Cross-Border Taxation Documents

Cross-Border Taxation

IRS Form 5329 Instructions for Additional Tax

IRS Form 5329 provides instructions for reporting additional taxes on qualified plans and other tax-favored accounts. It is essential for anyone who has taken early distributions from their retirement accounts. Understanding the details of Form 5329 helps taxpayers comply with IRS requirements.

Cross-Border Taxation

Heavy Highway Vehicle Use Tax Return Form 2290

The IRS Form 2290 is used to report and pay the Heavy Highway Vehicle Use Tax. This tax applies to vehicles that are driven on public highways with a gross weight of 55,000 pounds or more. It is essential for businesses and individuals operating heavy vehicles to complete this form accurately.

Cross-Border Taxation

Instructions for Form IT-2658 on Estimated Tax

This file provides essential guidance for completing Form IT-2658, which is used for estimated tax payments for nonresident individual partners and shareholders in New York. It includes detailed information about filing requirements, deadlines, and compliance with tax laws. Understanding this document is crucial for any entity involved in partnerships or S corporations operating in New York.

Cross-Border Taxation

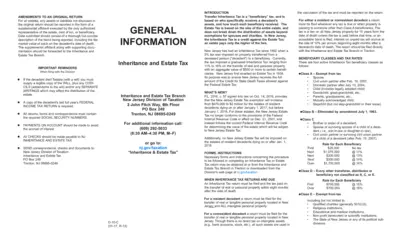

New Jersey Inheritance and Estate Tax Filing Guide

This guide provides essential information for filing the New Jersey Inheritance and Estate Tax returns. It details requirements, exemptions, and the steps involved in the filing process. Be informed about necessary documentation and deadlines to ensure compliance.

Cross-Border Taxation

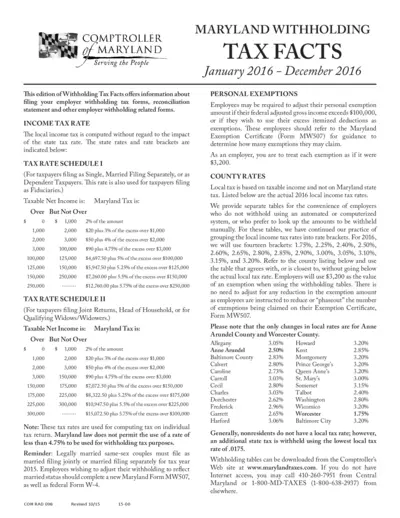

Maryland Withholding Tax Facts 2016

This document provides essential information regarding Maryland's employer withholding tax forms, tax rates, and filing procedures for 2016. It includes details on income tax rates, personal exemptions, county rates, electronic filing options, and other related forms. Designed for both employers and employees, it serves as a comprehensive guide to understanding your obligations under Maryland tax law.

Cross-Border Taxation

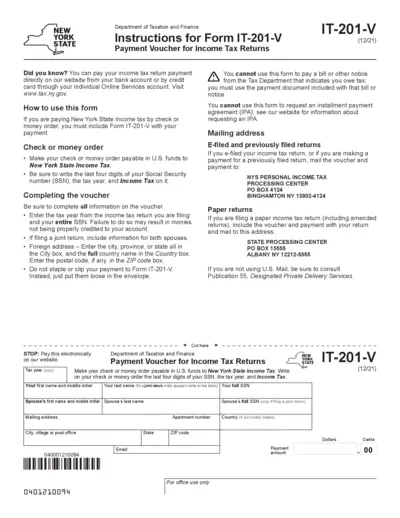

Instructions for Form IT-201-V Payment Voucher

This document provides clear instructions for completing Form IT-201-V, the New York State Payment Voucher for Income Tax Returns. Ensure proper submission to avoid processing delays. Follow the guidelines and utilize online services for convenience.

Cross-Border Taxation

York Adams Tax Bureau Employer Information Guide

This file contains essential information for employers regarding local income tax regulations in York and Adams counties. It provides guidelines for tax registration, withholding requirements, and filing procedures. Utilize the online services for a seamless and efficient filing experience.

Cross-Border Taxation

W-8IMY Instructions for Foreign Entities Tax Compliance

This file provides comprehensive instructions for Form W-8IMY. It is essential for foreign intermediaries, entities, and certain U.S. branches regarding U.S. tax withholding and reporting. Users will find guidance on completing the form to ensure compliance with IRS regulations.

Cross-Border Taxation

Closing Agreements for Exempt Organizations

This document discusses the use of closing agreements as a remedy for disputes between the IRS and taxpayers. It highlights their benefits in ensuring compliance and resolving issues without heavy penalties. The content provides valuable insights into the authority, function, and impact of these agreements.

Cross-Border Taxation

General Instructions for Forms W-2 and W-3

This file contains the essential instructions for completing Forms W-2 and W-3. It provides updates, reminders, and special situations relevant to employers. Important guidelines and regulatory information are also included to ensure compliance.

Cross-Border Taxation

Understanding Form 26AS: A Comprehensive Guide

This file provides essential information and instructions about Form 26AS, which is crucial for annual tax return filing. It explains what Form 26AS is, how to fill it out, and common mistakes to avoid. Ideal for taxpayers looking to navigate their tax obligations efficiently.

Cross-Border Taxation

Missouri Use Tax Return Instructions and Form

This document provides detailed instructions for filing the Missouri Use Tax Return. It includes necessary fields, rates, and guidelines for accurate submissions. Ensure compliance with state laws by following the outlined procedures.