Cross-Border Taxation Documents

Cross-Border Taxation

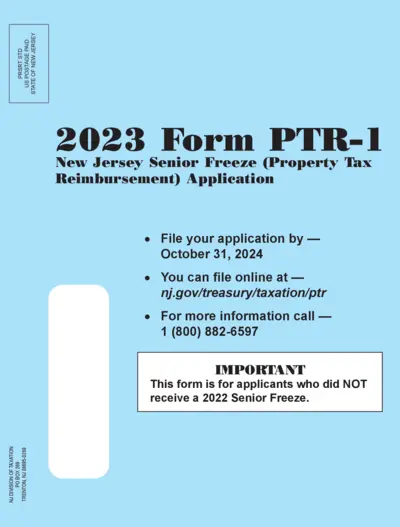

New Jersey Senior Freeze PTR-1 Application 2023

This is the New Jersey Senior Freeze (Property Tax Reimbursement) Application for 2023. Eligible applicants can file for property tax reimbursement for the years 2022 and 2023. Follow the instructions carefully to ensure successful submission of your application.

Cross-Border Taxation

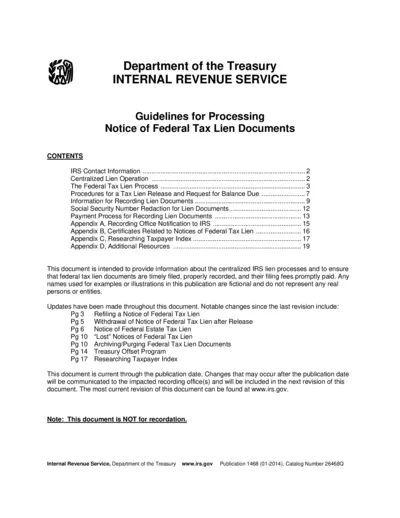

IRS Guidelines for Federal Tax Lien Processing

This document outlines the IRS guidelines for processing Notice of Federal Tax Lien documents, providing essential information for compliance. It serves as a comprehensive resource for understanding the federal tax lien process and its implications. Taxpayers and recording offices will benefit from the procedural clarity offered in this publication.

Cross-Border Taxation

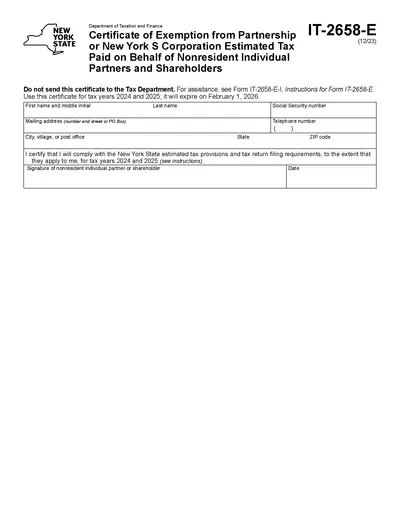

New York State Tax Exemption Certificate IT-2658-E

The New York State Certificate of Exemption is essential for nonresident individual partners and shareholders to claim estimated tax exemptions. This form must be filled out accurately for the tax years 2024 and 2025. Ensure compliance with New York State tax regulations by submitting this certificate timely.

Cross-Border Taxation

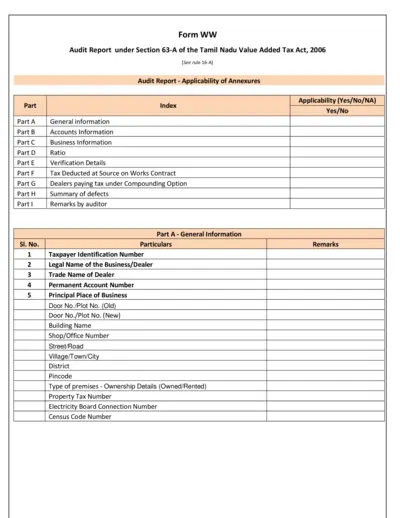

Audit Report under Section 63-A TN VAT 2006

This document contains the Audit Report required for compliance under the Tamil Nadu Value Added Tax Act of 2006. It provides essential information regarding business operations, owner details, and tax compliance. Proper completion of this form is crucial for accurate tax reporting.

Cross-Border Taxation

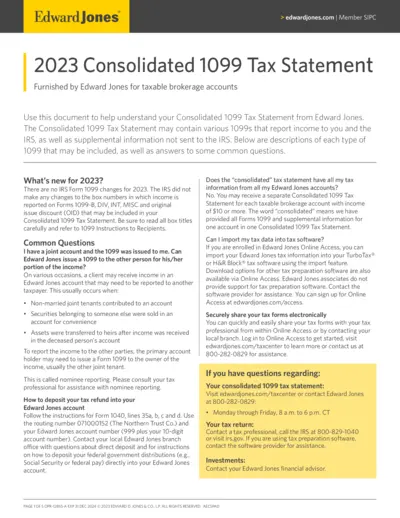

2023 Consolidated 1099 Tax Statement Overview

This document provides a comprehensive guide to understanding your Consolidated 1099 Tax Statement from Edward Jones. It includes detailed information on how to interpret various types of 1099 forms and answers to frequently asked questions. Use this resource to ensure accurate tax reporting and maximize your tax benefits.

Cross-Border Taxation

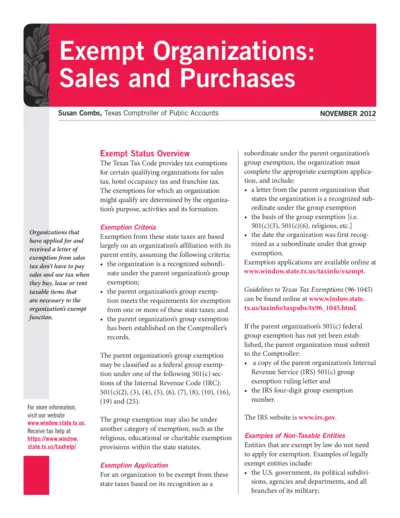

Texas Exempt Organizations Sales Tax Guide

This file provides detailed information on sales tax exemptions for organizations in Texas. It outlines eligibility criteria, application processes, and guidelines for exempt purchases. Ideal for nonprofit organizations, government entities, and educational institutions.

