Property Taxes Documents

Property Taxes

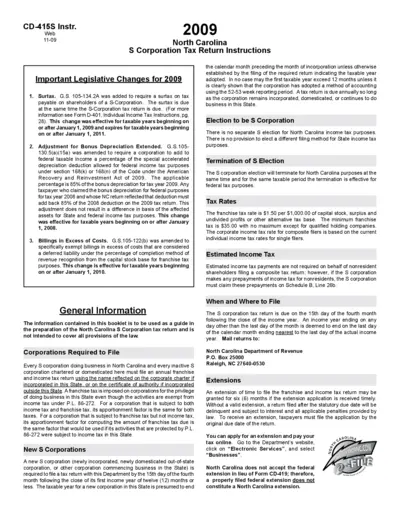

North Carolina S Corporation Tax Return Instructions

This document provides comprehensive instructions for completing the North Carolina S Corporation tax returns. It covers essential sections, important legislative changes, and filing requirements for both new and existing S corporations. Users can refer to this guide to ensure compliance with state tax laws.

Property Taxes

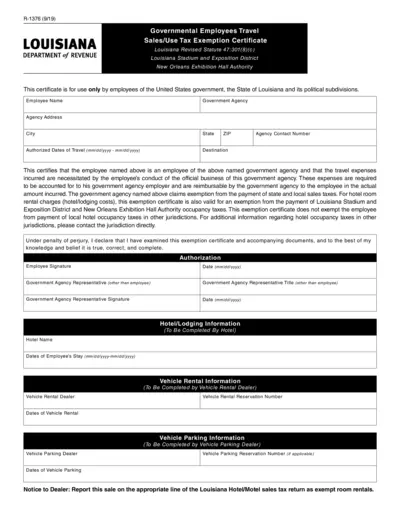

Louisiana Tax Exemption Certificate for Government Employees

This file is a Sales/Use Tax Exemption Certificate for governmental employees traveling on official business in Louisiana. It allows eligible employees to exempt specific travel expenses from sales and use taxes. Proper completion and retention of this form ensures compliance with Louisiana's tax regulations.

Property Taxes

2023 Virginia Form 760C Estimated Tax Underpayment

Form 760C is essential for individuals, estates, and trusts in Virginia to report and compute underpayment of estimated tax. Timely completion is critical to avoid additional tax penalties. This guide ensures users understand their obligations and can manage their payments accurately.

Property Taxes

Instructions for Schedule R Form 941 Rev March 2024

This file provides detailed instructions for completing Schedule R, Form 941, for the year 2024. It explains eligibility for filing, how to fill out various sections, and the purpose of Schedule R in context with the IRS. Users will find guidance on necessary information and requirements for aggregate Form 941 filers.

Property Taxes

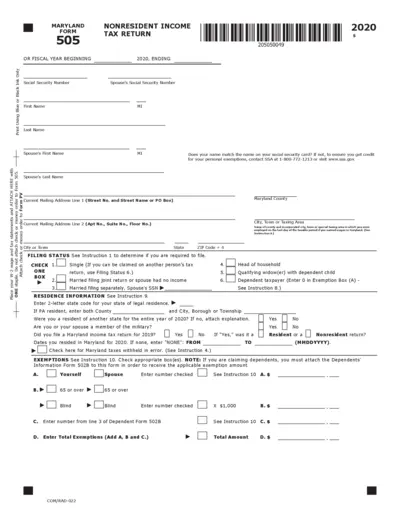

Maryland Nonresident Income Tax Return 2020

The Maryland Form 505 is designed for nonresidents to report their income tax for the year 2020. This form includes information about income, exemptions, and tax calculations. It is essential for nonresidents who earned income in Maryland to ensure accurate tax reporting.

Property Taxes

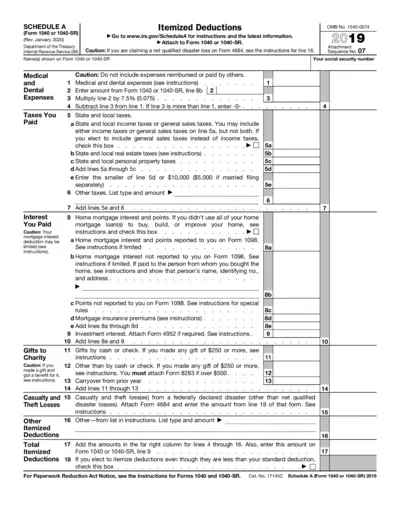

Schedule A Itemized Deductions IRS Form 1040

Schedule A is used to report itemized deductions for individual income tax returns. This form helps taxpayers claim deductions such as medical expenses, taxes paid, and mortgage interest. Accurate completion maximizes potential deductions and ensures compliance with tax regulations.

