Cross-Border Taxation Documents

Cross-Border Taxation

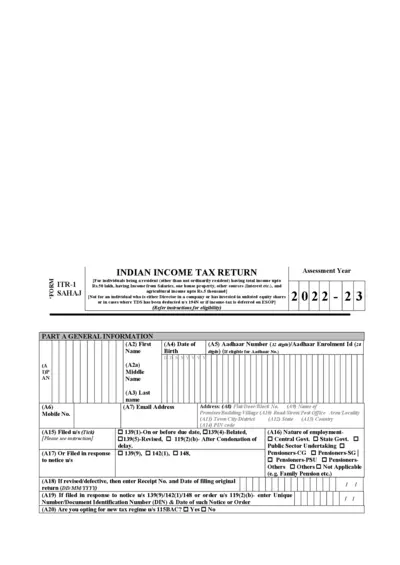

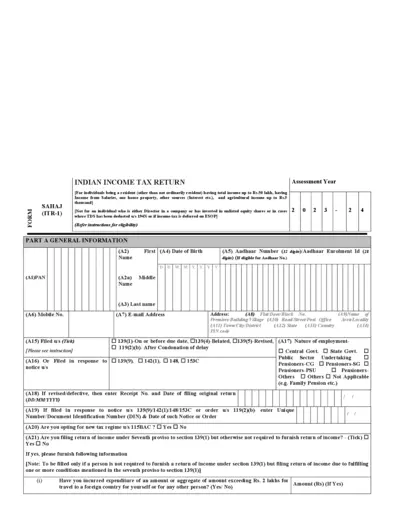

ITR-1 SAHAJ Income Tax Return Form 2022-2023

The ITR-1 SAHAJ is a simplified Income Tax Return form for Indian residents with total income up to Rs. 50 lakh. This form is designed for individuals earning income from salaries, one house property, and other sources like interest. Use this form to comply with tax filing requirements for the assessment year 2022-2023.

Cross-Border Taxation

TRRA Portal User Guide for Taxpayer Registration

The TRRA Portal User Guide provides essential instructions for taxpayers seeking to register or update their information. This guide covers the submission of applications electronically via email. Users will find detailed transactions and access instructions to navigate the TRRA Portal efficiently.

Cross-Border Taxation

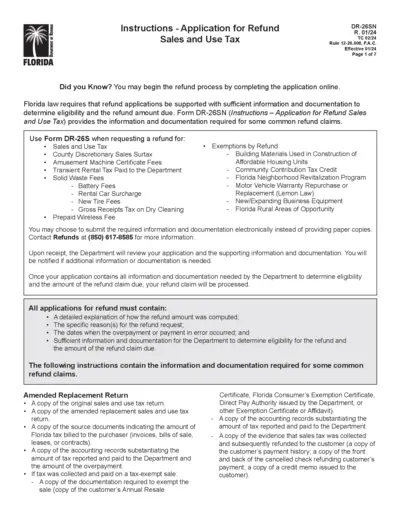

Instructions for Application for Refund Sales Use Tax

This file provides detailed instructions for filing a refund application for sales and use tax in Florida. It outlines eligibility criteria, required documentation, and common refund claims. Users can find essential information to ensure a successful refund application process.

Cross-Border Taxation

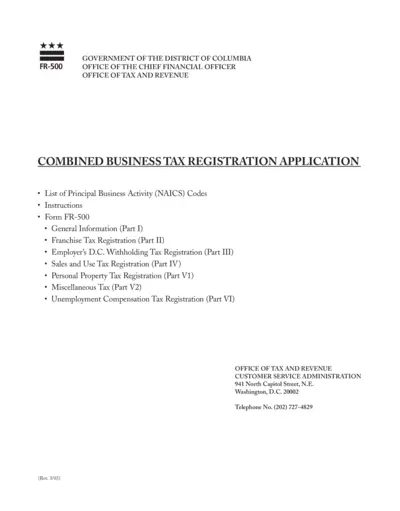

Combined Business Tax Registration Application

This file serves as the official Combined Business Tax Registration Application for the District of Columbia. It includes necessary instructions and forms for various tax registrations. Businesses seeking to register in D.C. should utilize this comprehensive document for compliance.

Cross-Border Taxation

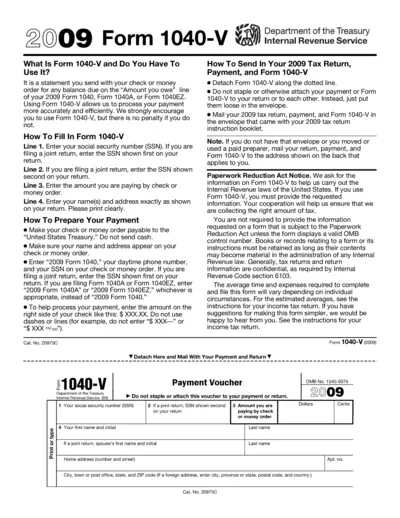

2009 Form 1040-V Instructions and Details

Form 1040-V helps you send your payment to the IRS alongside your tax return. This file contains necessary steps and information for correctly filing your 2009 taxes. Ensure that you follow the instructions to avoid payment processing delays.

Cross-Border Taxation

New York City Parking Tax Exemption for Residents

This document provides detailed information on the New York City Parking Tax Exemption for Manhattan residents. It outlines criteria, procedures, and eligibility requirements for obtaining the exemption. It is crucial for residents seeking tax relief on parking services within Manhattan.

