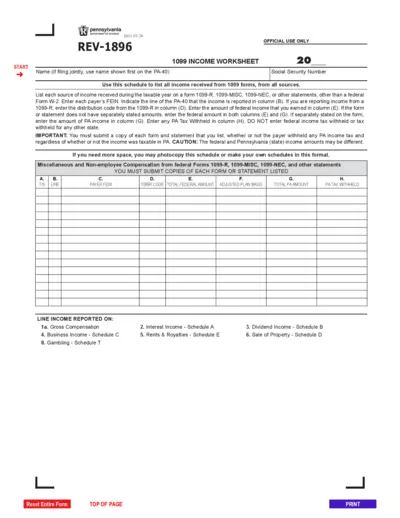

Pennsylvania 1099 Income Worksheet Instructions

The Pennsylvania 1099 Income Worksheet is essential for individuals reporting various income types. It helps ensure accurate income declaration from 1099 forms. This guide provides step-by-step instructions for completing and submitting the form correctly.

Property Taxes

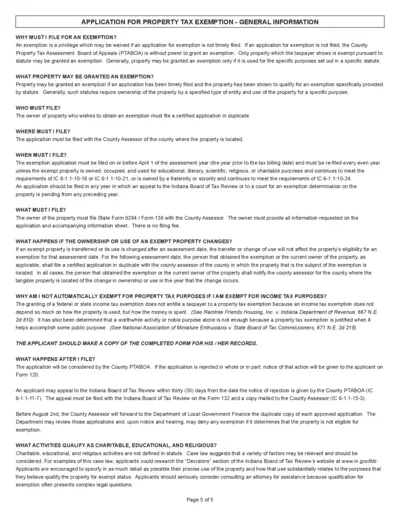

Property Tax Exemption Application Instructions

This document provides crucial information on applying for a property tax exemption. It outlines eligibility, filing procedures, and requirements. Perfect for property owners seeking tax relief.

Property Taxes

Net Operating Losses (NOLs) for Tax Years 2015

This document provides guidelines on net operating losses (NOLs) applicable to individuals, estates, and trusts. It offers detailed instructions on how to figure, claim, and carry over NOLs for tax purposes. Essential for understanding your tax obligations and maximizing deductions.

Property Taxes

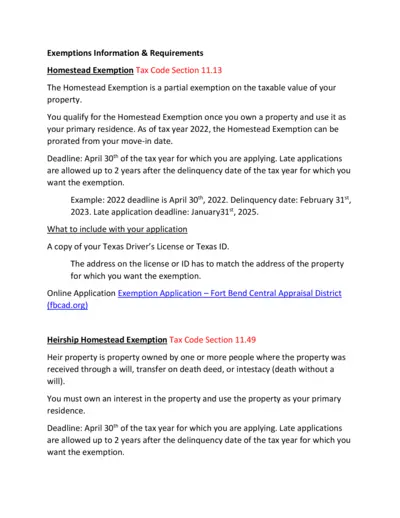

Homestead Exemption Application Instructions and Details

This file provides comprehensive information about the Homestead Exemption application process, including eligibility, required documents, and submission guidelines. It's essential for homeowners seeking tax reductions in Texas. The instructions also cover deadlines and late application procedures.

Property Taxes

IRS Identity Verification Process Guidance

This file provides detailed instructions for taxpayers receiving an identity verification request from the IRS. It includes steps to verify your identity through the IRS website. Ensure you follow these guidelines carefully to protect your personal information.