Property Taxes Documents

Property Taxes

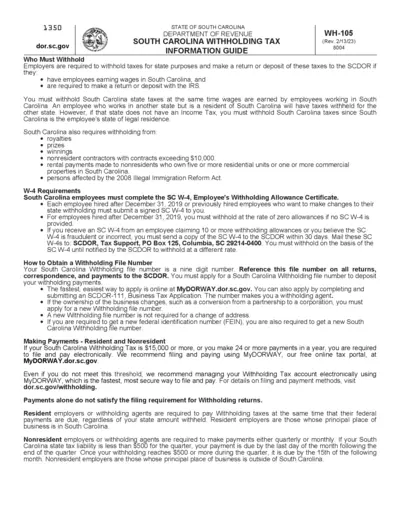

South Carolina Withholding Tax Information Guide

This comprehensive guide provides employers with essential information regarding South Carolina withholding tax obligations. It outlines the requirements for tax withholding on employees, nonresidents, and various payments. Understand how to correctly complete and submit the necessary forms for compliance with South Carolina tax law.

Property Taxes

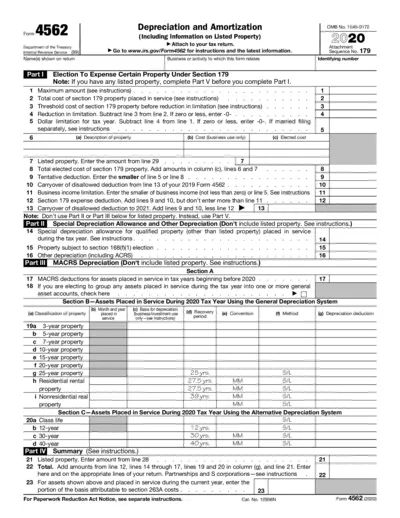

Form 4562: Depreciation and Amortization (2020)

Form 4562 is used for reporting depreciation and amortization. It includes detailed calculations and elections regarding property expense deductions. This form is essential for businesses to accurately reflect their assets on tax returns.

Property Taxes

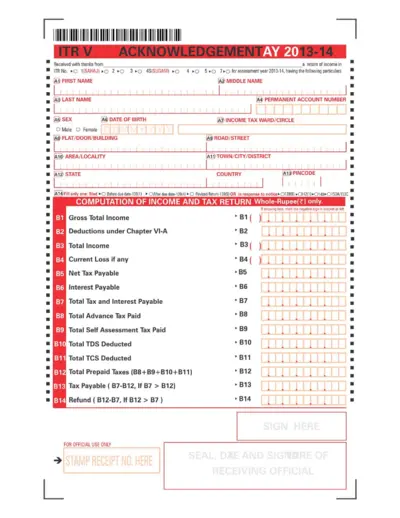

Income Tax Return Acknowledgement Form AY 2013-14

This file contains the ITR V acknowledgement for the assessment year 2013-14. It includes essential details for taxpayers to ensure their returns are filed correctly. A must-have for individuals and businesses filing tax returns in India.

Property Taxes

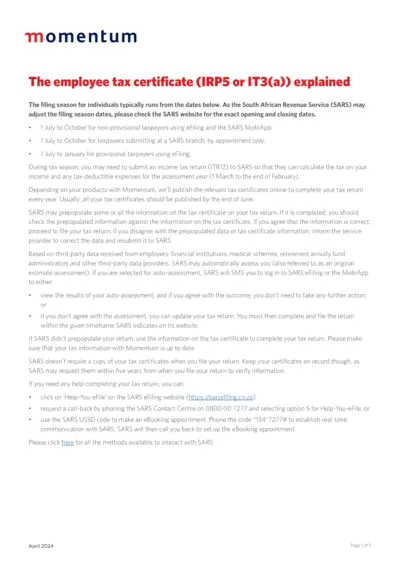

Employee Tax Certificate Guide for 2024-2025

This guide explains the employee tax certificate process for the filing season. It provides essential information regarding the IRP5 and IT3(a) forms. Follow this guide to understand how to complete your tax return efficiently.

