Business Tax Documents

Payroll Tax

Time Sheet Import and RUN Powered by ADP Instructions

This file provides comprehensive guidance on importing time sheets using ADP's payroll application. Users will find detailed instructions on setting up their time sheet import file. It's essential for businesses looking to streamline their payroll processes with ADP.

Payroll Tax

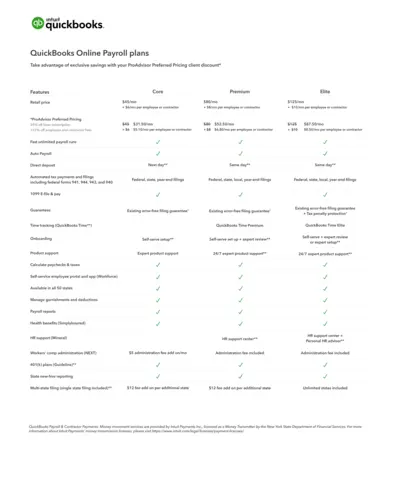

QuickBooks Online Payroll Plans Overview

Explore the features and pricing of QuickBooks Online Payroll plans. Understand how each plan can benefit your business payroll management needs.

Sales Tax

Closing the Sale: Strategies and Techniques

This document covers essential strategies for effectively closing sales. It provides insights on customer satisfaction and retention techniques. Ideal for marketing and sales professionals looking to enhance their skills.

Payroll Tax

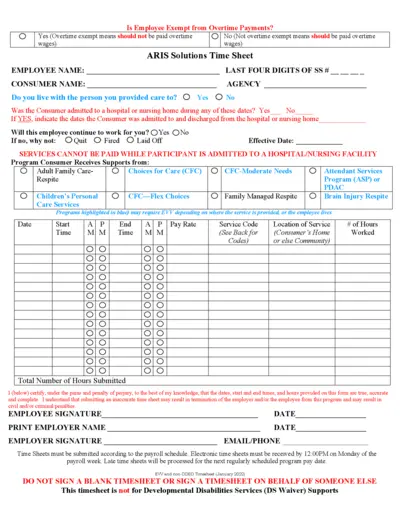

Employee Overtime Payment Exemption Form Guide

This file contains essential information about employee exemptions from overtime payments, including important instructions for filling out the associated time sheets. It's crucial for both employers and employees to understand their rights and responsibilities regarding overtime compensation. This guide also provides a step-by-step approach to ensure accurate submission of time sheets.

Sales Tax

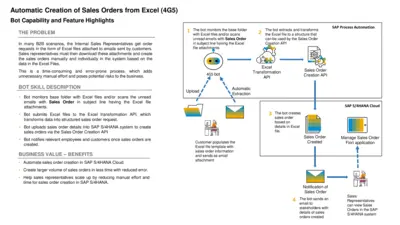

Automated Sales Order Creation from Excel Files

This file outlines the automated process for creating sales orders from Excel files using a bot. It streamlines order management and minimizes manual errors. Ideal for businesses looking to improve efficiency in order processing.

Sales Tax

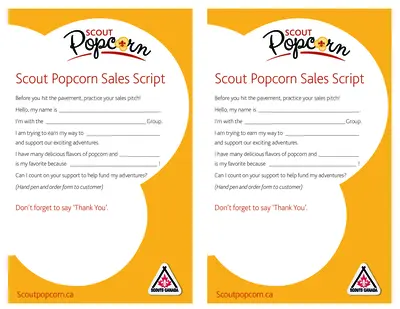

Scout Popcorn Sales Script for Fundraising

This file provides a comprehensive sales script for Scouts looking to sell popcorn. It includes a personalized approach to effectively engage potential customers. Use this script to maximize fundraising efforts while making sales enjoyable and interactive.

Payroll Tax

IRIS Payroll Professional Car and Fuel Benefit Guide

This document provides comprehensive instructions on managing car and fuel benefits in payroll. It includes how to add, edit, and allocate cars to employees. Understanding this guide is essential for employers managing benefits for their staff.

