Business Tax Documents

Payroll Tax

QuickBooks Payroll Getting Started Guide

This guide helps you start using QuickBooks Payroll efficiently. It provides detailed instructions and tips for managing payroll. Ideal for new users and employers looking to streamline payroll processes.

Sales Tax

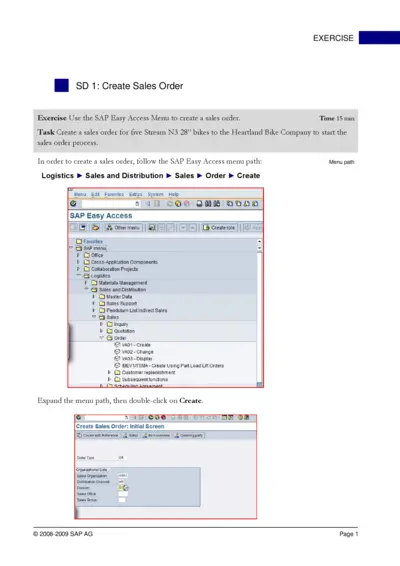

Create Sales Order using SAP Easy Access Menu

This document provides step-by-step instructions to create a sales order using the SAP Easy Access Menu. It includes necessary details such as fields and organizational data required for the process. Ideal for users in sales and distribution fields.

Payroll Tax

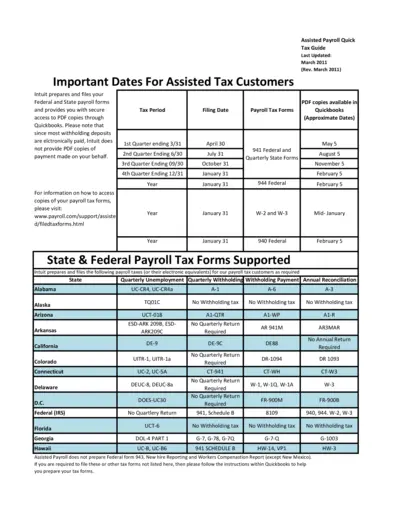

Assisted Tax Customer Payroll Tax Instructions

This file provides comprehensive details on payroll tax form filing for assisted tax customers. Users can find important dates and instructions for accessing and completing their tax forms. The document is essential for ensuring compliance with federal and state payroll tax requirements.

Payroll Tax

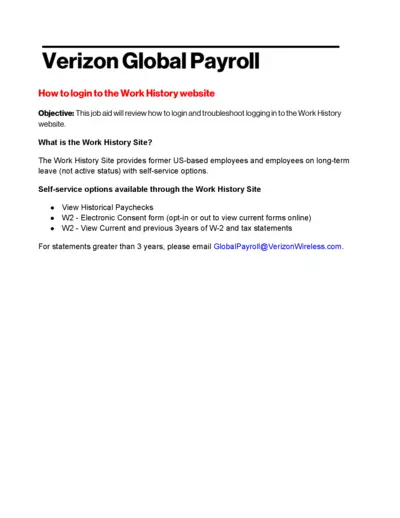

Verizon Global Payroll Login Instructions

This document provides comprehensive instructions for logging into the Verizon Work History site. It includes troubleshooting tips and self-service options for former employees. Users will find detailed steps to ensure a successful login and access to their historical paychecks and tax documents.

Payroll Tax

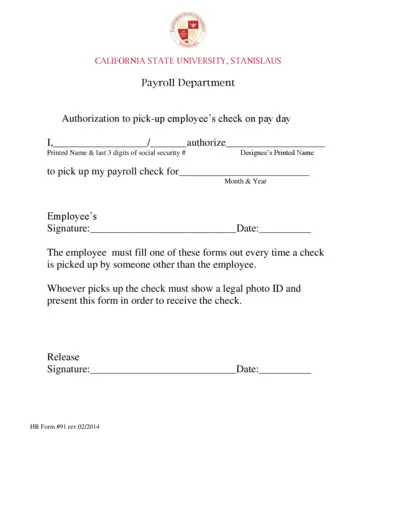

Authorization for Employee Check Pick-Up

This file allows designated individuals to pick up payroll checks on behalf of employees. It requires employee information, identification, and specific signatures for authorization. Ensure to adhere to the outlined instructions for a smooth check-pick up process.

Sales Tax

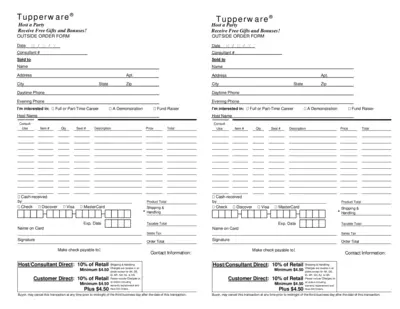

Tupperware Party Order Form and Instructions

This Tupperware order form allows users to easily place orders for products while hosting a party. Participants can track their orders, payments, and host rewards. Learn how to fill it out correctly to make the most of your Tupperware experience.

