Cross-Border Taxation Documents

Cross-Border Taxation

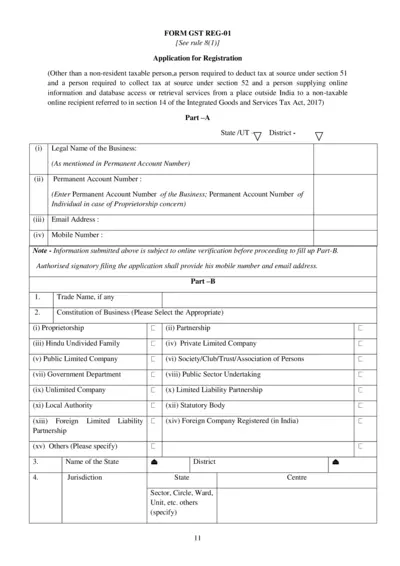

GST REG-01 Application for Business Registration

The form GST REG-01 is used to apply for registration in GST. This application is essential for businesses wanting to comply with tax regulations. It captures relevant business details required for the GST registration process.

Cross-Border Taxation

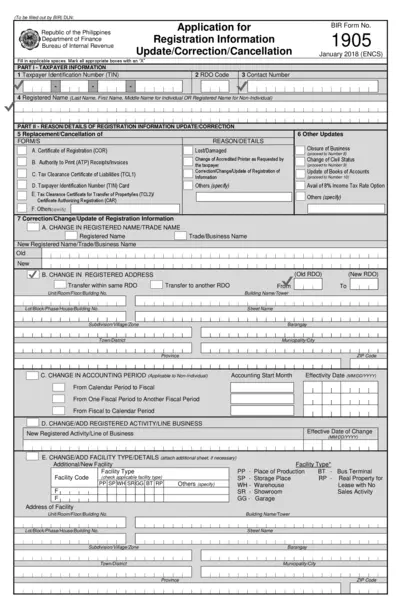

Application for Registration Information Update

This form is essential for taxpayers in the Philippines to update their registration details. It allows for corrections, cancellations, and updates of relevant information. Completing this form accurately is crucial for compliance with tax regulations.

Cross-Border Taxation

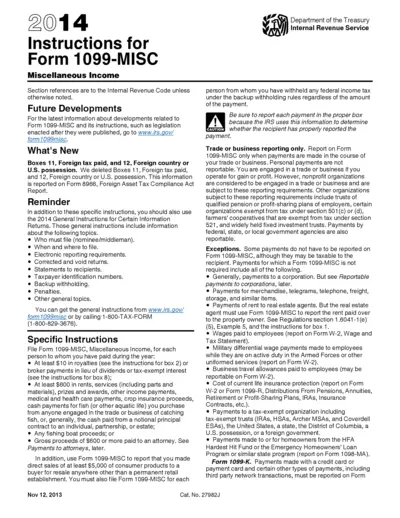

Instructions for Form 1099-MISC 2014

This file contains the complete instructions for filling out Form 1099-MISC for the tax year 2014. It covers who needs to file, what payments to report, and the specific boxes to fill. Aimed at individuals and businesses alike, this document serves as a vital resource for compliance with IRS regulations.

Cross-Border Taxation

Digital Statutory Forms User Manual

This user manual provides detailed instructions on how to access and utilize the Digital Statutory Forms (C, F, H, E1, E2) in Madhya Pradesh. It covers application procedures, validation of digital signatures, and more, aimed at facilitating users in their tax-related processes. Ideal for registered users needing guidance on statutory forms.

Cross-Border Taxation

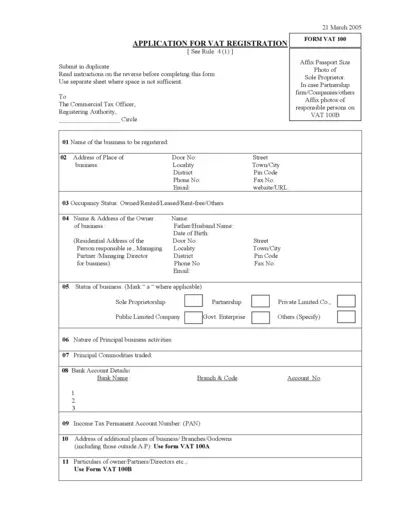

Application for VAT Registration Form

The VAT 100 form is used for VAT registration. This form collects essential business details to facilitate registration. Ensure all fields are completed accurately for a successful application.

Cross-Border Taxation

Proposed Changes to IRS EITC Due Diligence Standards

This document outlines proposed changes to the IRS Earned Income Tax Credit due diligence standards. It discusses implications for tax preparers and offers suggested reforms. A resource for understanding compliance issues and regulatory guidance.

