Property Taxes Documents

Property Taxes

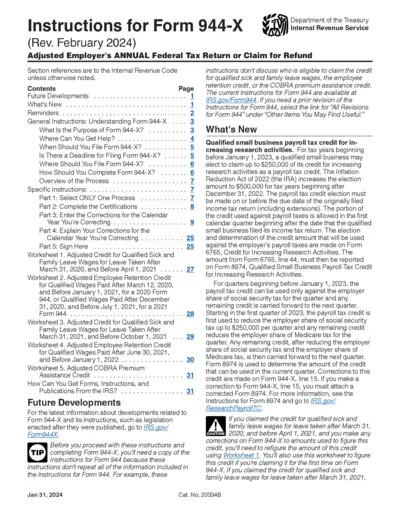

Instructions for Form 944-X Adjusted Tax Return

This file provides comprehensive instructions for completing Form 944-X, including error corrections and submission details. It's essential for employers who need to adjust their annual federal tax return or claim a refund. Stay informed with updates and worksheets included.

Property Taxes

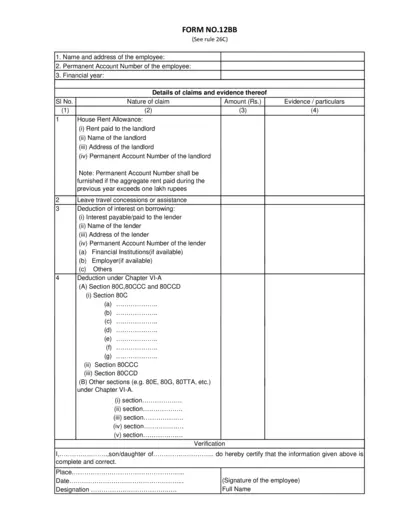

FORM NO. 12BB - Employee Tax Claim Details

FORM NO. 12BB is a crucial document for employees claiming tax deductions. It requires detailed information on various claims, including house rent and travel concessions. Ensure all information is accurately filled to facilitate smooth processing.

Property Taxes

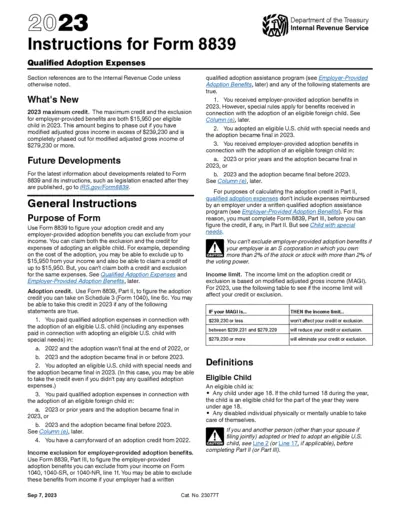

Instructions for Form 8839 on Qualified Adoption Expenses

This document provides comprehensive instructions for Form 8839, which is used to claim adoption credits and benefits. It outlines eligible expenses and income exclusion criteria, ensuring users understand the requirements for claiming credits. A crucial resource for individuals adopting an eligible child in 2023.

Property Taxes

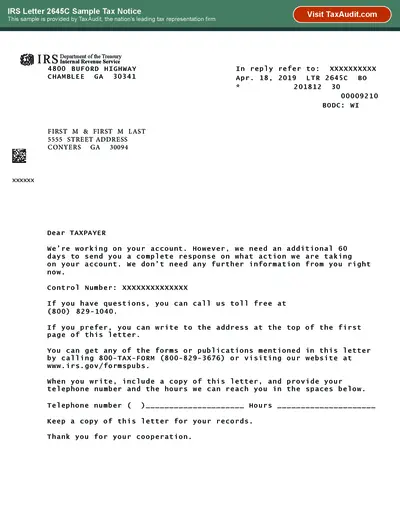

IRS Letter 2645C Sample Tax Notice for Tax Audit

This file contains a sample IRS Letter 2645C tax notice. It serves as a reference for individuals receiving similar notices from the IRS. The document includes important instructions and contact information relevant to tax inquiries.

