Business Tax Documents

Payroll Tax

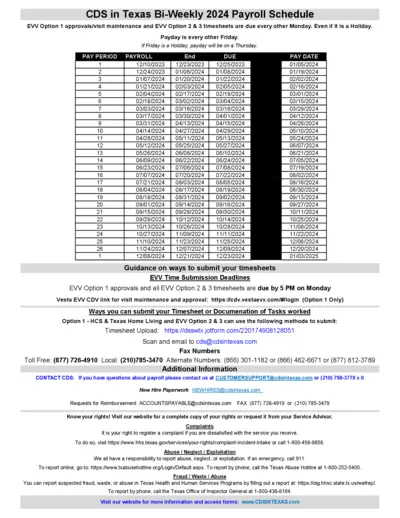

Texas 2024 Bi-Weekly Payroll Schedule

This file provides the bi-weekly payroll schedule for Texas for the year 2024. It includes important submission deadlines and payment dates for caregivers and services. Users can utilize this file to stay organized and timely with their payroll responsibilities.

Sales Tax

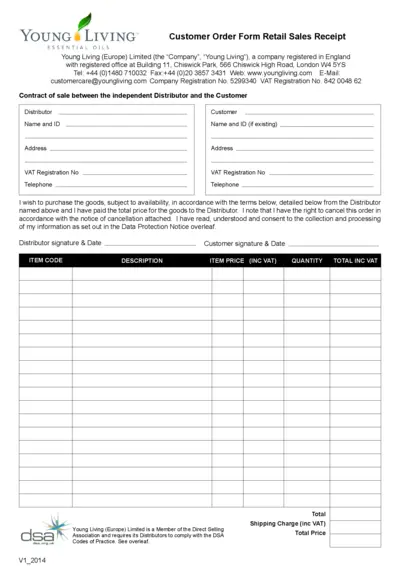

Young Living Customer Order Form and Instructions

This file contains essential information about the Young Living customer order process. It includes terms and conditions, instructions for order cancellation, and data protection guidelines. Ideal for customers and distributors to understand their rights and responsibilities.

Sales Tax

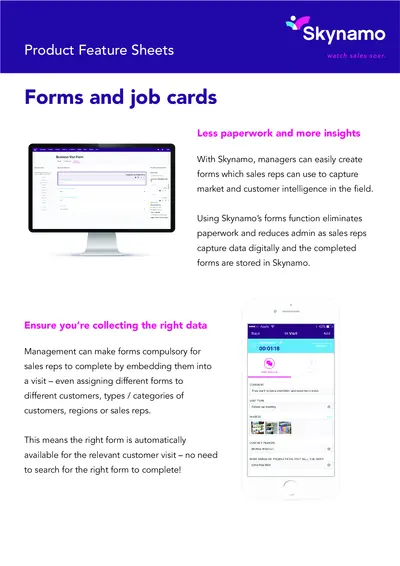

Skynamo Product Feature Sheets for Sales Teams

This file offers comprehensive insights into Skynamo's product features including customizable forms for data collection. Ideal for sales teams seeking to enhance their efficiency and gather valuable market intelligence. Understand the benefits of reducing paperwork and leveraging digital tools for customer engagement.

Sales Tax

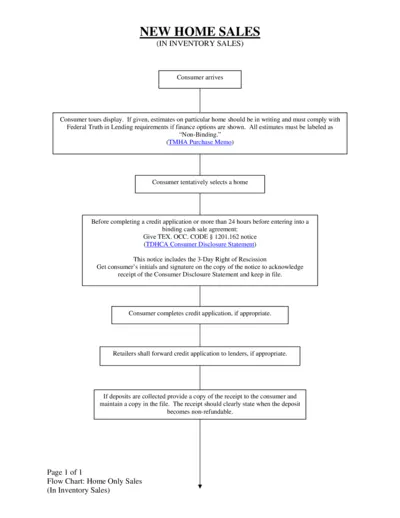

Home Sales Process Instruction Guide

This file provides essential steps for home sales procedures, ensuring compliance with legal requirements. It outlines necessary consumer disclosures and agreements. Follow these instructions to navigate the sales process effectively.

