Cross-Border Taxation Documents

Cross-Border Taxation

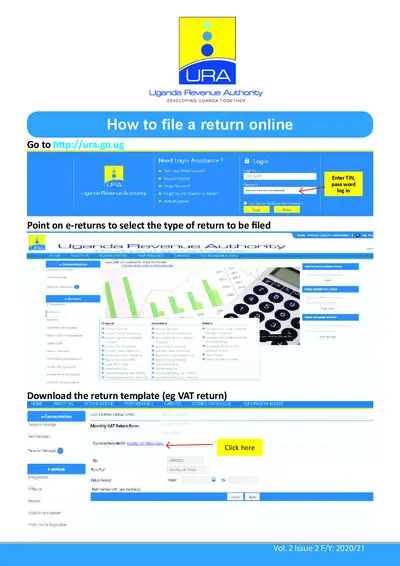

Uganda Revenue Authority Online Return Filing Instructions

This file provides detailed instructions on how to file online returns with the Uganda Revenue Authority. It also includes guidelines for filling out the forms correctly. Users can benefit from clear steps and necessary templates for submission.

Cross-Border Taxation

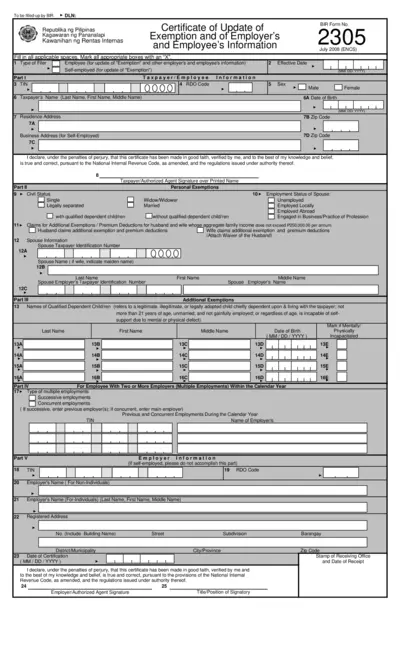

Certificate of Update of Exemption and Employee Info

This file is a certificate used for updating exemption and employee information for the Bureau of Internal Revenue. It is essential for employees and self-employed individuals to accurately report their tax-exempt status. Proper completion of this form ensures compliance with Philippine tax regulations.

Cross-Border Taxation

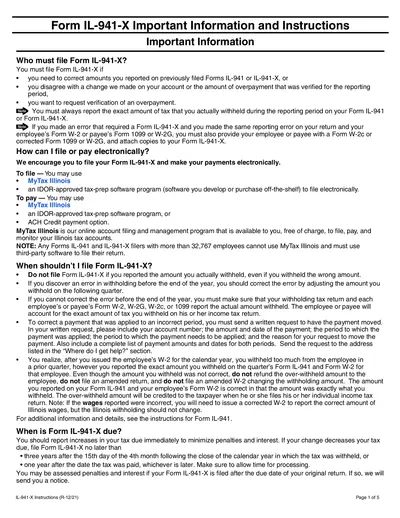

Form IL-941-X Important Information and Instructions

This important document provides instructions for filling out Form IL-941-X. It guides users in correcting previously filed IL-941 or IL-941-X forms. Ensure compliance with state tax regulations by following these instructions carefully.

Cross-Border Taxation

VAT Refund Guide for Non-EU Travelers in Spain

This file provides essential information about the VAT refund process for travelers from non-EU countries. It outlines eligibility requirements, procedures for obtaining refunds, and important documentation needed during departure from Spain. Perfect for international travelers aiming to reclaim value-added tax on purchases made in Spain.

Cross-Border Taxation

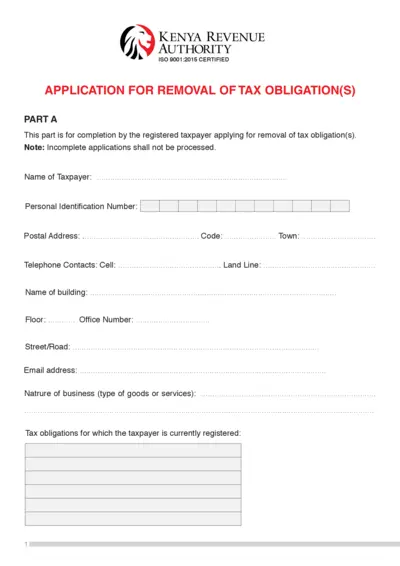

Application for Removal of Tax Obligation Kenya

This file provides the application form for taxpayers in Kenya wishing to remove tax obligations. It includes instructions on completing the form and details necessary for processing. Ensure all required documents are attached for successful submission.

Cross-Border Taxation

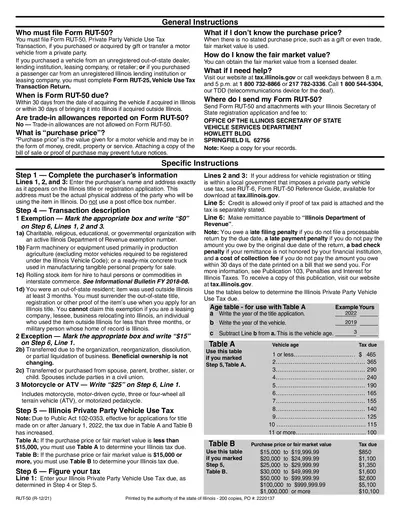

Form RUT-50 Instructions for Vehicle Tax Filing

Form RUT-50 is essential for reporting vehicle purchase taxes in Illinois. This file contains detailed instructions and guidelines for individuals and businesses. It serves as a comprehensive guide for filing and understanding vehicle use tax obligations.