Property Taxes

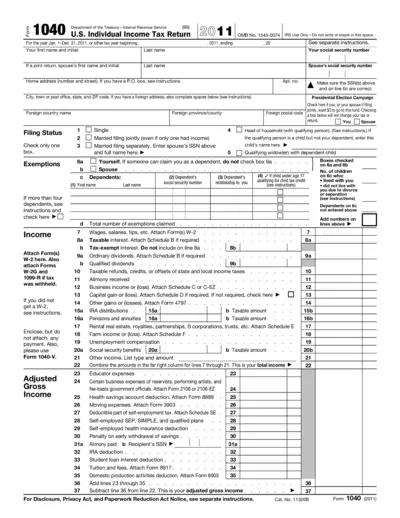

1040 U.S. Individual Income Tax Return Form 2011

The 1040 form is the U.S. Individual Income Tax Return for reporting and filing income taxes. This form serves to accurately report your income, deductions, and credits to the IRS. It is essential for individuals to fulfill their tax obligations and claim any eligible refunds.

Property Taxes

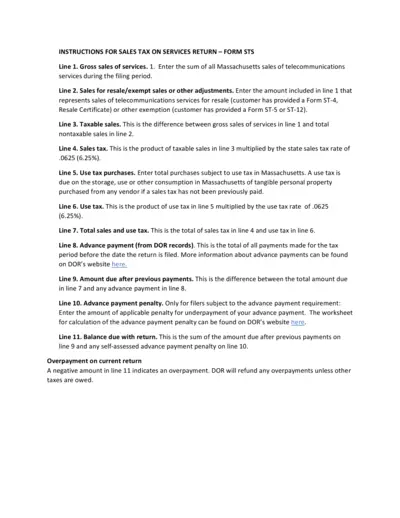

Sales Tax on Services Return Instructions

This file provides detailed instructions for completing the Massachusetts Sales Tax on Services Return - Form STS. It guides users through gross sales reporting, taxable sales calculation, and tax payment. Perfect for businesses needing clarity on sales tax obligations.

Property Taxes

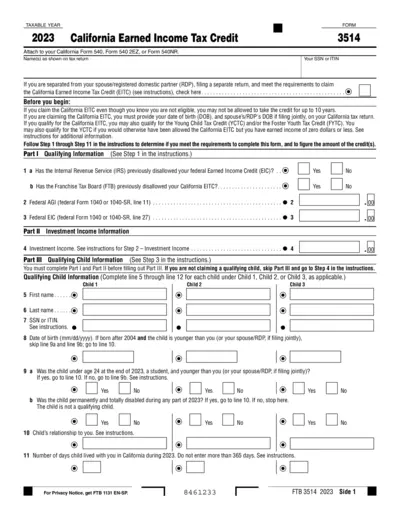

California Earned Income Tax Credit Form 3514 Guide

This document provides essential information about the California Earned Income Tax Credit for the year 2023. It includes instructions on eligibility and how to fill out the EITC application form. There are also guidelines for important tax credits related to children and foster youth.

Property Taxes

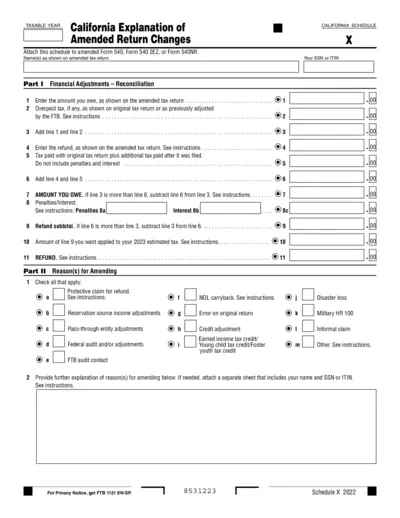

California Amended Tax Return Schedule 2022

This file contains the California Schedule for Amended Tax Returns. It provides detailed instructions for financial adjustments and reconciliation. Use this schedule when updating your tax returns.