Payroll Tax

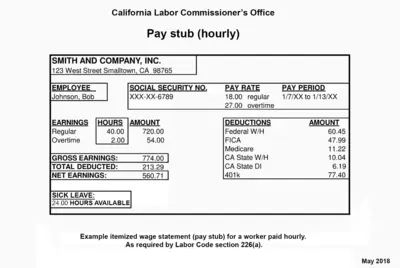

California Labor Commission Pay Stub Example

This file provides a sample pay stub for hourly employees. It outlines important earnings and deductions. Use it to understand your wage statements better.

Payroll Tax

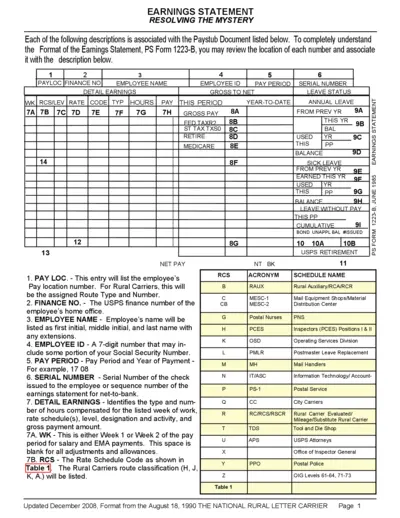

Earnings Statement Instructions and Format Guide

This document provides detailed instructions on how to fill out and interpret the earnings statement. Users can easily navigate the various fields and understand what information is required. This guide serves as a comprehensive resource for new and existing employees needing assistance with their paystub.

Payroll Tax

CEM Certified Payroll WH-347 Submission Guide

This document provides comprehensive instructions for filling out the CEM Certified Payroll WH-347 form. It is essential for managing prevailing wages for federal projects efficiently. Utilize this guide to ensure accurate compliance and reporting.

Payroll Tax

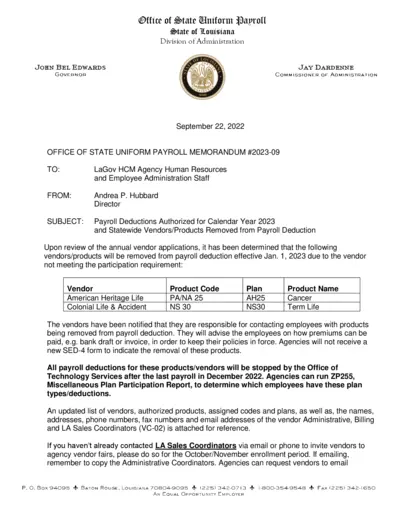

Payroll Deductions Authorized for Calendar Year 2023

This file contains payroll deduction information for the calendar year 2023 in Louisiana. It details which vendors/products are being removed from payroll deductions. Use this document for guidance on managing employee payroll deductions effectively.

Payroll Tax

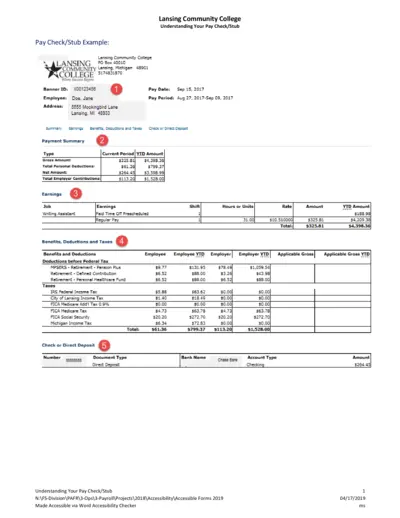

Understanding Your Pay Check/Stub Guide

This file provides a comprehensive guide to understanding your paycheck or stub. It includes details about earnings, deductions, and taxes. Perfect for employees wanting to understand their compensation better.