Tax Credits

Historic Homeownership Rehabilitation Credit Guidelines

This document provides essential guidelines for the Historic Homeownership Rehabilitation Credit application process in New York State. It includes detailed instructions on how to successfully complete and submit the application via DocuSign. Ensure you follow each step to avoid complications in your application.

Payroll Tax

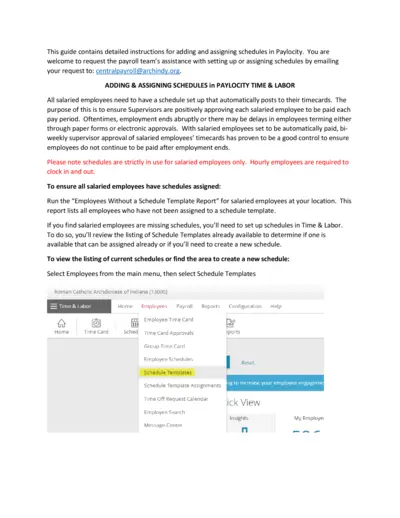

Adding and Assigning Schedules in Paylocity

This guide provides comprehensive instructions for adding and assigning schedules in Paylocity. It is designed to assist salaried employees in ensuring their work schedules are posted correctly. Contact the payroll team for further support.

Payroll Tax

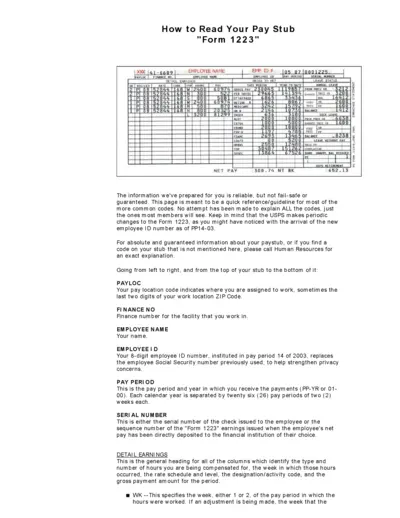

Pay Stub Reading Instructions and Details

This document provides essential instructions on how to read your pay stub effectively. It details the various codes and components included in your pay stub. Understanding these details will help you ensure accurate compensation and deductions.

Sales Tax

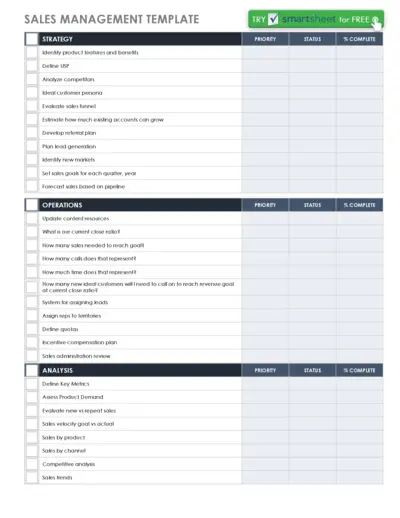

Sales Management Template for Effective Strategy

This sales management template is designed to help you strategize and prioritize your sales efforts effectively. It includes features for defining your unique selling proposition and analyzing your competition. Use this template to set sales goals and evaluate your operations for better results.

Sales Tax

Future of B2B Sales: The Big Reframe

This document outlines the current landscape of B2B sales and the necessary shifts companies must make to meet customer expectations. It dives into strategies such as enhancing channels, upgrading technology, and developing talent. Jointly crafted by experts from McKinsey's Growth, Marketing & Sales Practice, it offers valuable insights for sales professionals.

Payroll Tax

How to Update Your W-4 Form on ADP

This file provides detailed instructions on updating your W-4 form using ADP. It includes information about tax withholding and the importance of using the IRS calculator. Users will find step-by-step guidance for submission and links to helpful resources.

Payroll Tax

ADA Notice CEM-2502 Payroll Instructions

This file contains important payroll information for contractors and subcontractors. It includes instructions on how to fill out payroll forms correctly. Ensure compliance with California state regulations by following these guidelines.

Sales Tax

Sales Order Processing Guide for Microsoft Dynamics

This file contains detailed instructions and information for using the Sales Order Processing in Microsoft Dynamics GP. It covers setup, module configurations, and workflows. Ideal for users seeking to optimize their sales management processes.