Property Taxes

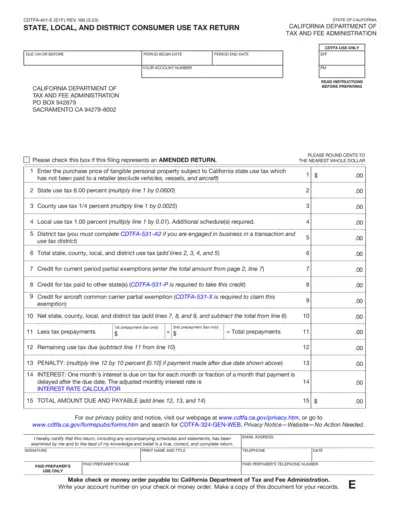

California Consumer Use Tax Return CDTFA-401-E

This file is the State, Local, and District Consumer Use Tax Return for California. It provides instructions for filing and calculating use tax amounts. Essential for residents and businesses to report and remit tax obligations.

Property Taxes

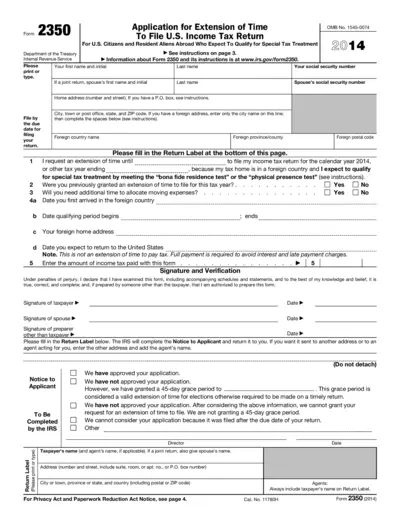

Application for Extension of Time to File US Tax Return

This form is for U.S. citizens and resident aliens living abroad who need to request an extension of time to file their income tax return. It is specifically for those who expect to qualify for special tax treatment. Properly completing this form can help avoid penalties for late filing.

Property Taxes

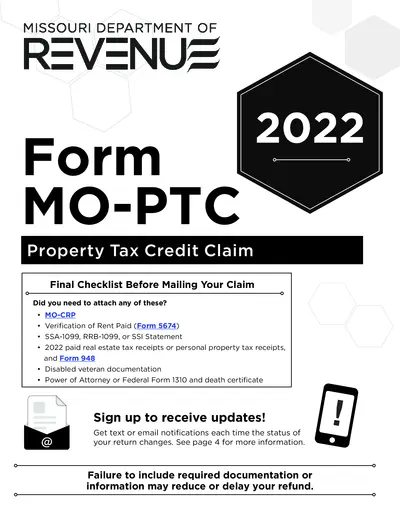

Missouri Property Tax Credit Claim Form 2022

The Missouri Property Tax Credit Claim Form is essential for Missouri residents seeking tax credits for property taxes paid in 2022. This comprehensive form includes eligibility requirements and detailed instructions on how to fill it out. Ensure to attach necessary documentation to avoid delays in your refund.

Property Taxes

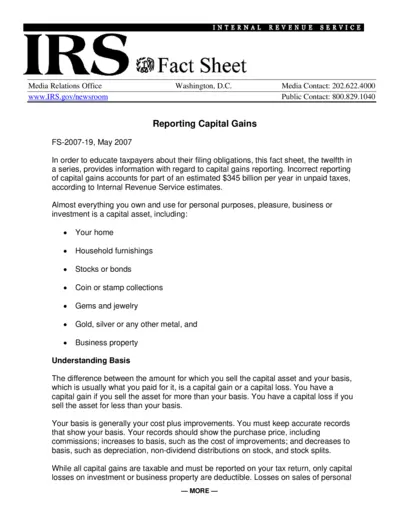

Reporting Capital Gains Instructions for Taxpayers

This IRS fact sheet provides essential guidance on reporting capital gains for taxpayers. It includes definitions, reporting obligations, and important tax considerations. Understanding how to accurately report capital gains can help you avoid penalties and maximize your tax benefits.