Cross-Border Taxation

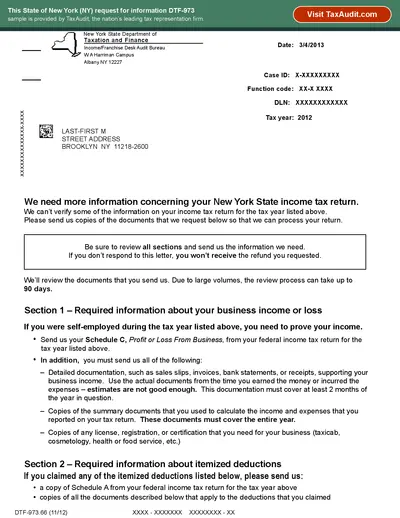

New York State Request for Information DTF-973

This file is a New York State request for information DTF-973, used to gather additional documentation for your tax return. It outlines the necessary documents and requirements to support your income tax claims. Ensure you follow the instructions provided to avoid delays in processing your tax return.

Cross-Border Taxation

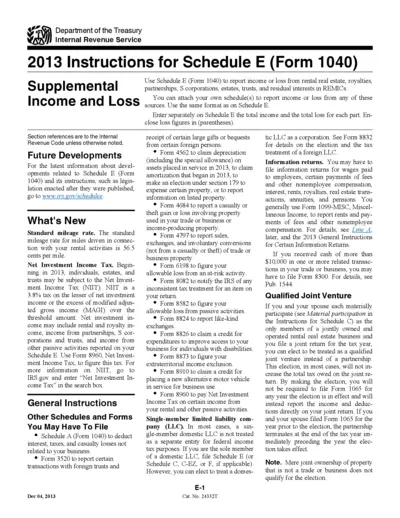

2013 IRS Schedule E Instructions for Income Reporting

This document provides comprehensive instructions for Schedule E, helping individuals to report their supplemental income or loss from various sources. It is essential for taxpayers with rental real estate, royalties, partnerships, or S corporations. Refer to this file for guidance on properly filing your income tax return with the IRS.

Cross-Border Taxation

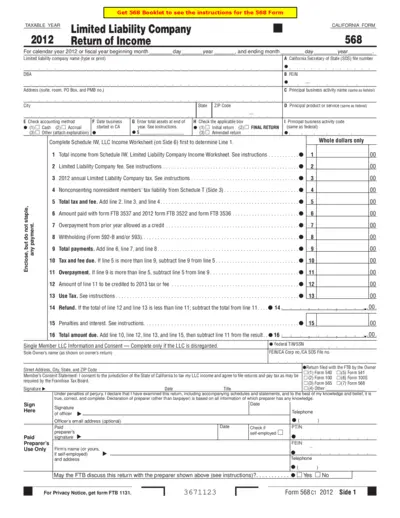

California Form 568 Limited Liability Company Income

The California Form 568 is a return of income for Limited Liability Companies. It provides detailed instructions on reporting income and taxes for LLCs in the state. This form is essential for compliance with California tax regulations.

Cross-Border Taxation

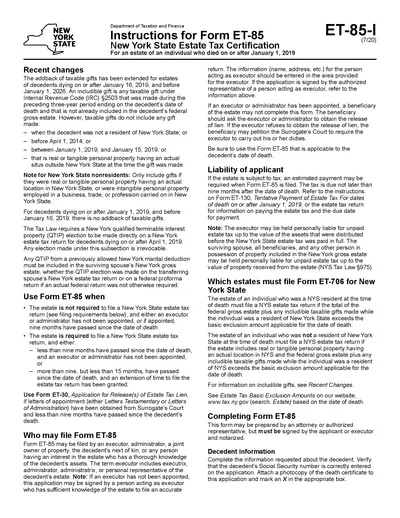

New York State Estate Tax Certification Instructions

This file contains important instructions for filling out Form ET-85 for New York State Estate Tax Certification. It explains the eligibility requirements, filing process, and details necessary for estate executors and beneficiaries. By following these instructions, users can ensure compliance with New York state estate tax laws.

Cross-Border Taxation

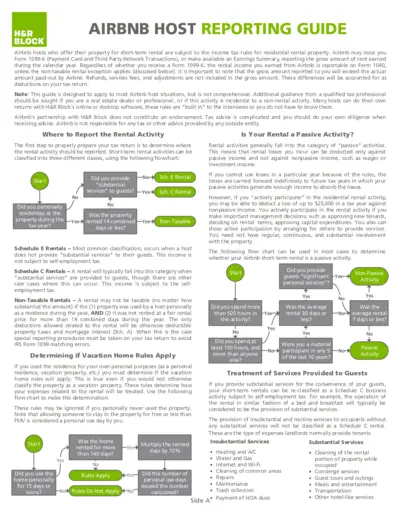

Airbnb Host Reporting Guide by H&R Block

This guide provides essential information for Airbnb hosts regarding income tax obligations. It outlines how to report rental income and expenses. Perfect for short-term rental owners navigating tax requirements.

Cross-Border Taxation

1120 E-File Guide for Tax Year 2022

The 1120 E-File Guide offers comprehensive instructions for filing tax returns electronically for the year 2022. This guide includes vital information on processes and requirements for taxpayers. Utilize this resource to ensure compliance and streamline your filing experience.