Cross-Border Taxation Documents

Cross-Border Taxation

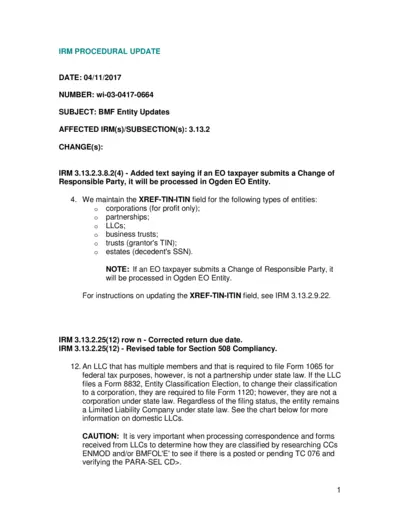

IRM Procedural Update BMF Entity Instructions

This document provides essential updates regarding BMF entity changes, including important instructions on Form 1065 and LLC classifications. It details the processing protocols for EO taxpayer submissions and clarifies the classification of LLCs under federal tax laws. Ideal for tax professionals needing guidance on compliance and entity updates.

Cross-Border Taxation

Arizona Employee Withholding Election Instructions

This file provides essential instructions for Arizona employees regarding their withholding election. It outlines procedures for new and current employees to complete the Arizona Form A-4. The document also includes information for nonresidents and important deadlines.

Cross-Border Taxation

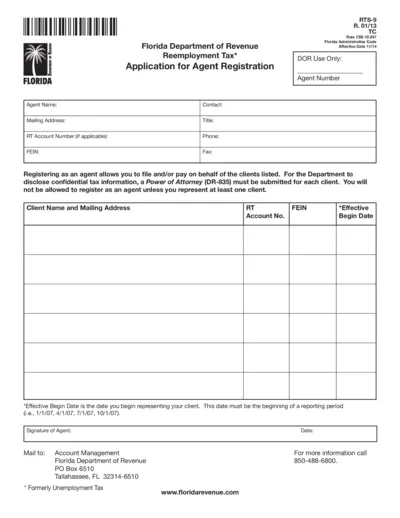

Florida Department of Revenue Reemployment Tax Registration

This file includes the application for agent registration for reemployment tax in Florida. It must be completed when registering as an agent representing clients for tax purposes. Ensure to submit the necessary Power of Attorney forms for client confidentiality.

Cross-Border Taxation

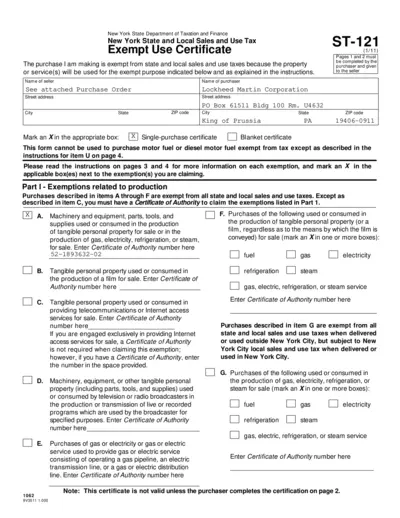

New York Sales and Use Tax Exempt Use Certificate

The New York State Exempt Use Certificate is a crucial document that allows purchasers to claim exemptions from state and local sales and use taxes. This certificate is specifically designed for properties or services used for exempt purposes. Proper completion and submission ensure compliance with New York State tax regulations.

Cross-Border Taxation

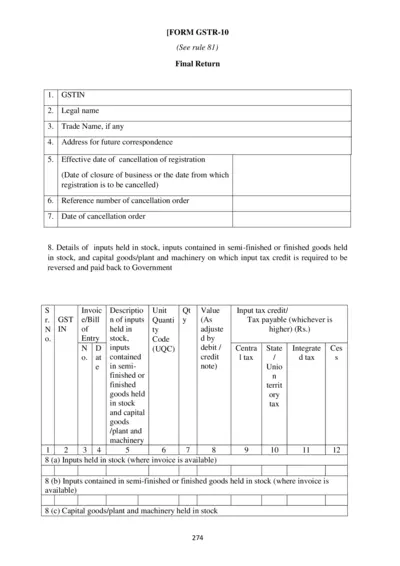

GSTR-10 Final Return Form Instructions and Information

The GSTR-10 form is a final return for taxpayers who cancel their GST registration. It includes details about stock, tax payable, and verification. This document is essential for ensuring compliance with GST regulations during registration cancellation.

Cross-Border Taxation

Technical Guide to Karnataka VAT by ICAI

This technical guide provides comprehensive details and instructions on Karnataka VAT. It is essential for tax professionals and businesses alike. Gain insights into VAT compliance and regulations specific to Karnataka.