Property Taxes

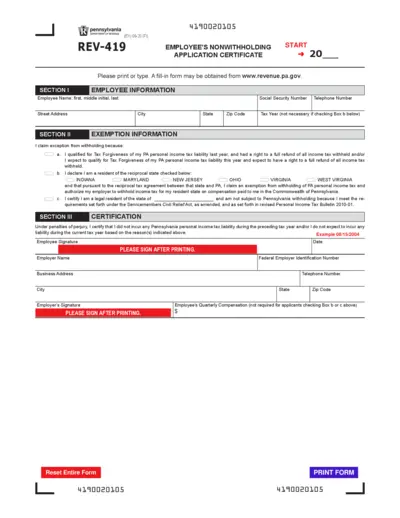

Employee's Nonwithholding Certificate Form REV-419

The REV-419 form allows employees to apply for nonwithholding of Pennsylvania personal income tax. This certificate is essential for individuals expecting no tax liability. Ensure accurate completion to facilitate proper tax management.

Property Taxes

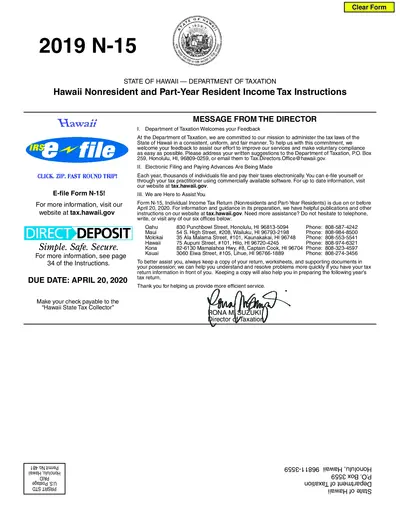

Hawaii Nonresident Part-Year Resident Tax Instructions

This file provides important instructions for filing the Hawaii Nonresident and Part-Year Resident Income Tax form. It includes details on due dates, filing methods, and contact information for assistance. It is essential for anyone needing to understand their tax obligations in Hawaii.

Property Taxes

Understanding Adjusted Gross Income for Tax Purposes

This file provides a comprehensive overview of the Adjusted Gross Income (AGI) as defined by tax law. It discusses its components, recent changes, and comparisons with other income measures. Ideal for taxpayers seeking clarity on AGI and its calculation.

Property Taxes

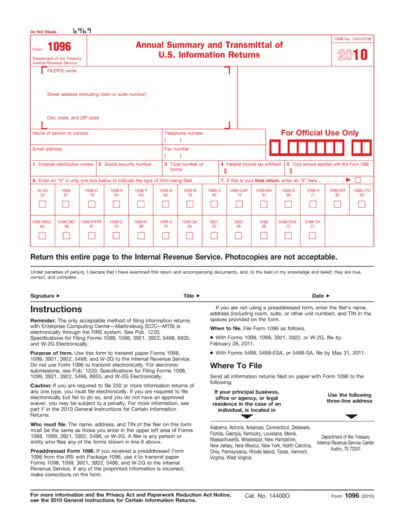

Form 1096 Annual Summary Transmittal U.S. Information Returns

Form 1096 is used to summarize and transmit information returns to the IRS. It must accompany Forms 1098, 1099, 3921, 3922, and 5498. Ensure accurate completion to avoid penalties.

Property Taxes

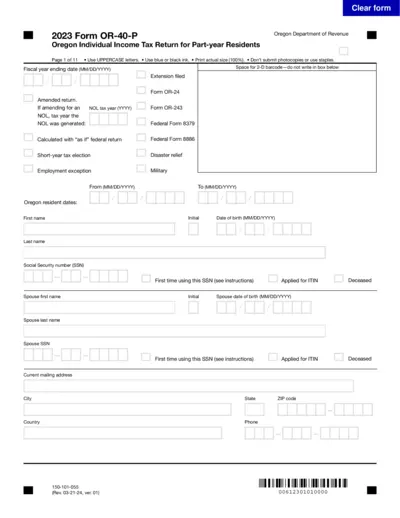

2023 Oregon Form OR-40-P Part-Year Tax Return

The 2023 Form OR-40-P is the Oregon Individual Income Tax Return for part-year residents. This form is essential for individuals who have moved in or out of Oregon during the tax year. Ensure accurate completion to avoid issues with the Oregon Department of Revenue.

Property Taxes

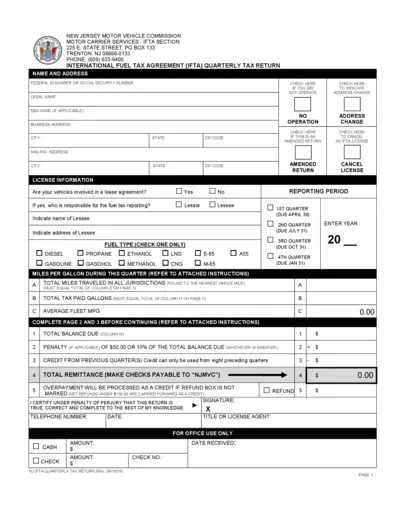

New Jersey IFTA Quarterly Tax Return Instructions

This document provides essential information and instructions for completing the New Jersey IFTA Quarterly Tax Return. It guides users through the necessary steps to ensure accurate submission. Understanding the requirements and sections helps in avoiding penalties and ensuring compliance.