Cross-Border Taxation Documents

Cross-Border Taxation

VAT Refund Guide for Overseas Visitors

This guide provides essential information on how to claim a VAT refund while traveling in the UK or EU. Understand the eligibility criteria, what goods qualify, and step-by-step instructions to fill out your VAT refund form. Perfect for overseas residents and travelers looking to save on their purchases.

Cross-Border Taxation

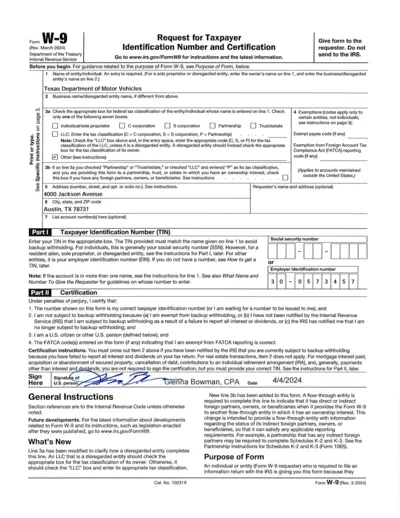

Form W-9 Request for Taxpayer Identification Number

The W-9 form is used by individuals and entities to provide their taxpayer identification number to requesters. This form is essential for tax reporting purposes. Ensure accurate completion to avoid withholding issues.

Cross-Border Taxation

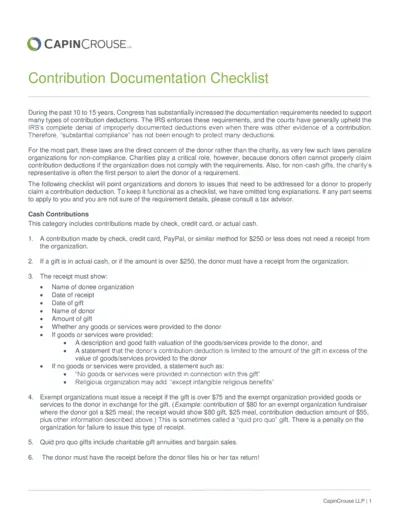

Contribution Documentation Checklist

This checklist outlines the documentation requirements for contribution deductions for donors. It helps ensure that both donors and charities comply with the IRS regulations regarding charitable contributions. Proper documentation is vital to secure potential tax deductions.

Cross-Border Taxation

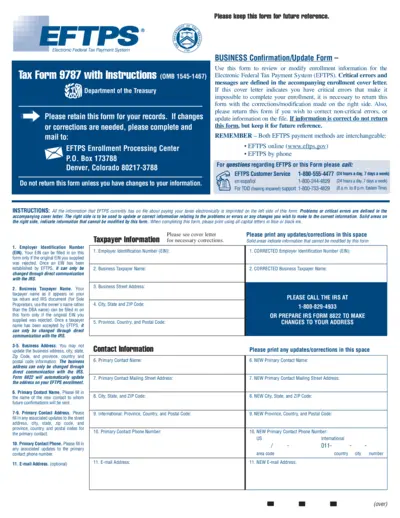

Electronic Federal Tax Payment System Update Form

This form is used to update or correct enrollment information for the EFTPS. Users can modify details such as taxpayer name, contact info, and payment methods. It is essential for businesses to maintain accurate records with the IRS.

Cross-Border Taxation

Fundamental Changes to Return Filing Process

This file outlines fundamental changes to return filing and processing that assist taxpayers. It discusses penalties, compliance, and the necessity of an accelerated information reporting system. The document aims to enhance taxpayer access to third-party data for efficient return preparation.

Cross-Border Taxation

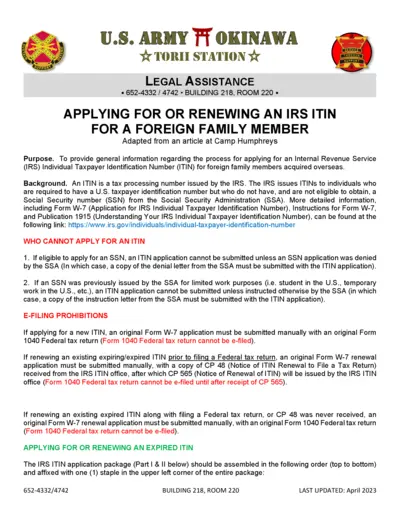

Application for IRS ITIN for Foreign Family Members

This document provides essential information on how to apply for or renew an IRS Individual Taxpayer Identification Number (ITIN) for foreign family members. Detailed instructions and required forms are included, ensuring a smooth application process. Ideal for US sponsors needing tax identification for their overseas family.

