Property Taxes Documents

Property Taxes

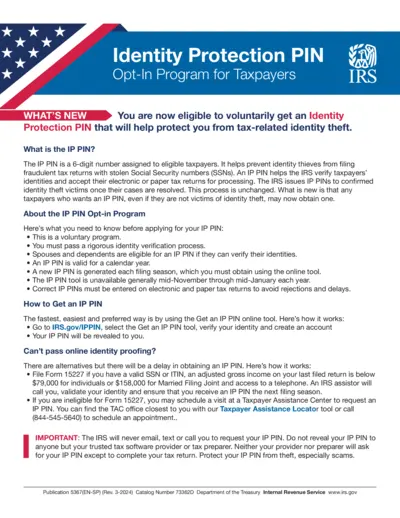

Identity Protection PIN Opt-In Program IRS Details

This file outlines the Identity Protection PIN (IP PIN) program by the IRS for taxpayers. It details eligibility, application processes, and security measures. The document is essential for individuals looking to safeguard themselves against tax-related identity theft.

Property Taxes

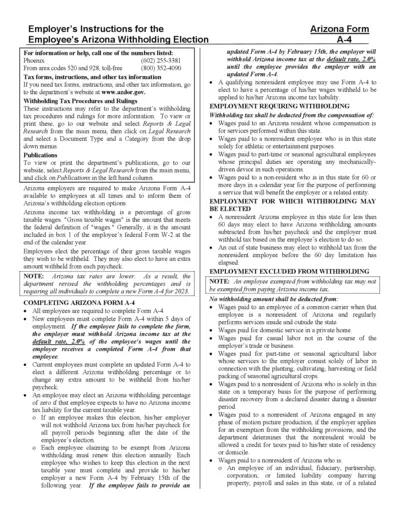

Employer's Instructions for Arizona Withholding Election

This document provides essential instructions for employees regarding Arizona's withholding tax election. It includes information on the procedure to complete Arizona Form A-4 and the tax withholding requirements. This guide is crucial for new and current employees to ensure proper tax withholding.

Property Taxes

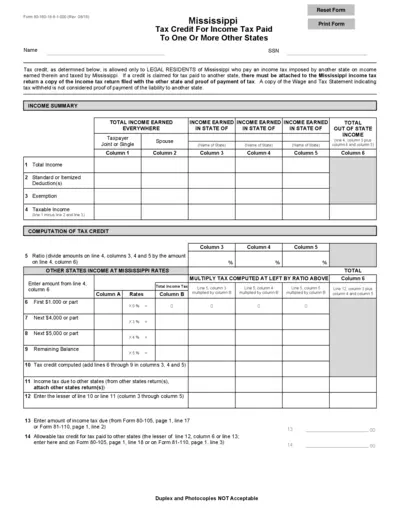

Mississippi Tax Credit for Income Tax Paid Form

This form allows Mississippi residents to claim a tax credit for income tax paid to other states. It is essential for those who earn income outside Mississippi and wish to offset their tax liability. Ensure to attach required documents for successful processing.

Property Taxes

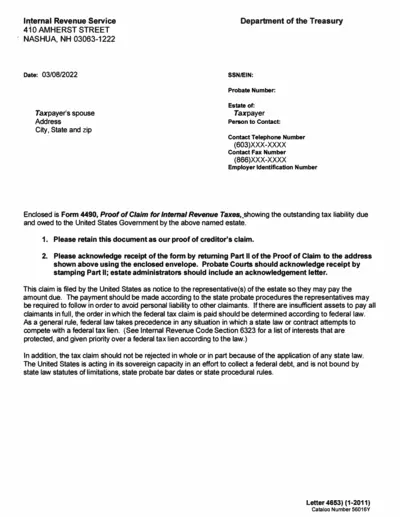

Proof of Claim for Internal Revenue Taxes Form 4490

This file contains the Proof of Claim for Internal Revenue Taxes, outlining tax liabilities due by an estate to the IRS. It includes detailed instructions for submission and important legal information regarding the filing. Ideal for those needing to address federal tax claims associated with an estate.

Property Taxes

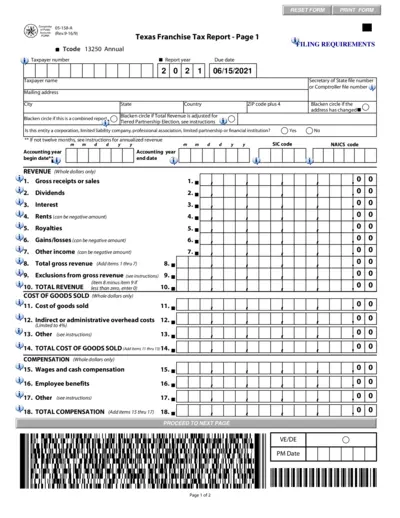

Texas Franchise Tax Report for 2021

The Texas Franchise Tax Report is essential for businesses reporting their tax obligations in Texas. This form requires detailed financial information to determine tax liability. Ensure accurate completion to avoid penalties.

