Property Taxes Documents

Property Taxes

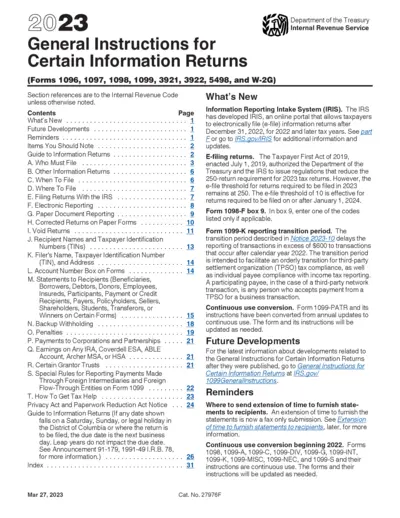

2023 General Instructions for Information Returns

This file provides general instructions for filing certain information returns with the IRS. It includes details on who must file, when to file, and how to file. The instructions cover forms such as 1096, 1097, 1098, 1099, 3921, 3922, 5498, and W-2G.

Property Taxes

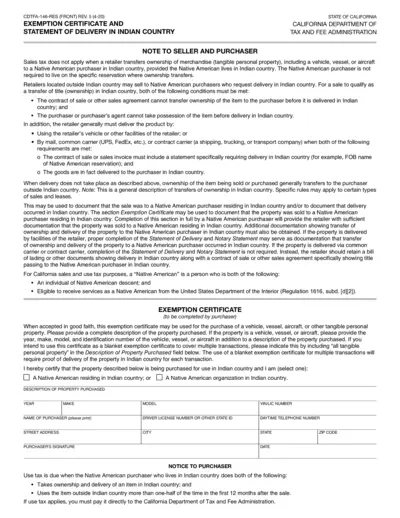

Exemption Certificate and Delivery Statement in Indian Country

This file is used to document sales of tangible personal property to Native Americans in Indian country. It includes an Exemption Certificate and Statement of Delivery. Completion of this form assists in determining sales tax applicability.

Property Taxes

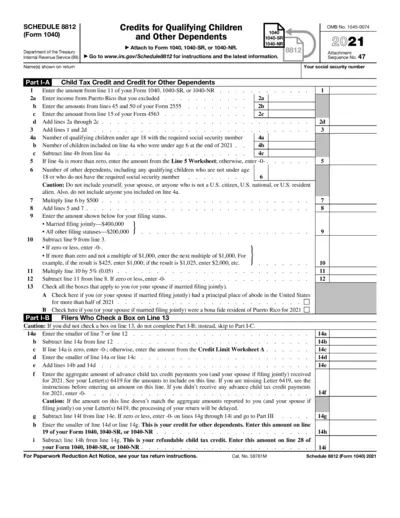

Credits for Qualifying Children and Other Dependents

Schedule 8812 helps taxpayers claim credits for qualifying children and other dependents. Attach it to Form 1040, 1040-SR, or 1040-NR. Follow the instructions precisely to ensure accurate filing.

Property Taxes

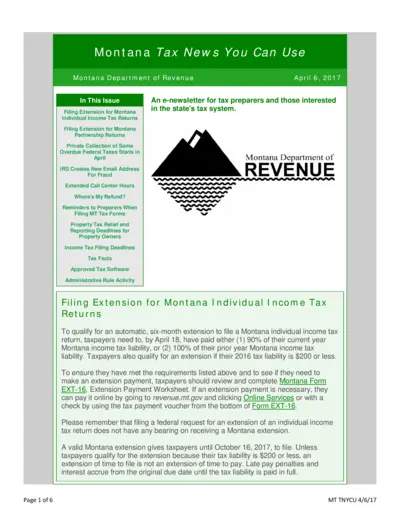

Montana Tax Updates and Filing Instructions

An informative newsletter providing updates on Montana taxes and filing instructions for individual income tax returns, partnership returns, and overdue federal taxes. Includes information on extended call center hours and how to check refunds.

Property Taxes

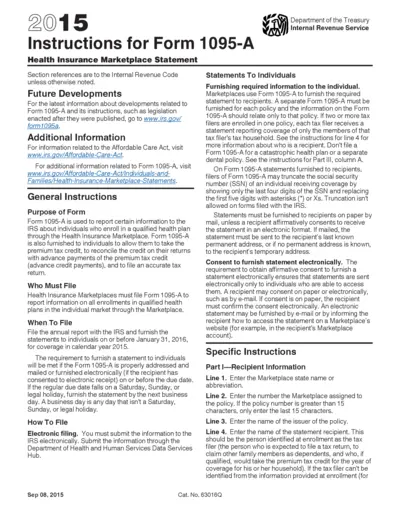

2015 Instructions for Form 1095-A Health Insurance Marketplace Statement

This document provides instructions for Form 1095-A, which is used to report individuals who enroll in a qualified health plan through the Health Insurance Marketplace, for tax credit purposes. It includes general instructions, specific line-by-line guidance, and obligations for both individuals and Marketplaces.

Property Taxes

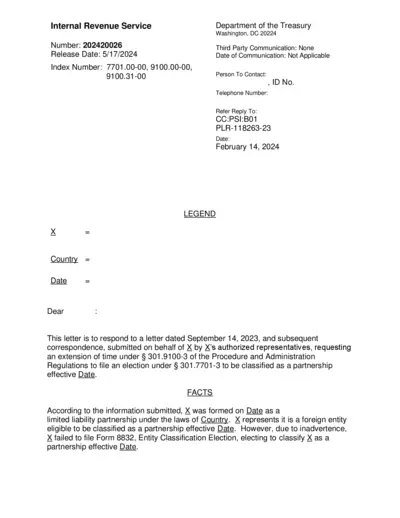

IRS Private Letter Ruling on Foreign Partnership Election

This document is a private letter ruling from the IRS about a foreign partnership's classification election. It includes the legal background, analysis, and conclusion. The ruling grants an extension of time to file Form 8832.

