Payroll Tax Documents

Payroll Tax

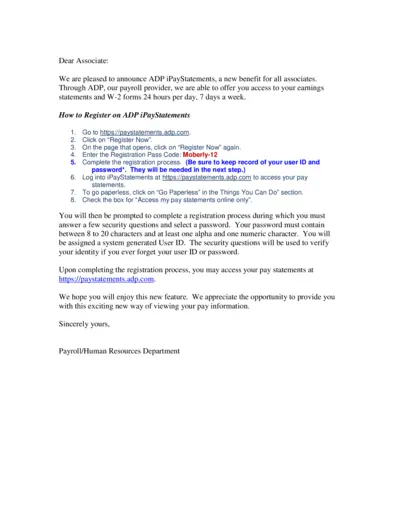

Access Your Pay Statements Anytime with ADP iPayStatements

The ADP iPayStatements provides associates with 24/7 access to earnings statements and W-2 forms. This guide outlines the registration process and beneficial features. Streamline your payroll experience with easy online access to your pay information.

Payroll Tax

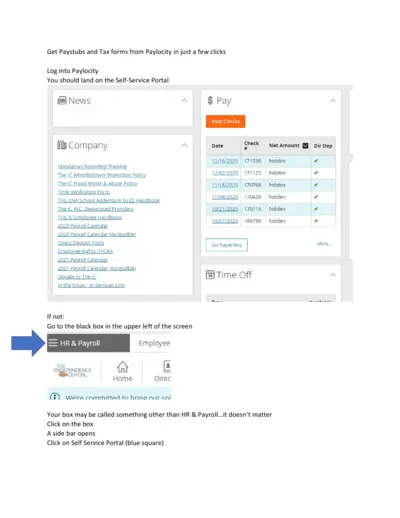

Retrieve Paystubs and Tax Forms from Paylocity Easily

This file provides a comprehensive guide on accessing paystubs and tax forms through Paylocity. Users can quickly navigate the Self-Service Portal and download necessary documents with simple instructions. Ideal for employees looking to manage their payroll information efficiently.

Payroll Tax

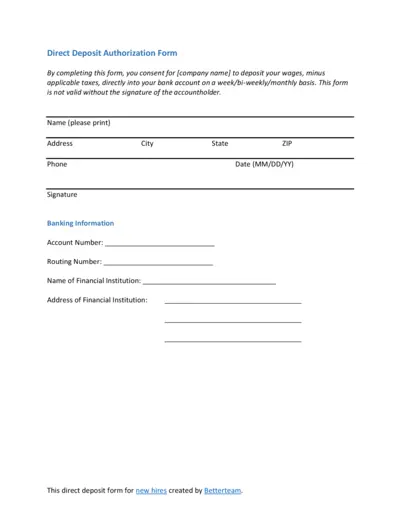

Direct Deposit Authorization Form for Employees

This direct deposit authorization form allows employees to authorize their wages to be deposited directly into their bank account. It includes essential banking information and personal details. This form is vital for new hires to set up their payroll efficiently.

Payroll Tax

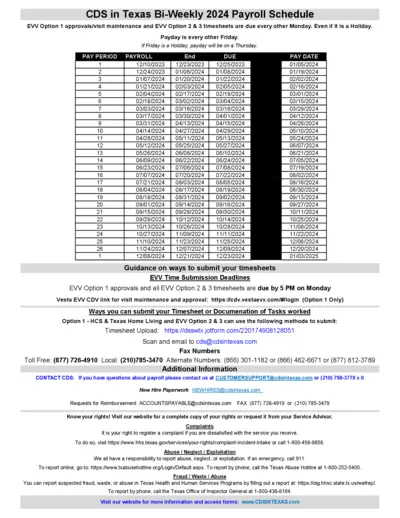

Texas 2024 Bi-Weekly Payroll Schedule

This file provides the bi-weekly payroll schedule for Texas for the year 2024. It includes important submission deadlines and payment dates for caregivers and services. Users can utilize this file to stay organized and timely with their payroll responsibilities.

Payroll Tax

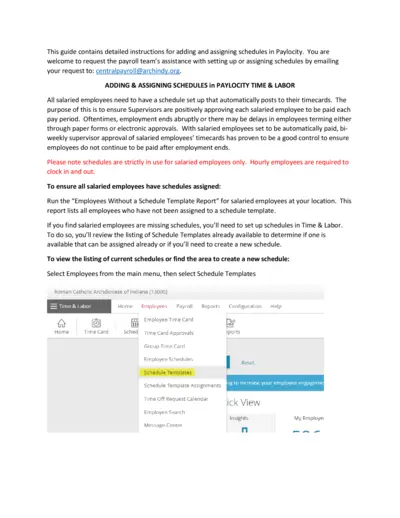

Adding and Assigning Schedules in Paylocity

This guide provides comprehensive instructions for adding and assigning schedules in Paylocity. It is designed to assist salaried employees in ensuring their work schedules are posted correctly. Contact the payroll team for further support.

