Business Tax Documents

Payroll Tax

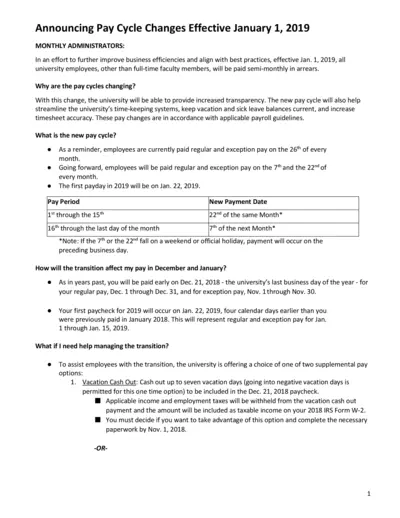

Pay Cycle Changes Announcement Effective January 2019

This document details the new pay cycle changes effective January 1, 2019, affecting university employees. It explains the transition process and supplemental pay options available. Employees are encouraged to review the changes and utilize the provided resources for assistance.

Sales Tax

Sales Orders and Cash Sales Guide for NetSuite

This document provides comprehensive instructions and guidelines for managing sales orders and cash sales in NetSuite. Users will find step-by-step directions on entry, approval, and billing procedures. Ideal for finance and operations personnel seeking to streamline sales transactions.

Payroll Tax

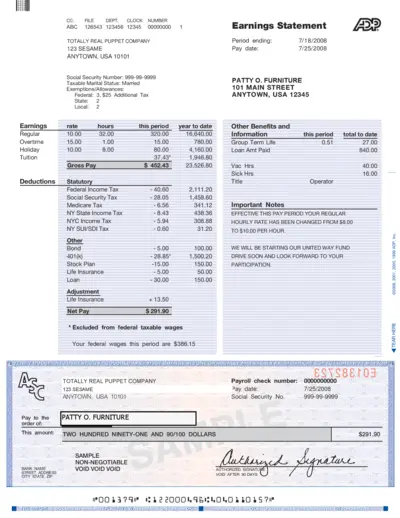

Earnings Statement and Payroll Instructions

This file contains important information regarding your earnings, deductions, and overall payroll details for the specified period. It serves as a guide for understanding gross and net pay breakdowns, tax withholdings, and any additional benefits provided by the employer. Users can utilize this document for verifying income, preparing tax documents, or understanding payment structure.

Sales Tax

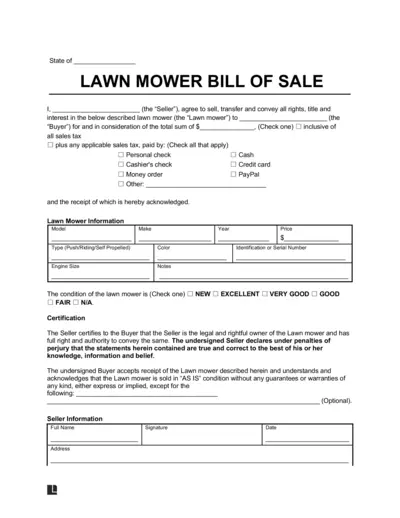

Lawn Mower Bill of Sale Document

The Lawn Mower Bill of Sale is a legal document used for the sale and transfer of ownership of a lawn mower. This form ensures that all pertinent information, including the condition and specifications of the mower, is clearly documented for both buyer and seller. It is crucial for maintaining a record of the transaction and protecting both parties' rights.

Sales Tax

Bill of Sale for Used Items and Instructions

This document contains a bill of sale template for used items, including essential details required for transactions. It outlines the necessary steps each party must follow to complete the sale accurately. Ensure both parties fill out the document completely to avoid potential disputes.

Payroll Tax

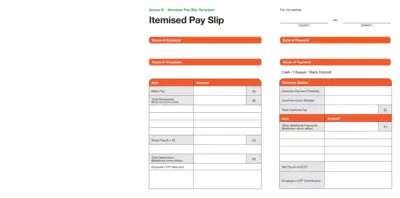

Itemised Pay Slip Template for Employers and Staff

This document provides a detailed itemised pay slip template for employers and employees. It helps to outline salaries, deductions, and overtime pay clearly. Perfect for businesses looking to maintain transparency in payroll processes.

