Business Tax Documents

Sales Tax

Catalog Based Sales Process Enhancements

This file provides detailed information about Dynavistics' Catalog Based Sales enhancements. It outlines features, benefits, and instructions for order entry processes. Ideal for professionals seeking to improve sales order accuracy and efficiency.

Payroll Tax

Payroll Processing Instructional and Informational Guide

This file provides detailed instructions and guidance on using Payroll4Free for payroll processing. Users will find essential information on batch entry, reports, and check management. It serves as a comprehensive resource for efficient payroll management.

Payroll Tax

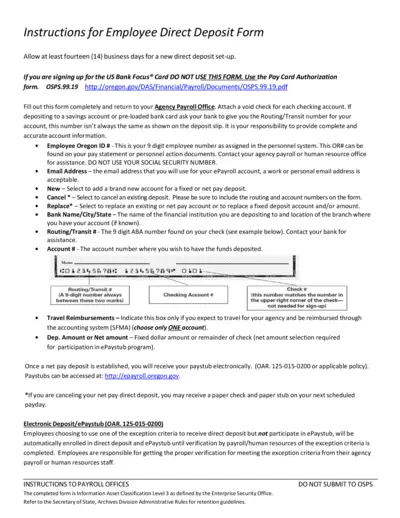

Employee Direct Deposit Form Instructions Oregon

The Employee Direct Deposit Form provides essential details for setting up direct deposits for employees in Oregon. It includes instructions for filling out the form and information required for successful processing. Follow the guidelines to ensure a smooth direct deposit experience.

Sales Tax

DBA Sales Orders Guide for Small Business

The DBA Sales Orders Guide provides comprehensive instructions for managing sales orders. It is essential for small businesses looking to streamline their sales processes. This guide covers everything from order entry to invoicing.

Excise Tax

Maharashtra Excise Department Digital Services Guide

This file provides a comprehensive checklist and fee structure for various digital services offered by the Maharashtra Excise Department. It outlines the application processes for different types of licenses related to alcohol services. Users can find relevant forms and procedural details to facilitate their applications.

Tax Compliance

Massachusetts Certificate of Good Standing

This file provides a Certificate of Good Standing and Tax Compliance issued by the Massachusetts Department of Revenue. It certifies an individual's or entity's compliance with tax obligations. It includes important information regarding tax types and liabilities.

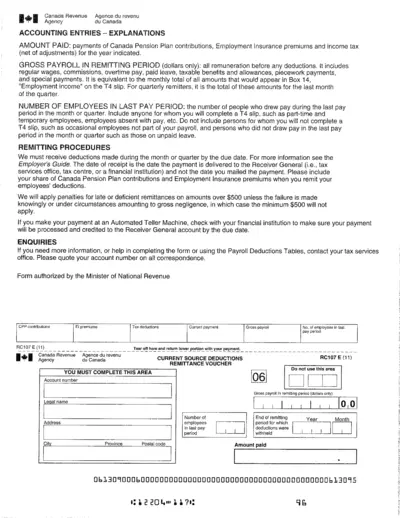

Payroll Tax

Canada Revenue Agency Accounting Entries Explanations

This file provides detailed explanations regarding accounting entries relevant to Canada Revenue Agency. It includes instructions for payroll remittances and how to report deductions. A must-have resource for employers handling payroll in Canada.

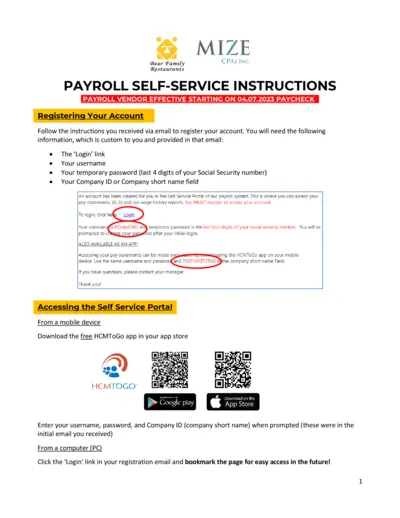

Payroll Tax

Payroll Self-Service Instructions for Employees

This document provides instructions for employees to register and access their payroll self-service account. It guides users on how to manage pay statements, tax withholdings, and direct deposit information. Essential for new and existing employees to navigate payroll processes smoothly.

Payroll Tax

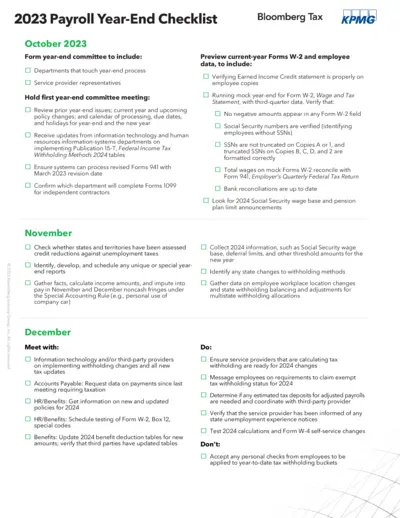

2023 Payroll Year-End Checklist Overview

This file provides a comprehensive checklist for year-end payroll processing, including important dates, tasks, and compliance measures. It aids employers in preparing required forms and making necessary updates for the year-end payroll close. Use this checklist to streamline your payroll processes and ensure compliance with tax regulations.

Payroll Tax

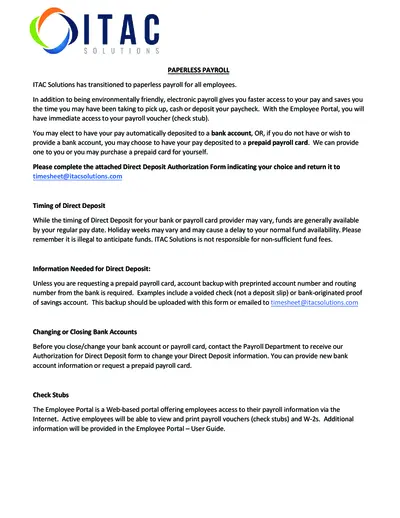

Paperless Payroll Solutions from ITAC

ITAC Solutions has transitioned to paperless payroll for all employees. This document provides essential information regarding direct deposits and payroll options. Ensure a seamless experience with the Employee Portal for payroll access.

Tax Credits

Child Tax Credit and Working Tax Credit Assistance

This file provides information on tax credits and other assistance available for families and individuals. It covers eligibility, how to apply, and available support programs. Essential for those seeking financial help during challenging times.

Payroll Tax

Federal and State W-4 Filing Instructions

This document outlines the necessary steps to complete and submit Federal and State W-4 forms. It provides important deadlines and guidelines for employers regarding withholding exemptions. Understanding these forms is essential for compliance and accurate tax filing.