Cross-Border Taxation

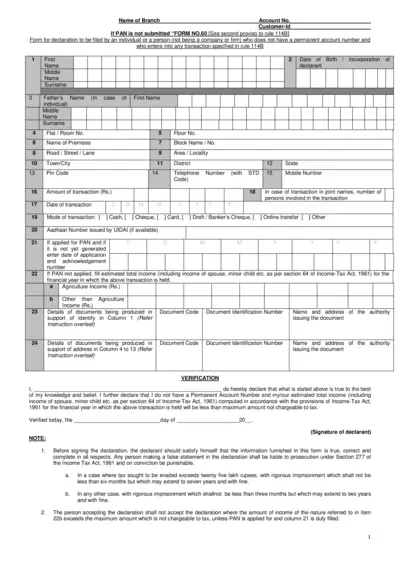

Form No. 60 Submission for Individuals without PAN

This file contains Form No. 60 instructions for individuals who do not possess a Permanent Account Number (PAN). It includes necessary details and guidelines for filling out the form accurately. This is essential for ensuring vital tax compliance and identity documentation.

Cross-Border Taxation

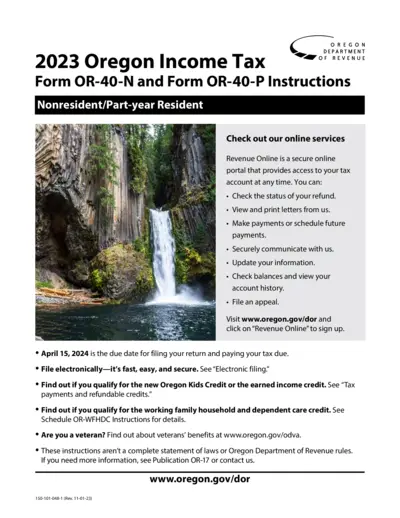

Oregon Dept Revenue 2023 Income Tax Instructions

This document provides detailed instructions for filing the 2023 Oregon Income Tax forms OR-40-N and OR-40-P. It includes eligibility guidelines, filing procedures, and important deadlines for taxpayers. Ensure compliance with state tax laws by following the official guidance presented in this form.

Cross-Border Taxation

Travel Logbook 2021/22 for SARS Tax Deductions

This Travel Logbook is essential for taxpayers receiving a travel allowance from SARS. It guides users in accurately recording business travel for tax deductions. Follow the provided instructions to ensure a valid claim.

Cross-Border Taxation

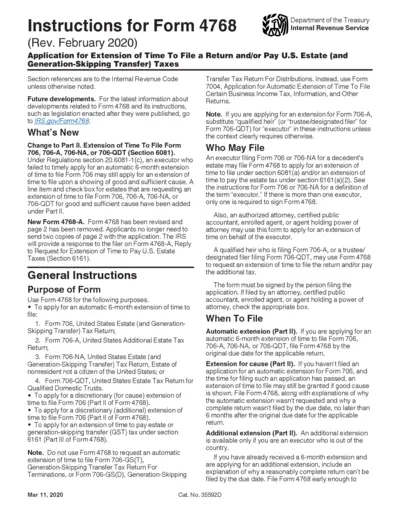

Form 4768 Application for Estate Tax Extension

This file contains the instructions for Form 4768, the application for extension of time to file U.S. estate taxes. It provides essential guidelines for executors seeking an extension, details about eligibility, and instructions on submission. Users can learn how to complete the form accurately and within prescribed timelines to avoid penalties.

Cross-Border Taxation

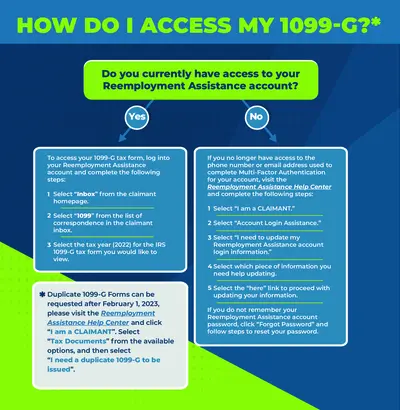

How to Access and Request a 1099-G Tax Form

This document outlines the steps to access your 1099-G tax form through your Reemployment Assistance account. It also provides guidance on how to request duplicate forms if needed. Essential for individuals seeking tax information for the year 2022.

Cross-Border Taxation

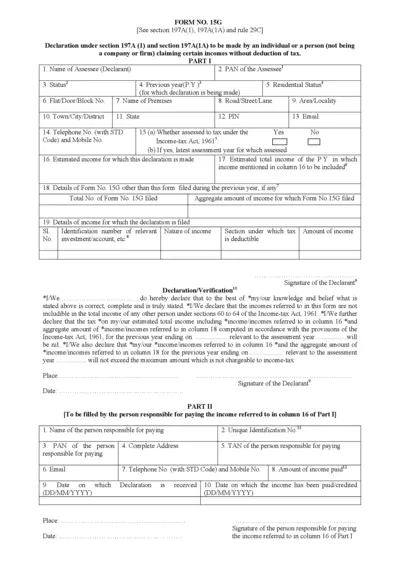

Form No 15G Declaration for Income Tax

Form No. 15G is a declaration form under the Income Tax Act for individuals claiming certain incomes without tax deduction. It is crucial for those whose income is below the taxable limit. Properly filling this form helps in avoiding unnecessary deductibles.