Cross-Border Taxation Documents

Cross-Border Taxation

Sprintax Guide for US Nonresidents Tax Filing

This file provides essential information about using Sprintax for tax return preparation. It outlines the step-by-step process for nonresidents to file their state and federal taxes. Get detailed instructions and tips tailored for your needs.

Cross-Border Taxation

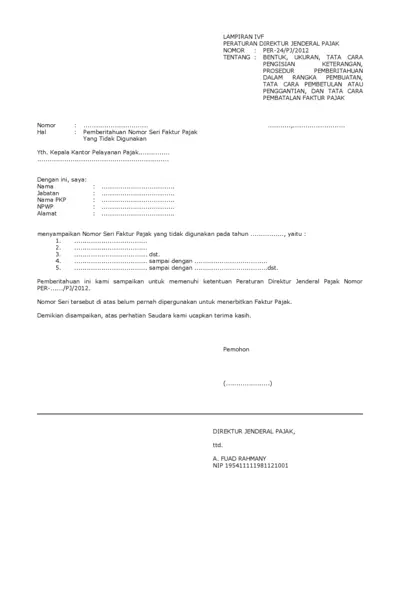

Pemberitahuan Nomor Seri Faktur Pajak Tidak Digunakan

This document provides essential information regarding the notification of unused tax invoice serial numbers. It outlines the procedures for reporting and correcting tax invoice issues. Users can utilize this file to ensure compliance with tax regulations.

Cross-Border Taxation

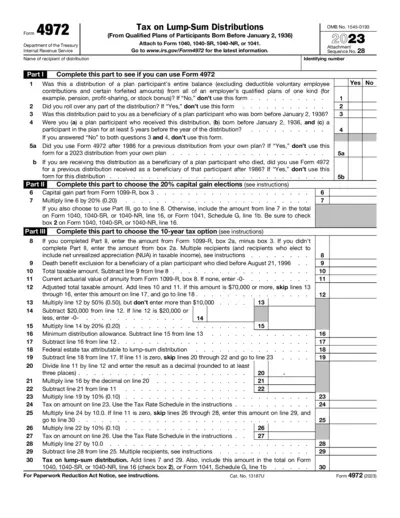

Form 4972 Tax on Lump-Sum Distributions Instructions

Form 4972 is used to calculate tax on qualified lump-sum distributions from retirement plans. This form is essential for beneficiaries born before January 2, 1936. Completing Form 4972 may offer tax advantages by allowing special calculations.

Cross-Border Taxation

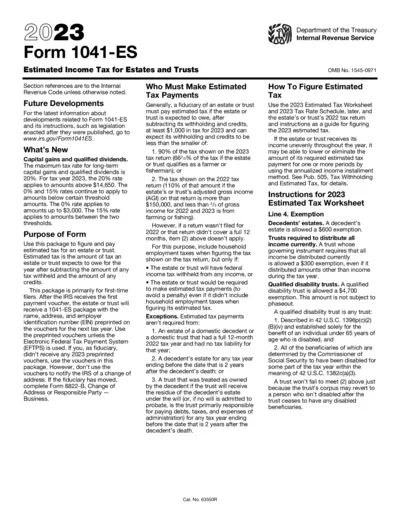

Form 1041-ES Estimated Tax for Estates and Trusts

Form 1041-ES is essential for estate and trust fiduciaries to calculate and prepay estimated taxes. Ensure compliance by submitting this form for tax year 2023. Understanding its structure aids in proper financial planning.

Cross-Border Taxation

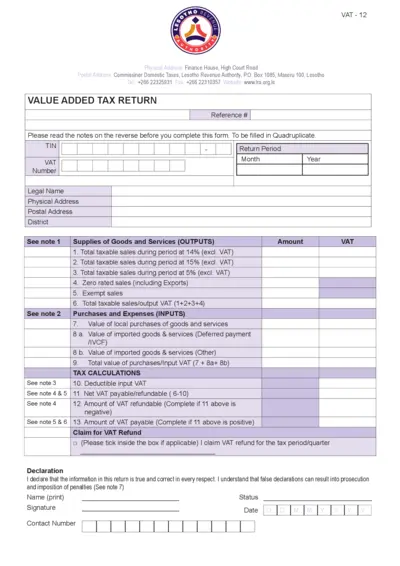

Value Added Tax Return - Lesotho VAT12 Form

The Value Added Tax Return is a crucial document for businesses in Lesotho to report their VAT payments. This return requires detailed information on taxable sales, input purchases, and VAT calculations. Ensuring correct completion is key to complying with Lesotho’s VAT regulations.