Payroll Tax

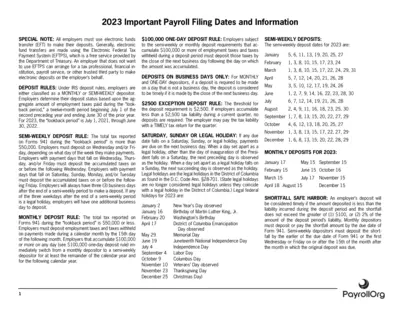

2023 Payroll Filing Dates and Information

This file provides essential dates and information for payroll filing in 2023. It outlines deposit rules for employers and important compliance deadlines. Ensure your payroll processes comply with the latest IRS regulations.

Payroll Tax

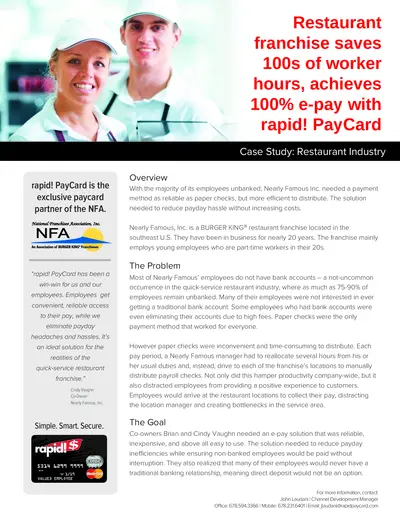

rapid PayCard e-Payment Solutions for Franchisees

This document outlines the advantages and usage of rapid PayCard for restaurant franchisees. It highlights the issues faced by unbanked employees and how rapid PayCard can provide a seamless payment solution. Discover how implementing rapid PayCard can improve efficiency and employee satisfaction.

Payroll Tax

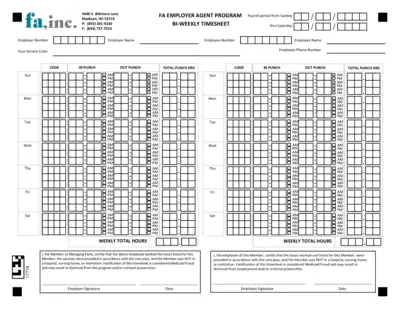

FA Employer Agent Program Bi-Weekly Timesheet

This bi-weekly timesheet is designed for use by employers in tracking employee working hours. It includes sections for inputting punch times and totals for payroll periods. Ensure accuracy to comply with Medicaid regulations.

Payroll Tax

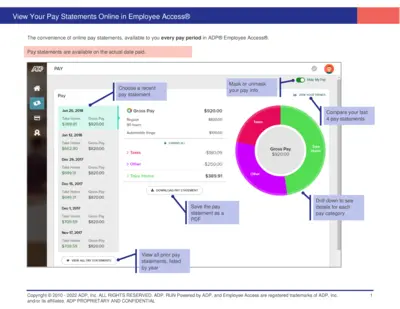

Learn to Access Your Pay Statements Online

This file provides a comprehensive guide on accessing online pay statements through ADP® Employee Access®. It includes detailed instructions, FAQs, and step-by-step guidance on managing your pay information. Perfect for employees looking to simplify their payroll processes.

Sales Tax

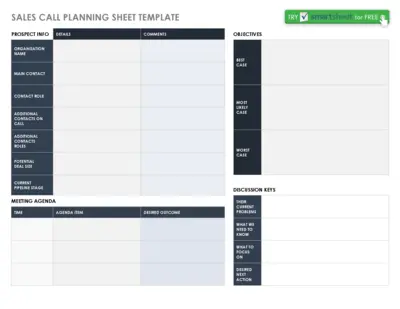

Sales Call Planning Sheet Template

This Sales Call Planning Sheet Template helps users effectively plan their sales calls. It includes sections for detailed prospect information and meeting agendas. Use it to organize your sales approach and achieve better results.

Payroll Tax

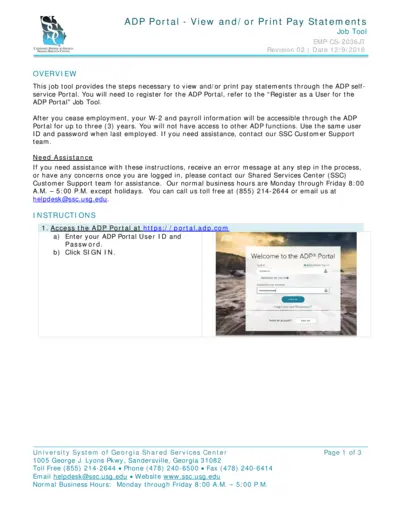

ADP Portal View and Print Pay Statements Guide

This file provides detailed instructions on how to view and print pay statements through the ADP Portal. It is essential for employees needing access to their payroll information. Follow the provided steps for a seamless experience.