Property Taxes

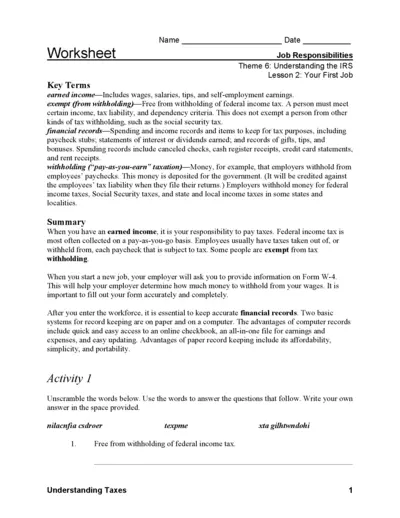

IRS Guidelines on Your First Job and Taxes

This file provides comprehensive instructions for managing taxes related to your first job. It includes key terms, necessary forms, and record-keeping tips. Ideal for new employees and students entering the workforce.

Property Taxes

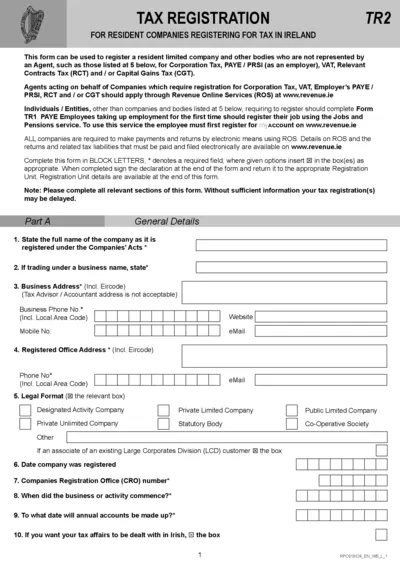

Tax Registration for Companies in Ireland

This file serves as a registration form for resident companies in Ireland for tax purposes. It outlines requirements for Corporation Tax, VAT, PAYE/PRSI, and more. Ensure accurate completion to avoid delays in tax registration.

Property Taxes

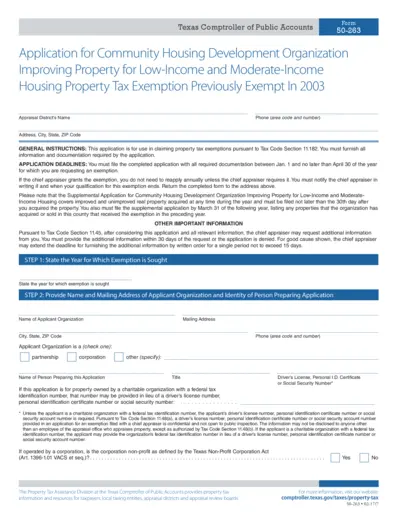

Texas Comptroller 50-263 Community Housing Exemption

This document is an application for property tax exemptions for community housing development organizations. It outlines eligibility criteria for low-income and moderate-income housing. Use this form to apply for tax exemption on properties meeting specified requirements.

Property Taxes

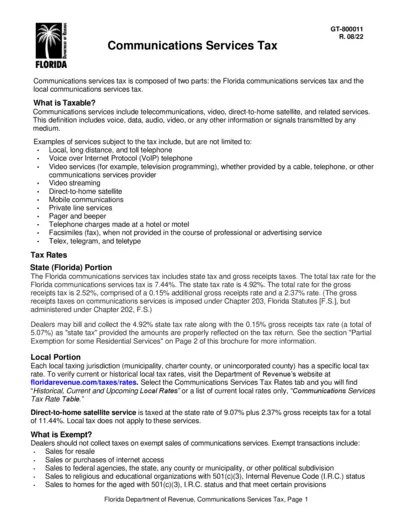

Florida Communications Services Tax Guide

This file provides detailed information on the Florida Communications Services Tax, including its components, tax rates, exemptions, and filing instructions. It serves as a comprehensive resource for individuals and businesses to understand their tax obligations and requirements. Users will find guidelines on how to comply with the Florida Department of Revenue’s regulations regarding communication services.