Cross-Border Taxation

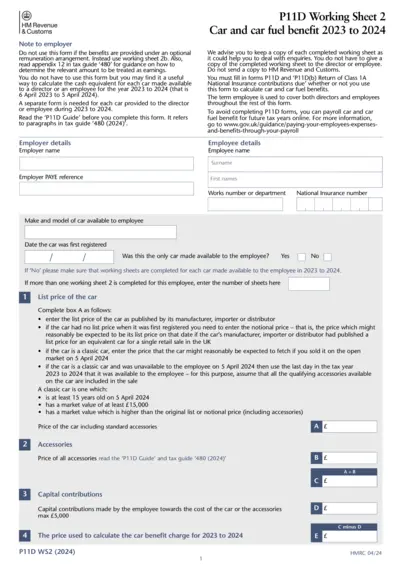

HMRC P11D Car Fuel Benefit Guide 2023-2024

This file provides essential information and instructions for employers regarding the P11D form related to car and fuel benefits. It helps in accurately calculating the cash equivalent for the vehicles made available to employees in the tax year 2023 to 2024. Additionally, it outlines necessary details about employer and employee responsibilities.

Cross-Border Taxation

Understanding Form 26AS for Tax Filing

This file provides comprehensive information on Form 26AS, essential for tax filing. Learn about its significance, filling process, and common mistakes. Ideal for taxpayers who want to ensure accurate annual returns.

Cross-Border Taxation

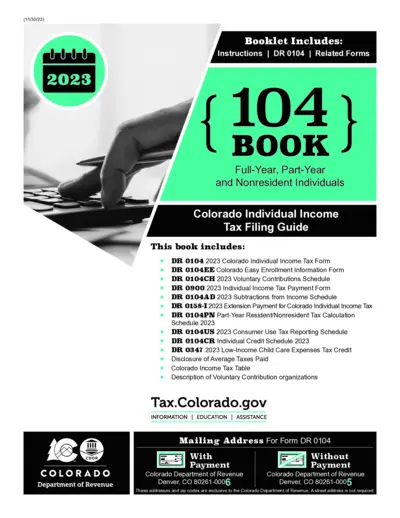

2023 Colorado Individual Income Tax Filing Guide

The Colorado Individual Income Tax Filing Guide provides detailed instructions for residents and nonresidents on completing their income tax returns. It includes various forms, schedules, and important tax information. Ideal for individuals looking to understand their obligations and options for filing taxes in Colorado.

Cross-Border Taxation

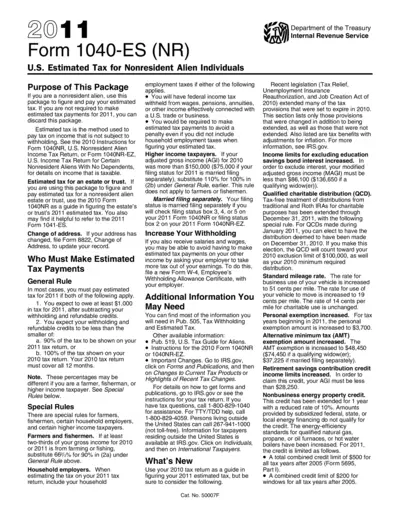

2011 Form 1040-ES NR Estimated Tax Nonresident Aliens

This file provides essential information for nonresident alien individuals filing their estimated taxes for 2011. It includes details about tax payments, instructions, and important updates. Understanding this document is crucial to ensure compliance with U.S. tax obligations.

Cross-Border Taxation

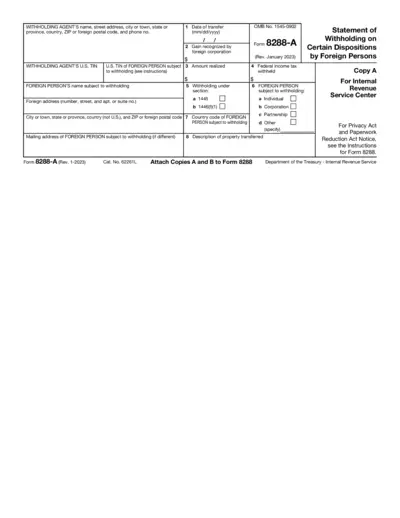

Form 8288-A Instructions for Foreign Withholding

The Form 8288-A is utilized for federal income tax withholding on foreign persons disposing of U.S. real property. This document provides essential instructions and the necessary fields to ensure accurate and compliant tax documentation. Users should follow the guidelines carefully to avoid penalties and ensure proper reporting.

Cross-Border Taxation

Florida Reemployment Tax Audit Guide

This document provides essential information regarding Florida reemployment tax audits. It outlines your rights and responsibilities during the audit process. Understanding this guide can help you navigate audits effectively.

Cross-Border Taxation

Instructions Schedule I Form 1120-F Interest Expense

This document provides instructions for completing Schedule I of Form 1120-F for foreign corporations reporting interest expenses. It details necessary allocations of interest expenses and related elections. Understanding this form is essential for accurately reporting effectively connected income for the tax year.