Property Taxes

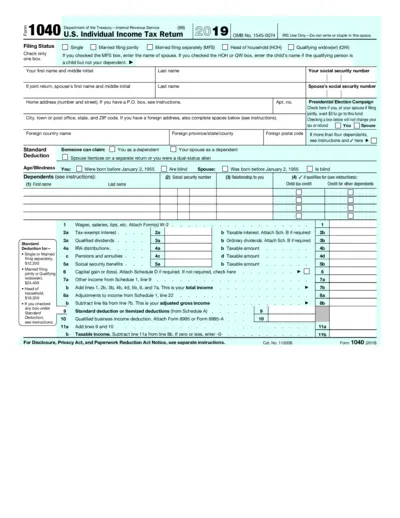

U.S. Individual Income Tax Return Form 1040 (2019)

The U.S. Individual Income Tax Return Form 1040 for 2019 is essential for individuals filing their annual income taxes. This IRS form requires personal information, income details, and deductions for accurate tax assessment. Use this guide to understand how to complete and submit the form effectively.

Property Taxes

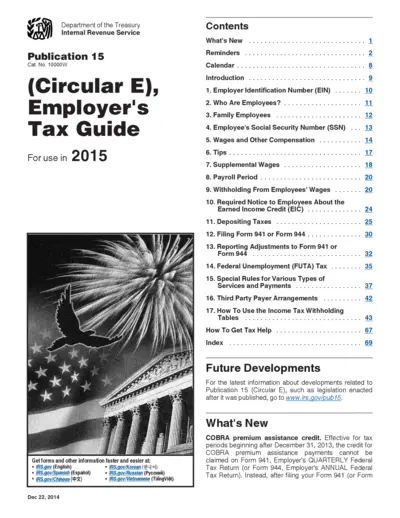

Employer Tax Guide 2015 | IRS Publication 15

The Employer's Tax Guide (Publication 15) provides important information for employers regarding tax responsibilities and requirements. This resource aids employers in understanding payroll tax calculations, withholding requirements, and tax forms they need to fill out. Essential for every employer managing taxes effectively and staying compliant with IRS regulations.

Property Taxes

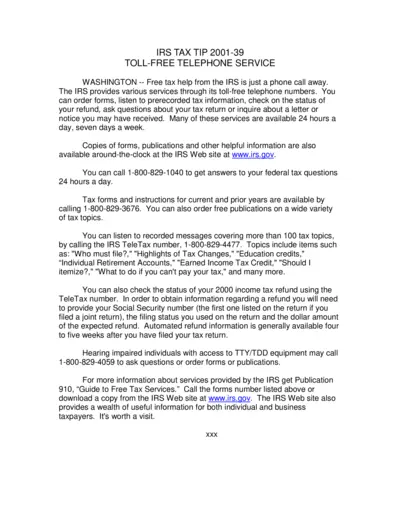

IRS Tax Tip 2001-39: Toll-Free Telephone Service

Discover how to access free tax help from the IRS via telephone. This resource explains the various services offered by the IRS to assist taxpayers. Learn about the specific numbers you can call for different inquiries and support.

Property Taxes

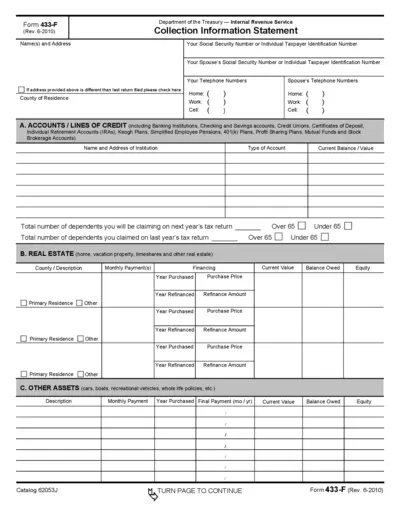

Form 433-F Collection Information Statement

Form 433-F is a crucial document for individuals seeking an installment agreement with the IRS. This form gathers financial information to assess payment capability. Complete the form accurately to facilitate your financial negotiations with the IRS.