Property Taxes

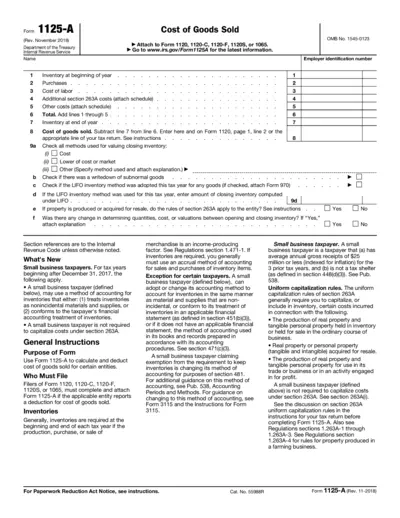

Form 1125-A Instructions for Cost of Goods Sold

Form 1125-A is used to calculate and report the cost of goods sold for various tax returns. This form is essential for businesses to accurately compute their taxable income. Make sure to follow the instructions carefully to ensure compliance with IRS regulations.

Property Taxes

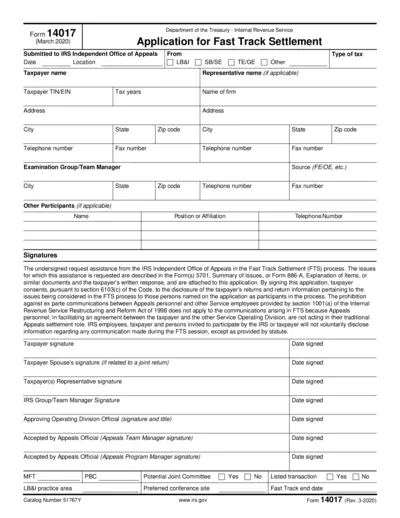

IRS Form 14017 Application for Fast Track Settlement

Form 14017 allows taxpayers to request Fast Track Settlement with the IRS. This process helps resolve disputes quickly and effectively. Use this form if you need assistance with the IRS Independent Office of Appeals.

Property Taxes

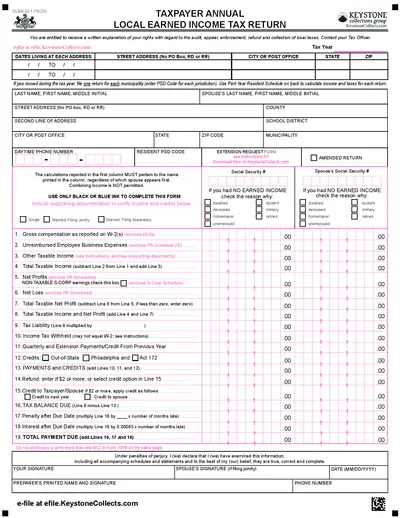

Taxpayer Annual Local Earned Income Tax Return

This form is the Annual Local Earned Income Tax Return for Taxpayers. It is used by residents to report earned income and taxes owed to local municipalities. Complete this form accurately to avoid any penalties or issues with local tax authorities.

Property Taxes

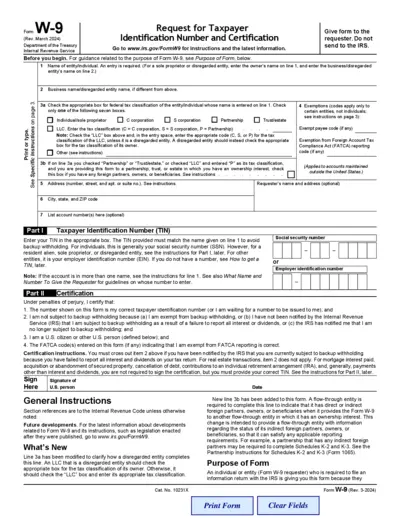

Form W-9 Request for Taxpayer Identification Number

The Form W-9 is essential for individuals or entities to request the Taxpayer Identification Number (TIN) from a U.S. person. It is used by requesters to report payments made to individuals or businesses to the IRS. This form provides necessary information required for accurate tax reporting and compliance.

Property Taxes

Form 8862 Instructions Claiming Credits After Disallowance

Form 8862 includes essential instructions for taxpayers who have had certain credits disallowed in prior years. This form is crucial for those seeking to reclaim their eligibility for credits like the EIC and CTC. Follow the detailed steps to ensure accurate filing and compliance.

Property Taxes

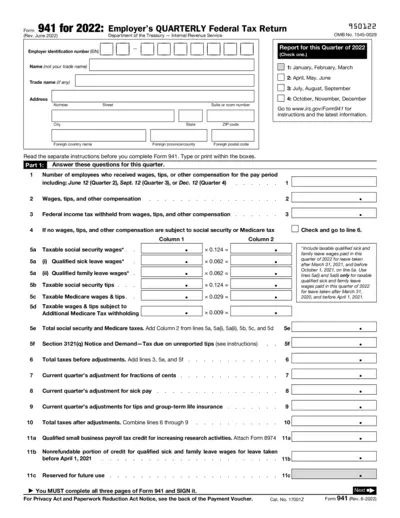

Employer's Quarterly Federal Tax Return Form 941

Form 941 is used by employers to report employment taxes. This quarterly tax return provides essential details about wages, tips, and other compensations. It facilitates the calculation and reporting of federal tax obligations by employers.

Property Taxes

Michigan Corporate Income Tax Amended Return

The Michigan Corporate Income Tax Amended Return form is essential for financial institutions to report tax revisions. This document provides clear instructions on how to amend prior tax returns, ensuring compliance with state regulations. Suitable for 2014 tax year filings.