Payroll Tax

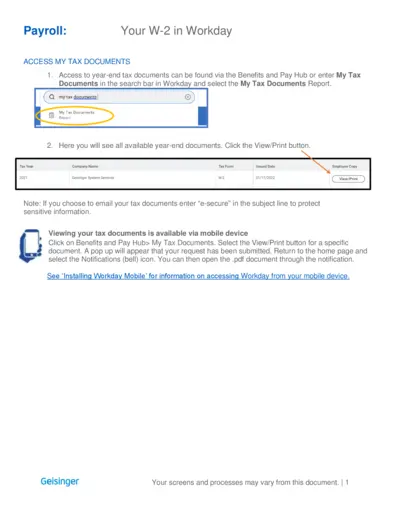

W-2 Year-End Tax Documents Access Guide

This guide provides instructions for accessing your W-2 tax documents on Workday. Learn how to view, print, and update your tax document preferences. Ensure you have the necessary information to manage your year-end tax documents effectively.

Sales Tax

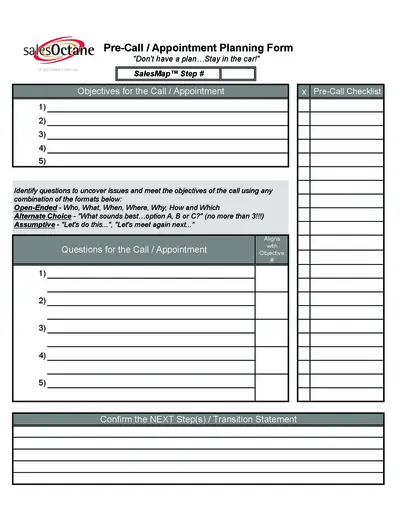

SalesOctane Pre-Call Planning Form Overview

The SalesOctane Pre-Call Planning Form is designed to help sales professionals prepare effectively for client interactions. It provides a structured approach to outlining objectives, questions, and next steps for successful appointments. This document ensures that users stay focused and organized throughout the sales process.

Payroll Tax

Intuit QuickBooks Payroll Getting Started Guide

This guide provides essential instructions for using Intuit QuickBooks Payroll. It covers setup, processing payroll, and managing employee information. Perfect for new users and seasoned accountants alike.

Sales Tax

SuperOffice CRM Quote Templates Instructions Guide

This file provides detailed instructions on using quote templates in SuperOffice CRM. It includes information on customising templates, adding mergefields, and generating order confirmations. Ideal for sales professionals looking to streamline their quote processes.

Payroll Tax

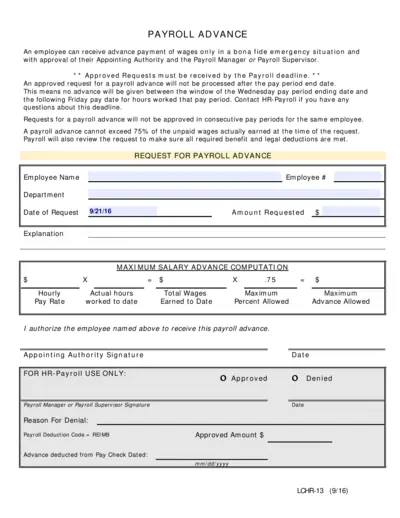

Payroll Advance Request Form Instructions

This file provides the necessary instructions and details for employees to request a payroll advance. It outlines the eligibility requirements, how to fill out the form, and the approval process involved. Use this guide to navigate the monthly payroll advance process efficiently.

Payroll Tax

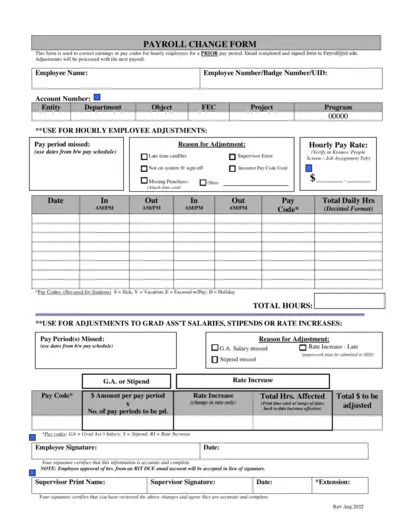

Payroll Change Form for Hourly Employee Adjustments

The Payroll Change Form is essential for rectifying earnings or pay codes for hourly employees. This form must be completed, signed, and emailed to Payroll for adjustments. Ensure all required fields are accurately filled to facilitate a smooth payroll process.