Payroll Tax

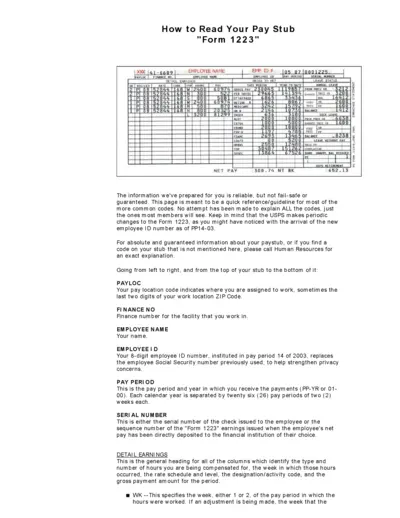

Pay Stub Reading Instructions and Details

This document provides essential instructions on how to read your pay stub effectively. It details the various codes and components included in your pay stub. Understanding these details will help you ensure accurate compensation and deductions.

Payroll Tax

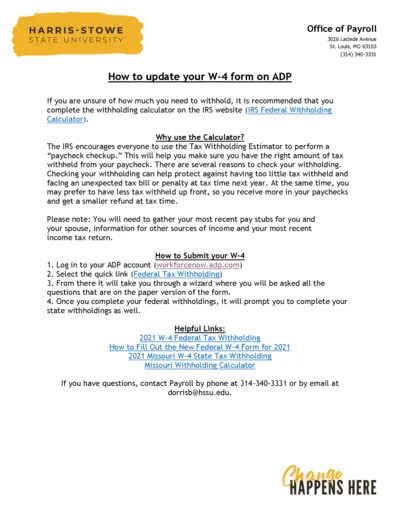

How to Update Your W-4 Form on ADP

This file provides detailed instructions on updating your W-4 form using ADP. It includes information about tax withholding and the importance of using the IRS calculator. Users will find step-by-step guidance for submission and links to helpful resources.

Payroll Tax

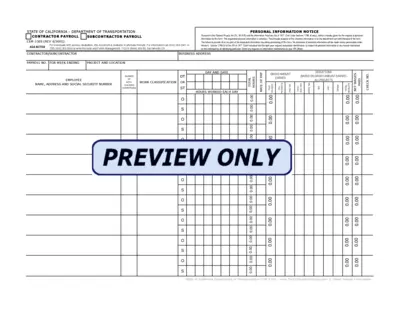

ADA Notice CEM-2502 Payroll Instructions

This file contains important payroll information for contractors and subcontractors. It includes instructions on how to fill out payroll forms correctly. Ensure compliance with California state regulations by following these guidelines.

Payroll Tax

Comprehensive Payroll Data Input API Guide

This guide provides detailed instructions on using the Payroll Data Input API for ADP Workforce. It includes setup steps, data requirements, and FAQs to assist users. Perfect for businesses looking to streamline payroll processes.

Payroll Tax

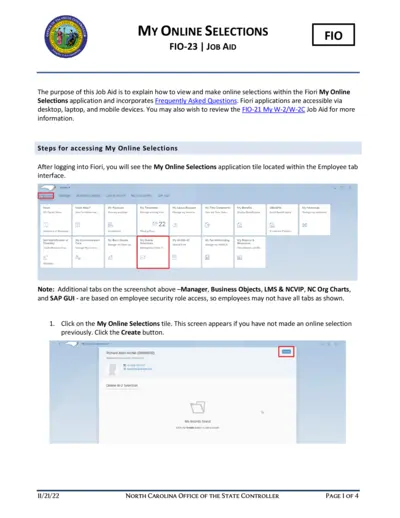

FIO-23 Job Aid: My Online Selections Instructions

This file provides comprehensive instructions on how to access and manage your W-2 selections online. It details the steps to view your selections and consent to receive electronic W-2s. Perfect for employees looking to stay updated with their payroll information.

Payroll Tax

Acumen Fiscal Agent Pay Selection Options

This file outlines the pay selection options available for employees at Acumen. Users can choose between direct deposit, pay card, or paper check for receiving their paychecks. Detailed instructions for completing the form and submitting your choice are also included for your convenience.

Payroll Tax

Special 16-Page Sample Issue of PAYTECH

This file contains a special 16-page sample issue of PAYTECH, the official publication of the American Payroll Association. It provides valuable insights, educational resources, and support for payroll professionals. Discover the benefits of joining the APA and staying updated on payroll-related topics.