Cross-Border Taxation

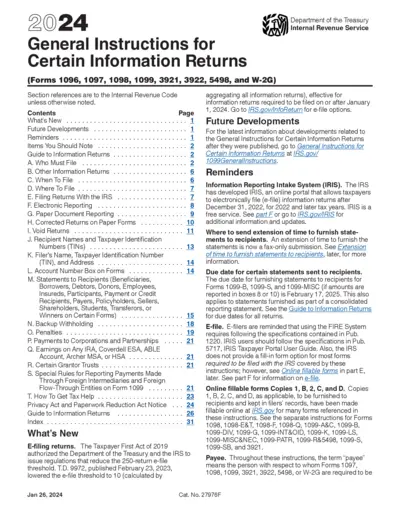

General Instructions for Certain Information Returns 2024

This document provides detailed instructions for filing various information returns with the IRS. It includes essential updates, reminders, and guidelines to help taxpayers navigate the complexities of tax reporting. Perfect for taxpayers and tax professionals seeking to ensure compliance with IRS regulations.

Cross-Border Taxation

Instructions for Form 8996 Qualified Opportunity Funds

Form 8996 is essential for corporations and partnerships investing in Qualified Opportunity Zones (QOZs). It certifies the organization as a Qualified Opportunity Fund (QOF) and ensures compliance with investment standards. Accurate completion assists in gaining tax benefits associated with investments in QOZs.

Cross-Border Taxation

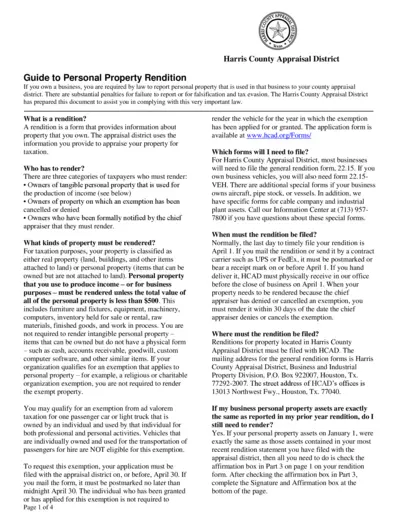

Harris County Appraisal District Personal Property Guide

This document serves as a comprehensive guide for businesses on reporting personal property for taxation in Harris County, Texas. It outlines the process, required forms, and deadlines for submission. Understanding this guide is crucial for compliance and avoiding penalties.

Cross-Border Taxation

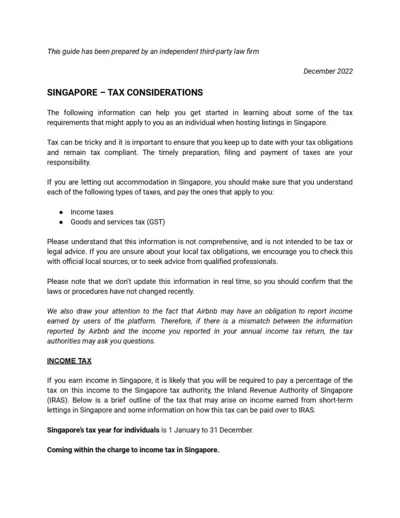

Singapore Tax Considerations for Individuals

This guide outlines essential tax obligations for individuals hosting listings in Singapore. It covers income tax and GST requirements. Stay informed and compliant with your tax responsibilities.

Cross-Border Taxation

California Employee Withholding Allowance Certificate

The Employee's Withholding Allowance Certificate (DE 4) is essential for California employees to ensure correct state income tax withholding. Fill out this form to claim your withholding allowances and meet your tax obligations. Use this certificate to guide your employer in adjusting your paycheck with the right California state tax deductions.

Cross-Border Taxation

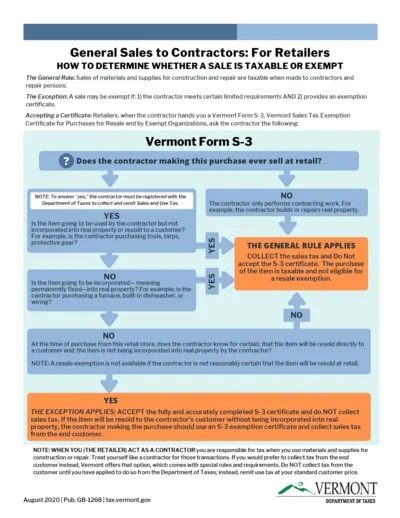

Sales Tax Guidelines for Contractors and Retailers

This file provides detailed guidelines on determining taxable and exempt sales when dealing with contractors. It includes instructions for retailers on accepting exemption certificates. Users can enhance their understanding of Vermont's sales tax laws through this resource.