Cross-Border Taxation

Non-Resident Tax Preparation Guide for Students

This document provides essential information on non-resident tax preparation for students and scholars. It covers key tax behaviors and filing instructions for the tax year 2016. Utilize this guide to ensure compliance with your tax responsibilities effectively.

Cross-Border Taxation

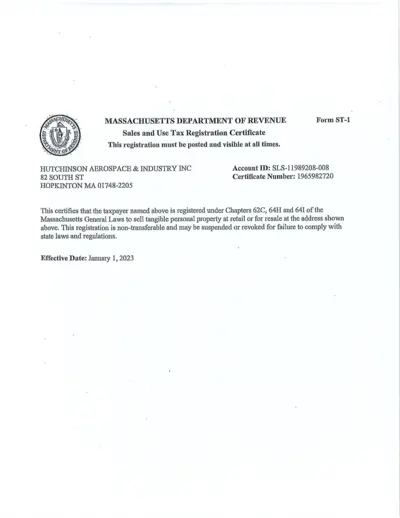

Massachusetts Sales and Use Tax Registration

This document is a Sales and Use Tax Registration Certificate for Massachusetts. It certifies that the taxpayer is registered to sell tangible personal property. This is important for compliance with state sales tax laws.

Cross-Border Taxation

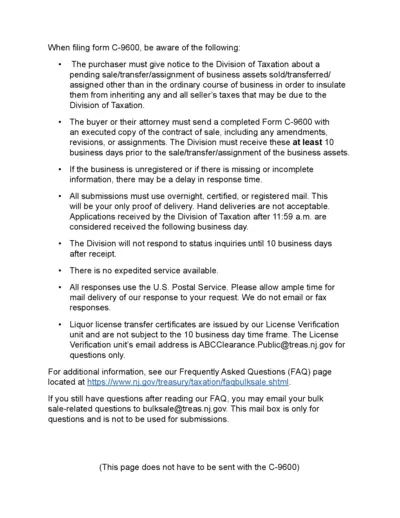

Filing Instructions for Form C-9600 in New Jersey

This file provides essential instructions for completing Form C-9600 required for reporting bulk sales in New Jersey. It details the submission process and necessary information to avoid tax liabilities. Users must follow these guidelines to ensure compliance with New Jersey tax regulations.

Cross-Border Taxation

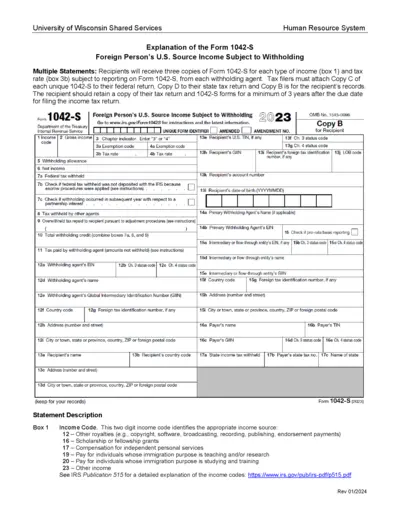

Wisconsin 1042-S Form Instructions for Foreign Income

This document provides crucial information on Form 1042-S for foreign persons receiving U.S. source income. It includes details on how to fill out the form, as well as guidelines for tax submission. Essential for non-resident aliens and other foreign entities to ensure tax compliance in the U.S.

Cross-Border Taxation

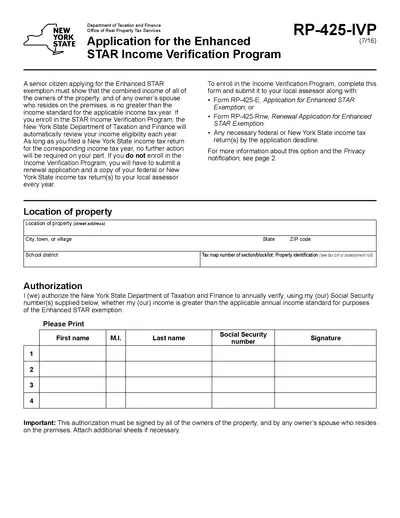

Enhanced STAR Income Verification Program Application

This file contains the application for the Enhanced STAR Income Verification Program in New York State. It details the eligibility criteria and necessary documents for senior citizens applying for tax exemptions. The file also provides instructions on how to fill out and submit the application.

Cross-Border Taxation

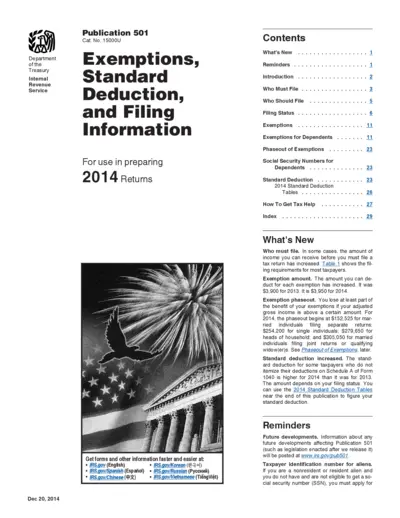

IRS Publication 501 Exemptions Standard Deduction

IRS Publication 501 provides essential details on exemptions, standard deductions, and filing information for the 2014 tax year. This guide is important for taxpayers to understand their filing requirements and benefits. Access crucial IRS resources and information to simplify your tax preparation process.