Business Tax Documents

Tax Compliance

Understanding FATCA: FAQs and Compliance Guide

This document provides essential information about FATCA and how it impacts individuals and businesses. It outlines compliance steps for clients dealing with HSBC. Stay informed about your tax obligations with this comprehensive guide.

Payroll Tax

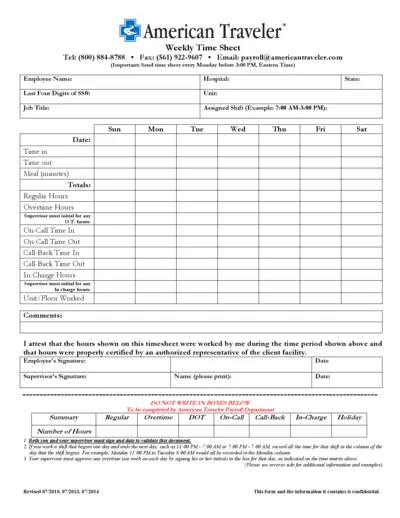

Weekly Time Sheet for American Traveler Employees

This document is a time sheet for employees of American Traveler to record their hours worked. It includes sections for overtime, on-call time, and signatures from both the employee and supervisor. Accurate submission ensures timely payroll processing.

Sales Tax

Sales to Purchasers From Mexico Publication 32

This publication provides essential information regarding the sales tax requirements for California retailers. It explains the nuances of selling to purchasers from Mexico, including tax exemptions. Retailers can learn how to document tax-exempt sales effectively.

Tax Credits

How to Complete Your Tax Credits Claim Form for 2008

This document provides essential instructions for completing your Tax Credits Claim Form TC600 for 2008. It outlines the necessary information and steps required to successfully complete the form. Ensure you understand the qualifications and processes involved to maximize your benefits.

Sales Tax

Strategic Selling Process for Complex Sales

This file outlines the Strategic Selling® program designed to help organizations develop effective strategies for complex sales. It provides insights into sales processes, key decision makers, and effective resource allocation. Ideal for teams looking to enhance their sales capabilities and forecasting accuracy.

Payroll Tax

University of Toledo Overpayment Repayment Guidelines

This document outlines the procedures for notifying the Payroll Department of salary overpayments. It provides detailed instructions for active and terminated employees regarding repayment options. Understanding these guidelines is essential for managing payroll discrepancies effectively.

Payroll Tax

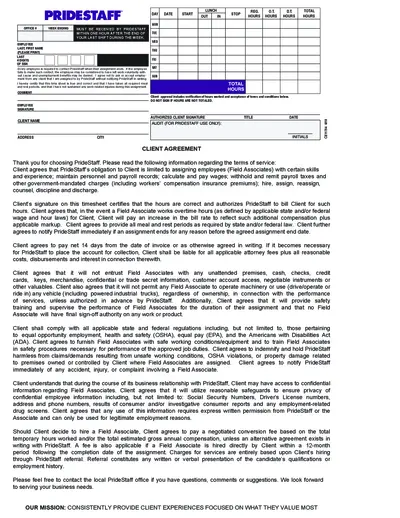

PrideStaff Employee Timesheet and Client Agreement

This document contains the PrideStaff Employee Timesheet and Client Agreement instructions. It is essential for employees to report their work hours accurately. Proper completion is required for payroll processing and compliance.

Payroll Tax

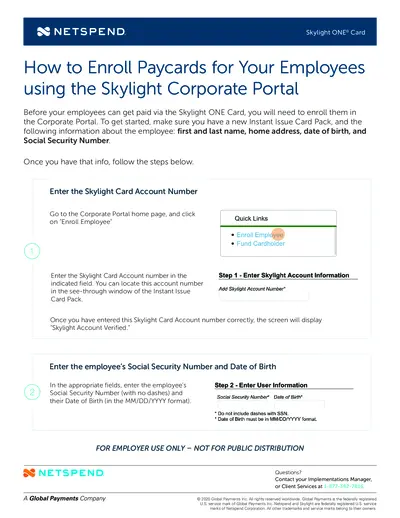

NETSPEND Skylight ONE Card Enrollment Instructions

This file provides detailed instructions on how to enroll employees for the Skylight ONE Card using the Corporate Portal. It includes necessary information for enrollment, step-by-step guidance, and contact details for support. Perfect for employers looking to streamline payment processes for their employees.

Payroll Tax

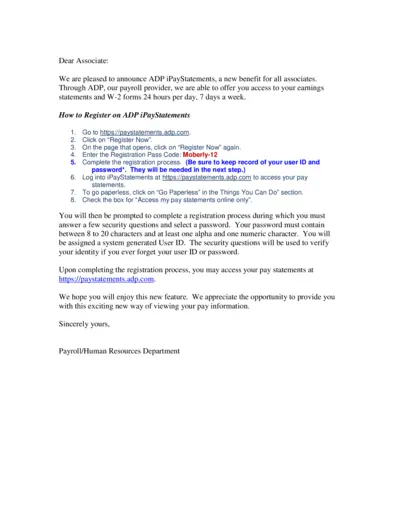

Access Your Pay Statements Anytime with ADP iPayStatements

The ADP iPayStatements provides associates with 24/7 access to earnings statements and W-2 forms. This guide outlines the registration process and beneficial features. Streamline your payroll experience with easy online access to your pay information.

Payroll Tax

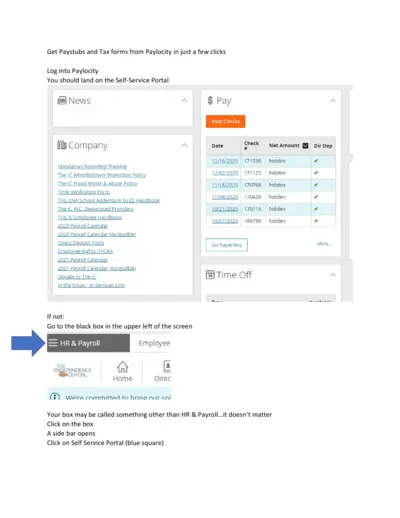

Retrieve Paystubs and Tax Forms from Paylocity Easily

This file provides a comprehensive guide on accessing paystubs and tax forms through Paylocity. Users can quickly navigate the Self-Service Portal and download necessary documents with simple instructions. Ideal for employees looking to manage their payroll information efficiently.

Tax Credits

Work Opportunity Tax Credit Quick Reference Guide

This guide provides essential information about the Work Opportunity Tax Credit (WOTC) available to employers. It outlines the benefits, application process, and resources for finding eligible job candidates. Enhance your hiring practices and learn how to maximize your tax credits with WOTC.

Payroll Tax

Direct Deposit Authorization Form for Employees

This direct deposit authorization form allows employees to authorize their wages to be deposited directly into their bank account. It includes essential banking information and personal details. This form is vital for new hires to set up their payroll efficiently.