Business Tax Documents

Payroll Tax

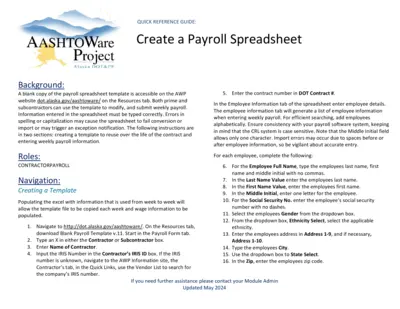

Create a Payroll Spreadsheet for AASHTOWare

This file provides a comprehensive guide for creating a payroll spreadsheet tailored for AASHTOWare Project. It includes essential instructions and templates for both contractors and subcontractors. Designed for weekly payroll submissions to Alaska DOT&PF.

Sales Tax

Rio Grande Council Fall Popcorn Sale Handbook

This handbook provides crucial information for participating in the Rio Grande Council's Fall Popcorn Sale. Users will find details on the sale's objectives, commission structure, and essential dates. It serves as a guide for units aiming to maximize their fundraising efforts.

Payroll Tax

TIEM32 Payroll March 2019 Instructions and Guide

This document contains essential payroll instructions for March 2019. It provides version details and revision history. Ideal for users needing guidance on payroll processing.

Payroll Tax

ePayStub Build Notes Documentation

This document provides build notes for ePayStub by Encore Business Solutions. It includes important updates, installation requirements, and user instructions. Ideal for users looking to understand the latest changes and how to utilize the ePayStub software.

Payroll Tax

Online Pay Stub Enrollment Guide - Key Instructions

This guide explains how associates with a Compass Group network ID can access their pay stubs online. It provides detailed instructions on logging in to the Owner's Management Suite. Users can also find answers to common questions related to pay stub access and security.

Payroll Tax

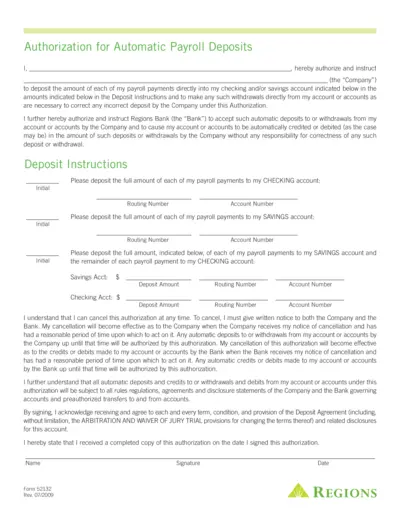

Automatic Payroll Deposit Authorization Form

This form allows employees to authorize direct deposits of their payroll payments into their designated bank accounts. It outlines the necessary banking details required for the process. Follow the provided instructions carefully to ensure proper submission.

Sales Tax

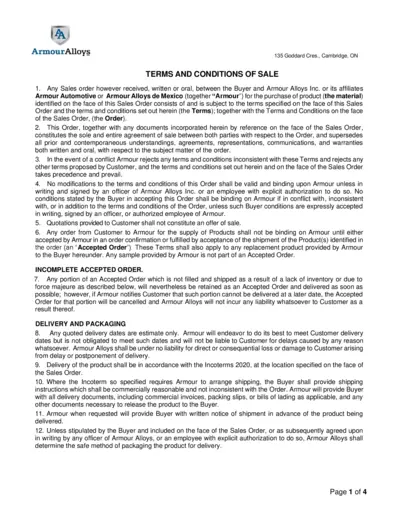

Armour Alloys Terms and Conditions of Sale

This document outlines the terms and conditions of sale for products purchased from Armour Alloys.

Payroll Tax

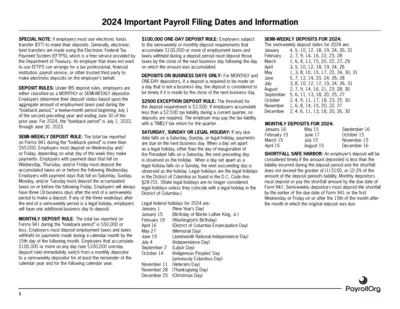

2024 Important Payroll Filing Dates and Information

This document provides essential payroll filing dates and related information for employers in 2024. It outlines deposit rules, deadlines, and important tax compliance dates to help employers manage their payroll responsibilities effectively. Read this guide to ensure timely and accurate payroll filings.