Property Taxes

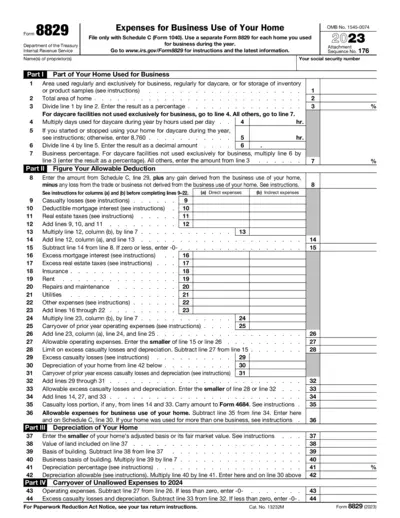

Form 8829: Expenses for Business Use of Your Home

IRS Form 8829 is used to claim expenses for the business use of your home. It includes sections on calculating the allowable deduction, depreciation, and carryover of unallowed expenses. Be sure to follow the instructions to ensure accuracy.

Property Taxes

MIRS, VITA/TCE Intake/Interview and Quality Review Handbook

This handbook provides detailed instructions for the VITA/TCE programs, outlining the process for conducting effective intake, interviews, and quality reviews. It is essential for all volunteers, coordinators, and instructors involved in tax return preparation to understand these processes. It ensures accurate return preparation and quality service for taxpayers.

Property Taxes

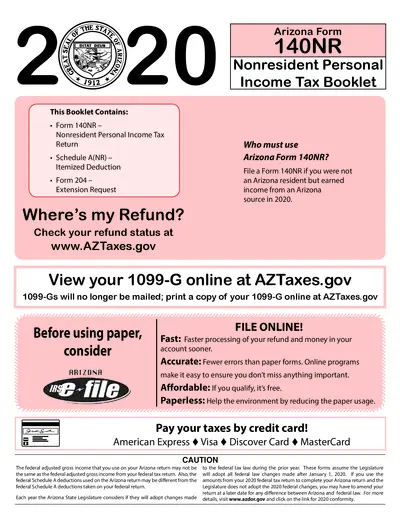

Arizona Form 140NR Nonresident Personal Income Tax Booklet 2020

This document contains the Arizona Form 140NR for nonresident personal income tax filing for the year 2020. It includes details on itemized deductions, extension requests, and instructions on how to file and submit the form. It is essential for nonresidents who earned income from an Arizona source in 2020.

Property Taxes

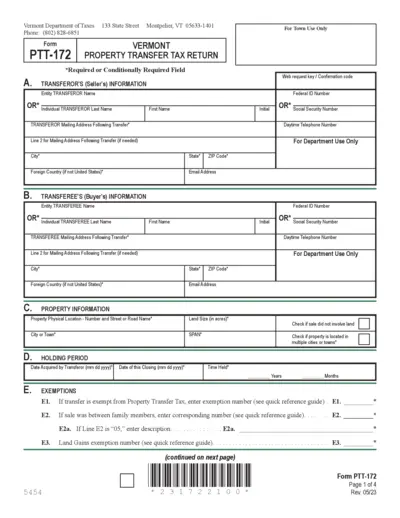

Vermont Property Transfer Tax Return Form PTT-172

This form is used for reporting the transfer of property in Vermont and calculating the property transfer tax due. Included are sections for both the transferor's and transferee's information, property details, exemptions, transfer information, and tax calculation. It is essential for buyers and sellers to complete this form accurately to comply with Vermont tax laws.

Property Taxes

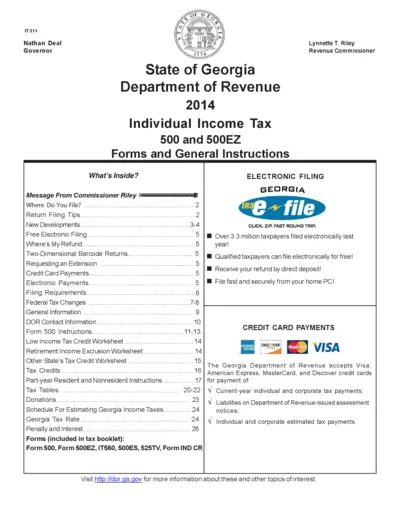

Georgia Individual Income Tax Forms and Instructions 2024

This document provides detailed instructions and forms for filing Georgia individual income tax for the year 2024. It includes information about electronic filing, payment methods, and tax credits. The guide also highlights new developments and offers tips for filing your tax return accurately.

Property Taxes

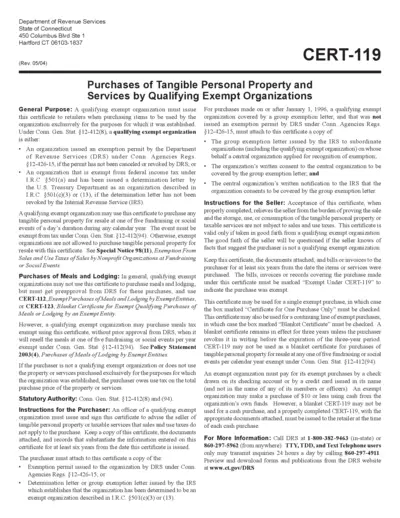

Connecticut CERT-119: Exempt Purchases by Qualifying Organizations

This document is Connecticut's CERT-119 form for exempt purchases by qualifying organizations. It provides guidelines for organizations on how to issue this certificate when purchasing items. It also includes instructions for both the purchaser and the seller.