Cross-Border Taxation

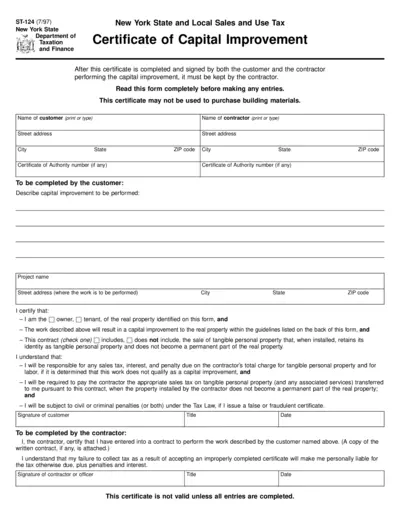

New York State Sales Use Tax Capital Improvement

This file contains the New York State Certificate of Capital Improvement. It details the requirements for customers and contractors regarding sales and use tax exemptions. Following the guidelines in this document is essential for compliance.

Cross-Border Taxation

Colorado C Corporation Income Tax Booklet 2014

The Colorado C Corporation Income Tax Booklet provides essential filing instructions and forms required for tax returns. It includes information on extensions, payment vouchers, and online filing options. Ideal for corporations looking to ensure compliance with Colorado income tax regulations.

Cross-Border Taxation

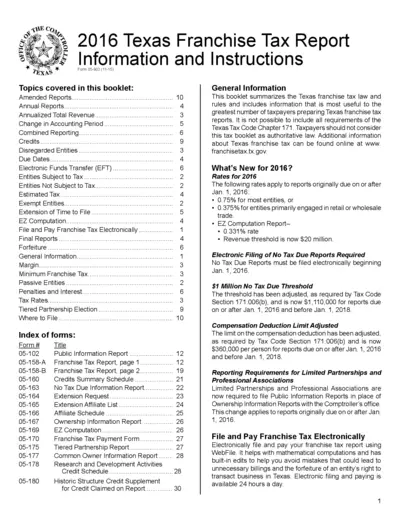

2016 Texas Franchise Tax Report Information

This file provides essential details and instructions for completing the 2016 Texas Franchise Tax Report. It serves as a guide for Texas taxpayers to properly file their franchise tax reports. Ensure compliance with Texas tax regulations by following the guidelines provided in this document.

Cross-Border Taxation

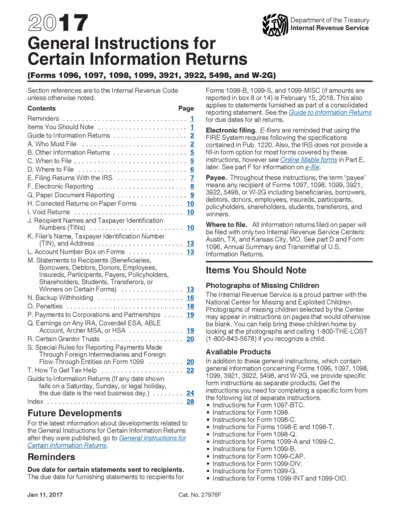

General Instructions for Information Returns 2017

This file provides detailed instructions for specific information returns including Forms 1096, 1097, 1098, and others. It outlines filing guidelines, recipient information, and reporting requirements. Ideal for taxpayers and professionals handling information returns.

Cross-Border Taxation

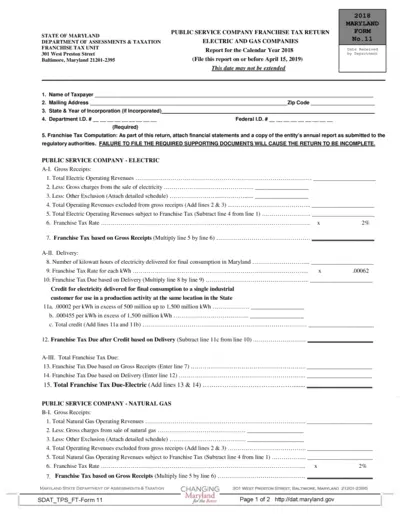

Maryland Franchise Tax Return - Electric and Gas 2018

This document provides the Franchise Tax Return for Electric and Gas Companies in Maryland for the year 2018. It outlines the necessary information and computations required to accurately file the tax return. Users should ensure all supporting documents are attached for proper submission.

Cross-Border Taxation

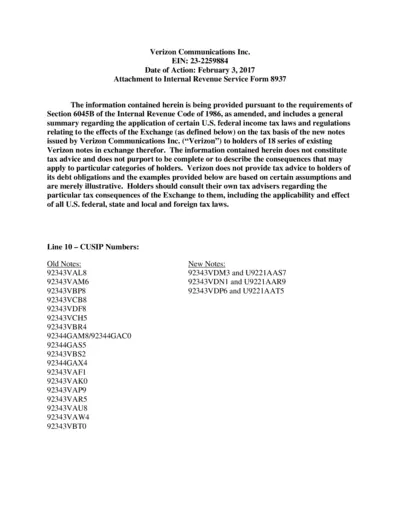

Verizon Communications 2017 Organizational Action Summary

This document explains the organizational action taken by Verizon Communications regarding the exchange of notes. It provides an overview of the tax implications and instructions related to the exchange. Tax advisors should be consulted for personalized advice.