Payroll Tax

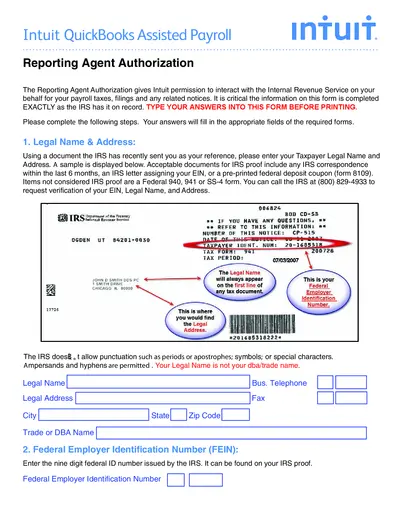

Intuit QuickBooks Assisted Payroll Reporting Authorization

This file provides essential instructions for completing the Reporting Agent Authorization form for Intuit QuickBooks payroll. It guides users on how to fill out vital information required by the IRS. Perfect for businesses looking to authorize Intuit for payroll tax interactions.

Payroll Tax

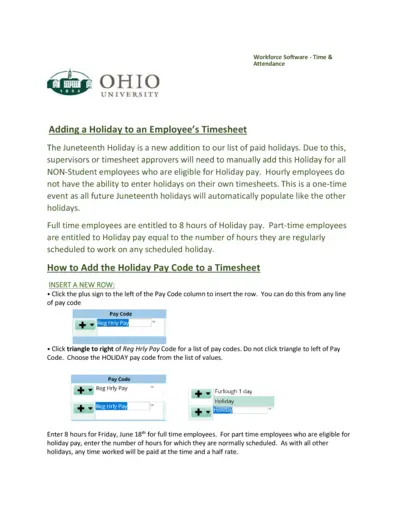

Employee Holiday Pay Instructions for Timesheets

This document outlines the process for adding the Juneteenth holiday to employee timesheets. It specifies the guidelines for both full-time and part-time employees regarding holiday pay. It serves as a crucial reference for supervisors and approvers to ensure accurate payroll processing.

Payroll Tax

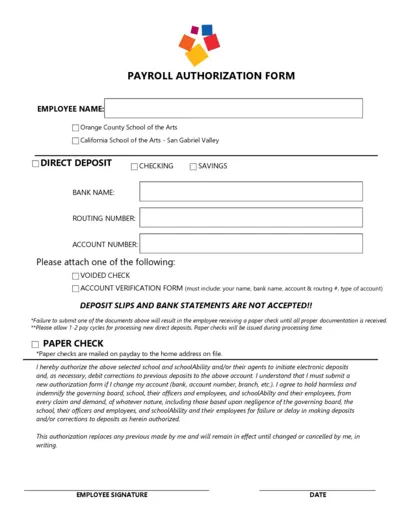

Payroll Authorization Form for Direct Deposit

This Payroll Authorization Form enables employees to authorize direct deposits into their bank accounts. It is essential for smooth payroll processing and ensures timely payments. Completing this form accurately helps in avoiding delays in your paycheck.

Payroll Tax

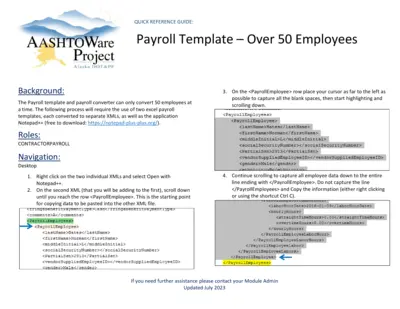

Alaska DOT&PF Payroll Template - Over 50 Employees

This guide provides essential instructions for using the payroll template designed for organizations with over 50 employees. It ensures accurate payroll data conversion and submission. Follow the steps carefully to streamline your payroll processing.