Cross-Border Taxation

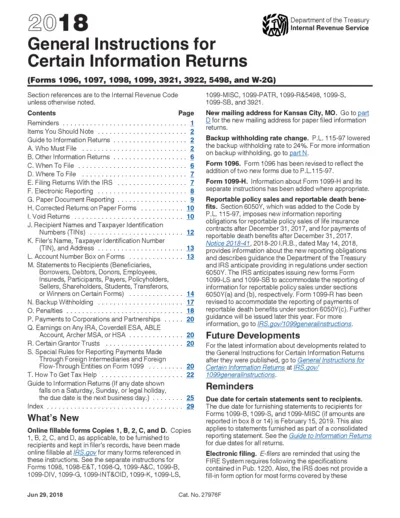

General Instructions for Information Returns 2018

This file provides essential guidelines for completing various IRS information return forms, including 1096 and 1099 series. It's crucial for filers to understand the requirements and due dates to ensure compliance with tax obligations. The instructions help navigate the complexities of U.S. tax reporting.

Cross-Border Taxation

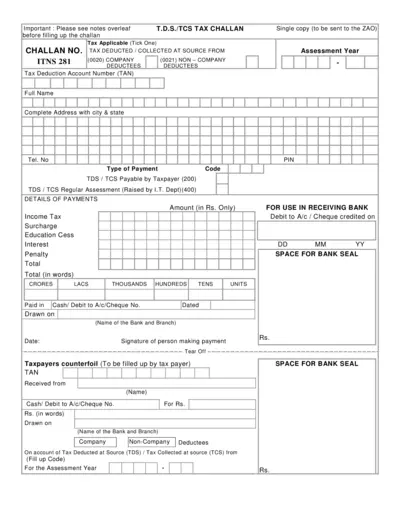

TDS/TCS Tax Challan Payment Instructions

This file contains essential instructions for filling out the TDS/TCS tax challan. It includes details on tax applicable, payment types, and important fields. Users can refer to this document for guidelines to ensure accurate submissions.

Cross-Border Taxation

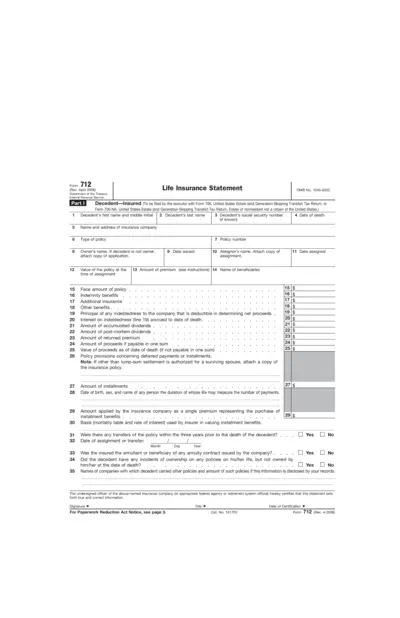

Life Insurance Statement Form 712 - IRS Guidelines

Form 712 is essential for reporting life insurance policies for estate tax purposes. Executors of estates must file this form with Form 706 or 706-NA. This form collects vital information about the insured's policies and is crucial for accurate tax assessments.

Cross-Border Taxation

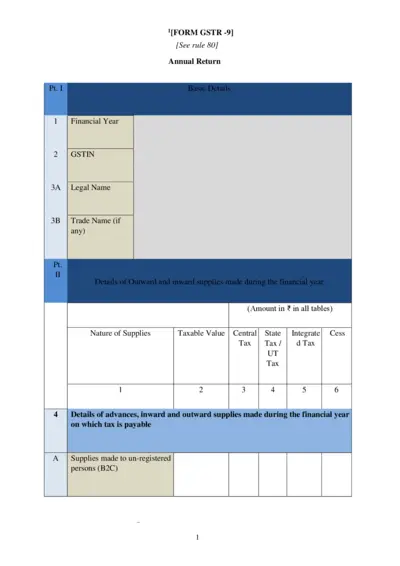

GSTR-9 Annual Return Filing Guide

The GSTR-9 is an annual return that aggregates all the data from GSTR-1 and GSTR-3B. This comprehensive guide will help users navigate through the form easily. Understand the components, instructions, and submission processes to ensure compliance.

Cross-Border Taxation

Indian Income Tax Return ITR-1 Form Overview

The ITR-1 form is specifically designed for individuals with a total income up to Rs.50 lakh. It includes income from salaries, one house property, and other sources like interest. Use this form to ensure accurate and timely filing of your income tax return.

Cross-Border Taxation

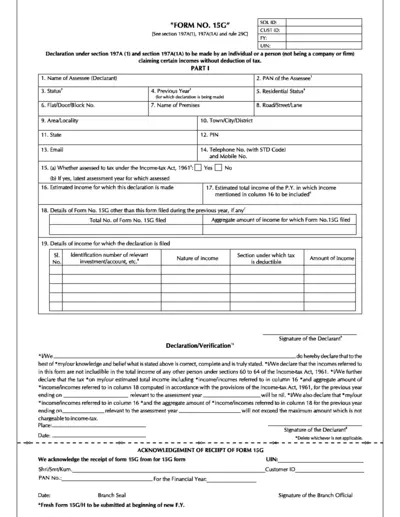

Form No 15G Declaration for Income-Tax Exemption

This file is a Form No. 15G declaration for individuals claiming certain incomes without tax deduction. It provides essential sections for filling out personal information, estimated income, and declarations related to tax. Use this form to submit income declarations to avoid tax deductions on certain incomes.